Real Estate Purchase Agreement Template for the State of Texas

The Texas Real Estate Purchase Agreement is a crucial document in the home buying and selling process in Texas. This form outlines the terms and conditions of the sale, ensuring both parties understand their rights and responsibilities. Key elements of the agreement include the purchase price, financing details, and the closing date. It also addresses contingencies, such as inspections and appraisals, which can affect the transaction. Additionally, the agreement specifies the property description, earnest money deposit, and any items included in the sale, like appliances or fixtures. Understanding these components is essential for both buyers and sellers to facilitate a smooth transaction and to protect their interests throughout the process.

Common mistakes

-

Incorrect Property Description: Many buyers and sellers fail to provide a complete and accurate description of the property. This includes not listing the correct address, legal description, or any additional parcels included in the sale.

-

Missing Signatures: A common mistake is neglecting to obtain the necessary signatures from all parties involved. Each buyer and seller must sign the agreement for it to be legally binding.

-

Omitting Contingencies: Buyers often forget to include essential contingencies, such as financing or inspection clauses. These contingencies protect the buyer's interests and should be clearly stated in the agreement.

-

Inaccurate Dates: Entering incorrect dates can lead to confusion and disputes. Important dates include the closing date, the date the offer is made, and any deadlines for contingencies.

-

Failure to Specify Earnest Money: Buyers sometimes overlook specifying the amount of earnest money. This deposit shows good faith and should be clearly stated to avoid misunderstandings.

Other Common Real Estate Purchase Agreement State Templates

Washington State Purchase and Sale Agreement - Clarifies how legal fees will be shared or paid, if applicable.

Nj Real Estate Contract - Clarifies the title transfer process to ensure clear ownership for the buyer.

To streamline the process of setting up your corporation, you can easily access the required documents online, including the essential Articles of Incorporation form. For convenience, visit Fill PDF Forms to begin your application and ensure all necessary details are accurately captured.

Agreement for Sale Arizona - Sets expectations for open house or showing schedules before closing.

Tennessee Real Estate Contract - Documents any seller concessions to assist the buyer with closing costs.

Key takeaways

When dealing with the Texas Real Estate Purchase Agreement, it’s essential to understand its components and implications. Here are some key takeaways to keep in mind:

- Clarity is Key: Ensure that all terms and conditions are clearly stated. Ambiguities can lead to misunderstandings and disputes down the line.

- Include All Necessary Details: The agreement should contain specific information such as the purchase price, property description, and any contingencies. Missing information can complicate the transaction.

- Understand Your Rights and Obligations: Both buyers and sellers have rights and responsibilities outlined in the agreement. Familiarizing yourself with these can help you navigate the process more effectively.

- Consult Professionals: It’s wise to seek advice from real estate agents or attorneys. Their expertise can provide valuable insights and help avoid potential pitfalls.

Using the Texas Real Estate Purchase Agreement form correctly can significantly impact your real estate transaction. Being informed and prepared will lead to a smoother process.

