Operating Agreement Template for the State of Texas

The Texas Operating Agreement form is a crucial document for any limited liability company (LLC) operating in Texas. It outlines the management structure, operational procedures, and ownership interests among members. This agreement serves as a roadmap for the LLC, detailing how decisions are made, how profits and losses are distributed, and how disputes will be resolved. Additionally, it specifies the rights and responsibilities of each member, ensuring that everyone is on the same page. By establishing clear guidelines, the Operating Agreement helps prevent misunderstandings and conflicts down the line. It is important to note that while Texas law does not require an LLC to have an Operating Agreement, having one can provide significant legal protections and clarity for all members involved.

Common mistakes

-

Incomplete Information: Failing to provide all required information can lead to delays or rejection. Ensure that every section is filled out completely.

-

Incorrect Member Names: Using incorrect or misspelled names for members can create confusion. Double-check the names against official documents.

-

Missing Signatures: Not signing the agreement or having all members sign can invalidate the document. Make sure every required party has signed.

-

Omitting the Effective Date: Forgetting to include the effective date of the agreement can lead to misunderstandings about when the terms apply.

-

Ignoring State Requirements: Each state has specific rules. Failing to comply with Texas regulations can result in legal issues.

-

Inconsistent Terms: Using terms that contradict each other can create confusion. Ensure that all terms are consistent throughout the document.

-

Not Updating the Agreement: Failing to revise the agreement when changes occur can lead to outdated information. Review and update regularly.

-

Neglecting to Include a Dispute Resolution Clause: Not having a clear process for resolving disputes can lead to complications. Include this clause to avoid future issues.

-

Overlooking Tax Implications: Not considering the tax structure can have financial consequences. Consult a tax professional to understand the implications.

Other Common Operating Agreement State Templates

Virginia Llc Operating Agreement Template - An Operating Agreement aids in demonstrating the legitimacy of the business to banks and investors.

How to Make an Operating Agreement - It can outline the conditions under which the LLC can be dissolved.

For those seeking a reliable mechanism to document their transactions, the Georgia Motorcycle Bill of Sale presents a crucial resource for any motorcycle sale. To explore this further, you can find an informative overview of the process in our guide on the comprehensive Georgia Motorcycle Bill of Sale.

Llc Operating Agreement Tennessee - Details the procedure for handling disputes among members.

Key takeaways

When filling out and using the Texas Operating Agreement form, there are several important points to keep in mind:

- The Operating Agreement outlines the management structure and operating procedures of your business.

- It is not legally required in Texas, but having one is highly recommended for clarity and protection.

- All members of the business should participate in drafting the agreement to ensure everyone's voice is heard.

- Clearly define each member's roles and responsibilities to avoid confusion in the future.

- Include provisions for profit distribution, which should be agreed upon by all members.

- Consider including procedures for resolving disputes among members to maintain harmony.

- Review the agreement regularly and update it as necessary, especially when there are changes in membership or business goals.

- Once completed, ensure that all members sign the document to make it official and binding.

