Gift Deed Template for the State of Virginia

When it comes to transferring property without the exchange of money, the Virginia Gift Deed form serves as a vital tool for individuals wishing to convey real estate as a gift. This legal document outlines the specifics of the transaction, detailing the donor, who is the person giving the gift, and the recipient, known as the donee. It is essential to understand that the Gift Deed must be executed voluntarily and without any form of coercion, ensuring that the transfer reflects the true intentions of the parties involved. Additionally, the form requires a description of the property being gifted, which helps to clarify the exact boundaries and features of the real estate in question. While the process may seem straightforward, it is important to recognize that certain legal requirements must be met for the Gift Deed to be valid, including the need for notarization and proper recording with the local government. This form not only facilitates the transfer of ownership but also carries significant tax implications that both the donor and the donee should consider. As such, understanding the nuances of the Virginia Gift Deed form is crucial for anyone contemplating a property gift, ensuring that the process is smooth and legally sound.

Common mistakes

-

Incomplete Information: Failing to provide all required details can delay the processing of the deed. Ensure that names, addresses, and property descriptions are fully filled out.

-

Incorrect Property Description: Not accurately describing the property can lead to confusion or disputes later. Use the legal description found in the property deed.

-

Not Signing the Deed: A gift deed must be signed by the donor. Forgetting this step means the deed is not valid.

-

Improper Witnesses: Some states require witnesses to sign the deed. Check Virginia's requirements to avoid issues.

-

Not Notarizing: In Virginia, notarization is often necessary. Without a notary, the deed may not be accepted by the county.

-

Failing to Record the Deed: After signing, the deed should be recorded with the local county clerk. Skipping this step can lead to problems with ownership proof.

-

Ignoring Tax Implications: Gift taxes may apply. It’s important to understand any potential tax consequences before completing the deed.

-

Not Consulting a Professional: Skipping legal advice can result in mistakes. Consulting a real estate attorney or a knowledgeable professional can help ensure everything is done correctly.

Other Common Gift Deed State Templates

How to Gift a House to a Child - The process of creating a Gift Deed can vary by state, so check local requirements.

For those interested in creating a rental agreement in Florida, a convenient resource is available at https://floridaforms.net/blank-lease-agreement-form/, which offers a blank lease agreement form that helps clarify the necessary terms and conditions between landlords and tenants.

Key takeaways

When filling out and using the Virginia Gift Deed form, there are several important points to keep in mind. Below are key takeaways to consider:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money.

- Identify the Parties: Clearly list the names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Property: Provide a detailed description of the property being gifted, including its address and any identifying features.

- Consider Tax Implications: Be aware of potential gift tax implications. Consult a tax professional if necessary.

- Signatures Required: The donor must sign the Gift Deed in the presence of a notary public to validate the document.

- Record the Deed: After signing, the Gift Deed should be recorded with the local county clerk's office to ensure public notice of the transfer.

- Check for Existing Liens: Investigate whether there are any liens or encumbrances on the property before completing the transfer.

- Consider Legal Advice: It may be beneficial to seek legal advice to ensure that the Gift Deed is completed correctly and in compliance with Virginia laws.

- Review State Requirements: Familiarize yourself with any specific requirements or forms mandated by Virginia law for gift transactions.

- Future Ownership Issues: Understand that once the Gift Deed is executed, the donor relinquishes all rights to the property, which may affect future ownership decisions.

By keeping these takeaways in mind, individuals can navigate the process of using a Virginia Gift Deed more effectively.

