Printable Texas residential property affidavit T-47 Template

The Texas residential property affidavit T-47 form plays a crucial role in real estate transactions within the state. This form is primarily used to affirm the current ownership of a residential property and to disclose any relevant information that may affect the property’s title. When buying or selling a home, both parties benefit from the clarity that the T-47 provides. It serves as a declaration that the seller has not made any significant changes to the property that could impact its value or title since the last transfer. Additionally, the form helps to ensure that all parties are aware of any encumbrances or liens against the property, which is vital for protecting the interests of the buyer. By completing the T-47, sellers can facilitate a smoother transaction process, while buyers gain confidence in their purchase. Understanding the nuances of this form can empower homeowners and real estate professionals alike, making it an essential component of property dealings in Texas.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required details. Each section of the T-47 form must be filled out completely to avoid delays in processing.

-

Incorrect Property Description: People often misstate the legal description of the property. It is essential to match the description exactly as it appears in the property deed.

-

Missing Signatures: A signature is mandatory on the T-47 form. Omitting this can lead to rejection or additional processing time.

-

Failure to Notarize: The affidavit must be notarized. Neglecting this step can render the document invalid.

-

Incorrect Dates: Entering the wrong date or failing to date the document can create confusion and may lead to complications during the transaction.

-

Inconsistent Information: Providing information that conflicts with other documents related to the property can raise red flags. Consistency is key.

-

Ignoring Instructions: Each section of the T-47 form comes with specific instructions. Ignoring these can lead to mistakes that may complicate the process.

-

Not Keeping Copies: Failing to retain a copy of the completed affidavit can be problematic. Having a record is vital for future reference.

-

Submitting Without Review: Rushing to submit the form without a thorough review often results in errors. Taking time to double-check can save significant hassle.

Find Common Documents

Health Certificate for Cats to Fly - Use clear handwriting to avoid miscommunication with airline staff.

In addition to the essential details outlined in the California Motorcycle Bill of Sale form, it's important for buyers and sellers to utilize reliable templates to ensure accuracy; for a well-structured document, consider visiting California Templates which provides helpful resources and guidance for completing this form effectively.

Aircraft Bill of Sale Example - Aircraft sales can be complex, but the AC 8050-2 helps simplify the process.

Royal Caribbean Minor Traveling With One Parent - The form is crucial for ensuring that travel plans adhere to regulations regarding minors.

Key takeaways

Here are key takeaways about filling out and using the Texas residential property affidavit T-47 form:

- Purpose: The T-47 form serves to confirm the ownership and description of a residential property in Texas.

- Who Uses It: Homeowners, buyers, and lenders typically use this form during real estate transactions.

- Filling Out the Form: Ensure all sections are completed accurately. Incomplete forms can delay the closing process.

- Signature Requirement: The affidavit must be signed by the property owner. This signature must be notarized.

- Notarization: A notary public must witness the signature to validate the affidavit. This step is crucial.

- Submission: Submit the completed T-47 form to the title company or lender as part of the closing documents.

- Accuracy: Double-check all property details, including the legal description, to avoid discrepancies.

- Updates: If there are changes to the property, a new T-47 form may be required.

- Record Keeping: Keep a copy of the signed and notarized form for your records after submission.

- Legal Implications: Providing false information on the T-47 form can lead to legal consequences.