Texas Operating Agreement Example

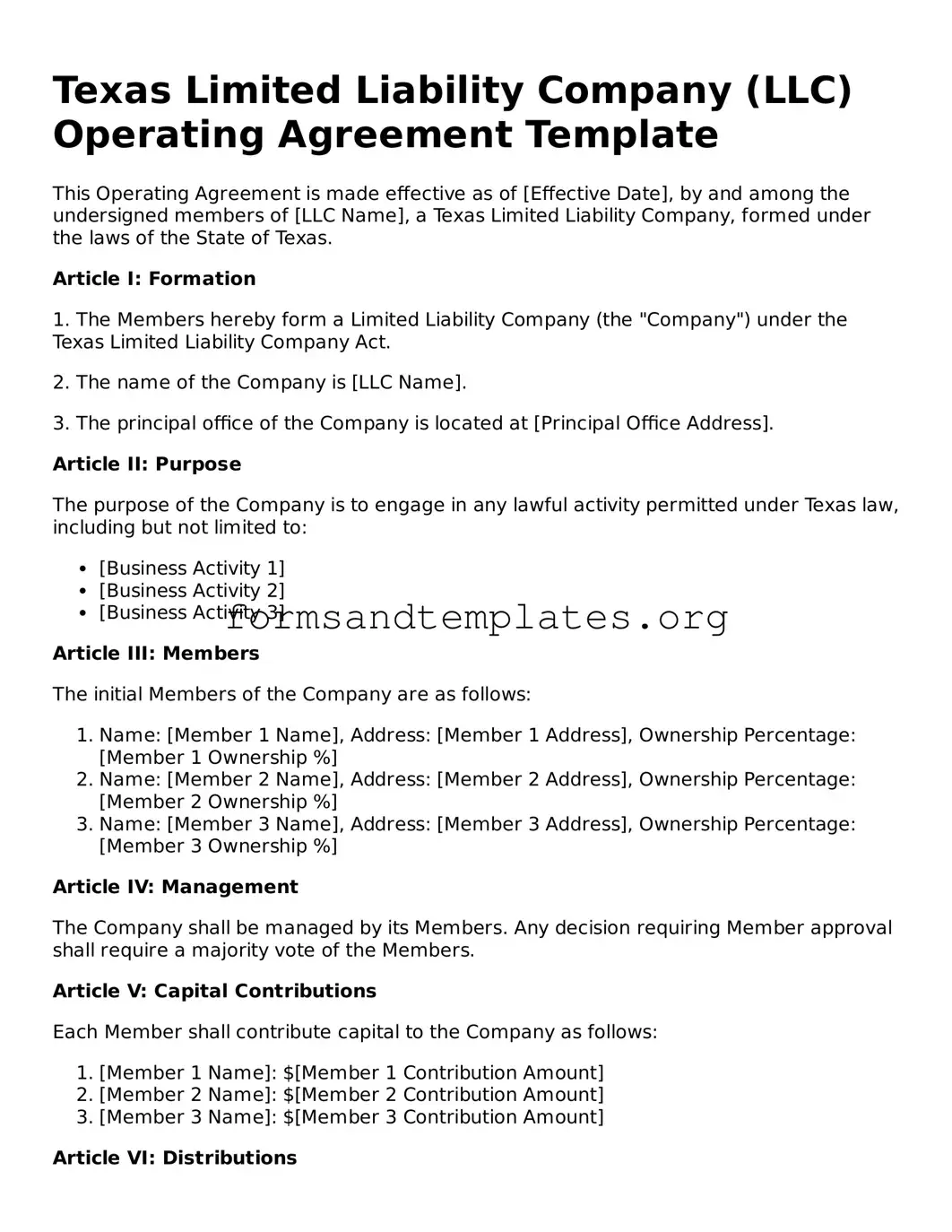

Texas Limited Liability Company (LLC) Operating Agreement Template

This Operating Agreement is made effective as of [Effective Date], by and among the undersigned members of [LLC Name], a Texas Limited Liability Company, formed under the laws of the State of Texas.

Article I: Formation

1. The Members hereby form a Limited Liability Company (the "Company") under the Texas Limited Liability Company Act.

2. The name of the Company is [LLC Name].

3. The principal office of the Company is located at [Principal Office Address].

Article II: Purpose

The purpose of the Company is to engage in any lawful activity permitted under Texas law, including but not limited to:

- [Business Activity 1]

- [Business Activity 2]

- [Business Activity 3]

Article III: Members

The initial Members of the Company are as follows:

- Name: [Member 1 Name], Address: [Member 1 Address], Ownership Percentage: [Member 1 Ownership %]

- Name: [Member 2 Name], Address: [Member 2 Address], Ownership Percentage: [Member 2 Ownership %]

- Name: [Member 3 Name], Address: [Member 3 Address], Ownership Percentage: [Member 3 Ownership %]

Article IV: Management

The Company shall be managed by its Members. Any decision requiring Member approval shall require a majority vote of the Members.