Virginia Gift Deed Example

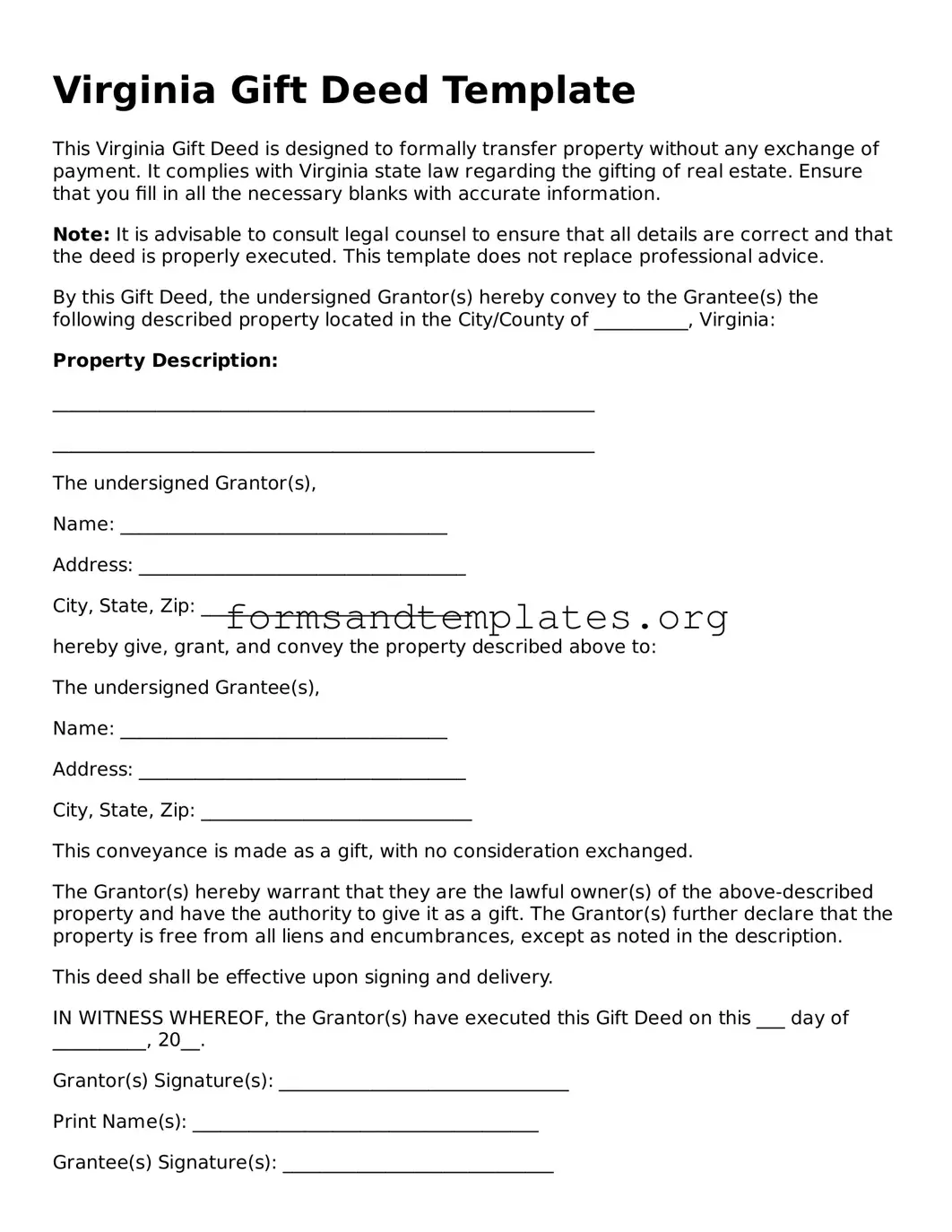

Virginia Gift Deed Template

This Virginia Gift Deed is designed to formally transfer property without any exchange of payment. It complies with Virginia state law regarding the gifting of real estate. Ensure that you fill in all the necessary blanks with accurate information.

Note: It is advisable to consult legal counsel to ensure that all details are correct and that the deed is properly executed. This template does not replace professional advice.

By this Gift Deed, the undersigned Grantor(s) hereby convey to the Grantee(s) the following described property located in the City/County of __________, Virginia:

Property Description:

__________________________________________________________

__________________________________________________________

The undersigned Grantor(s),

Name: ___________________________________

Address: ___________________________________

City, State, Zip: _____________________________

hereby give, grant, and convey the property described above to:

The undersigned Grantee(s),

Name: ___________________________________

Address: ___________________________________

City, State, Zip: _____________________________

This conveyance is made as a gift, with no consideration exchanged.

