Transfer-on-Death Deed Template for the State of Virginia

In Virginia, the Transfer-on-Death (TOD) Deed is a powerful tool for property owners who want to ensure their real estate passes directly to their chosen beneficiaries without the hassle of probate. This form allows individuals to designate one or more beneficiaries who will receive the property upon the owner's death, making the transfer process straightforward and efficient. Importantly, the property owner retains full control over the property during their lifetime, meaning they can sell, lease, or change the beneficiaries as they see fit. The TOD Deed must be properly executed and recorded to be valid, and it is crucial to understand the specific requirements to avoid complications later. This deed can provide peace of mind, knowing that your property will go to your loved ones without unnecessary delays or legal obstacles. Understanding how this form works and the steps involved in creating one can help you make informed decisions about your estate planning needs.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details, such as the full legal names of both the grantor and the beneficiary. Omitting this information can lead to confusion and potential legal challenges later.

-

Improper Witness Signatures: The Virginia Transfer-on-Death Deed requires signatures from two witnesses. A common mistake is not having the deed signed in the presence of these witnesses, which can invalidate the deed.

-

Not Recording the Deed: After completing the form, some people neglect to record the deed with the local clerk’s office. Without this step, the transfer may not be recognized, and the property could remain part of the grantor's estate.

-

Failure to Update the Deed: Life changes, such as marriage or divorce, can affect beneficiaries. Many do not revisit or update their Transfer-on-Death Deed, which can lead to unintended consequences regarding property distribution.

-

Confusing Beneficiary Designations: Some individuals mistakenly designate multiple beneficiaries without clear instructions on how the property should be divided. This can create disputes among heirs and complicate the transfer process.

Other Common Transfer-on-Death Deed State Templates

Transfer on Death Deed Washington State Form - Some states may require the deed to be notarized to be legally enforceable.

In addition to providing essential information for the transaction, utilizing a reliable resource like California Templates can help streamline the process of filling out the California Motorcycle Bill of Sale form, ensuring that all details are accurately captured and legally binding for both buyer and seller.

New Jersey Transfer on Death Deed - Ensuring proper execution and recording of the deed will safeguard your intentions after passing.

Free Printable Beneficiary Deed Form Arizona - Families can benefit from using a Transfer-on-Death Deed as part of a broader strategy for caring for their loved ones’ future financial needs.

Property Title Transfer Attorney - This option can also be a part of a broader estate plan, providing an easy way to transfer real estate assets.

Key takeaways

When considering the Virginia Transfer-on-Death Deed form, it’s important to understand its key aspects. Here are some essential takeaways to keep in mind:

- Purpose: The Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate.

- Eligibility: This deed can be used by individuals who own real estate in Virginia and wish to designate one or more beneficiaries.

- Revocability: The Transfer-on-Death Deed can be revoked or modified at any time before the property owner’s death, providing flexibility.

- Execution Requirements: To be valid, the deed must be signed by the property owner and witnessed by two individuals or notarized.

- Filing: After execution, the deed must be recorded in the local land records office where the property is located to take effect.

- Beneficiary Rights: Beneficiaries do not have any rights to the property until the death of the owner, which means they cannot sell or manage the property during the owner’s lifetime.

- Tax Implications: It’s advisable to consult a tax professional, as there may be tax consequences associated with the transfer of property upon death.

Understanding these points can help ensure that you use the Virginia Transfer-on-Death Deed form effectively and in accordance with your estate planning goals.