Article V: Capital Contributions

Each Member shall contribute capital to the Company as follows:

- [Member 1 Name]: $[Member 1 Contribution Amount]

- [Member 2 Name]: $[Member 2 Contribution Amount]

- [Member 3 Name]: $[Member 3 Contribution Amount]

Article VI: Distributions

Profits and losses shall be allocated to Members in proportion to their ownership percentages.

Article VII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article VIII: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Members' Signatures:

- [Member 1 Name] _______________________ Date: ____________

- [Member 2 Name] _______________________ Date: ____________

- [Member 3 Name] _______________________ Date: ____________

Understanding Texas Operating Agreement

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. This agreement serves as an internal guideline for the members, detailing how the business will be run, how profits and losses will be distributed, and how decisions will be made. Although it is not required by law, having an Operating Agreement is highly recommended to prevent misunderstandings and disputes among members.

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement for your LLC provides several benefits:

- Clarifies Roles: It clearly defines the roles and responsibilities of each member, which helps in avoiding conflicts.

- Protects Limited Liability Status: An Operating Agreement reinforces the limited liability status of the LLC, which can protect your personal assets from business debts.

- Guides Decision-Making: It outlines how decisions will be made, whether by majority vote or unanimous consent, ensuring everyone is on the same page.

- Facilitates Business Operations: The agreement can include provisions for adding new members, handling member departures, and other operational aspects.

What should be included in a Texas Operating Agreement?

A well-drafted Texas Operating Agreement typically includes the following elements:

- Company Information: Name, address, and purpose of the LLC.

- Member Details: Names and ownership percentages of all members.

- Management Structure: Whether the LLC will be member-managed or manager-managed.

- Voting Rights: How votes will be conducted and what constitutes a quorum.

- Profit Distribution: How profits and losses will be shared among members.

- Amendments: Procedures for making changes to the agreement.

Is an Operating Agreement legally binding?

Yes, an Operating Agreement is legally binding among the members of the LLC. It acts as a contract, and as long as it is properly executed and complies with Texas law, it can be enforced in court. This means that if a member fails to adhere to the terms outlined in the agreement, other members can seek legal remedies.

Do I need to file my Operating Agreement with the state?

No, you do not need to file your Operating Agreement with the state of Texas. This document is kept internally among the members of the LLC. However, it is important to maintain a copy for your records and to provide it when necessary, such as during legal disputes or when opening a business bank account.

Can I change my Operating Agreement after it has been created?

Absolutely! You can amend your Operating Agreement at any time. Most agreements include a specific process for making amendments, which usually requires a vote among the members. It’s important to document any changes in writing and keep the updated version with your original agreement to ensure everyone is aware of the current terms.

How to Use Texas Operating Agreement

Once you have gathered the necessary information, you can begin filling out the Texas Operating Agreement form. This document will outline the management structure and operational guidelines for your business. Ensure that all information is accurate and complete to avoid any issues in the future.

- Title the Document: Start by clearly labeling the document as the "Operating Agreement" at the top.

- Business Name: Write the official name of your business as registered with the state of Texas.

- Principal Office Address: Provide the physical address of your business’s main office.

- Formation Date: Indicate the date when your business was officially formed.

- Members: List all members of the LLC, including their names and addresses.

- Capital Contributions: Specify the amount each member has contributed to the business.

- Management Structure: State whether the LLC will be member-managed or manager-managed.

- Voting Rights: Describe the voting rights of each member, including how decisions will be made.

- Distribution of Profits: Outline how profits and losses will be distributed among members.

- Amendments: Include a section on how the Operating Agreement can be amended in the future.

- Signatures: Ensure all members sign and date the document to validate it.