Durable Power of Attorney Template for the State of Washington

The Washington Durable Power of Attorney form serves as a crucial legal document that allows individuals to designate someone they trust to make decisions on their behalf in the event they become incapacitated. This form not only empowers the appointed agent to manage financial matters, such as banking transactions and property management, but it can also extend to health care decisions, depending on the specific provisions included. Importantly, the durable nature of this power means that it remains effective even if the principal becomes mentally or physically unable to make their own decisions. The form must be signed by the principal and typically requires witnesses or notarization to ensure its validity. Understanding the nuances of this document is essential, as it can significantly impact personal and financial well-being during challenging times. Additionally, individuals can customize the powers granted, specifying limitations or conditions, which adds a layer of flexibility to meet unique needs. Overall, the Washington Durable Power of Attorney form is an essential tool for planning ahead and ensuring that one's wishes are honored when they can no longer advocate for themselves.

Common mistakes

-

Not specifying the powers granted: Many individuals fail to clearly outline the specific powers they wish to grant their agent. This can lead to confusion or limitations in the agent's ability to act on behalf of the principal.

-

Choosing the wrong agent: Selecting someone who may not be trustworthy or capable can lead to serious issues. It’s crucial to choose an agent who understands your wishes and can handle the responsibilities.

-

Failing to sign and date the document: A Durable Power of Attorney is not valid unless it is signed and dated by the principal. Omitting this step renders the document ineffective.

-

Not having witnesses or notarization: In Washington, the document must be signed in front of a notary public or two witnesses. Neglecting this requirement can invalidate the form.

-

Using outdated forms: Laws can change, and using an old version of the Durable Power of Attorney form may not comply with current regulations. Always ensure you have the latest form.

-

Failing to discuss intentions with the agent: It’s essential to communicate your wishes and expectations with your chosen agent. Without this conversation, the agent may not fully understand your desires.

-

Not considering alternate agents: Life is unpredictable. Naming a backup agent ensures that your wishes can still be carried out if your primary agent is unavailable or unable to serve.

-

Neglecting to review and update the document: Situations change over time. Regularly reviewing and updating your Durable Power of Attorney can help ensure it reflects your current wishes and circumstances.

-

Overlooking specific limitations: Some people forget to include any limitations on the agent’s powers. Clearly defining what the agent can and cannot do is important for maintaining control over your affairs.

-

Not storing the document safely: After completing the form, it should be stored in a secure location. Informing your agent where to find it is equally important to ensure it can be accessed when needed.

Other Common Durable Power of Attorney State Templates

Free Power of Attorney Form Texas - This form can be used in various states, but laws may vary.

Virginia Financial Power of Attorney - A Durable Power of Attorney may also include provisions for health care decisions, depending on how you choose to structure it.

The California Release of Liability form is a legal document designed to protect individuals and organizations from claims resulting from injuries or damages that may occur during an activity. By signing this form, participants acknowledge the risks involved and agree to waive their right to hold the organizers accountable. Understanding this form is essential for anyone engaging in activities that carry inherent risks, so consider filling out the form by clicking the button below or visiting California Templates for more information.

New Jersey Power of Attorney Form Pdf - It ensures that your designated agent can act on your behalf even if you lose mental capacity.

Key takeaways

When considering a Durable Power of Attorney (DPOA) in Washington, it's essential to understand its significance and how to properly fill it out. Here are some key takeaways:

- Purpose: A Durable Power of Attorney allows you to appoint someone to make decisions on your behalf if you become unable to do so.

- Durability: Unlike regular powers of attorney, a DPOA remains effective even if you become incapacitated.

- Choosing an Agent: Select someone you trust, as they will have significant control over your financial and legal matters.

- Specific Powers: You can specify what powers you grant your agent, such as managing bank accounts or selling property.

- Signing Requirements: The form must be signed by you and, in some cases, witnessed or notarized to be valid.

- Revocation: You can revoke the DPOA at any time as long as you are mentally competent.

- State Laws: Familiarize yourself with Washington's specific laws regarding DPOAs, as they can vary by state.

- Healthcare Decisions: A DPOA for finances is separate from a healthcare directive; ensure you have both if needed.

- Storage: Keep the original document in a safe place and provide copies to your agent and relevant institutions.

- Review Regularly: Life changes, such as marriage or divorce, may necessitate updates to your DPOA.

