Real Estate Purchase Agreement Template for the State of Washington

When it comes to buying or selling property in Washington State, the Real Estate Purchase Agreement form plays a crucial role in ensuring a smooth transaction. This comprehensive document outlines the essential terms of the agreement between the buyer and seller, covering everything from the purchase price and payment terms to contingencies and closing dates. It serves as a roadmap for both parties, detailing the responsibilities and expectations involved in the sale. Key components include information about the property, such as its legal description, as well as any included fixtures and personal property. Additionally, the form addresses important contingencies, which may include home inspections, financing, and appraisal conditions, allowing buyers to protect their interests. With clearly defined timelines and procedures, the agreement helps prevent misunderstandings and disputes, fostering a more transparent process. Understanding the nuances of this form is vital for anyone looking to navigate the Washington real estate market effectively.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Buyers should ensure that every section is completed, including names, addresses, and property details.

-

Incorrect Dates: Entering the wrong dates can lead to confusion or even legal issues. Always double-check that the date of the agreement and any deadlines are accurate.

-

Omitting Contingencies: Buyers often forget to include important contingencies, such as financing or inspection clauses. These protect buyers and should be clearly stated in the agreement.

-

Ignoring the Earnest Money Deposit: Not specifying the amount of earnest money can create misunderstandings. Clearly state the amount and terms associated with this deposit to avoid issues later.

-

Misunderstanding the Closing Costs: Buyers sometimes overlook the details about who pays for closing costs. Clarifying this in the agreement can prevent disputes down the line.

-

Failure to Review the Agreement: Skipping the review process is a significant error. Always read through the entire document carefully, and consider having a legal expert review it before signing.

Other Common Real Estate Purchase Agreement State Templates

Agreement for Sale Arizona - Includes tax information and obligations for both parties.

Completing the California Motor Vehicle Bill of Sale is crucial for accurately documenting the transfer of vehicle ownership, and you can easily obtain a template for this purpose from California Templates, which provides a user-friendly option to ensure all necessary details are captured correctly.

Nj Real Estate Contract - Can incorporate elements like contingencies for home inspections or appraisals.

Realestate Purchase Agreement - Can specify inclusions and exclusions in the sale.

Key takeaways

When filling out and using the Washington Real Estate Purchase Agreement form, there are several important points to consider. Here are key takeaways to keep in mind:

- Ensure that all parties involved are clearly identified. This includes the buyer(s) and seller(s) with their full legal names.

- Specify the property details accurately. Include the address, legal description, and any relevant parcel numbers.

- Outline the purchase price clearly. Make sure to state the total amount and any earnest money deposits required.

- Detail the terms of the sale. This includes financing arrangements, closing dates, and any contingencies that may apply.

- Include any disclosures required by Washington state law. Sellers must provide information about the property's condition and any known issues.

- Be aware of the timeline. The agreement should specify deadlines for inspections, financing, and other critical steps in the process.

- Review the terms regarding repairs and improvements. Clarify who is responsible for any repairs before closing.

- Understand the implications of contingencies. These are conditions that must be met for the sale to proceed, such as obtaining financing or passing inspections.

- Consult with a real estate professional if needed. They can provide guidance and ensure that the agreement meets all legal requirements.

By paying attention to these key points, you can navigate the Washington Real Estate Purchase Agreement with greater confidence and clarity.

