Transfer-on-Death Deed Template for the State of Texas

In the state of Texas, estate planning can be simplified through the use of a Transfer-on-Death Deed (TODD). This innovative legal tool allows property owners to designate a beneficiary who will automatically receive their real estate upon their death, effectively bypassing the often lengthy and costly probate process. With a TODD, individuals can maintain full control of their property during their lifetime, as the deed does not take effect until after their passing. It's important to note that the form must be properly executed and recorded to ensure its validity, and it can be revoked or modified at any time before the owner's death. This deed serves as a straightforward solution for those looking to streamline the transfer of property, providing peace of mind that their wishes will be honored while also simplifying the process for their heirs. Understanding the key elements of the Transfer-on-Death Deed, including the requirements for execution and the implications for beneficiaries, is crucial for anyone considering this option in their estate planning strategy.

Common mistakes

-

Inaccurate Property Description: One of the most common mistakes occurs when individuals fail to provide a precise and complete description of the property. A vague or incorrect description can lead to confusion or disputes among heirs. It is crucial to include details such as the property's address, legal description, and any relevant identifiers.

-

Improper Signatures: The deed must be signed by the property owner, and in some cases, notarization is required. Failing to have the deed properly signed or notarized can render it invalid. Additionally, if multiple owners are involved, all must sign the document. Neglecting this step can create significant legal challenges later on.

-

Not Naming Beneficiaries Clearly: When designating beneficiaries, clarity is essential. Individuals sometimes use vague terms like “my children” without specifying names. This can lead to uncertainty about who is entitled to the property. Listing each beneficiary by name ensures that there is no ambiguity about the intended recipients.

-

Failing to Record the Deed: After completing the Transfer-on-Death Deed, it is vital to record it with the county clerk's office where the property is located. Some individuals overlook this step, thinking that merely signing the document is sufficient. Without proper recording, the deed may not be enforceable, and the property could be treated as part of the owner’s estate upon death.

Other Common Transfer-on-Death Deed State Templates

Free Printable Beneficiary Deed Form Arizona - For individuals with simple estate needs, a Transfer-on-Death Deed provides an effective alternative to a full estate plan.

Transfer on Death Deed Virginia - Allows for clarity in property distribution, reducing the likelihood of family disputes.

The California Release of Liability form is a crucial legal tool that safeguards individuals and organizations against potential claims arising from injuries or damages during various activities. By signing this document, participants fully recognize and accept the risks involved, thereby relinquishing their right to pursue any liability against the organizers. To ensure a clear understanding and proper execution of this form, consider exploring options for obtaining it through California Templates.

New Jersey Transfer on Death Deed - A Transfer-on-Death Deed allows you to transfer real estate to a beneficiary upon your death.

Transfer on Death Deed Washington State Form - This form must be signed and recorded prior to the owner’s death to be valid.

Key takeaways

When considering the Texas Transfer-on-Death Deed, it's important to understand its implications and requirements. Here are some key takeaways to keep in mind:

- Purpose: The Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit the property upon their death, avoiding probate.

- Eligibility: Any individual who owns real property in Texas can create a Transfer-on-Death Deed.

- Form Requirements: The deed must be in writing, signed by the property owner, and must include the names of the beneficiaries.

- Recording: To be effective, the deed must be recorded in the county where the property is located before the owner's death.

- Revocation: The property owner can revoke the deed at any time before their death by filing a new deed or a revocation form.

- Multiple Beneficiaries: It is possible to name multiple beneficiaries, and the property can be divided among them as specified in the deed.

- Effect on Creditors: The Transfer-on-Death Deed does not shield the property from creditors' claims against the estate.

- Tax Implications: Beneficiaries may need to consider potential tax implications when they inherit the property.

- Legal Advice: Consulting with an attorney can help ensure that the deed is filled out correctly and meets all legal requirements.

- State-Specific Rules: Each state has its own rules regarding Transfer-on-Death Deeds, so it is essential to follow Texas-specific guidelines.

Understanding these key points can help ensure that the Transfer-on-Death Deed serves its intended purpose and provides peace of mind for property owners and their families.

