Transfer-on-Death Deed Template for the State of Washington

The Washington Transfer-on-Death Deed form is an important tool for property owners who wish to simplify the transfer of their real estate upon death. This legal document allows individuals to designate a beneficiary who will receive their property without the need for probate, thereby streamlining the process and reducing associated costs. By completing and recording this form, property owners can retain full control over their property during their lifetime, while ensuring that their wishes are honored after they pass away. The form requires specific information, including the names of the property owners, a description of the property, and the designated beneficiary’s details. It must be signed and notarized to be valid, and it’s crucial to understand that the deed can be revoked or amended at any time before the owner's death. Understanding the nuances of the Transfer-on-Death Deed can provide peace of mind and facilitate a smoother transition of property to loved ones, making it a valuable option for estate planning in Washington State.

Common mistakes

-

Not including the full legal name of the property owner. It's important to ensure that the name matches exactly as it appears on the property title.

-

Failing to list the correct property address. Double-checking the address helps avoid any confusion about which property is being transferred.

-

Omitting the names of the beneficiaries. All intended beneficiaries should be clearly listed to ensure that the property goes to the right individuals.

-

Not having the form signed in front of a notary. A notary's signature is required to validate the deed.

-

Forgetting to date the document. Including the date is essential for establishing when the transfer takes effect.

-

Using incorrect legal descriptions of the property. This can lead to disputes or delays in the transfer process.

-

Neglecting to file the deed with the appropriate county office. Filing is crucial for the transfer to be recognized legally.

-

Not consulting with a professional if unsure about any part of the form. Seeking guidance can prevent mistakes that may complicate the transfer.

Other Common Transfer-on-Death Deed State Templates

New Jersey Transfer on Death Deed - It provides peace of mind knowing your property will go to the people you designate.

Property Title Transfer Attorney - The deed can be a practical solution for individuals looking to plan their estates without the involvement of probate courts.

Transfer on Death Deed Texas Form Free - By opting for a Transfer-on-Death Deed, owners can preserve cherished properties for loved ones with minimal fuss.

When purchasing a motorcycle, it's vital to ensure all paperwork is in order to protect both parties involved. The California Motorcycle Bill of Sale form serves as an essential tool in this process, providing a clear record of the transaction. For those looking to create this document with ease, resources like California Templates can be invaluable in ensuring that all necessary information is captured accurately, facilitating a smooth ownership transfer.

Transfer on Death Deed Virginia - Encourages proactive estate planning to reduce complications later.

Key takeaways

Here are some important points to remember when filling out and using the Washington Transfer-on-Death Deed form:

- Eligibility: Only individuals who own real property can use this form. Ensure you meet the requirements before proceeding.

- Completeness: Fill out the form completely. Missing information can lead to delays or complications.

- Signatures: The deed must be signed by the property owner. If there are multiple owners, all must sign.

- Witness Requirement: A witness must be present when the deed is signed. This adds a layer of validity to the document.

- Recording: After signing, the deed must be recorded with the county auditor's office. This step is crucial for it to take effect.

- Revocation: You can revoke the deed at any time before your death. Follow the proper procedure to ensure it is done correctly.