Understanding these key points can help ensure that your Durable Power of Attorney serves its intended purpose effectively.

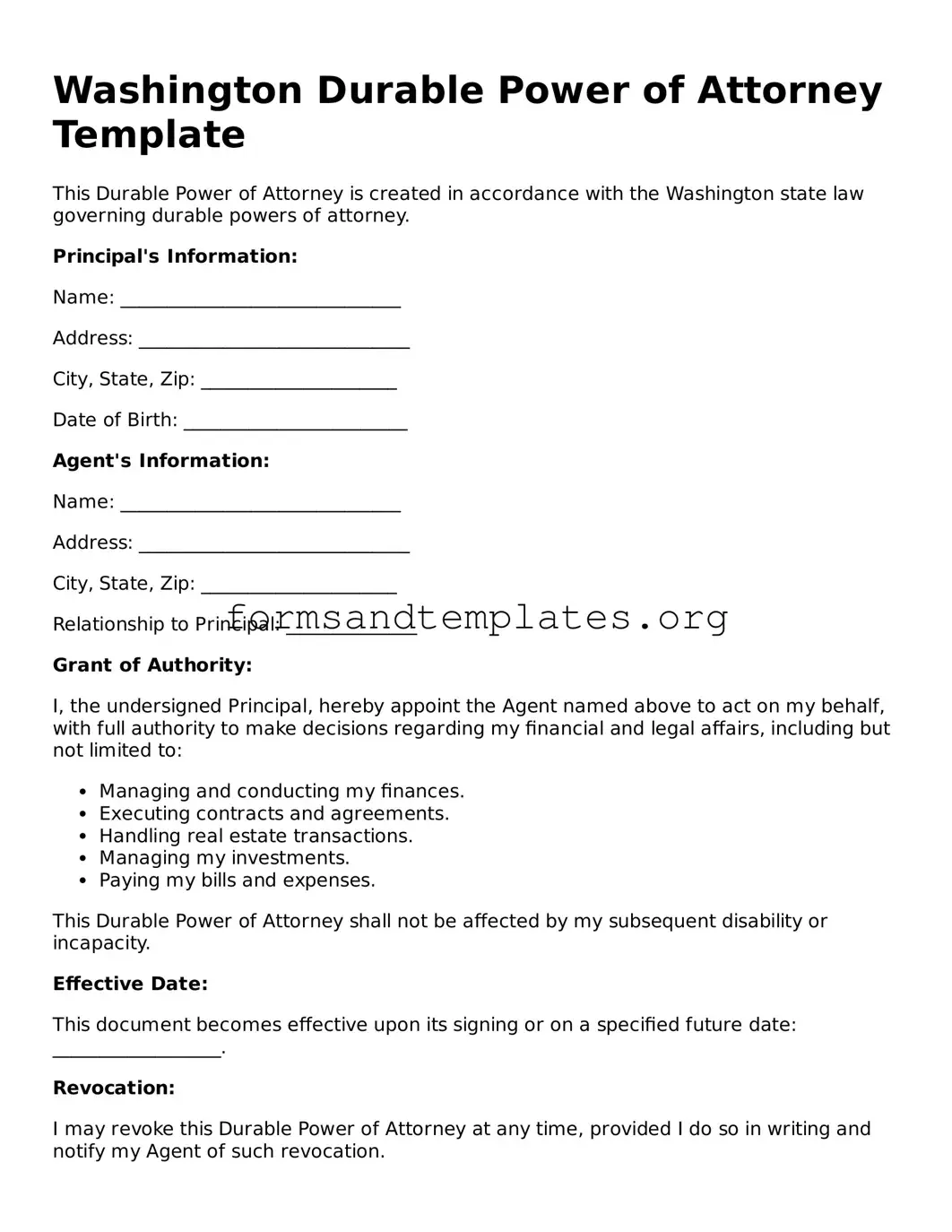

Washington Durable Power of Attorney Example

Washington Durable Power of Attorney Template

This Durable Power of Attorney is created in accordance with the Washington state law governing durable powers of attorney.

Principal's Information:

Name: ______________________________

Address: _____________________________

City, State, Zip: _____________________

Date of Birth: ________________________

Agent's Information:

Name: ______________________________

Address: _____________________________

City, State, Zip: _____________________

Relationship to Principal: ______________

Grant of Authority:

I, the undersigned Principal, hereby appoint the Agent named above to act on my behalf, with full authority to make decisions regarding my financial and legal affairs, including but not limited to:

- Managing and conducting my finances.

