Promissory Note Template for the State of Washington

In the realm of personal and business finance, a promissory note serves as a vital instrument for establishing a clear agreement between a borrower and a lender. Specifically, the Washington Promissory Note form is tailored to meet the unique legal requirements of the state of Washington, ensuring that both parties understand their rights and obligations. This document outlines essential elements such as the principal amount borrowed, the interest rate, repayment schedule, and any applicable fees. It also specifies the consequences of default, providing a roadmap for what happens if the borrower fails to meet their obligations. Importantly, the form can be customized to reflect the specific terms agreed upon by the parties involved, making it a versatile tool in various lending scenarios. Whether used for personal loans, business financing, or real estate transactions, understanding the nuances of the Washington Promissory Note is crucial for anyone looking to navigate the complexities of borrowing and lending in this state.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to confusion or disputes later on. Ensure that all fields are filled out accurately, including the names of the borrower and lender, the loan amount, and the repayment terms.

-

Incorrect Loan Amount: Double-check the figures. Entering the wrong loan amount can result in legal complications. Make sure to verify the numbers before finalizing the document.

-

Missing Signatures: Both parties must sign the note. Without signatures, the document may not be enforceable. Make sure that both the borrower and lender have signed and dated the form.

-

Ignoring State Laws: Each state has specific requirements for promissory notes. Familiarize yourself with Washington's laws to ensure compliance. This includes understanding interest rates and any additional disclosures that may be necessary.

-

Vague Repayment Terms: Clearly outline the repayment schedule. Ambiguous terms can lead to misunderstandings. Specify the due dates, payment amounts, and any penalties for late payments.

-

Not Keeping Copies: Always retain a copy of the signed note for your records. Failing to do so can complicate matters if disputes arise. Both parties should keep their own copies for reference.

Other Common Promissory Note State Templates

Promissory Note Template Arizona - Interest rates and repayment schedules can vary widely based on the agreement.

A California Non-disclosure Agreement (NDA) is a legal document designed to protect confidential information shared between parties. By establishing clear boundaries around sensitive data, this form helps prevent unauthorized disclosure and misuse. If you need to safeguard your proprietary information, consider filling out the NDA form from California Templates by clicking the button below.

Create Promissory Note - This document may be secured or unsecured, depending on the agreement between the parties.

Key takeaways

When filling out and using the Washington Promissory Note form, there are several important points to keep in mind. Here are some key takeaways:

- Understand the Basics: A promissory note is a written promise to pay a specified amount of money to a person or entity. Make sure you understand the terms before signing.

- Include Essential Information: Clearly state the names of both the borrower and the lender, the amount of money being borrowed, and the repayment terms. This clarity helps avoid confusion later.

- Specify Interest Rates: If applicable, include the interest rate on the loan. Be sure to indicate whether it is fixed or variable, as this affects how much will be repaid over time.

- Signatures Matter: Both parties must sign the document for it to be legally binding. Ensure that all signatures are dated to provide a clear timeline of the agreement.

- Keep Copies: After filling out the form, make copies for both the borrower and the lender. This ensures that both parties have a record of the agreement.