Washington Transfer-on-Death Deed Example

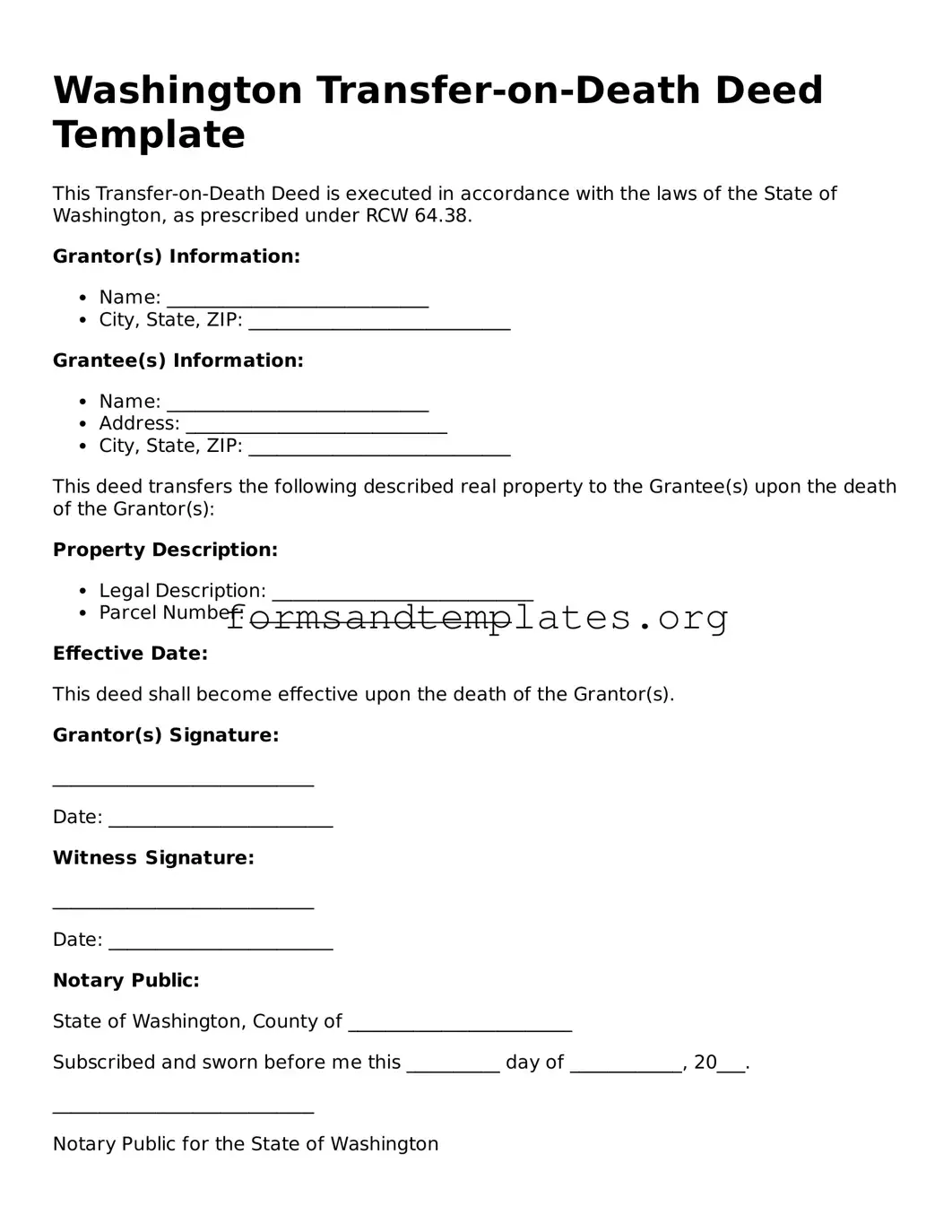

Washington Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of the State of Washington, as prescribed under RCW 64.38.

Grantor(s) Information:

- Name: ____________________________

- City, State, ZIP: ____________________________

Grantee(s) Information:

- Name: ____________________________

- Address: ____________________________

- City, State, ZIP: ____________________________

This deed transfers the following described real property to the Grantee(s) upon the death of the Grantor(s):

Property Description:

- Legal Description: ____________________________

- Parcel Number: ____________________________

Effective Date:

This deed shall become effective upon the death of the Grantor(s).

Grantor(s) Signature:

____________________________

Date: ________________________

Witness Signature:

____________________________

Date: ________________________

Notary Public:

State of Washington, County of ________________________

Subscribed and sworn before me this __________ day of ____________, 20___.

____________________________

Notary Public for the State of Washington

My commission expires: ________________________

Understanding Washington Transfer-on-Death Deed

-

What is a Transfer-on-Death Deed in Washington?

A Transfer-on-Death Deed (TODD) allows property owners in Washington to transfer real estate to a designated beneficiary upon their death without going through probate. This deed can simplify the transfer process and ensure that your property goes directly to your chosen beneficiary.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Washington can utilize a Transfer-on-Death Deed. This includes homeowners, co-owners, and individuals holding property in their name. However, the property must be solely owned by the grantor to be eligible for this type of deed.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, follow these steps:

- Obtain the official form from a reliable source.

- Fill out the form with accurate property and beneficiary information.

- Sign the deed in front of a notary public.

- Record the deed with the county auditor where the property is located.

-

Do I need a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to have a lawyer, consulting with one is advisable. A legal professional can ensure that the deed is completed correctly and that your intentions are clearly stated, minimizing the risk of future disputes.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed or a formal revocation document and record it with the county auditor. Make sure to inform your beneficiary of any changes.

-

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the property will not automatically transfer to them. Instead, the property will become part of your estate and will be distributed according to your will or state law if no will exists.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the beneficiary may face tax consequences upon inheriting the property. It is recommended to consult a tax professional for personalized advice.

-

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for real estate, such as land and buildings. It cannot be used for personal property, bank accounts, or other types of assets. For those assets, consider alternative estate planning methods.

-

Is a Transfer-on-Death Deed valid in other states?

Transfer-on-Death Deeds are specific to certain states. While Washington allows them, not all states have the same provisions. If you own property in multiple states, check the laws in each state regarding Transfer-on-Death Deeds.

-

How do I ensure my Transfer-on-Death Deed is valid?

To ensure validity, follow these steps:

- Complete the deed accurately.

- Sign it in front of a notary public.

- Record the deed with the appropriate county office.

How to Use Washington Transfer-on-Death Deed

After obtaining the Washington Transfer-on-Death Deed form, the next step involves accurately filling it out to ensure that your wishes regarding property transfer are clearly stated. It is essential to provide the correct information to avoid any complications in the future.

- Begin by entering your name as the owner of the property. Include your full legal name.

- Provide your address. This should be your current residential address.

- Identify the property you wish to transfer. Include the complete legal description of the property, which can typically be found on your property deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon your passing. Ensure that you use their full legal names.

- Include the address(es) of the beneficiary or beneficiaries. This ensures that there is no confusion about who will receive the property.

- Sign and date the form. Your signature should be in the presence of a notary public to ensure its validity.

- Have the form notarized. The notary will verify your identity and witness your signature.

- File the completed and notarized form with the county auditor's office where the property is located. This step is crucial for the deed to be legally effective.