The IRS 1099-MISC form is a tax document used to report various types of income received by individuals and businesses that are not classified as wages. This form is essential for ensuring that all income is accurately reported to the...

The IRS Form 1120 is a tax return used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal income tax liability. Understanding how to accurately fill out this...

The IRS 2553 form is a document used by small business owners to elect S Corporation status for federal tax purposes. This election allows corporations to pass income, losses, and deductions directly to shareholders, avoiding double taxation. Understanding how to...

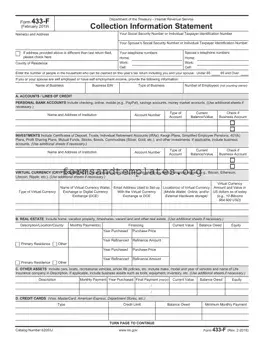

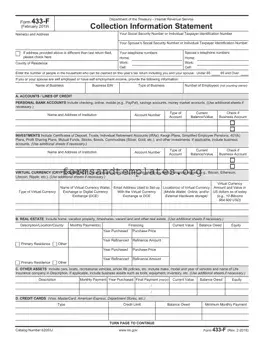

The IRS 433-F form is a financial statement used by taxpayers to provide the Internal Revenue Service (IRS) with detailed information about their income, expenses, and assets. This form plays a crucial role in determining an individual's ability to pay...

The IRS 941 form is a quarterly tax return that employers must file to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form helps the IRS track the payroll taxes that businesses owe and...

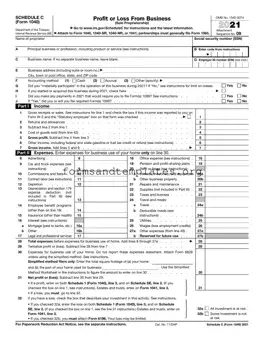

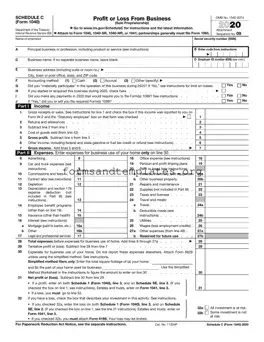

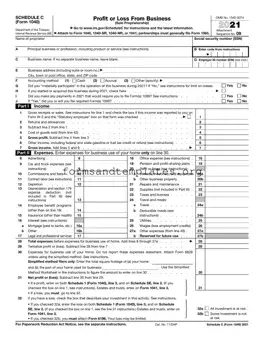

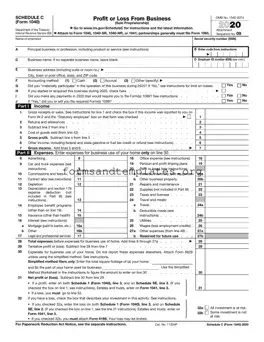

The IRS Schedule C 1040 form is a crucial document for self-employed individuals and sole proprietors, as it allows them to report income and expenses from their business activities. This form plays a vital role in determining your taxable income,...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings and expenses, providing a clear picture of their business's...

The IRS W-2 form is a crucial document that reports an employee's annual wages and the taxes withheld from their paycheck. This form is essential for accurate tax filing and ensures that individuals fulfill their tax obligations. To ensure compliance...

The IRS W-3 form is a summary of all W-2 forms submitted by an employer, providing the Social Security Administration with essential information about employee wages and tax withholdings. This form plays a crucial role in ensuring that employees receive...

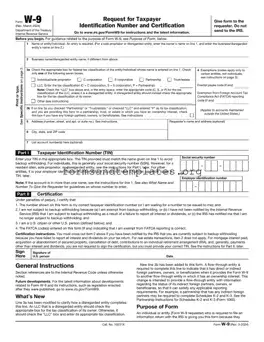

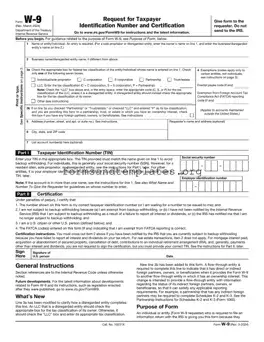

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to entities that will report income paid to them. This form is essential for independent contractors and freelancers, as it ensures accurate...

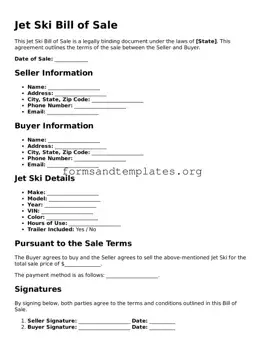

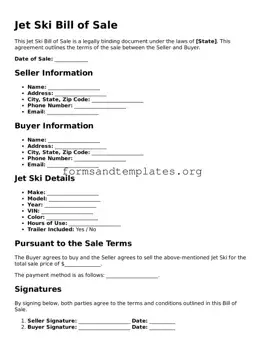

The Jet Ski Bill of Sale form is a legal document that records the transfer of ownership of a jet ski from one party to another. This form serves as proof of the transaction and includes essential details such as...

The Konami Decklist form is an essential document used in competitive card gaming to ensure that players accurately report their decks during events. This form requires players to provide complete and legible names of their cards, along with the quantities...