Promissory Note Template for the State of Virginia

In the realm of personal and business finance, the Virginia Promissory Note stands as a crucial instrument for documenting a loan agreement between a borrower and a lender. This legally binding document outlines the terms of the loan, including the principal amount borrowed, the interest rate, and the repayment schedule. It provides clarity and security for both parties involved, ensuring that the borrower understands their obligations and the lender knows their rights. Additionally, the form typically includes provisions for late fees, default consequences, and any collateral securing the loan, which can further protect the lender's interests. Importantly, the Virginia Promissory Note is designed to be straightforward, allowing individuals and businesses to customize it according to their specific needs while adhering to state laws. By utilizing this form, parties can foster trust and transparency in their financial dealings, paving the way for successful transactions.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill in all required fields. This can include missing the borrower's name, the lender's name, or the loan amount. Each section is crucial for the validity of the note.

-

Incorrect Loan Amount: Entering an incorrect loan amount can lead to confusion and disputes later. Double-check the numbers to ensure accuracy.

-

Omitting Interest Rate: Not specifying the interest rate or leaving it blank can cause misunderstandings. Clearly state the interest rate to avoid potential legal issues.

-

Improper Signatures: Both the borrower and lender must sign the document. Missing signatures or not having them in the correct places can render the note invalid.

-

Failure to Date the Note: Forgetting to include the date on which the note is signed can create complications. Always include the date to establish a clear timeline for the loan.

Other Common Promissory Note State Templates

Tennessee Promissory Note - Different states may have varying regulations regarding the enforcement of promissory notes.

In addition to the essential details outlined in the lease agreement, landlords and tenants can benefit from utilizing resources like the California Templates, which provide a customizable fillable format to ensure all necessary terms are included effectively.

Washington Promissory Note - The note’s enforceability can vary based on jurisdiction and local laws in effect.

Key takeaways

Understanding the Virginia Promissory Note form is crucial for anyone involved in lending or borrowing money. Here are some key takeaways to consider:

- Clear Identification: Ensure that both the lender and borrower are clearly identified in the document. This includes full names and addresses.

- Loan Amount: Specify the exact amount being borrowed. Ambiguities can lead to disputes later.

- Interest Rate: If applicable, state the interest rate clearly. This helps both parties understand the cost of borrowing.

- Payment Terms: Outline the payment schedule, including due dates and amounts. This creates a clear roadmap for repayment.

- Default Clauses: Include provisions for what happens if the borrower fails to repay. This protects the lender's interests.

- Governing Law: The form should specify that Virginia law governs the agreement. This is important for legal enforcement.

- Signatures: Both parties must sign the document. This step is essential for the note to be legally binding.

By paying attention to these key elements, both lenders and borrowers can create a solid foundation for their financial agreement, minimizing potential misunderstandings and legal issues in the future.