- Executing contracts and agreements.

- Handling real estate transactions.

- Managing my investments.

- Paying my bills and expenses.

This Durable Power of Attorney shall not be affected by my subsequent disability or incapacity.

Effective Date:

This document becomes effective upon its signing or on a specified future date: __________________.

Revocation:

I may revoke this Durable Power of Attorney at any time, provided I do so in writing and notify my Agent of such revocation.

Signature:

_______________________________

Signature of Principal

Date: ____________________________

Witnesses:

Two witnesses are required for this document to be valid:

- Name: ___________________________ Signature: ______________________ Date: ________________

- Name: ___________________________ Signature: ______________________ Date: ________________

Notary Public:

State of Washington

County of _________________________

Subscribed and sworn before me this ____ day of ____________, 20___.

_______________________________

Notary Public

My commission expires: ________________

Understanding Washington Durable Power of Attorney

What is a Durable Power of Attorney in Washington State?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become incapacitated. Unlike a regular Power of Attorney, a DPOA remains effective even if you are unable to make decisions for yourself. This ensures that your chosen representative can act on your behalf during critical times.

Who can be appointed as an agent under a Durable Power of Attorney?

You can appoint any competent adult as your agent. This can include family members, friends, or even professionals such as attorneys or financial advisors. It is essential to choose someone you trust, as they will have significant control over your financial matters.

What powers can be granted to the agent in a Durable Power of Attorney?

The powers granted to your agent can be broad or limited, depending on your preferences. Common powers include:

- Managing bank accounts and finances

- Buying or selling property

- Paying bills and expenses

- Filing taxes

- Making investment decisions

You can specify which powers you want to grant or restrict, tailoring the document to fit your needs.

Do I need to have my Durable Power of Attorney notarized?

Yes, in Washington State, your Durable Power of Attorney must be signed in the presence of a notary public. This step helps ensure that the document is legally valid and can be recognized by banks and other institutions.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are still competent. To do this, you should create a written notice of revocation and inform your agent and any institutions that may have a copy of the original document. It’s wise to destroy any copies of the old DPOA to prevent confusion.

Is a Durable Power of Attorney effective immediately?

A Durable Power of Attorney can be effective immediately upon signing, or you can specify that it only becomes effective upon your incapacity. This flexibility allows you to decide when your agent can begin acting on your behalf.

How does a Durable Power of Attorney differ from a healthcare Power of Attorney?

A Durable Power of Attorney primarily focuses on financial and legal matters, while a healthcare Power of Attorney allows someone to make medical decisions on your behalf if you are unable to do so. Both documents are important, but they serve different purposes. It is advisable to have both in place for comprehensive planning.

What should I consider before creating a Durable Power of Attorney?

Before creating a Durable Power of Attorney, consider the following:

- Choosing a trustworthy agent who understands your values and wishes.

- Deciding what powers to grant and any limitations you want to impose.

- Discussing your plans with your agent to ensure they are willing to take on this responsibility.

- Consulting with a legal professional if you have specific concerns or complex financial situations.

Taking these steps can help ensure that your Durable Power of Attorney meets your needs and protects your interests.

How to Use Washington Durable Power of Attorney

Filling out the Washington Durable Power of Attorney form is an important step in designating someone to handle your financial matters if you become unable to do so. This process requires careful attention to detail to ensure that your wishes are clearly communicated. Follow these steps to complete the form accurately.

- Obtain a copy of the Washington Durable Power of Attorney form. You can find it online or at a local legal office.

- Begin by filling in your name and address at the top of the form. This identifies you as the principal.

- Next, write the name and address of the person you are appointing as your attorney-in-fact. This individual will have the authority to make decisions on your behalf.

- Specify the powers you want to grant. You can choose to give broad authority or limit it to specific tasks. Make sure to check the appropriate boxes or write in the details clearly.

- Indicate when the powers will begin. You may want them to start immediately or only if you become incapacitated.

- Sign and date the form at the designated area. Your signature must match the name you provided at the top.

- Have the form witnessed. Washington law requires that you have at least one witness who is not related to you or your attorney-in-fact.

- Consider having the form notarized. While not required, notarization adds an extra layer of authenticity.

- Keep a copy of the completed form for your records and provide a copy to your attorney-in-fact.