Quitclaim Deed Template for the State of Texas

In Texas, the Quitclaim Deed serves as a crucial tool for property owners seeking to transfer their interest in real estate without the complexities often associated with traditional deeds. This straightforward document allows an individual, known as the grantor, to convey their rights and claims to a property to another party, referred to as the grantee. Unlike warranty deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property, nor does it provide any assurances regarding potential claims from third parties. This form is particularly useful in situations such as transferring property between family members, resolving disputes, or clearing up title issues. The process of executing a Quitclaim Deed in Texas is relatively simple, requiring the completion of the form, signature by the grantor, and proper notarization. Once filed with the county clerk, the deed becomes a matter of public record, ensuring that the transfer is legally recognized. Understanding the nuances of this form can empower individuals to make informed decisions about their property transactions, thereby facilitating smoother transfers and enhancing clarity in property ownership.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate legal description of the property can lead to confusion and potential disputes. It's crucial to include details such as lot numbers, block numbers, and subdivision names.

-

Missing Signatures: All parties involved must sign the deed. Omitting a signature can render the document invalid. Ensure that both the grantor and grantee have signed the form.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be legally effective. Failing to have the document notarized can prevent it from being accepted by the county clerk.

-

Inaccurate Names: Names of the grantor and grantee must be spelled correctly and match their legal identification. Errors can lead to complications in property ownership.

-

Improperly Identifying the Grantor: The person transferring the property must be the legal owner. If the grantor is not the rightful owner, the deed is invalid.

-

Failure to Record the Deed: After completing the quitclaim deed, it must be filed with the appropriate county office. Not recording the deed can result in problems with future property transactions.

-

Ignoring State-Specific Requirements: Each state may have specific requirements for quitclaim deeds. Not adhering to Texas-specific rules can lead to legal issues.

Other Common Quitclaim Deed State Templates

Quitclaim Deed Tennessee - Can be beneficial in cases of property disputes.

To start your journey with Chick-fil-A, it is essential to complete the application process by using the Chick-fil-A Application for Employment, ensuring you provide all the necessary information to enhance your chances of joining this vibrant team.

Quick Claim Deed Form Arizona - It’s an essential document in real estate for trust-based transfers.

Key takeaways

When dealing with a Texas Quitclaim Deed form, it’s important to understand several key points. Here are some takeaways to consider:

- Purpose of the Quitclaim Deed: This document transfers ownership of property without guaranteeing that the title is clear. It’s often used among family members or in divorce settlements.

- Parties Involved: The form requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A complete and accurate description of the property is essential. This includes the address and legal description.

- Signatures: The grantor must sign the deed in front of a notary public. This step is crucial for the document to be legally binding.

- Filing the Deed: After signing, the deed must be filed with the county clerk’s office where the property is located. This makes the transfer official.

- No Warranty: Remember, a Quitclaim Deed does not guarantee that the property is free of liens or other claims. The grantee accepts the property "as is."

- Tax Implications: Consult a tax professional to understand any potential tax consequences that may arise from the transfer.

By keeping these points in mind, you can navigate the process of using a Texas Quitclaim Deed more effectively.