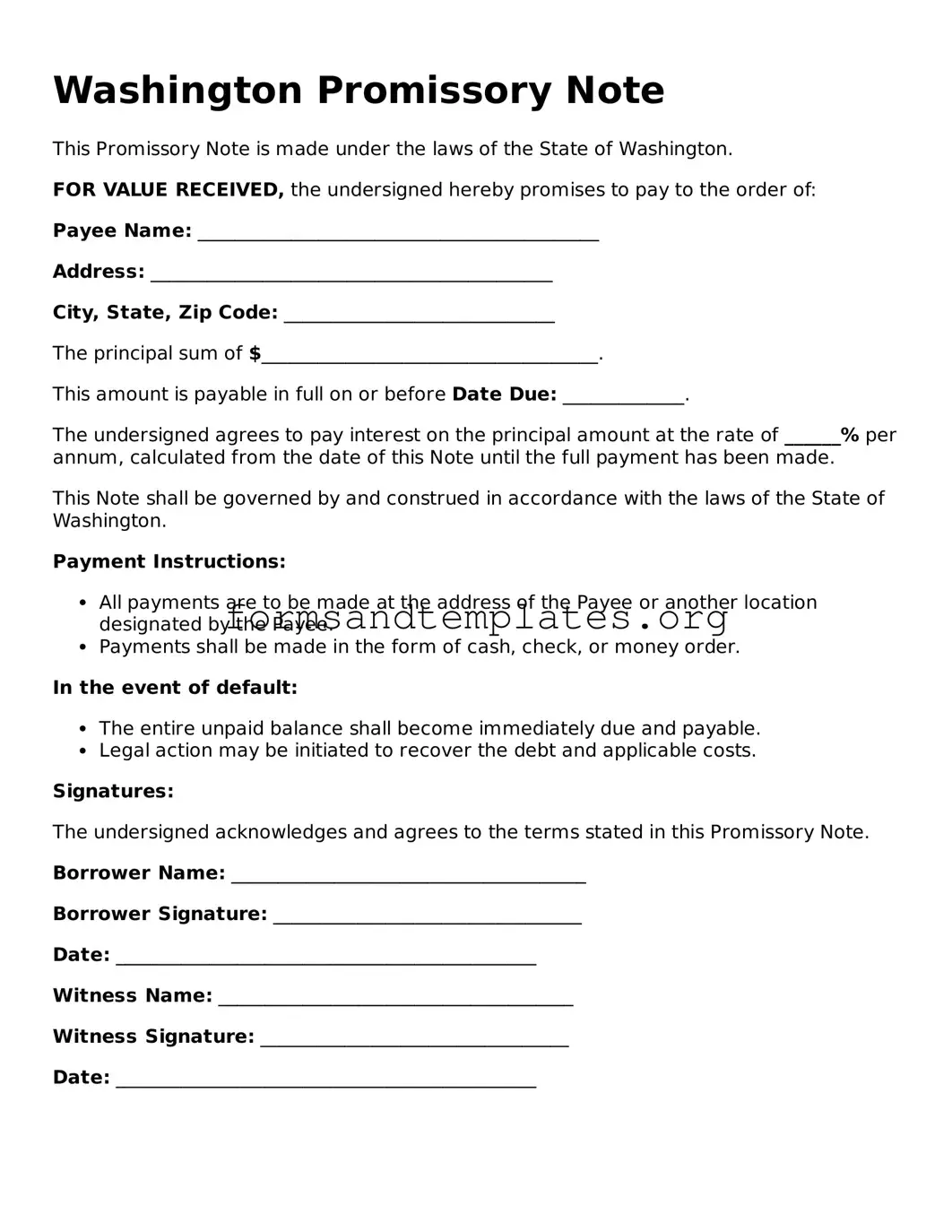

Washington Promissory Note Example

Washington Promissory Note

This Promissory Note is made under the laws of the State of Washington.

FOR VALUE RECEIVED, the undersigned hereby promises to pay to the order of:

Payee Name: ___________________________________________

Address: ___________________________________________

City, State, Zip Code: _____________________________

The principal sum of $____________________________________.

This amount is payable in full on or before Date Due: _____________.

The undersigned agrees to pay interest on the principal amount at the rate of ______% per annum, calculated from the date of this Note until the full payment has been made.

This Note shall be governed by and construed in accordance with the laws of the State of Washington.

Payment Instructions:

- All payments are to be made at the address of the Payee or another location designated by the Payee.

- Payments shall be made in the form of cash, check, or money order.

In the event of default:

- The entire unpaid balance shall become immediately due and payable.

- Legal action may be initiated to recover the debt and applicable costs.

Signatures:

The undersigned acknowledges and agrees to the terms stated in this Promissory Note.

Borrower Name: ______________________________________

Borrower Signature: _________________________________

Date: _____________________________________________

Witness Name: ______________________________________

Witness Signature: _________________________________

Date: _____________________________________________

Understanding Washington Promissory Note

What is a Washington Promissory Note?

A Washington Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This note serves as a written record of the loan agreement and can include details such as the interest rate, repayment schedule, and consequences for defaulting on the loan.

Who typically uses a Promissory Note?

Promissory Notes are commonly used by individuals, businesses, and financial institutions. They can be employed in various situations, including:

- Personal loans between friends or family members

- Business loans for startup capital or operational expenses

- Real estate transactions, such as seller financing

What are the key components of a Washington Promissory Note?

A typical Washington Promissory Note includes several essential components, such as:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the unpaid balance.

- Repayment Schedule: The timeline for when payments are due, including the frequency (e.g., monthly, quarterly).

- Maturity Date: The date by which the loan must be fully repaid.

- Default Terms: Conditions that outline what happens if the borrower fails to make payments.

Is a Promissory Note legally binding in Washington?

Yes, a Promissory Note is legally binding in Washington, provided it meets certain criteria. For the note to be enforceable, it must be signed by both the borrower and the lender. Additionally, it should clearly outline the terms of the loan, including the repayment details. If these conditions are met, the note can be used in court to enforce repayment.

Can I modify a Promissory Note after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement. This helps avoid confusion and ensures that all parties are aware of the new terms.

What should I do if the borrower defaults on the Promissory Note?

If a borrower defaults on a Promissory Note, the lender has several options. First, they may try to communicate with the borrower to resolve the issue amicably. If that does not work, the lender can pursue legal action to recover the owed amount. This may involve filing a lawsuit to obtain a judgment against the borrower. It is recommended to consult with a legal professional to understand the best course of action in such situations.

How to Use Washington Promissory Note

Once you have the Washington Promissory Note form in front of you, it’s time to fill it out carefully. This form is essential for documenting a loan agreement between a borrower and a lender. Follow these steps to ensure that you complete the form correctly.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate what the document is.

- Identify the Parties: Fill in the names and addresses of both the borrower and the lender. Make sure the information is accurate.

- Loan Amount: Specify the total amount of money being borrowed. Write this clearly in both numbers and words.

- Interest Rate: Indicate the interest rate that will apply to the loan. This should be a percentage.

- Payment Terms: Describe how and when the borrower will repay the loan. Include details about the payment schedule and any late fees.

- Maturity Date: State the date by which the loan must be fully repaid.

- Signatures: Both the borrower and the lender must sign the document. Include the date of signing next to each signature.

- Witness or Notary: If required, have a witness or notary public sign the document to validate it.

After completing the form, review it for any errors or omissions. Once everything is in order, you can proceed with the next steps to formalize your agreement.