Real Estate Purchase Agreement Template for the State of Virginia

The Virginia Real Estate Purchase Agreement form is a crucial document for anyone looking to buy or sell property in the state. This form outlines the terms and conditions of the transaction, ensuring that both parties have a clear understanding of their rights and responsibilities. Key components include the purchase price, financing details, and the closing date, which all play a vital role in the successful transfer of ownership. Additionally, the agreement addresses contingencies, such as home inspections and appraisals, which protect buyers and sellers by allowing them to back out of the deal under specific circumstances. The form also includes provisions for earnest money deposits, which demonstrate the buyer's serious intent to purchase. By clearly laying out these details, the Virginia Real Estate Purchase Agreement helps to minimize misunderstandings and disputes, paving the way for a smoother transaction process. Understanding this form is essential for both first-time homebuyers and seasoned investors alike, as it serves as the foundation for any real estate deal in Virginia.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or complications in the transaction.

-

Incorrect Property Description: Not accurately describing the property can create legal issues later. Always double-check the address and parcel number.

-

Missing Signatures: Both parties must sign the agreement. Omitting a signature can invalidate the contract.

-

Not Specifying Contingencies: Leaving out contingencies, such as financing or inspection, can put buyers at risk if issues arise.

-

Ignoring Deadlines: Failing to include or adhere to important dates can jeopardize the agreement. Be clear about timelines.

-

Misunderstanding Earnest Money: Not specifying the amount or terms of earnest money can lead to confusion. Clearly outline this in the agreement.

-

Overlooking Closing Costs: Not addressing who pays closing costs can result in disputes. Define these costs in the agreement.

-

Vague Terms: Using ambiguous language can lead to different interpretations. Be specific about all terms and conditions.

-

Not Consulting a Professional: Attempting to fill out the form without legal or real estate guidance can lead to mistakes. Always consider seeking help.

-

Failing to Review the Agreement: Skipping a final review before submission can cause overlooked errors. Take the time to read everything carefully.

Other Common Real Estate Purchase Agreement State Templates

Tennessee Real Estate Contract - Includes information on how earnest money will be handled if the transaction fails.

The California Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a residential property. This agreement serves to protect the rights of both parties while clearly defining their responsibilities. For more resources on creating a comprehensive rental agreement, visit California Templates to ensure a smooth rental experience; fill out the form by clicking the button below.

Nj Real Estate Contract - Can serve as a foundation for future communications between parties after the sale.

Key takeaways

When filling out and using the Virginia Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Understand the Basics: Familiarize yourself with the essential components of the agreement, including buyer and seller information, property details, and purchase price.

- Be Accurate: Ensure all information is correct. Mistakes can lead to misunderstandings or legal issues down the line.

- Disclosures Matter: Review any required disclosures. Sellers must provide specific information about the property's condition.

- Contingencies: Include contingencies that protect you. Common ones involve financing, inspections, and appraisal results.

- Dates and Deadlines: Pay attention to important dates. Timely actions are crucial for keeping the agreement valid.

- Earnest Money: Understand the role of earnest money. This deposit shows the buyer's commitment and can be forfeited under certain conditions.

- Closing Costs: Be clear about who pays closing costs. This can be negotiated between the buyer and seller.

- Review Before Signing: Always read the agreement thoroughly before signing. Ensure you understand all terms and conditions.

- Seek Professional Help: Consider consulting a real estate attorney or agent. They can provide valuable insights and guidance.

- Keep Copies: After signing, keep copies of the agreement for your records. This will be important for future reference.

By following these tips, you can navigate the Virginia Real Estate Purchase Agreement with greater confidence and clarity.

