Attorney-Verified Vehicle Repayment Agreement Template

When navigating the complexities of vehicle financing, understanding the Vehicle Repayment Agreement form is essential for both lenders and borrowers. This document serves as a binding contract that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. Key aspects of the form include the total amount financed, the interest rate, and the repayment schedule, which specifies how and when payments will be made. Additionally, it details any fees associated with late payments and the consequences of defaulting on the loan. By clearly defining these parameters, the Vehicle Repayment Agreement helps protect the rights of both parties involved, ensuring transparency and accountability throughout the repayment process. Furthermore, the form often includes clauses regarding insurance requirements and the maintenance of the vehicle, emphasizing the importance of responsible ownership. Understanding these components can empower borrowers to make informed decisions while providing lenders with the necessary framework to manage their financial risks effectively.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details such as their full name, address, and contact information. This can lead to delays in processing the agreement.

-

Missing Vehicle Details: It's crucial to include the correct vehicle identification number (VIN) and make/model of the vehicle. Omitting this information can cause confusion and may invalidate the agreement.

-

Improper Signature: Some people forget to sign the form or do not sign in the designated area. An unsigned agreement may not be legally binding.

-

Failure to Read Terms: Not reviewing the repayment terms can lead to misunderstandings. Individuals should ensure they understand the payment schedule and any associated fees.

-

Inaccurate Financial Information: Providing incorrect income or expense details can result in unrealistic repayment plans. Accurate financial disclosure is essential for a fair agreement.

-

Neglecting to Keep Copies: After submitting the form, some forget to keep a copy for their records. Retaining a copy is important for future reference and tracking payments.

Fill out Other Templates

Wage and Tax Statement - It is issued by an employer to each employee at the end of the tax year.

Understanding the terms of a lease is essential for a successful rental experience, and the California Residential Lease Agreement plays a key role in this process. By clearly defining the responsibilities and rights of both landlords and tenants, this document eliminates any potential for misunderstandings. For those looking to streamline the agreement process, consider utilizing resources like California Templates, which can help you fill out the necessary forms efficiently.

Is a Corporation Number the Same as a Business Number - Lists the address of the corporation's principal office.

How to Write Letter of Recommendation for Pa School - The applicant is skilled in time management, balancing academic, clinical, and personal commitments effectively.

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, it is essential to follow certain guidelines to ensure clarity and compliance. Here are some key takeaways to consider:

- Understand the Purpose: The Vehicle Repayment Agreement is designed to outline the terms of repayment for a vehicle loan. Familiarize yourself with its intent before proceeding.

- Provide Accurate Information: Ensure that all personal and vehicle information is correct. Double-check details like your name, address, and vehicle identification number (VIN).

- Specify Payment Terms: Clearly state the repayment schedule, including the amount due, due dates, and the total repayment period. This helps avoid confusion later.

- Include Contact Information: Both parties should provide contact details. This facilitates communication in case of any questions or issues that arise during the repayment process.

- Read the Agreement Thoroughly: Before signing, review the entire document. Ensure that all terms are understood and that they reflect what was agreed upon.

- Keep a Copy: After signing, retain a copy of the agreement for your records. This serves as a reference in case of disputes or misunderstandings.

- Seek Clarification: If any part of the agreement is unclear, do not hesitate to ask questions. It’s important that both parties fully understand their obligations.

- Follow Up on Payments: Stay organized and keep track of payments. If any issues arise, address them promptly to avoid penalties or complications.