Texas Real Estate Purchase Agreement Example

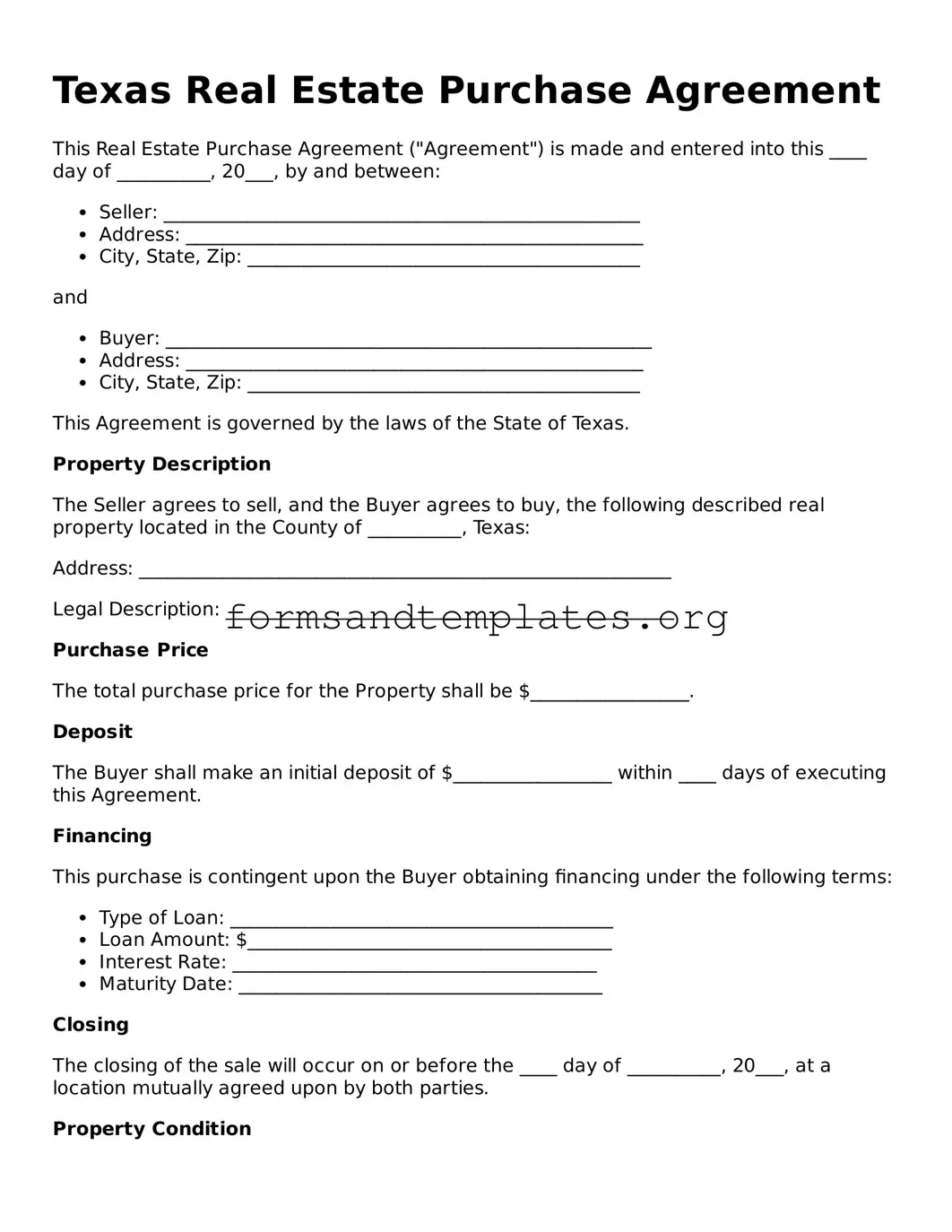

Texas Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into this ____ day of __________, 20___, by and between:

- Seller: ___________________________________________________

- Address: _________________________________________________

- City, State, Zip: __________________________________________

and

- Buyer: ____________________________________________________

- Address: _________________________________________________

- City, State, Zip: __________________________________________

This Agreement is governed by the laws of the State of Texas.

Property Description

The Seller agrees to sell, and the Buyer agrees to buy, the following described real property located in the County of __________, Texas:

Address: _________________________________________________________

Legal Description: ________________________________________________

Purchase Price

The total purchase price for the Property shall be $_________________.

Deposit

The Buyer shall make an initial deposit of $_________________ within ____ days of executing this Agreement.

Financing

This purchase is contingent upon the Buyer obtaining financing under the following terms:

- Type of Loan: _________________________________________

- Loan Amount: $_______________________________________

- Interest Rate: _______________________________________

- Maturity Date: _______________________________________

Closing

The closing of the sale will occur on or before the ____ day of __________, 20___, at a location mutually agreed upon by both parties.

