RV Bill of Sale Template for the State of Virginia

When buying or selling a recreational vehicle (RV) in Virginia, having the right documentation is crucial for a smooth transaction. The Virginia RV Bill of Sale form serves as a vital record that outlines the details of the sale, protecting both the buyer and the seller. This form includes essential information such as the names and addresses of the parties involved, a description of the RV, including its make, model, and vehicle identification number (VIN), and the sale price. Additionally, it may specify any terms of the sale, such as whether the RV is being sold "as is" or if any warranties are included. Properly completing this form not only helps establish ownership but also provides a clear record for future reference, such as registering the vehicle or addressing any disputes that may arise. Understanding the importance of this document can help ensure a successful transaction, giving both parties peace of mind as they navigate the process of buying or selling an RV.

Common mistakes

-

Incorrect Vehicle Information: One of the most common mistakes is failing to provide accurate details about the RV. This includes the make, model, year, and Vehicle Identification Number (VIN). Missing or incorrect information can lead to complications during registration.

-

Omitting Seller and Buyer Details: It's crucial to include complete names and addresses for both the seller and the buyer. Skipping this step can create confusion and legal issues later on.

-

Not Including the Sale Price: Forgetting to specify the sale price is another frequent error. This information is vital for tax purposes and helps establish the transaction's legitimacy.

-

Failing to Sign the Document: Both parties must sign the Bill of Sale for it to be valid. Neglecting to do so can render the document ineffective in the eyes of the law.

-

Not Keeping Copies: After filling out the form, it's essential to make copies for both the seller and the buyer. Without copies, you may lack proof of the transaction in the future.

-

Ignoring State Requirements: Each state may have specific requirements for a Bill of Sale. Failing to adhere to Virginia's regulations can lead to issues with the DMV or future ownership disputes.

Other Common RV Bill of Sale State Templates

Texas Trailer Bill of Sale - A legal document for selling an RV.

Az Bill of Sale - The RV Bill of Sale can assist in determining the tax obligations related to the sale.

In addition to understanding its importance, parents should familiarize themselves with the process of completing the necessary documentation. For a comprehensive resource, you can refer to California Templates, which provides helpful templates for creating the Power of Attorney for a Child form.

Vehicle Bill of Sale Washington - Filling out the RV Bill of Sale carefully is necessary to avoid later complications.

Key takeaways

When dealing with the Virginia RV Bill of Sale form, it is essential to understand its purpose and how to complete it correctly. Here are some key takeaways:

- The RV Bill of Sale serves as a legal document that proves the transfer of ownership from the seller to the buyer.

- Both the buyer and seller should fill out the form completely to avoid future disputes.

- Include important details such as the RV's make, model, year, and Vehicle Identification Number (VIN).

- Ensure that both parties sign and date the document. This validates the transaction.

- Consider having the document notarized. While not required, it adds an extra layer of authenticity.

- Keep a copy of the completed Bill of Sale for your records. This can be useful for registration and tax purposes.

- Be aware of any state-specific requirements, such as emissions testing or safety inspections.

- Using the Bill of Sale can help protect both parties in case of legal issues regarding the sale.

- Finally, check for any local regulations that may apply to RV sales in your area.