Vehicle Repayment Agreement Example

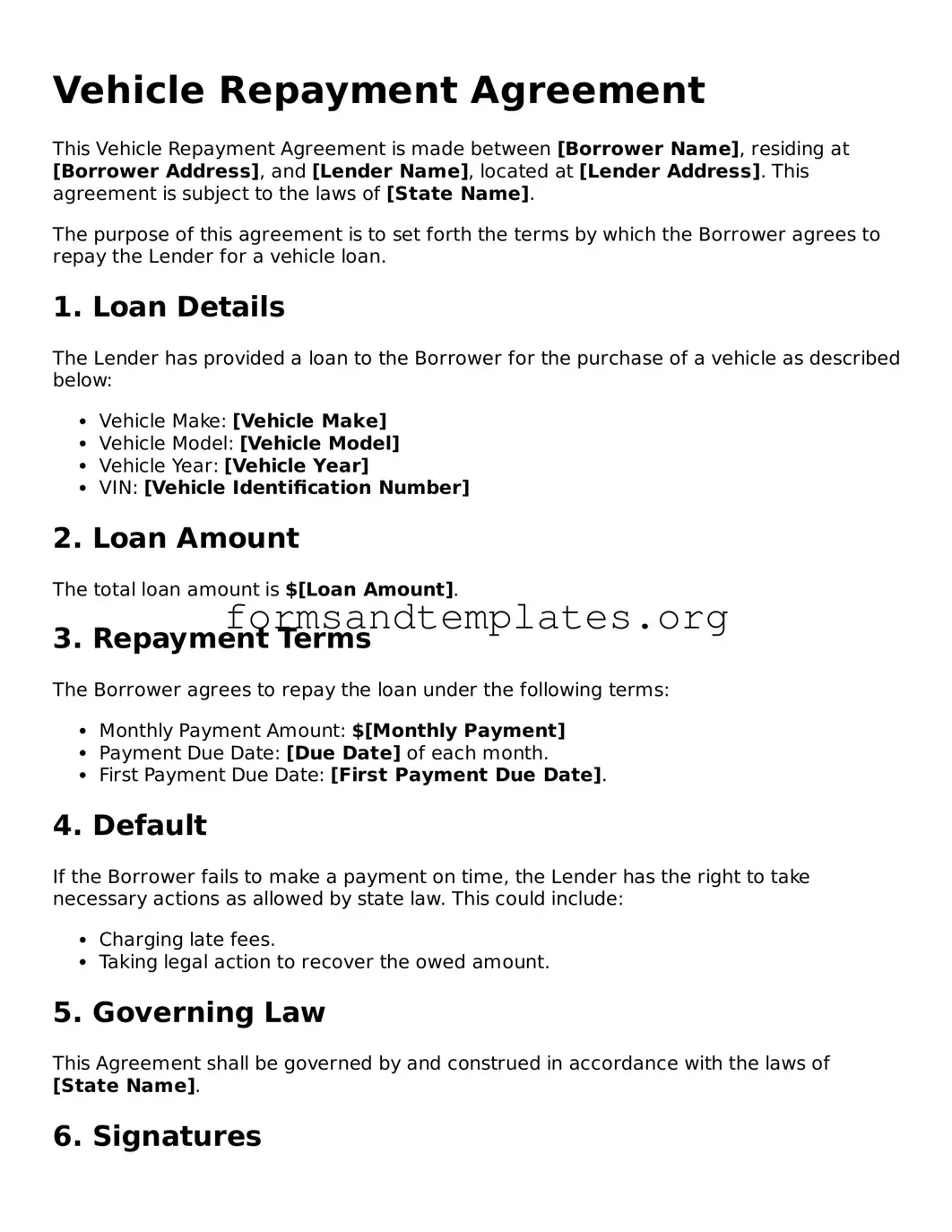

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made between [Borrower Name], residing at [Borrower Address], and [Lender Name], located at [Lender Address]. This agreement is subject to the laws of [State Name].

The purpose of this agreement is to set forth the terms by which the Borrower agrees to repay the Lender for a vehicle loan.

1. Loan Details

The Lender has provided a loan to the Borrower for the purchase of a vehicle as described below:

- Vehicle Make: [Vehicle Make]

- Vehicle Model: [Vehicle Model]

- Vehicle Year: [Vehicle Year]

- VIN: [Vehicle Identification Number]

2. Loan Amount

The total loan amount is $[Loan Amount].

3. Repayment Terms

The Borrower agrees to repay the loan under the following terms:

- Monthly Payment Amount: $[Monthly Payment]

- Payment Due Date: [Due Date] of each month.