Washington Real Estate Purchase Agreement Example

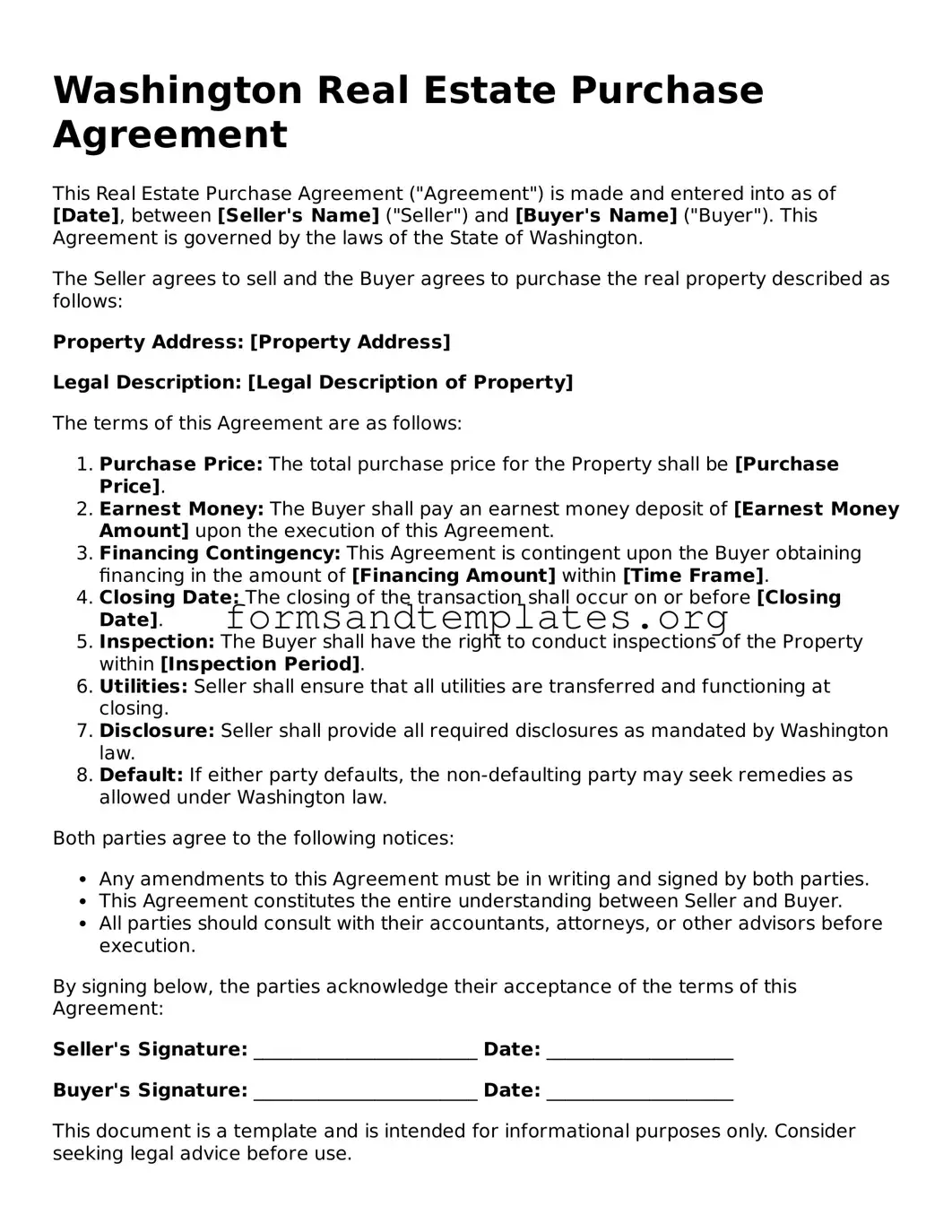

Washington Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of [Date], between [Seller's Name] ("Seller") and [Buyer's Name] ("Buyer"). This Agreement is governed by the laws of the State of Washington.

The Seller agrees to sell and the Buyer agrees to purchase the real property described as follows:

Property Address: [Property Address]

Legal Description: [Legal Description of Property]

The terms of this Agreement are as follows:

- Purchase Price: The total purchase price for the Property shall be [Purchase Price].

- Earnest Money: The Buyer shall pay an earnest money deposit of [Earnest Money Amount] upon the execution of this Agreement.

- Financing Contingency: This Agreement is contingent upon the Buyer obtaining financing in the amount of [Financing Amount] within [Time Frame].

- Closing Date: The closing of the transaction shall occur on or before [Closing Date].

- Inspection: The Buyer shall have the right to conduct inspections of the Property within [Inspection Period].

- Utilities: Seller shall ensure that all utilities are transferred and functioning at closing.

- Disclosure: Seller shall provide all required disclosures as mandated by Washington law.

- Default: If either party defaults, the non-defaulting party may seek remedies as allowed under Washington law.

Both parties agree to the following notices:

- Any amendments to this Agreement must be in writing and signed by both parties.

- This Agreement constitutes the entire understanding between Seller and Buyer.