Texas Transfer-on-Death Deed Example

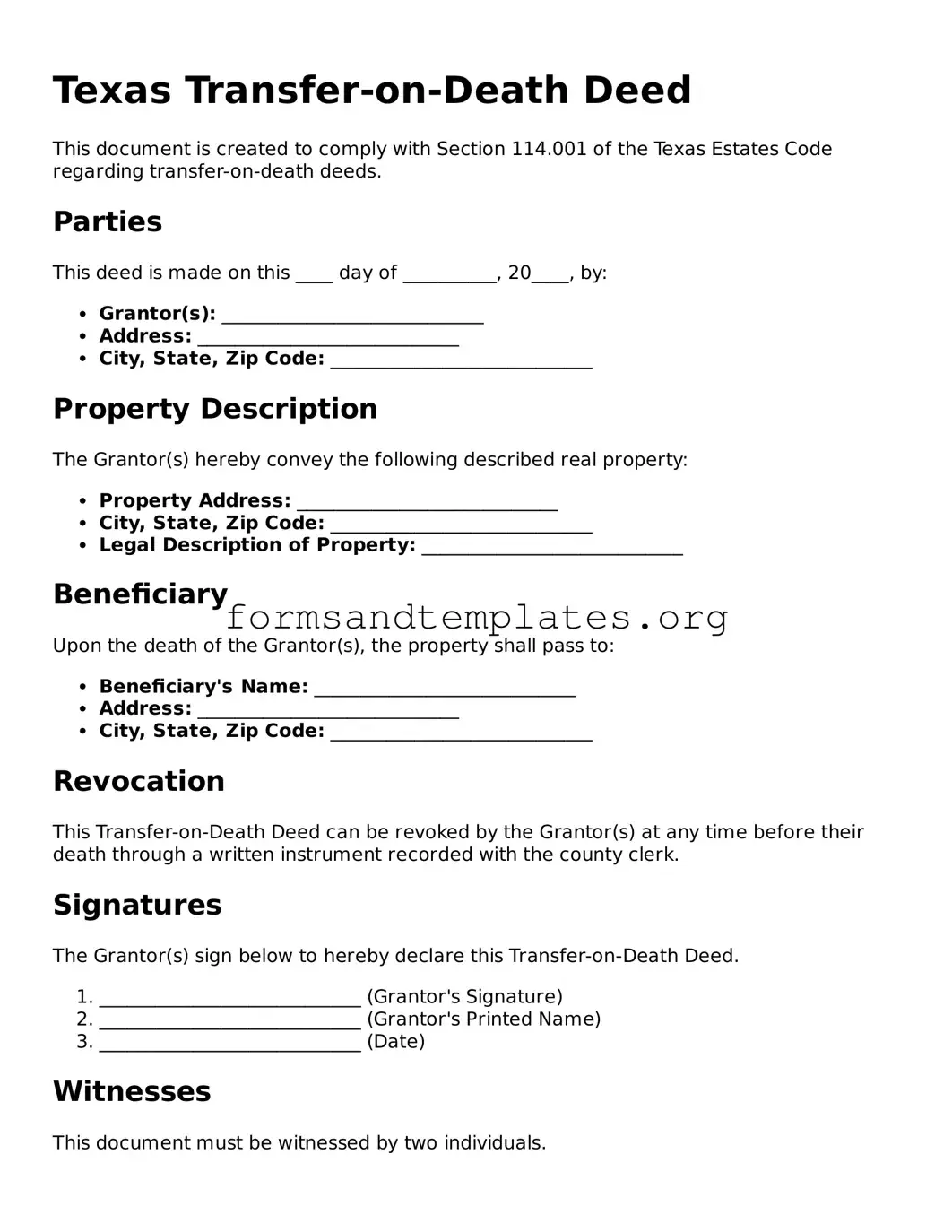

Texas Transfer-on-Death Deed

This document is created to comply with Section 114.001 of the Texas Estates Code regarding transfer-on-death deeds.

Parties

This deed is made on this ____ day of __________, 20____, by:

- Grantor(s): ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

Property Description

The Grantor(s) hereby convey the following described real property:

- Property Address: ____________________________

- City, State, Zip Code: ____________________________

- Legal Description of Property: ____________________________

Beneficiary

Upon the death of the Grantor(s), the property shall pass to:

- Beneficiary's Name: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

Revocation

This Transfer-on-Death Deed can be revoked by the Grantor(s) at any time before their death through a written instrument recorded with the county clerk.