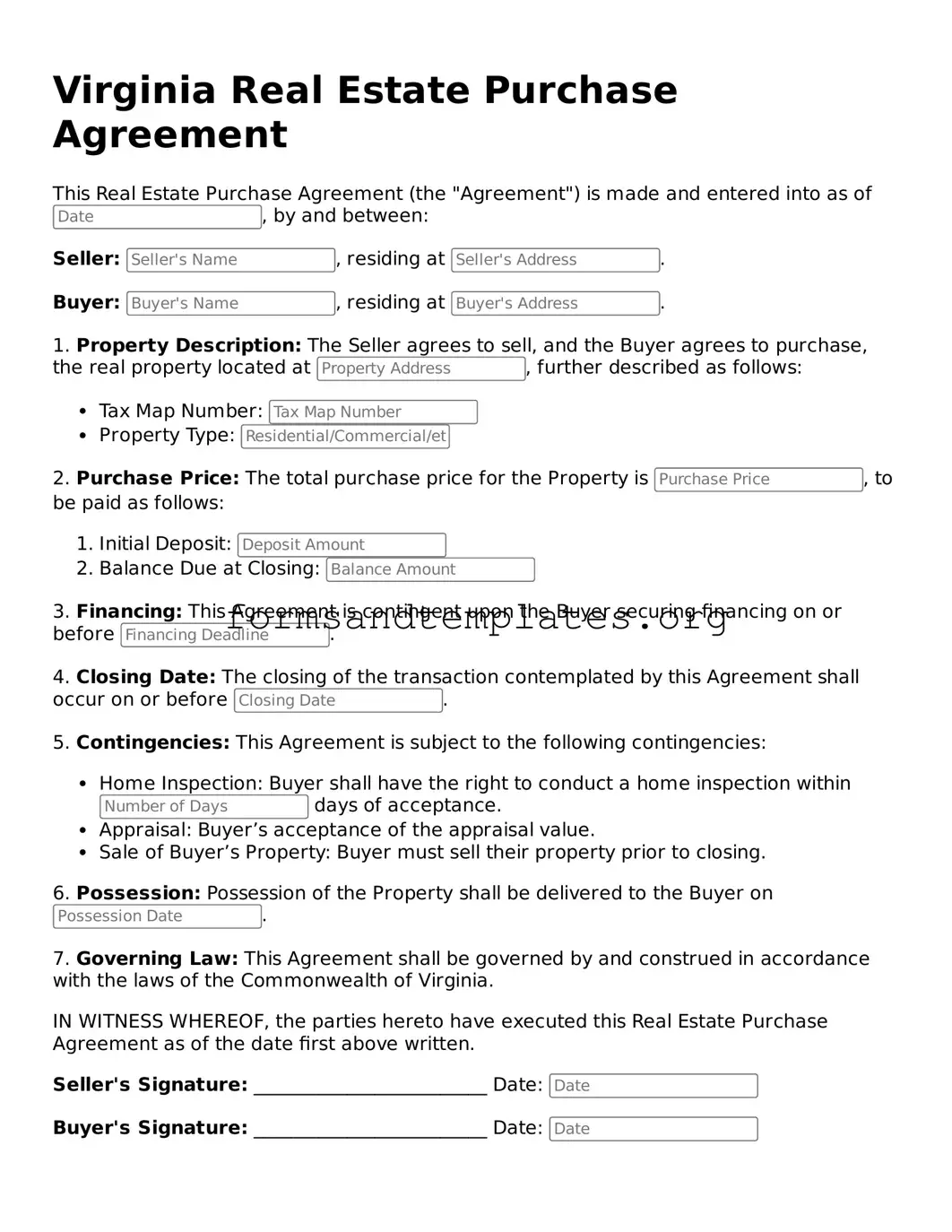

Virginia Real Estate Purchase Agreement Example

Virginia Real Estate Purchase Agreement

This Real Estate Purchase Agreement (the "Agreement") is made and entered into as of , by and between:

Seller: , residing at .

Buyer: , residing at .

1. Property Description: The Seller agrees to sell, and the Buyer agrees to purchase, the real property located at , further described as follows:

- Tax Map Number:

- Property Type:

2. Purchase Price: The total purchase price for the Property is , to be paid as follows:

- Initial Deposit:

- Balance Due at Closing:

3. Financing: This Agreement is contingent upon the Buyer securing financing on or before .

4. Closing Date: The closing of the transaction contemplated by this Agreement shall occur on or before .

5. Contingencies: This Agreement is subject to the following contingencies:

- Home Inspection: Buyer shall have the right to conduct a home inspection within days of acceptance.

- Appraisal: Buyer’s acceptance of the appraisal value.

- Sale of Buyer’s Property: Buyer must sell their property prior to closing.

6. Possession: Possession of the Property shall be delivered to the Buyer on .

7. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia.

IN WITNESS WHEREOF, the parties hereto have executed this Real Estate Purchase Agreement as of the date first above written.

Seller's Signature: _________________________ Date:

Buyer's Signature: _________________________ Date:

Understanding Virginia Real Estate Purchase Agreement

What is the Virginia Real Estate Purchase Agreement form?

The Virginia Real Estate Purchase Agreement form is a legal document used in real estate transactions. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form includes essential details such as the purchase price, property description, closing date, and any contingencies that may apply.

Who should use the Virginia Real Estate Purchase Agreement form?

This form is intended for use by both buyers and sellers involved in a real estate transaction in Virginia. Real estate agents often assist in filling out this form, but individuals can also use it independently. It is crucial for both parties to understand the terms before signing.

What key elements are included in the agreement?

The agreement typically includes the following key elements:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Property Description: A detailed description of the property being sold, including its address and legal description.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspection requirements.

- Closing Date: The date on which the sale will be finalized and ownership transferred.

- Earnest Money: A deposit made by the buyer to show good faith in the transaction.

Can the agreement be modified after it is signed?

Yes, the Virginia Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability.

What happens if one party breaches the agreement?

If one party fails to fulfill their obligations under the agreement, it is considered a breach. The non-breaching party may have several options, including:

- Seeking damages for any losses incurred.

- Requesting specific performance, which means asking the court to enforce the terms of the agreement.

- Terminating the agreement if the breach is significant.

Is it necessary to have a lawyer review the agreement?

How to Use Virginia Real Estate Purchase Agreement

Filling out the Virginia Real Estate Purchase Agreement form is a crucial step in the home buying process. Ensure that all information is accurate and complete to facilitate a smooth transaction.

- Begin by entering the date of the agreement at the top of the form.

- Fill in the names of the buyer(s) and seller(s). Ensure all parties are clearly identified.

- Provide the property address, including the city, state, and zip code.

- Specify the purchase price of the property. Double-check this figure for accuracy.

- Detail the earnest money deposit amount. Indicate how this will be paid.

- Outline the financing terms, including the type of loan, if applicable, and any contingencies.

- Include the closing date or a timeline for when the transaction should be completed.

- List any contingencies that must be met before the sale can proceed, such as inspections or appraisals.

- Sign and date the agreement at the bottom. Ensure all parties sign where indicated.

Once completed, review the form for any errors or omissions. It may be wise to consult with a real estate professional before submitting the agreement.