- All parties should consult with their accountants, attorneys, or other advisors before execution.

By signing below, the parties acknowledge their acceptance of the terms of this Agreement:

Seller's Signature: ________________________ Date: ____________________

Buyer's Signature: ________________________ Date: ____________________

This document is a template and is intended for informational purposes only. Consider seeking legal advice before use.

Understanding Washington Real Estate Purchase Agreement

What is a Washington Real Estate Purchase Agreement?

The Washington Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement details important aspects such as the purchase price, financing terms, and contingencies that must be met before the sale can be finalized.

What are the key components of the agreement?

Several critical elements are included in the Washington Real Estate Purchase Agreement:

- Purchase Price: The amount the buyer agrees to pay for the property.

- Earnest Money: A deposit made by the buyer to show commitment to the purchase.

- Contingencies: Conditions that must be satisfied for the sale to proceed, such as inspections or financing approval.

- Closing Date: The date on which the sale will be finalized and ownership transferred.

- Property Description: A detailed description of the property being sold.

Do I need a lawyer to complete this agreement?

While it is not legally required to have a lawyer to complete the Washington Real Estate Purchase Agreement, having legal guidance can be beneficial. An attorney can help ensure that your interests are protected, clarify terms, and assist with any complex issues that may arise during the transaction.

What is earnest money, and how much should I offer?

Earnest money is a deposit made by the buyer to demonstrate their seriousness about purchasing the property. Typically, this amount ranges from 1% to 3% of the purchase price, but it can vary based on local customs and the specifics of the deal. The earnest money is held in escrow and is credited toward the buyer’s down payment at closing.

What happens if I back out of the agreement?

If a buyer decides to back out of the agreement without a valid reason (such as failing to meet a contingency), they may forfeit their earnest money. However, if the buyer withdraws due to a contingency that has not been met, they can typically recover their earnest money. Always review the specific terms of your agreement to understand your rights and obligations.

How long is the agreement valid?

The Washington Real Estate Purchase Agreement remains valid until the closing date or until one party withdraws from the agreement according to the terms specified. It’s important to act promptly, especially regarding contingencies, to avoid any potential issues.

Can I make changes to the agreement after it has been signed?

Yes, changes can be made to the agreement after it has been signed, but both parties must agree to the modifications. Any changes should be documented in writing and signed by both the buyer and the seller to ensure they are legally enforceable.

What is the role of an escrow agent in this process?

An escrow agent acts as a neutral third party who manages the earnest money and ensures that all conditions of the purchase agreement are met before the transaction is finalized. They play a crucial role in facilitating communication between the buyer and seller and ensuring that funds and documents are handled appropriately during the closing process.

Where can I obtain a Washington Real Estate Purchase Agreement form?

You can obtain a Washington Real Estate Purchase Agreement form from various sources, including real estate agents, online legal document services, or local real estate associations. It’s essential to use the most current version of the form to ensure compliance with Washington state laws.

How to Use Washington Real Estate Purchase Agreement

After obtaining the Washington Real Estate Purchase Agreement form, you will need to complete it accurately to ensure a smooth transaction. Each section of the form requires specific information about the property, the buyer, and the seller. Follow these steps carefully to fill out the form correctly.

- Identify the Parties: Fill in the names and contact information of both the buyer and the seller. Make sure to include any applicable legal names.

- Property Description: Provide a detailed description of the property being purchased. This includes the address, parcel number, and any relevant legal descriptions.

- Purchase Price: Clearly state the agreed-upon purchase price. This should be a specific dollar amount.

- Earnest Money: Indicate the amount of earnest money the buyer will deposit. Include details about how this money will be held.

- Financing Terms: Specify how the buyer plans to finance the purchase. This could include conventional loans, FHA loans, or cash purchases.

- Closing Date: Set a proposed closing date for the transaction. This is when the property will officially change hands.

- Contingencies: List any contingencies that must be met before the sale can proceed. Common contingencies include inspections and financing approvals.

- Signatures: Ensure that both the buyer and seller sign the agreement. Dates should also be included next to each signature.

Once the form is completed, it should be reviewed carefully by both parties. After that, it can be submitted to the appropriate parties to move forward with the real estate transaction.