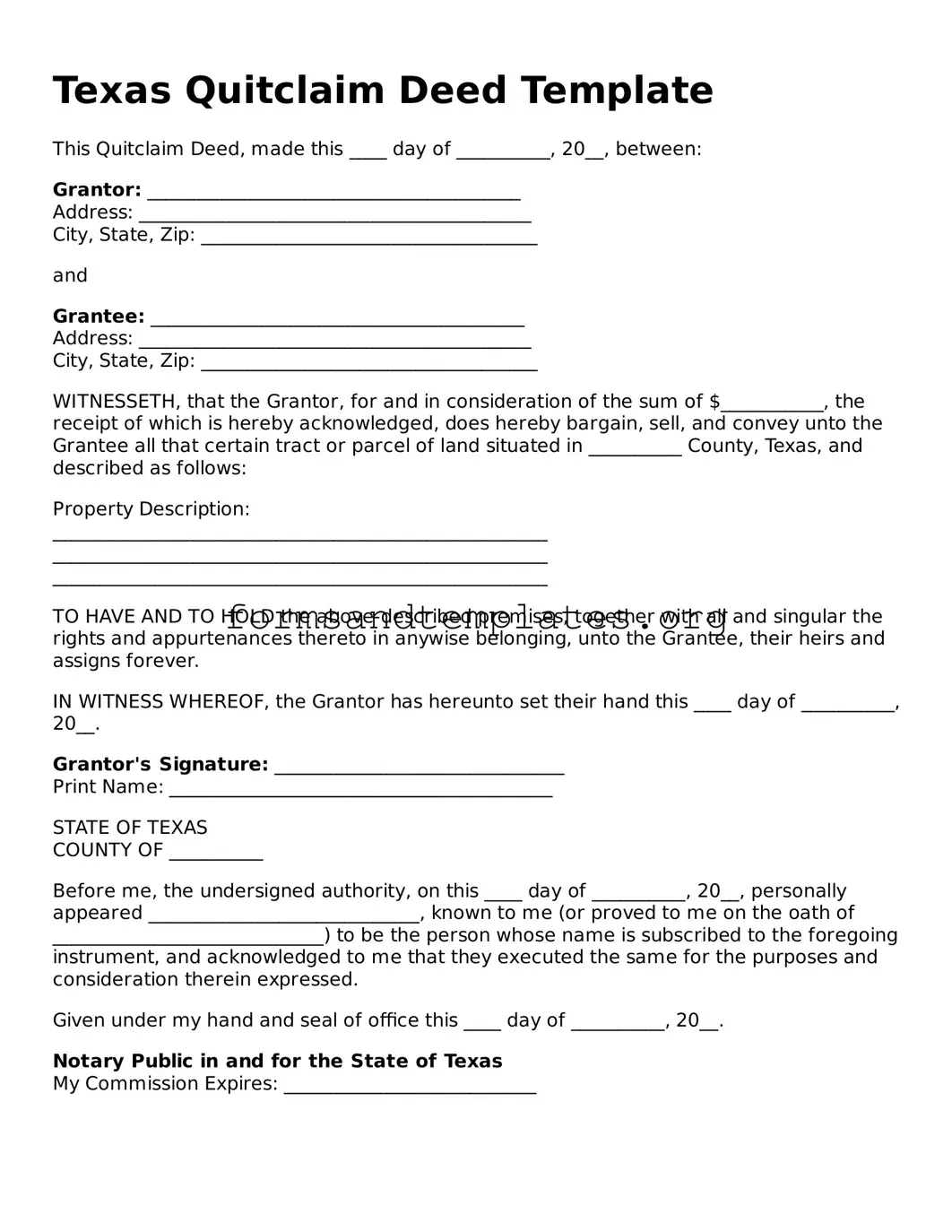

Texas Quitclaim Deed Example

Texas Quitclaim Deed Template

This Quitclaim Deed, made this ____ day of __________, 20__, between:

Grantor: ________________________________________

Address: __________________________________________

City, State, Zip: ____________________________________

and

Grantee: ________________________________________

Address: __________________________________________

City, State, Zip: ____________________________________

WITNESSETH, that the Grantor, for and in consideration of the sum of $___________, the receipt of which is hereby acknowledged, does hereby bargain, sell, and convey unto the Grantee all that certain tract or parcel of land situated in __________ County, Texas, and described as follows:

Property Description:

_____________________________________________________

_____________________________________________________

_____________________________________________________

TO HAVE AND TO HOLD the above-described premises, together with all and singular the rights and appurtenances thereto in anywise belonging, unto the Grantee, their heirs and assigns forever.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this ____ day of __________, 20__.

Grantor's Signature: _______________________________

Print Name: _________________________________________

STATE OF TEXAS

COUNTY OF __________

Before me, the undersigned authority, on this ____ day of __________, 20__, personally appeared _____________________________, known to me (or proved to me on the oath of _____________________________) to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ____ day of __________, 20__.

Notary Public in and for the State of Texas

My Commission Expires: ___________________________

Understanding Texas Quitclaim Deed

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property title. The grantor (the person transferring the property) relinquishes their interest, but the deed does not ensure that the title is clear of claims or liens.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific situations, including:

- Transferring property between family members, such as during a divorce or inheritance.

- Correcting a title issue, such as misspellings or errors in the property description.

- Transferring property into a trust or business entity.

How do I complete a Quitclaim Deed in Texas?

To complete a Quitclaim Deed in Texas, follow these steps:

- Obtain a Quitclaim Deed form, which can be found online or at legal stationery stores.

- Fill in the names of the grantor and grantee, along with the property description.

- Sign the deed in front of a notary public.

- File the completed deed with the county clerk in the county where the property is located.

Do I need a lawyer to create a Quitclaim Deed?

While it is not legally required to have a lawyer to create a Quitclaim Deed, consulting with one can be beneficial. A lawyer can ensure that the document is filled out correctly and meets all legal requirements, reducing the risk of future disputes.

Are there any taxes associated with a Quitclaim Deed?

In Texas, transferring property via a Quitclaim Deed may trigger certain tax implications. Generally, the grantee may need to file a Texas Property Transfer Tax form. However, exemptions may apply, especially for family transfers. It’s advisable to check with a tax professional for specific guidance.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. If the grantor wishes to regain ownership, they must create a new deed transferring the property back. This process requires the consent of both parties involved.

What happens if there are liens on the property?

A Quitclaim Deed does not remove any existing liens or encumbrances on the property. The grantee takes the property subject to any liens. If there are concerns about liens, a title search is recommended before completing the transfer.

How to Use Texas Quitclaim Deed

After obtaining the Texas Quitclaim Deed form, it's important to fill it out accurately to ensure a smooth transfer of property ownership. Once completed, the form will need to be signed and filed with the appropriate county office.

- Start by entering the date at the top of the form.

- In the section labeled "Grantor," write the name of the person transferring the property. Include their address.

- In the "Grantee" section, fill in the name of the person receiving the property, along with their address.

- Next, provide a legal description of the property being transferred. This may include the lot number, block number, and any relevant survey information.

- Indicate the county where the property is located.

- Check the appropriate box to indicate whether the transfer is for consideration (payment) or if it is a gift.

- Both the grantor and grantee should sign the form. Ensure that the signatures are dated.

- Have the signatures notarized. A notary public will need to witness the signing.

- Finally, submit the completed form to the county clerk's office in the county where the property is located. Be sure to keep a copy for your records.