Attorney-Verified Transfer-on-Death Deed Template

The Transfer-on-Death Deed (TOD) form offers a straightforward way for property owners to ensure their real estate passes directly to their chosen beneficiaries upon their death, avoiding the often lengthy and costly probate process. This form allows individuals to retain full control of their property during their lifetime, as it does not take effect until the owner has passed away. Importantly, the TOD deed can be revoked or changed at any time before the owner's death, providing flexibility and peace of mind. It is essential to understand that the beneficiaries named in the deed do not have any rights to the property until the owner dies, which helps maintain the owner's autonomy. Additionally, the TOD deed is generally simple to execute, requiring only the owner's signature and notarization, making it an accessible option for many. This form is particularly beneficial for those looking to streamline the transfer of their assets and minimize complications for their loved ones in the future.

Common mistakes

-

Not including a legal description of the property: Many people forget to provide a precise legal description of the property they intend to transfer. A simple address is often insufficient. The legal description should be detailed enough to identify the property uniquely.

-

Failing to sign the deed: A common oversight is neglecting to sign the Transfer-on-Death Deed. Without a signature, the document is not valid and will not effectuate the intended transfer.

-

Not having witnesses or notarization: Depending on state laws, some jurisdictions require the deed to be witnessed or notarized. Skipping this step can lead to complications later.

-

Incorrectly naming beneficiaries: It’s crucial to accurately name the beneficiaries. Mistakes in spelling or using informal names can create confusion and lead to disputes.

-

Leaving out the date: Failing to date the document can result in ambiguity about when the deed was executed, which can complicate matters if there are disputes or if the deed is challenged.

-

Not understanding state-specific rules: Each state has its own laws regarding Transfer-on-Death Deeds. Ignoring these specific regulations can lead to invalidation of the deed.

-

Assuming the deed is automatically effective: Some individuals mistakenly believe that filling out the form automatically transfers the property. In reality, the deed must be properly recorded to be effective.

-

Overlooking existing liens or debts: Individuals may forget to consider any liens or debts attached to the property. These obligations can complicate the transfer process.

-

Not updating the deed when circumstances change: Life events such as divorce, death, or changes in relationships can necessitate updates to the deed. Failing to make these changes can lead to unintended consequences.

Transfer-on-Death Deed - Tailored for State

Create Popular Types of Transfer-on-Death Deed Templates

Quitclaim Deed Form New Jersey - A Quitclaim Deed can assist in fast sales or transfers without complications.

A California Non-disclosure Agreement (NDA) is a legal document designed to protect confidential information shared between parties. By establishing clear boundaries around sensitive data, this form helps prevent unauthorized disclosure and misuse. If you need to safeguard your proprietary information, consider filling out the NDA form by clicking the button below or by visiting California Templates for additional resources.

Correction Deed Form California - A Corrective Deed is crucial for title insurance.

What Is a Deed in Lieu of Foreclosure? - It can potentially improve a homeowner's credit timeline compared to foreclosure.

Key takeaways

When considering the Transfer-on-Death Deed (TODD), it is essential to understand its implications and requirements. Here are key takeaways to keep in mind:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit their property upon their death, bypassing the probate process.

- Filling out the form requires accurate information about the property, including its legal description, which is critical for ensuring the deed's validity.

- It is important to have the TODD signed and notarized to ensure it is legally binding. Without proper execution, the deed may not be enforceable.

- Beneficiaries should be clearly identified, as any ambiguity can lead to disputes or complications after the property owner's passing.

- Property owners retain full control over their property while they are alive. They can sell, mortgage, or change the beneficiaries at any time without any restrictions.

- Consulting with a legal professional before finalizing the deed is advisable, as they can provide guidance tailored to individual circumstances and state laws.