Property Condition

The Buyer accepts the Property in its current condition, understanding that the Seller makes no warranties, either express or implied, regarding the Property.

Additional Terms

Any additional terms agreed upon by both parties shall be noted below:

___________________________________________________________________

___________________________________________________________________

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller's Signature: _____________________________

Buyer's Signature: _____________________________

Witnessed By:

Name: ______________________________________

Signature: __________________________________

Date: ______________________________________

This template provides a clear and structured approach to a Texas Real Estate Purchase Agreement, including necessary elements while leaving space for specific details to be filled in.Understanding Texas Real Estate Purchase Agreement

What is a Texas Real Estate Purchase Agreement?

A Texas Real Estate Purchase Agreement is a legally binding document used when buying or selling property in Texas. It outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies that may apply. This agreement serves to protect both the buyer and seller during the transaction process.

What key elements are included in the agreement?

The Texas Real Estate Purchase Agreement typically includes the following key elements:

- Parties Involved: Names and contact information of the buyer and seller.

- Property Description: A detailed description of the property being sold, including the address and legal description.

- Purchase Price: The agreed-upon price for the property.

- Earnest Money: The amount of money the buyer will deposit to show their commitment.

- Closing Date: The date when the transaction will be finalized.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

Do I need a lawyer to complete the agreement?

While it is not legally required to have a lawyer for a real estate transaction in Texas, it can be beneficial. A lawyer can help ensure that the agreement is properly drafted, that your interests are protected, and that you understand all the terms involved. If you have any doubts or specific legal questions, consulting a lawyer is advisable.

Can I modify the agreement after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller. This helps avoid misunderstandings and ensures that all parties are on the same page.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations under the agreement, the other party may have several options. They can seek to enforce the agreement, negotiate a resolution, or, in some cases, pursue legal action for breach of contract. It is important to review the terms of the agreement to understand the specific remedies available.

How does earnest money work?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. This money is typically held in an escrow account until the transaction is completed. If the sale goes through, the earnest money is usually applied to the purchase price. However, if the buyer backs out without a valid reason as outlined in the agreement, they may lose the earnest money.

What is the role of contingencies in the agreement?

Contingencies are conditions that must be satisfied for the sale to proceed. Common contingencies include financing, home inspections, and appraisal results. If a contingency is not met, the buyer may have the right to back out of the agreement without losing their earnest money. Clearly outlining these contingencies in the agreement is crucial for protecting both parties.

Where can I find a Texas Real Estate Purchase Agreement template?

Templates for a Texas Real Estate Purchase Agreement can be found online through various legal websites, real estate associations, or local real estate offices. It is essential to ensure that any template used complies with Texas laws and is tailored to your specific transaction needs. Always consider consulting a professional before finalizing the agreement.

How to Use Texas Real Estate Purchase Agreement

Completing the Texas Real Estate Purchase Agreement form is an essential step in finalizing a property transaction. Once you have gathered all necessary information, follow these steps to ensure accuracy and completeness in your submission.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Fill in the names and contact information of both the buyer and the seller.

- Provide the property address. Include the full street address, city, state, and ZIP code.

- Specify the purchase price. Clearly state the total amount the buyer is offering for the property.

- Outline the earnest money details. Indicate the amount of earnest money the buyer will provide and the method of payment.

- Detail any financing terms. If applicable, describe how the buyer intends to finance the purchase, including loan types and any contingencies.

- Include any special provisions. Note any specific agreements or conditions that both parties have discussed and agreed upon.

- Review the closing date. Enter the proposed date for closing the sale.

- Sign and date the agreement. Both the buyer and seller must sign and date the document to make it legally binding.

After completing the form, ensure that all parties receive a copy for their records. It is advisable to consult with a real estate professional or attorney to confirm that all details are correct and that the agreement meets your needs.