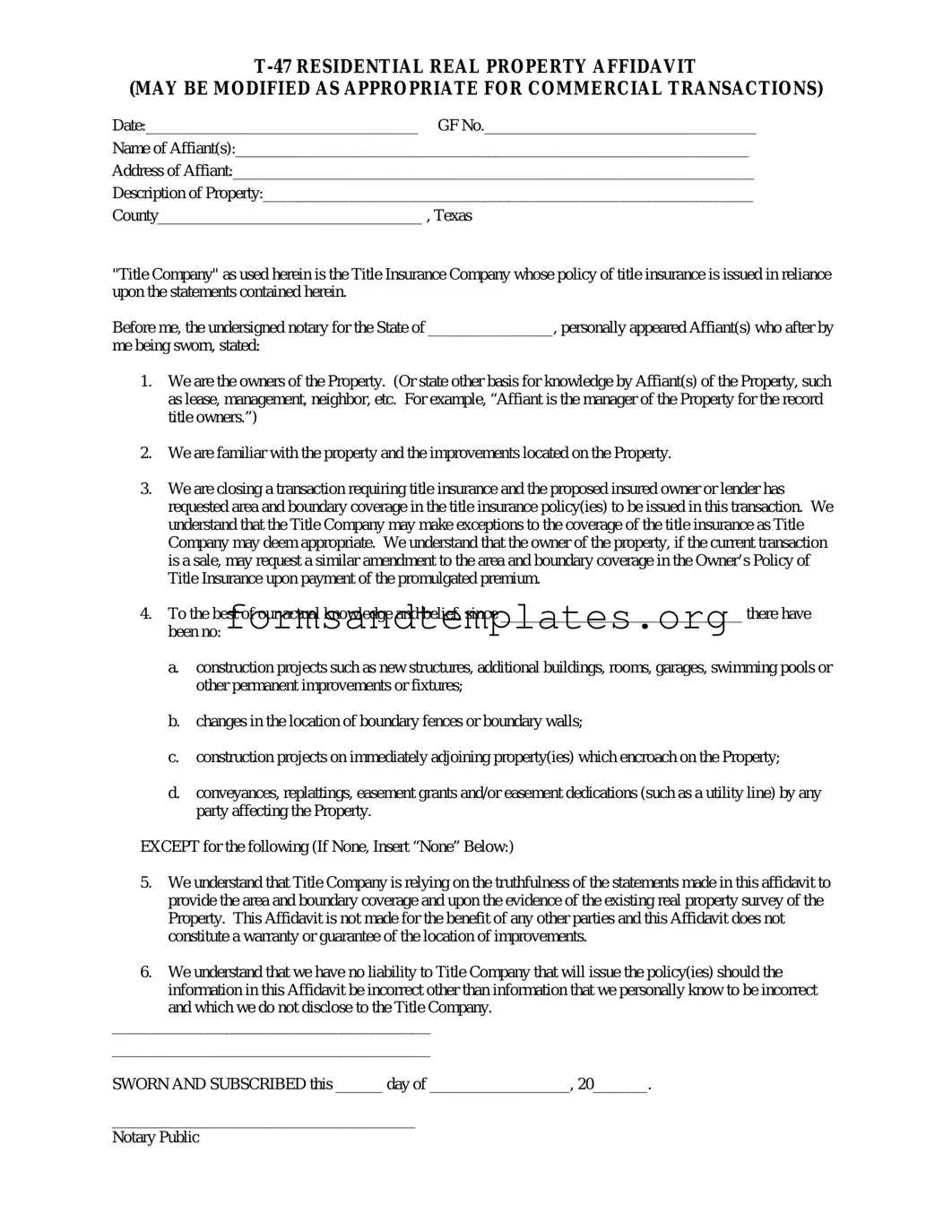

Texas residential property affidavit T-47 Example

(MAY BE MODIFIED AS APPROPRIATE FOR COMMERCIAL TRANSACTIONS)

Date:___________________________________ GF No.___________________________________

Name of Affiant(s):__________________________________________________________________

Address of Affiant:___________________________________________________________________

Description of Property:_______________________________________________________________

County__________________________________ , Texas

"Title Company" as used herein is the Title Insurance Company whose policy of title insurance is issued in reliance upon the statements contained herein.

Before me, the undersigned notary for the State of ________________, personally appeared Affiant(s) who after by

me being sworn, stated:

1.We are the owners of the Property. (Or state other basis for knowledge by Affiant(s) of the Property, such as lease, management, neighbor, etc. For example, “Affiant is the manager of the Property for the record title owners.”)

2.We are familiar with the property and the improvements located on the Property.

3.We are closing a transaction requiring title insurance and the proposed insured owner or lender has requested area and boundary coverage in the title insurance policy(ies) to be issued in this transaction. We understand that the Title Company may make exceptions to the coverage of the title insurance as Title Company may deem appropriate. We understand that the owner of the property, if the current transaction is a sale, may request a similar amendment to the area and boundary coverage in the Owner’s Policy of Title Insurance upon payment of the promulgated premium.