Transfer-on-Death Deed Example

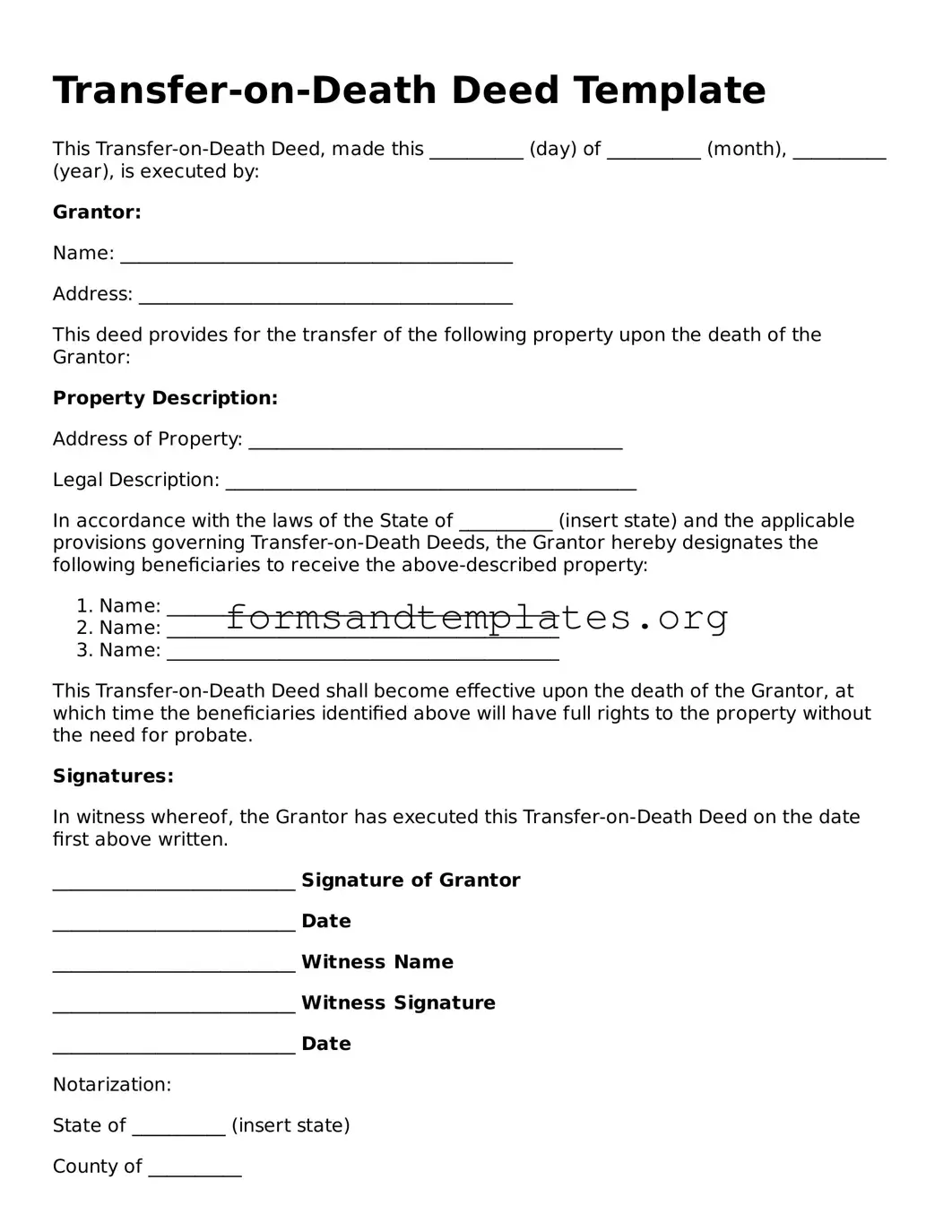

Transfer-on-Death Deed Template

This Transfer-on-Death Deed, made this __________ (day) of __________ (month), __________ (year), is executed by:

Grantor:

Name: __________________________________________

Address: ________________________________________

This deed provides for the transfer of the following property upon the death of the Grantor:

Property Description:

Address of Property: ________________________________________

Legal Description: ____________________________________________

In accordance with the laws of the State of __________ (insert state) and the applicable provisions governing Transfer-on-Death Deeds, the Grantor hereby designates the following beneficiaries to receive the above-described property:

- Name: __________________________________________

- Name: __________________________________________

- Name: __________________________________________

This Transfer-on-Death Deed shall become effective upon the death of the Grantor, at which time the beneficiaries identified above will have full rights to the property without the need for probate.

Signatures:

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on the date first above written.

__________________________ Signature of Grantor

__________________________ Date

__________________________ Witness Name

__________________________ Witness Signature

__________________________ Date

Notarization:

State of __________ (insert state)

County of __________

On this __________ (day) of __________ (month), __________ (year), before me, a notary public in and for said state, personally appeared the above-named Grantor, who acknowledged that they executed the same for the purposes therein stated.

__________________________ Notary Public Signature

__________________________ Date

My commission expires: __________ (date)

Understanding Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to designate one or more beneficiaries to receive their property upon their death. This type of deed is beneficial because it bypasses the probate process, allowing for a smoother and quicker transfer of property. The property owner retains full control of the property during their lifetime, and they can revoke or change the deed at any time before their death.

How do I create a Transfer-on-Death Deed?

Creating a Transfer-on-Death Deed typically involves the following steps:

- Gather necessary information, including the legal description of the property and the names of the beneficiaries.

- Obtain the appropriate form, which may vary by state. Many states provide templates or forms online.

- Complete the form, ensuring all required information is accurately filled out.

- Sign the deed in the presence of a notary public, as most states require notarization.

- File the deed with the appropriate local government office, such as the county recorder or assessor's office, to make it effective.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner's death. To revoke the deed, the property owner must create a new document that explicitly states the revocation or file a revocation form, if available in their state. If changes are needed, a new TOD Deed can be created, which will replace the previous one. It is essential to follow the same procedures for signing and filing the new deed to ensure it is valid.

Are there any limitations to using a Transfer-on-Death Deed?

While a Transfer-on-Death Deed offers several advantages, there are some limitations to consider:

- The deed only applies to real property, such as land or buildings, and cannot be used for personal property like vehicles or bank accounts.

- Beneficiaries must be alive at the time of the property owner's death to inherit the property. If a beneficiary predeceases the owner, their share may not automatically transfer to their heirs unless specified in the deed.

- Some states may have specific rules regarding the use of Transfer-on-Death Deeds, so it is important to understand local laws.

How to Use Transfer-on-Death Deed

Once you have your Transfer-on-Death Deed form ready, the next step involves filling it out accurately to ensure your wishes are clearly documented. It’s essential to take your time and double-check each section to avoid any potential issues in the future.

- Gather necessary information: Collect details about the property you wish to transfer, including the legal description and address.

- Identify the owner: Write your full name as the current owner of the property. Make sure it matches the name on the property title.

- List the beneficiary: Clearly state the full name of the person or entity you want to inherit the property after your death.

- Provide beneficiary details: Include the beneficiary’s address and any other relevant information that identifies them.

- Sign the form: As the owner, sign the deed in the presence of a notary public to ensure it is legally binding.

- Notarization: Have the notary public sign and stamp the form, confirming your identity and the authenticity of your signature.

- Record the deed: Submit the completed and notarized deed to your local county recorder’s office to officially record it.

After completing these steps, keep a copy of the recorded deed for your records. This will help ensure that your intentions are clear and legally recognized when the time comes for the transfer to take place.