Virginia Transfer-on-Death Deed Example

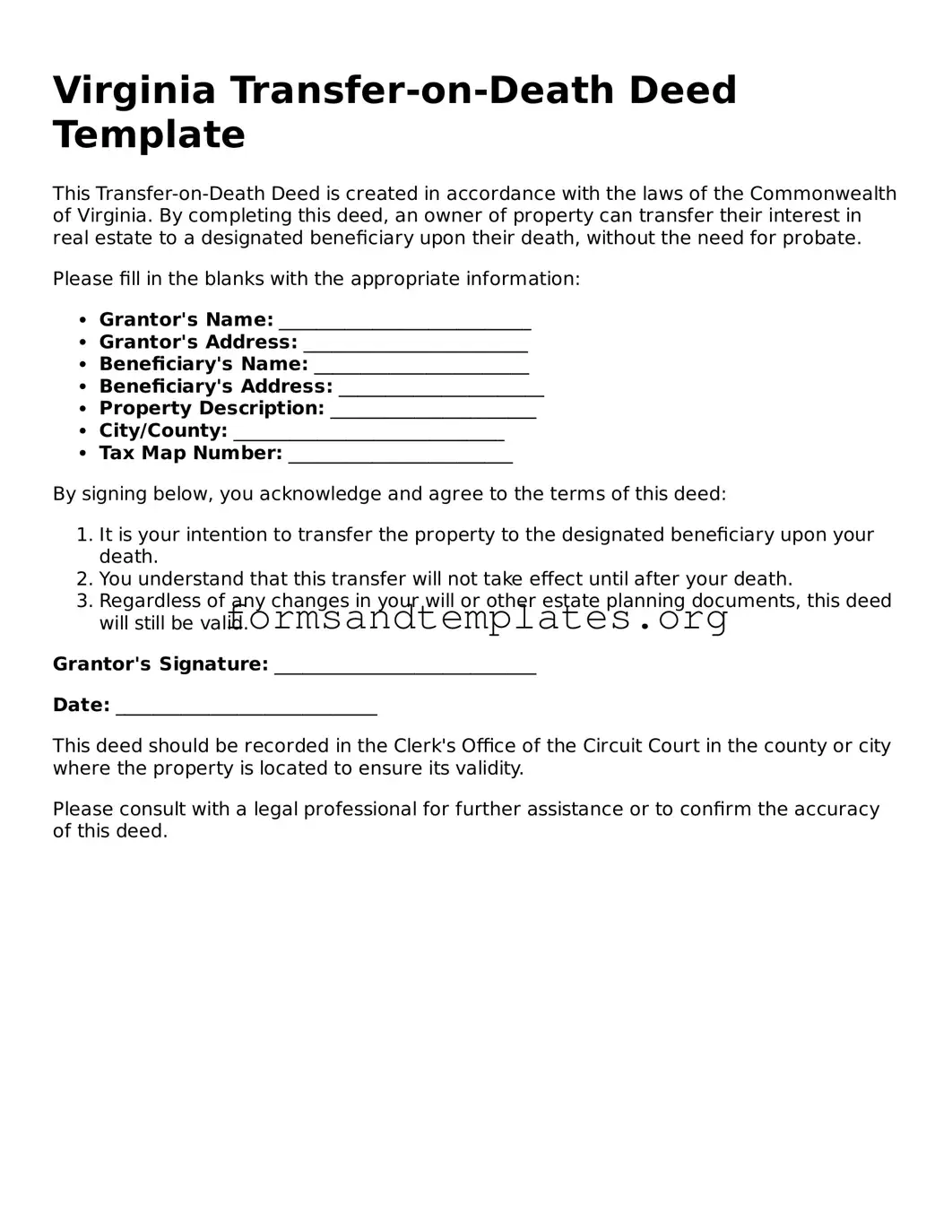

Virginia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the laws of the Commonwealth of Virginia. By completing this deed, an owner of property can transfer their interest in real estate to a designated beneficiary upon their death, without the need for probate.

Please fill in the blanks with the appropriate information:

- Grantor's Name: ___________________________

- Grantor's Address: ________________________

- Beneficiary's Name: _______________________

- Beneficiary's Address: ______________________

- Property Description: ______________________

- City/County: _____________________________

- Tax Map Number: ________________________

By signing below, you acknowledge and agree to the terms of this deed:

- It is your intention to transfer the property to the designated beneficiary upon your death.

- You understand that this transfer will not take effect until after your death.

- Regardless of any changes in your will or other estate planning documents, this deed will still be valid.

Grantor's Signature: ____________________________

Date: ____________________________

This deed should be recorded in the Clerk's Office of the Circuit Court in the county or city where the property is located to ensure its validity.

Please consult with a legal professional for further assistance or to confirm the accuracy of this deed.

Understanding Virginia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Virginia?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Virginia to transfer real estate to a designated beneficiary upon their death. This type of deed bypasses probate, meaning the property can be transferred directly to the beneficiary without going through the lengthy and often costly probate process. The property owner retains full control of the property during their lifetime, and they can revoke or change the deed at any time before their death.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

In Virginia, any individual or entity can be named as a beneficiary in a Transfer-on-Death Deed. This includes family members, friends, or even organizations. However, it is essential to ensure that the beneficiary is legally capable of receiving the property. For instance, minors may require a guardian or custodian to manage the property until they reach adulthood.

How do I create a Transfer-on-Death Deed in Virginia?

Creating a Transfer-on-Death Deed involves several steps:

- Obtain the appropriate TOD Deed form from a reliable source, such as a legal website or local government office.

- Fill out the form with accurate information, including the property description and beneficiary details.

- Sign the deed in front of a notary public to ensure its validity.

- Record the completed deed with the local circuit court clerk's office where the property is located. This step is crucial for the deed to be legally recognized.

Can I revoke a Transfer-on-Death Deed once it is created?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. To revoke the deed, the property owner must complete a revocation form, which should also be signed and notarized. Additionally, the revocation must be recorded with the same circuit court where the original TOD Deed was filed. This ensures that the change is officially recognized and that any future beneficiaries are aware of the revocation.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when a Transfer-on-Death Deed is created. The property remains part of the owner’s estate for tax purposes until their death. At that point, the beneficiary may be subject to estate taxes, depending on the overall value of the estate. It is advisable to consult with a tax professional to understand any potential tax liabilities that may arise upon the transfer of property.

How to Use Virginia Transfer-on-Death Deed

After obtaining the Virginia Transfer-on-Death Deed form, you will need to complete it carefully to ensure proper execution. Once filled out, the deed must be recorded with the appropriate local government office to take effect.

- Begin by entering the name of the current property owner(s) in the designated section.

- Provide the complete address of the property being transferred.

- Include a legal description of the property. This can typically be found on the property deed or tax records.

- Identify the beneficiary or beneficiaries who will receive the property upon the owner’s death. Include their full names and addresses.

- Sign the form in the presence of a notary public. Ensure that all owners sign if there are multiple owners.

- Have the notary public complete their section, verifying the signatures.

- Make copies of the completed and notarized form for your records.

- File the original form with the appropriate local land records office. Check for any filing fees that may apply.