Promissory Note Template for the State of Texas

In the realm of financial agreements, the Texas Promissory Note form serves as a crucial document for individuals and businesses alike. This legally binding instrument outlines the terms under which one party promises to pay a specified sum of money to another party, often with interest, within a designated timeframe. Key elements of the form include the principal amount, interest rate, payment schedule, and any applicable fees or penalties for late payments. Additionally, it stipulates the rights and responsibilities of both the borrower and the lender, ensuring clarity and mutual understanding. Whether used for personal loans, business transactions, or real estate dealings, the Texas Promissory Note is designed to protect the interests of both parties while providing a clear framework for repayment. Understanding its components and implications is essential for anyone looking to engage in a lending agreement in Texas.

Common mistakes

-

Failing to include the borrower's name correctly. It's crucial that the name matches the legal name on identification documents.

-

Not specifying the loan amount clearly. Ambiguities can lead to disputes later on.

-

Omitting the interest rate. If not stated, the note may be considered non-enforceable.

-

Leaving out the payment schedule. Clearly outline when payments are due and the amount of each payment.

-

Not including a default clause. This clause should specify what happens if the borrower fails to make payments.

-

Forgetting to sign the document. Both the borrower and lender must sign for the note to be valid.

-

Using vague language. Clear and precise wording helps prevent misunderstandings.

-

Not dating the note. The date of signing is essential for establishing the timeline of the loan.

-

Failing to keep copies. Both parties should retain a copy for their records to avoid future disputes.

Other Common Promissory Note State Templates

How to Do a Promissory Note - Some notes may include late fees if payments are not made on time.

Promissory Note Template Arizona - Failure to repay a Promissory Note can result in significant legal consequences.

Create Promissory Note - Ensuring all terms are mutually understood and agreed upon is vital for a promissory note’s effectiveness.

For a thorough understanding of the legal implications involved, reviewing this guideline on Hold Harmless Agreement forms can be invaluable in ensuring you are prepared for any situation that may arise during events.

Tennessee Promissory Note - Some promissory notes may allow for early repayment without penalty.

Key takeaways

Filling out a Texas Promissory Note form is an important step in establishing a clear agreement between a borrower and a lender. Here are some key takeaways to keep in mind:

- Understand the Basics: A promissory note is a written promise to pay a specific amount of money at a specified time. Knowing this fundamental concept is crucial.

- Identify the Parties: Clearly list the names and addresses of both the borrower and the lender. This ensures everyone knows who is involved in the agreement.

- Specify the Loan Amount: Clearly state the exact amount being borrowed. This avoids any confusion later on.

- Detail the Interest Rate: If applicable, include the interest rate. This can be a fixed or variable rate, but it must be clearly defined.

- Set the Repayment Terms: Outline how and when the borrower will repay the loan. Include details about payment frequency and due dates.

- Include Default Terms: Clearly state what happens if the borrower fails to make payments. This protects the lender's interests.

- Signatures Matter: Ensure that both parties sign and date the document. This makes the agreement legally binding.

- Keep Copies: After completing the form, make copies for both the borrower and the lender. This ensures that everyone has a record of the agreement.

By following these guidelines, you can effectively fill out and utilize a Texas Promissory Note form, creating a clear and enforceable agreement.