- First Payment Due Date: [First Payment Due Date].

4. Default

If the Borrower fails to make a payment on time, the Lender has the right to take necessary actions as allowed by state law. This could include:

- Charging late fees.

- Taking legal action to recover the owed amount.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of [State Name].

6. Signatures

By signing below, both parties agree to the terms outlined in this Vehicle Repayment Agreement.

Borrower Signature: ________________________ Date: _______________

Lender Signature: ________________________ Date: _______________

Witness Signature: ________________________ Date: _______________

Understanding Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement form?

A Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

Who needs to fill out this form?

Anyone who is financing a vehicle purchase through a loan will need to complete a Vehicle Repayment Agreement form. This includes individuals, businesses, or organizations that are borrowing money to buy a vehicle.

What information is required on the form?

The form generally requires the following information:

- Borrower’s name and contact information

- Lender’s name and contact information

- Details of the vehicle being financed (make, model, VIN)

- Loan amount

- Interest rate

- Repayment schedule (monthly, quarterly, etc.)

- Any applicable fees or penalties

What happens if I miss a payment?

If a payment is missed, the lender may impose penalties as outlined in the agreement. This can include late fees or an increase in the interest rate. It is crucial to communicate with the lender as soon as possible to discuss options for making the payment or restructuring the loan.

Can I modify the terms of the agreement after signing?

Modifying the terms of the agreement is possible but typically requires the consent of both the borrower and the lender. Any changes should be documented in writing and signed by both parties to ensure clarity and enforceability.

Is the Vehicle Repayment Agreement legally binding?

Yes, once both parties sign the Vehicle Repayment Agreement form, it becomes a legally binding contract. This means that both the borrower and the lender are obligated to adhere to the terms outlined in the document.

What should I do if I want to refinance my vehicle loan?

To refinance your vehicle loan, you should first review your current agreement to understand any penalties for early repayment. Then, shop around for better loan terms and consult with your current lender about the refinancing process. Once you secure a new loan, you will need to complete a new Vehicle Repayment Agreement form.

Can I use this form for any type of vehicle?

Yes, the Vehicle Repayment Agreement form can be used for various types of vehicles, including cars, trucks, motorcycles, and recreational vehicles. However, ensure that the lender is aware of the specific type of vehicle being financed, as this may affect the terms of the loan.

What should I do if I have questions about the form?

If you have questions regarding the Vehicle Repayment Agreement form, it is advisable to reach out to the lender directly. They can provide clarification on specific terms and conditions. Additionally, consulting with a legal or financial advisor may help in understanding the implications of the agreement.

Where can I obtain a Vehicle Repayment Agreement form?

A Vehicle Repayment Agreement form can often be obtained from the lender, whether it is a bank, credit union, or dealership. Many lenders also provide the form online, allowing you to fill it out electronically or download it for printing.

How to Use Vehicle Repayment Agreement

Once you have the Vehicle Repayment Agreement form in front of you, it’s important to fill it out accurately. Each section requires specific information, and completing it correctly will help ensure a smooth process moving forward.

- Read the Instructions: Before starting, take a moment to read any instructions provided with the form. This will give you a clear understanding of what information is needed.

- Provide Personal Information: Fill in your full name, address, and contact information in the designated sections. Make sure this information is current and accurate.

- Vehicle Details: Enter the make, model, year, and Vehicle Identification Number (VIN) of the vehicle in question. Double-check the VIN for accuracy.

- Repayment Terms: Specify the repayment amount, frequency (e.g., monthly), and due date. Be clear about how long you plan to take to repay the amount.

- Sign and Date: After completing all sections, sign and date the form at the bottom. Your signature indicates your agreement to the terms outlined in the document.

- Review: Before submitting, review the entire form for any errors or omissions. Ensure that all required fields are completed.

After filling out the form, you may need to submit it to the appropriate party, such as a lender or financial institution. Keep a copy for your records, as it’s important to have documentation of your agreement.