Virginia RV Bill of Sale Example

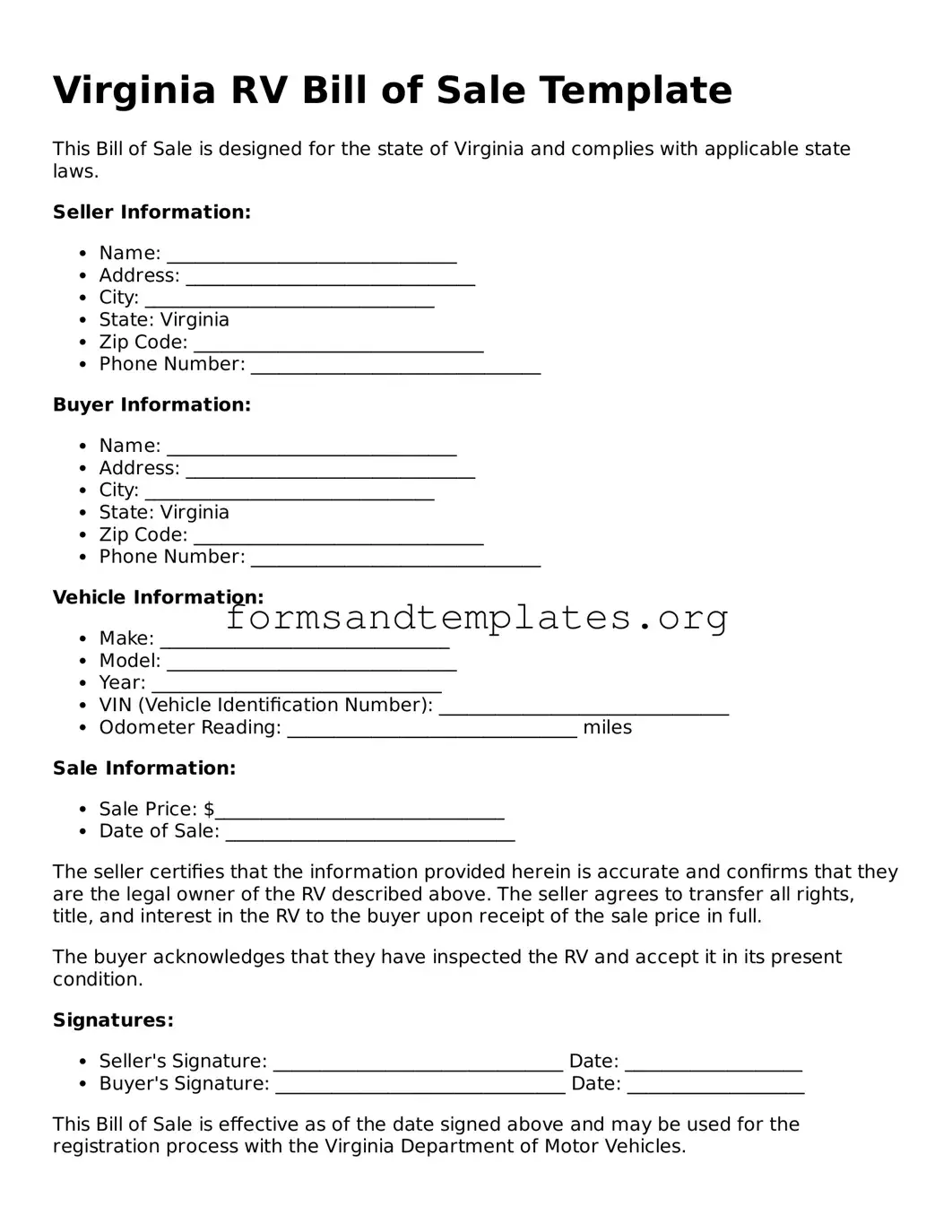

Virginia RV Bill of Sale Template

This Bill of Sale is designed for the state of Virginia and complies with applicable state laws.

Seller Information:

- Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: Virginia

- Zip Code: _______________________________

- Phone Number: _______________________________

Buyer Information:

- Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: Virginia

- Zip Code: _______________________________

- Phone Number: _______________________________

Vehicle Information:

- Make: _______________________________

- Model: _______________________________

- Year: _______________________________

- VIN (Vehicle Identification Number): _______________________________

- Odometer Reading: _______________________________ miles

Sale Information:

- Sale Price: $_______________________________

- Date of Sale: _______________________________

The seller certifies that the information provided herein is accurate and confirms that they are the legal owner of the RV described above. The seller agrees to transfer all rights, title, and interest in the RV to the buyer upon receipt of the sale price in full.

The buyer acknowledges that they have inspected the RV and accept it in its present condition.

Signatures:

- Seller's Signature: _______________________________ Date: ___________________

- Buyer's Signature: _______________________________ Date: ___________________

This Bill of Sale is effective as of the date signed above and may be used for the registration process with the Virginia Department of Motor Vehicles.

Understanding Virginia RV Bill of Sale

What is a Virginia RV Bill of Sale?

A Virginia RV Bill of Sale is a legal document that records the sale of a recreational vehicle (RV) between a seller and a buyer. It serves as proof of the transaction and includes important details about the RV and the parties involved.

Why do I need a Bill of Sale for my RV?

The Bill of Sale is essential for several reasons:

- It provides legal proof of ownership transfer.

- It can help in the registration process with the Virginia Department of Motor Vehicles (DMV).

- It protects both the buyer and seller in case of disputes.

What information is included in the RV Bill of Sale?

The RV Bill of Sale typically includes:

- The names and addresses of the buyer and seller.

- The RV's make, model, year, and Vehicle Identification Number (VIN).

- The sale price of the RV.

- The date of the sale.

- Signatures of both parties.

Do I need to have the Bill of Sale notarized?

In Virginia, notarization is not required for the RV Bill of Sale to be valid. However, having it notarized can add an extra layer of security and authenticity to the document.

Can I create my own RV Bill of Sale?

Yes, you can create your own RV Bill of Sale as long as it includes all necessary information. However, using a template or form specifically designed for Virginia can help ensure that you include all required details.

Is there a specific form I must use in Virginia?

While there is no official state form for the RV Bill of Sale, it is important to include all relevant information. Many online resources offer templates that comply with Virginia's requirements.

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it is advisable to contact the seller to request a duplicate. Keeping a copy of the document in a safe place is always a good practice to avoid future complications.

How does the Bill of Sale affect registration?

The Bill of Sale is a crucial document when registering your RV with the Virginia DMV. It provides proof of ownership and helps establish the sale price for tax purposes.

What should I do if the seller refuses to provide a Bill of Sale?

If a seller refuses to provide a Bill of Sale, it is wise to reconsider the transaction. A Bill of Sale protects both parties and is an important part of the buying process. Always insist on having one before completing the sale.

Can I use the RV Bill of Sale for tax purposes?

Yes, the RV Bill of Sale can be used for tax purposes. It serves as proof of the purchase price, which may be needed when filing taxes or applying for any tax exemptions related to the vehicle.

How to Use Virginia RV Bill of Sale

After obtaining the Virginia RV Bill of Sale form, you are ready to provide the necessary information to ensure a smooth transaction. This document will serve as proof of the sale and transfer of ownership for the recreational vehicle.

- Start by entering the date of the sale at the top of the form.

- Fill in the seller's name and address. Make sure to include the complete address for accurate identification.

- Next, provide the buyer's name and address, just as you did for the seller.

- In the designated section, describe the RV. Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the RV. Be clear and precise in stating the amount.

- If applicable, note any additional terms or conditions of the sale in the provided area.

- Both the seller and buyer should sign and date the form to validate the transaction.

Once you have completed the form, ensure that both parties keep a copy for their records. This will help avoid any potential disputes in the future.