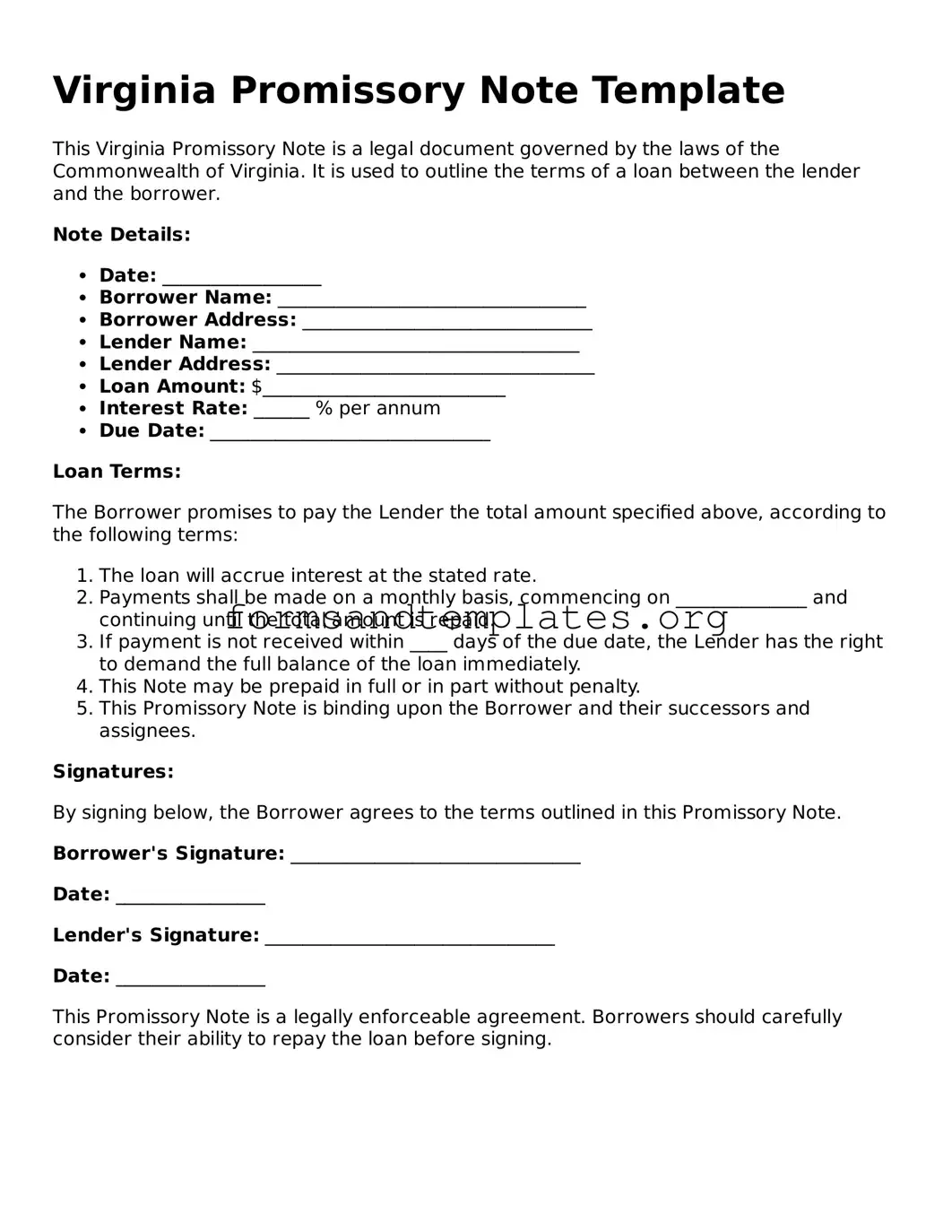

Virginia Promissory Note Example

Virginia Promissory Note Template

This Virginia Promissory Note is a legal document governed by the laws of the Commonwealth of Virginia. It is used to outline the terms of a loan between the lender and the borrower.

Note Details:

- Date: _________________

- Borrower Name: _________________________________

- Borrower Address: _______________________________

- Lender Name: ___________________________________

- Lender Address: __________________________________

- Loan Amount: $__________________________

- Interest Rate: ______ % per annum

- Due Date: ______________________________

Loan Terms:

The Borrower promises to pay the Lender the total amount specified above, according to the following terms:

- The loan will accrue interest at the stated rate.

- Payments shall be made on a monthly basis, commencing on ______________ and continuing until the total amount is repaid.

- If payment is not received within ____ days of the due date, the Lender has the right to demand the full balance of the loan immediately.

- This Note may be prepaid in full or in part without penalty.

- This Promissory Note is binding upon the Borrower and their successors and assignees.

Signatures:

By signing below, the Borrower agrees to the terms outlined in this Promissory Note.

Borrower's Signature: _______________________________

Date: ________________

Lender's Signature: _______________________________

Date: ________________

This Promissory Note is a legally enforceable agreement. Borrowers should carefully consider their ability to repay the loan before signing.

Understanding Virginia Promissory Note

What is a Virginia Promissory Note?

A Virginia Promissory Note is a legal document in which one party (the borrower) agrees to repay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the amount borrowed, interest rates, repayment schedule, and any other conditions related to the loan.

What are the key components of a Virginia Promissory Note?

Key components typically include:

- The principal amount of the loan

- The interest rate, if applicable

- The repayment schedule, including due dates

- Signatures of both the borrower and lender

- Any collateral involved, if applicable

- Default and late payment terms

Is a Virginia Promissory Note legally binding?

Yes, a properly executed Virginia Promissory Note is legally binding. Once signed by both parties, it creates an enforceable obligation for the borrower to repay the loan according to the terms outlined in the document. However, both parties must have the legal capacity to enter into a contract for it to be valid.

Do I need a lawyer to create a Virginia Promissory Note?

While it is not legally required to have a lawyer draft a Virginia Promissory Note, consulting one is advisable, especially for larger loans or complex terms. A lawyer can ensure that the document complies with state laws and adequately protects the interests of both parties.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. They may pursue legal action to recover the owed amount, which could include filing a lawsuit or seeking a judgment. The specific remedies available will depend on the terms of the Promissory Note and Virginia law.

Can a Virginia Promissory Note be modified after it is signed?

Yes, a Virginia Promissory Note can be modified, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended agreement to avoid potential disputes in the future.

How to Use Virginia Promissory Note

After gathering all necessary information, it is time to complete the Virginia Promissory Note form. This document requires specific details about the parties involved, the loan amount, and the repayment terms. Ensuring accuracy is essential, as any discrepancies could lead to complications in the future.

- Begin by entering the date at the top of the form. This should reflect the day you are completing the note.

- Next, fill in the name and address of the borrower. This identifies the individual or entity responsible for repaying the loan.

- Then, provide the lender's name and address. This is the party that is extending the loan to the borrower.

- Specify the principal amount of the loan. This figure represents the total sum borrowed by the borrower.

- Indicate the interest rate, if applicable. This should be expressed as a percentage and must be clear to avoid misunderstandings.

- Outline the repayment schedule. Include details such as the frequency of payments (e.g., monthly, quarterly) and the due date for each payment.

- Include any late fees or penalties for missed payments. Clearly state the conditions under which these fees will apply.

- Sign and date the document. Both the borrower and lender must provide their signatures to validate the agreement.

- Lastly, ensure that both parties retain a copy of the completed form for their records.