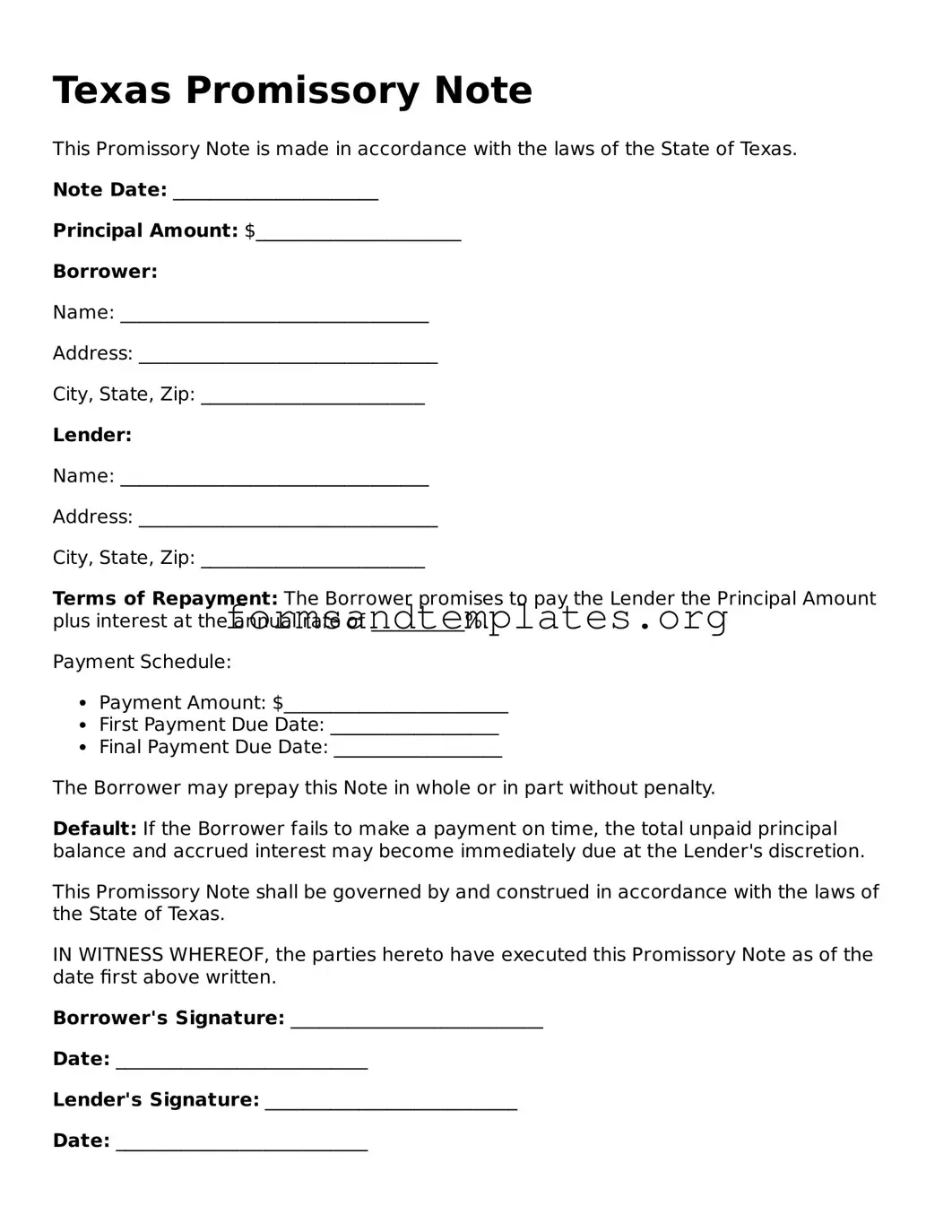

Texas Promissory Note Example

Texas Promissory Note

This Promissory Note is made in accordance with the laws of the State of Texas.

Note Date: ______________________

Principal Amount: $______________________

Borrower:

Name: _________________________________

Address: ________________________________

City, State, Zip: ________________________

Lender:

Name: _________________________________

Address: ________________________________

City, State, Zip: ________________________

Terms of Repayment: The Borrower promises to pay the Lender the Principal Amount plus interest at the annual rate of __________%.

Payment Schedule:

- Payment Amount: $________________________

- First Payment Due Date: __________________

- Final Payment Due Date: __________________

The Borrower may prepay this Note in whole or in part without penalty.

Default: If the Borrower fails to make a payment on time, the total unpaid principal balance and accrued interest may become immediately due at the Lender's discretion.

This Promissory Note shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the date first above written.

Borrower's Signature: ___________________________

Date: ___________________________

Lender's Signature: ___________________________

Date: ___________________________

Understanding Texas Promissory Note

What is a Texas Promissory Note?

A Texas Promissory Note is a written agreement in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the loan amount, interest rate, payment schedule, and any penalties for late payments. It serves as a legal record of the debt and the borrower's commitment to repay it.

What are the key components of a Texas Promissory Note?

A well-drafted Texas Promissory Note should include the following key components:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage of interest charged on the loan.

- Payment Terms: Schedule of payments, including frequency (monthly, quarterly, etc.) and due dates.

- Default Terms: Conditions that define a default and the consequences of defaulting.

- Governing Law: A statement that the note is governed by Texas law.

Do I need to have the Texas Promissory Note notarized?

While notarization is not strictly required for a Texas Promissory Note to be valid, it is highly recommended. Having the document notarized adds an extra layer of protection and can help prevent disputes about the authenticity of the signatures. If the note is not notarized, it may still be enforceable, but proving its validity could become more challenging in court.

Can a Texas Promissory Note be modified after it is signed?

Yes, a Texas Promissory Note can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and the lender. This ensures that both parties have a clear understanding of the new terms and helps avoid future disputes. Always keep a copy of the modified note for your records.

How to Use Texas Promissory Note

After obtaining the Texas Promissory Note form, it’s essential to complete it accurately to ensure that all parties understand their obligations. Follow these steps carefully to fill out the form correctly.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate the purpose of the document.

- Identify the Borrower: In the first section, enter the full name and address of the borrower. This is the individual or entity receiving the loan.

- Identify the Lender: Next, provide the full name and address of the lender. This is the individual or entity providing the loan.

- Loan Amount: Clearly state the total amount of money being borrowed. This should be a specific dollar amount.

- Interest Rate: Indicate the interest rate applicable to the loan. Make sure to specify whether it is a fixed or variable rate.

- Payment Terms: Outline how and when payments will be made. Include details like the payment schedule (monthly, quarterly, etc.) and the duration of the loan.

- Late Fees: If applicable, specify any late fees that will be charged if payments are not made on time.

- Signatures: Finally, both the borrower and lender must sign and date the document. This confirms that both parties agree to the terms outlined in the note.

Once the form is filled out, ensure that both parties keep a signed copy for their records. This document serves as a legal agreement, so it’s important to handle it with care.