4.To the best of our actual knowledge and belief, since _______________________________ there have been no:

a.construction projects such as new structures, additional buildings, rooms, garages, swimming pools or other permanent improvements or fixtures;

b.changes in the location of boundary fences or boundary walls;

c.construction projects on immediately adjoining property(ies) which encroach on the Property;

d.conveyances, replattings, easement grants and/or easement dedications (such as a utility line) by any party affecting the Property.

EXCEPT for the following (If None, Insert “None” Below:)

5.We understand that Title Company is relying on the truthfulness of the statements made in this affidavit to provide the area and boundary coverage and upon the evidence of the existing real property survey of the Property. This Affidavit is not made for the benefit of any other parties and this Affidavit does not constitute a warranty or guarantee of the location of improvements.

6.We understand that we have no liability to Title Company that will issue the policy(ies) should the

information in this Affidavit be incorrect other than information that we personally know to be incorrect and which we do not disclose to the Title Company.

_________________________________________

_________________________________________

SWORN AND SUBSCRIBED this ______ day of __________________, 20_______.

_______________________________________

Notary Public

Understanding Texas residential property affidavit T-47

What is the Texas residential property affidavit T-47 form?

The Texas residential property affidavit T-47 form is a legal document used in real estate transactions. It serves to confirm the ownership and condition of a residential property. This form helps clarify details about the property for potential buyers and lenders, ensuring transparency in the sale process.

Who needs to fill out the T-47 form?

The T-47 form is typically filled out by the seller of the property. If you are selling a home or residential property in Texas, you will likely need to complete this affidavit. It is important for anyone involved in the sale to understand the information being provided in this form.

What information is required on the T-47 form?

The T-47 form requires several key pieces of information, including:

- Your name and contact information.

- The property address.

- A description of the property.

- Details about any improvements made to the property.

- Confirmation of the property's current use.

Providing accurate information is crucial, as it helps establish the property's status and value.

Is the T-47 form mandatory?

While the T-47 form is not legally required for all transactions, many lenders and title companies request it. Completing the form can facilitate the closing process and help avoid potential disputes later on. It's wise to check with your real estate agent or attorney to see if it's necessary for your specific situation.

How does the T-47 form affect the sale of my property?

The T-47 form can significantly impact the sale by providing potential buyers and lenders with essential information about the property. It helps establish trust and transparency. If the form is not completed accurately or is missing, it could lead to delays in the transaction or even jeopardize the sale.

Can I make changes to the T-47 form after it has been submitted?

Once the T-47 form is submitted, making changes can be complicated. If you realize that you need to correct or update any information, it's best to communicate with your real estate agent or attorney immediately. They can guide you on the appropriate steps to take, which may involve submitting an amended form.

How do I submit the T-47 form?

The submission process for the T-47 form typically involves providing it to your title company or lender. They will include it as part of the closing documents. Ensure that you keep a copy for your records. It's important to submit the form in a timely manner to avoid delays in the closing process.

What happens if I do not provide a T-47 form?

If you choose not to provide a T-47 form, you may face challenges during the sale. Lenders may require it for financing, and title companies might refuse to proceed without it. This could result in delays or even cause the sale to fall through. It's generally advisable to complete the form to facilitate a smoother transaction.

Where can I find the T-47 form?

You can obtain the T-47 form from various sources, including your real estate agent, title company, or online legal document services. Ensure that you are using the most current version of the form. It's also a good idea to consult with a legal professional if you have any questions about filling it out correctly.

How to Use Texas residential property affidavit T-47

After obtaining the Texas residential property affidavit T-47 form, it's essential to fill it out correctly to ensure a smooth process. Follow these steps carefully to complete the form accurately.

- Begin by entering the property owner's name in the designated space at the top of the form.

- Provide the property address, including street number, street name, city, and zip code.

- In the next section, include the legal description of the property. This information can usually be found on the property deed or tax records.

- Indicate the date of the affidavit in the appropriate field. Make sure this date is current.

- Next, fill in the signature line. The property owner must sign the form to validate it.

- Have the signature witnessed by a notary public. This step is crucial for the affidavit to be legally binding.

- Finally, double-check all information for accuracy before submitting the form.

Once you have completed the form, ensure that it is submitted to the appropriate authority as required. This will help in processing your affidavit without delays.