Tractor Bill of Sale Template for the State of Texas

When buying or selling a tractor in Texas, having a well-drafted Tractor Bill of Sale form is essential. This document serves as a legal record of the transaction, providing both the buyer and seller with protection and clarity. Key elements of the form typically include the names and addresses of both parties, a detailed description of the tractor, including its make, model, year, and Vehicle Identification Number (VIN). Additionally, the form outlines the purchase price and any terms related to payment, such as whether it will be made in full or through installments. It's also important to include a statement confirming that the seller has the legal right to sell the tractor and that it is free from any liens or encumbrances. By ensuring all relevant details are captured, the Tractor Bill of Sale not only facilitates a smooth transfer of ownership but also helps avoid potential disputes in the future. Understanding the importance of this document can make the buying or selling process much more straightforward for everyone involved.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to issues. Ensure that both the seller and buyer's names, addresses, and contact information are fully filled out.

-

Incorrect Vehicle Identification Number (VIN): Double-check the VIN. An incorrect number can complicate registration and ownership transfer.

-

Missing Signatures: Both parties must sign the document. Without signatures, the bill of sale is not valid.

-

Improper Date: Ensure the date of the sale is clearly written. An incorrect or missing date can create confusion about the transaction.

-

Not Including Payment Details: Specify the payment method and amount. This information is crucial for both parties to understand the terms of the sale.

-

Neglecting to Keep Copies: Both the seller and buyer should retain a copy of the bill of sale. This serves as proof of the transaction and can be important for future reference.

Other Common Tractor Bill of Sale State Templates

Do Tractors Have a Title - Enhances the professionalism of the transaction.

The California Motorcycle Bill of Sale form is not only a vital document for ensuring a transparent transaction, but it also highlights the importance of using reliable resources, such as California Templates, to streamline the filling process and avoid any potential ambiguities in the sale agreement.

Tractor Bill of Sale - It includes essential details such as the purchase price, date of sale, and identification of the tractor.

Key takeaways

When dealing with the Texas Tractor Bill of Sale form, there are several important aspects to consider. This document serves as a crucial record of the transaction between the buyer and seller. Here are key takeaways to keep in mind:

- Complete Information: Ensure that all fields are filled out accurately. This includes the names and addresses of both the buyer and seller, as well as the tractor's details such as make, model, and year.

- Sales Price: Clearly state the agreed-upon sales price. This is important for both parties and can have implications for taxes.

- Date of Sale: Include the date on which the transaction takes place. This establishes a timeline for ownership transfer.

- Signatures Required: Both the buyer and seller must sign the form. This indicates mutual agreement and acceptance of the terms outlined in the bill of sale.

- Notarization: While not always required, having the document notarized can provide an additional layer of authenticity and protection for both parties.

- Record Keeping: Keep a copy of the completed bill of sale for your records. This document may be needed for future reference, especially for tax purposes or in case of disputes.

- Transfer of Title: Remember that the bill of sale does not transfer ownership on its own. You will also need to complete the title transfer process with the Texas Department of Motor Vehicles.

By following these guidelines, both buyers and sellers can navigate the process more smoothly and ensure a successful transaction.