The Grantor(s) hereby warrant that they are the lawful owner(s) of the above-described property and have the authority to give it as a gift. The Grantor(s) further declare that the property is free from all liens and encumbrances, except as noted in the description.

This deed shall be effective upon signing and delivery.

IN WITNESS WHEREOF, the Grantor(s) have executed this Gift Deed on this ___ day of __________, 20__.

Grantor(s) Signature(s): _______________________________

Print Name(s): _____________________________________

Grantee(s) Signature(s): _____________________________

Print Name(s): _____________________________________

Notary Public Certification

Commonwealth of Virginia

City/County of _________________________

Subscribed and sworn before me this ___ day of __________, 20__.

__________________________________________

Notary Public

My commission expires: ____________________

Understanding Virginia Gift Deed

What is a Virginia Gift Deed?

A Virginia Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is typically used when a property owner wishes to give their property as a gift to a family member or friend. It serves to formalize the transfer and provides a record of the transaction.

What are the requirements for a valid Gift Deed in Virginia?

To create a valid Gift Deed in Virginia, the following requirements must be met:

- The deed must be in writing.

- It must clearly identify the donor (the person giving the gift) and the recipient (the person receiving the gift).

- The property being transferred must be adequately described.

- The donor must intend to make a gift and must sign the deed.

- The deed should be notarized to ensure its authenticity.

Is there a tax implication for gifting property in Virginia?

Yes, gifting property can have tax implications. While the recipient of the gift does not pay income tax on the value of the property received, the donor may be subject to federal gift tax if the value exceeds a certain threshold. As of 2023, the annual exclusion amount is $17,000 per recipient. It is advisable to consult with a tax professional to understand any potential tax liabilities.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it generally cannot be revoked. The transfer is considered complete. However, if the donor has not yet delivered the deed or if there are specific conditions outlined in the deed itself, there may be circumstances under which the gift can be rescinded. Legal advice should be sought in such cases.

What happens if the donor dies after executing a Gift Deed?

If the donor dies after executing a Gift Deed, the property is typically no longer part of the donor's estate. The recipient becomes the legal owner of the property, assuming the deed was properly executed and delivered. This can help avoid probate for that property, simplifying the transfer process.

Do I need an attorney to prepare a Gift Deed?

While it is not legally required to have an attorney prepare a Gift Deed, consulting with one is highly recommended. An attorney can ensure that the deed complies with Virginia law, help avoid potential pitfalls, and provide guidance on any tax implications associated with the gift.

Can a Gift Deed include conditions or restrictions?

Yes, a Gift Deed can include conditions or restrictions. For example, the donor may specify that the recipient must use the property for a certain purpose or maintain it in a particular manner. However, it is essential that these conditions are clearly stated in the deed to avoid confusion or disputes in the future.

How do I record a Gift Deed in Virginia?

To record a Gift Deed in Virginia, the completed deed must be submitted to the local clerk's office in the jurisdiction where the property is located. There may be a small recording fee. Recording the deed provides public notice of the transfer and protects the recipient's ownership rights.

How to Use Virginia Gift Deed

Once you have obtained the Virginia Gift Deed form, it is essential to fill it out accurately to ensure that the transfer of property is valid. The following steps provide a clear guide to completing the form correctly.

- Obtain the Form: Download or request a hard copy of the Virginia Gift Deed form from a reliable source.

- Identify the Grantor: Fill in the name and address of the person giving the gift (the grantor).

- Identify the Grantee: Enter the name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a detailed description of the property being transferred. Include the address, tax map number, and any other identifying information.

- State the Gift: Clearly state that the property is being given as a gift, without any exchange of money or other consideration.

- Include the Date: Write the date on which the gift is being made.

- Signatures: Both the grantor and grantee must sign the form. If applicable, have the signatures notarized to validate the document.

- Witnesses: If required, include the signatures of witnesses to the transaction.

- File the Deed: Submit the completed Gift Deed to the appropriate local government office to ensure it is recorded in public records.