Signatures

The Grantor(s) sign below to hereby declare this Transfer-on-Death Deed.

- ____________________________ (Grantor's Signature)

- ____________________________ (Grantor's Printed Name)

- ____________________________ (Date)

Witnesses

This document must be witnessed by two individuals.

- ____________________________ (Witness 1 Signature)

- ____________________________ (Witness 2 Signature)

Notary Acknowledgment

State of Texas

County of ______________________

On this ____ day of __________, 20____, before me appeared the Grantor(s) and the witnesses, known or identified to me to be the persons whose names are subscribed to this document, and acknowledged that they executed the same for the purposes and consideration therein expressed.

____________________________ (Notary Public Signature)

____________________________ (Notary Public Printed Name)

My commission expires: ____________________________

Understanding Texas Transfer-on-Death Deed

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed (TOD deed) is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This type of deed bypasses the probate process, making it a straightforward way to ensure that property passes directly to the intended recipient without delays or additional costs.

Who can create a Transfer-on-Death Deed in Texas?

Any individual who is the owner of real property in Texas can create a Transfer-on-Death Deed. This includes single owners, joint owners, and even owners of community property. However, the deed must be executed properly to be valid.

How do I properly execute a Transfer-on-Death Deed?

To execute a Transfer-on-Death Deed, the following steps should be taken:

- Complete the deed form, ensuring all required information is included, such as the legal description of the property and the name of the beneficiary.

- Sign the deed in the presence of a notary public.

- File the signed deed with the county clerk’s office in the county where the property is located.

It is crucial that these steps are followed to ensure the deed is legally binding.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner’s death. To revoke the deed, the owner must create a new deed that explicitly states the revocation or file a notice of revocation with the county clerk. This flexibility allows property owners to adjust their estate plans as needed.

What happens if the beneficiary dies before the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed becomes ineffective. The property owner should consider naming alternate beneficiaries to ensure that the property still transfers according to their wishes. This can prevent complications and ensure a smooth transition of ownership.

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be a fee for filing the Transfer-on-Death Deed with the county clerk’s office. The amount can vary by county, so it is advisable to check with the local office for specific fees. Additionally, there may be costs related to obtaining a notary public's services if needed.

Will a Transfer-on-Death Deed affect my property taxes?

Generally, a Transfer-on-Death Deed does not affect property taxes during the property owner’s lifetime. However, when the property is transferred to the beneficiary after the owner's death, the property may be reassessed for tax purposes. It is important to consult with a tax professional to understand any potential implications.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can only be used for real property, such as land and buildings. It does not apply to personal property like vehicles, bank accounts, or other assets. For those types of assets, different estate planning tools would be necessary.

What should I do if I have more questions about Transfer-on-Death Deeds?

If you have further questions or need assistance with a Transfer-on-Death Deed, consider consulting with an estate planning attorney. They can provide guidance tailored to your specific situation and help ensure that your estate plan meets your needs and complies with Texas laws.

How to Use Texas Transfer-on-Death Deed

After obtaining the Texas Transfer-on-Death Deed form, you will need to fill it out carefully. This deed allows you to designate a beneficiary for your property after your passing. Follow the steps below to complete the form accurately.

- Begin with the title of the form at the top. Write “Transfer on Death Deed” clearly.

- Provide the name of the current owner(s) of the property. Include all legal names as they appear on the property title.

- Next, enter the address of the property. Be specific and include the street number, street name, city, and zip code.

- Identify the beneficiary or beneficiaries. List their full names and relationship to you. If there are multiple beneficiaries, ensure to indicate how the property will be divided.

- Include a legal description of the property. This can usually be found on the property’s deed or tax records. Make sure it is accurate.

- Sign and date the form. The owner(s) must sign in the presence of a notary public. This step is crucial for the deed to be valid.

- Have the notary public sign and stamp the document. This confirms that the signatures are authentic.

- Finally, file the completed deed with the county clerk’s office where the property is located. There may be a filing fee, so check with the office for details.