Texas Tractor Bill of Sale Example

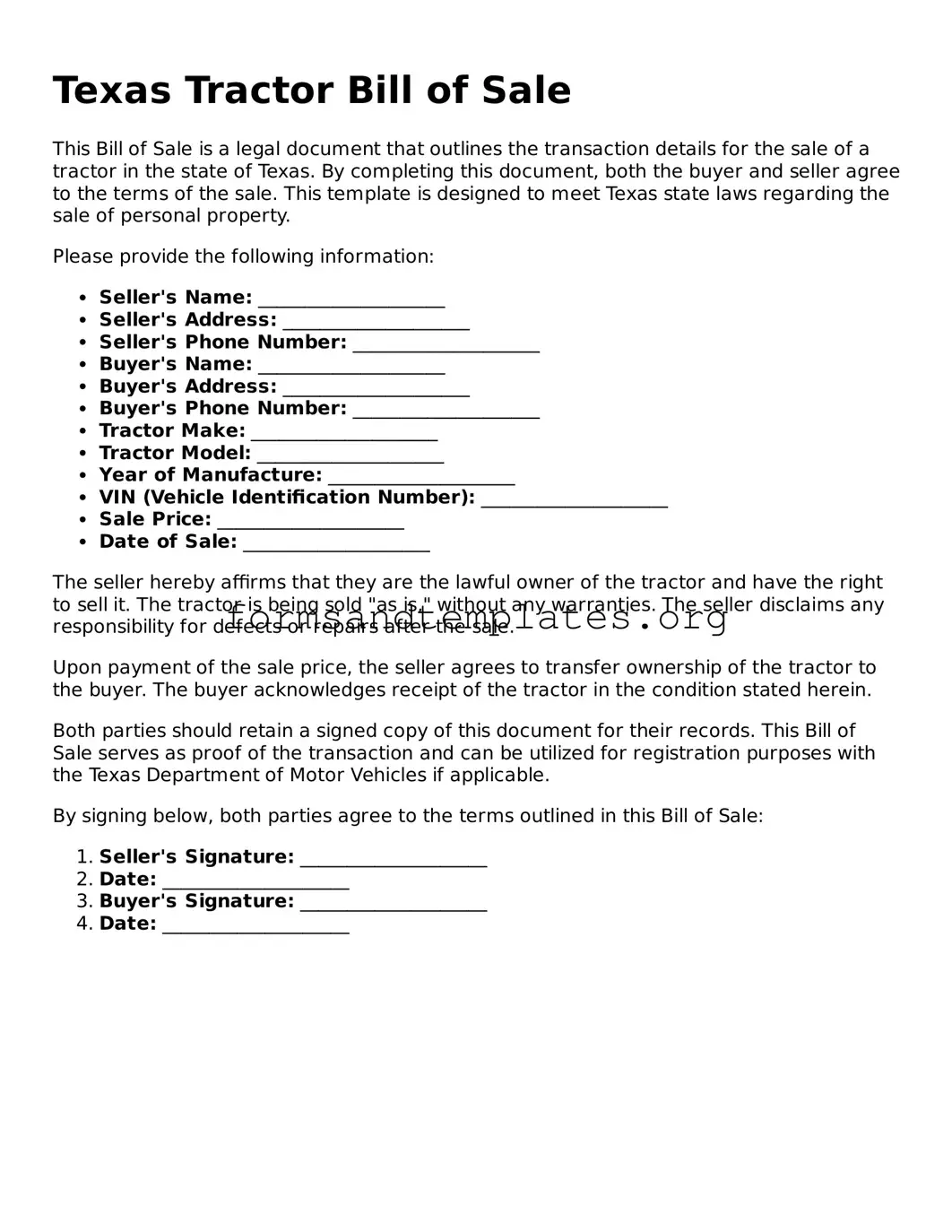

Texas Tractor Bill of Sale

This Bill of Sale is a legal document that outlines the transaction details for the sale of a tractor in the state of Texas. By completing this document, both the buyer and seller agree to the terms of the sale. This template is designed to meet Texas state laws regarding the sale of personal property.

Please provide the following information:

- Seller's Name: ____________________

- Seller's Address: ____________________

- Seller's Phone Number: ____________________

- Buyer's Name: ____________________

- Buyer's Address: ____________________

- Buyer's Phone Number: ____________________

- Tractor Make: ____________________

- Tractor Model: ____________________

- Year of Manufacture: ____________________

- VIN (Vehicle Identification Number): ____________________

- Sale Price: ____________________

- Date of Sale: ____________________

The seller hereby affirms that they are the lawful owner of the tractor and have the right to sell it. The tractor is being sold "as is," without any warranties. The seller disclaims any responsibility for defects or repairs after the sale.

Upon payment of the sale price, the seller agrees to transfer ownership of the tractor to the buyer. The buyer acknowledges receipt of the tractor in the condition stated herein.

Both parties should retain a signed copy of this document for their records. This Bill of Sale serves as proof of the transaction and can be utilized for registration purposes with the Texas Department of Motor Vehicles if applicable.

By signing below, both parties agree to the terms outlined in this Bill of Sale:

- Seller's Signature: ____________________

- Date: ____________________

- Buyer's Signature: ____________________

- Date: ____________________

Understanding Texas Tractor Bill of Sale

- It provides legal proof of the transaction.

- It helps establish ownership, which is crucial for registration and insurance purposes.

- It can protect both the buyer and seller in case of disputes.

- The full names and addresses of both the buyer and seller.

- The tractor's make, model, year, and Vehicle Identification Number (VIN).

- The sale price and payment method.

- The date of the sale.

- Any warranties or guarantees provided by the seller.

What is a Texas Tractor Bill of Sale?

A Texas Tractor Bill of Sale is a legal document that records the sale of a tractor between a buyer and a seller. This form outlines essential details such as the purchase price, the tractor's identification information, and the parties involved in the transaction. It serves as proof of ownership and can be used for registration purposes.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is important for several reasons:

What information should be included in the Bill of Sale?

When completing a Texas Tractor Bill of Sale, include the following information:

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every transaction in Texas, it is highly recommended. Having this document can simplify the process of transferring ownership and may be necessary for registration with the Texas Department of Motor Vehicles.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. However, it is essential to ensure that it includes all necessary information and complies with Texas laws. Many templates are available online, or you can consult with a legal professional for assistance.

Do I need to notarize the Bill of Sale?

Notarization is not a requirement for a Texas Tractor Bill of Sale. However, having the document notarized can add an extra layer of security and authenticity, which might be beneficial in case of disputes.

How does the Bill of Sale affect the registration process?

The Bill of Sale is a critical document when registering your tractor with the Texas Department of Motor Vehicles. It serves as proof of ownership and helps facilitate the transfer of title. Without it, the registration process may be delayed or complicated.

What if the tractor has a lien on it?

If there is a lien on the tractor, it is essential to disclose this information in the Bill of Sale. The seller should ensure that the lien is satisfied before selling the tractor. Failing to do so could lead to legal complications for both parties.

Where can I obtain a Texas Tractor Bill of Sale form?

You can find a Texas Tractor Bill of Sale form online through various legal document websites. Alternatively, you can create one using templates or consult with a legal professional to draft a custom document tailored to your needs.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer should take the document to the local DMV to register the tractor and obtain a new title. It’s also a good idea to check if any additional paperwork is required for the registration process.

How to Use Texas Tractor Bill of Sale

Filling out the Texas Tractor Bill of Sale form is an important step in the process of transferring ownership of a tractor. It is essential to ensure that all information is accurate and complete to avoid any future complications. After you have filled out the form, both the buyer and seller should keep a copy for their records.

- Obtain the form: You can find the Texas Tractor Bill of Sale form online or at your local county office.

- Enter the date: Write the date of the transaction at the top of the form.

- Provide seller information: Fill in the seller's full name, address, and contact information.

- Provide buyer information: Fill in the buyer's full name, address, and contact information.

- Describe the tractor: Include details such as the make, model, year, Vehicle Identification Number (VIN), and any other identifying features.

- State the sale price: Clearly write the agreed-upon sale price for the tractor.

- Include payment details: Specify the payment method (cash, check, etc.) and any relevant terms.

- Sign the form: Both the seller and buyer must sign and date the form to validate the transaction.

- Make copies: After signing, make copies for both parties to retain for their records.