Motor Vehicle Bill of Sale Template for the State of Texas

When it comes to buying or selling a vehicle in Texas, the Motor Vehicle Bill of Sale form plays a crucial role in ensuring a smooth and legally sound transaction. This document serves as a written record of the sale, capturing essential details that protect both the buyer and the seller. Key components of the form include the names and addresses of both parties, a description of the vehicle—including its make, model, year, and Vehicle Identification Number (VIN)—and the sale price. Additionally, the form often includes a statement regarding the condition of the vehicle, which can help clarify any potential disputes in the future. By completing this form, both parties acknowledge the transfer of ownership, making it a vital step in the vehicle sale process. Without this documentation, buyers may face challenges in registering their new vehicle, while sellers could encounter issues related to liability or ownership claims. Understanding the importance of the Motor Vehicle Bill of Sale form can save you time, money, and headaches down the road.

Common mistakes

-

Not including the correct vehicle identification number (VIN). This number is crucial for identifying the vehicle.

-

Failing to provide accurate odometer readings. This information is important for tracking the vehicle's mileage.

-

Omitting the date of the sale. Without a date, there may be confusion about when the transaction occurred.

-

Neglecting to include both the buyer’s and seller’s signatures. Both parties must sign to validate the sale.

-

Not specifying the sale price. This detail is necessary for tax purposes and for both parties’ records.

-

Using incorrect names or misspellings for the buyer or seller. Accurate names help avoid future disputes.

-

Failing to indicate if the vehicle is being sold as-is or with a warranty. This affects the buyer's expectations.

-

Not keeping a copy of the completed form. It’s important for both parties to have a record of the transaction.

-

Overlooking any state-specific requirements. Each state may have unique rules that need to be followed.

Other Common Motor Vehicle Bill of Sale State Templates

Az Title Transfer Bill of Sale - This bill of sale can help support claims of ownership in case of theft or loss.

For those looking to ensure compliance in hiring practices, the thorough Employment Verification process can help organizations validate an applicant's employment history and qualifications. This essential step fosters trust between employers and potential employees while streamlining onboarding procedures.

Nj Title Transfer - Signing this form may help avoid future disputes about the vehicle's ownership or sale terms.

Virginia Department of Motor Vehicles Fotos - May require notarization in certain states for added security.

Key takeaways

- Purpose: The Texas Motor Vehicle Bill of Sale form serves as a legal document that records the transfer of ownership from the seller to the buyer.

- Required Information: Fill out essential details including the vehicle's make, model, year, Vehicle Identification Number (VIN), and the sale price.

- Signatures: Both the seller and the buyer must sign the form to validate the transaction. This confirms that both parties agree to the sale.

- Notarization: While notarization is not mandatory, having the document notarized can provide additional legal protection and verification.

- Record Keeping: Keep a copy of the Bill of Sale for your records. This document may be needed for future reference, especially for title transfers or registration.

- Sales Tax: The buyer is responsible for paying sales tax when registering the vehicle. The Bill of Sale may be required for tax calculations.

- Additional Documentation: Depending on the situation, other documents such as the title and odometer disclosure statement may also be necessary to complete the sale.

Texas Motor Vehicle Bill of Sale Example

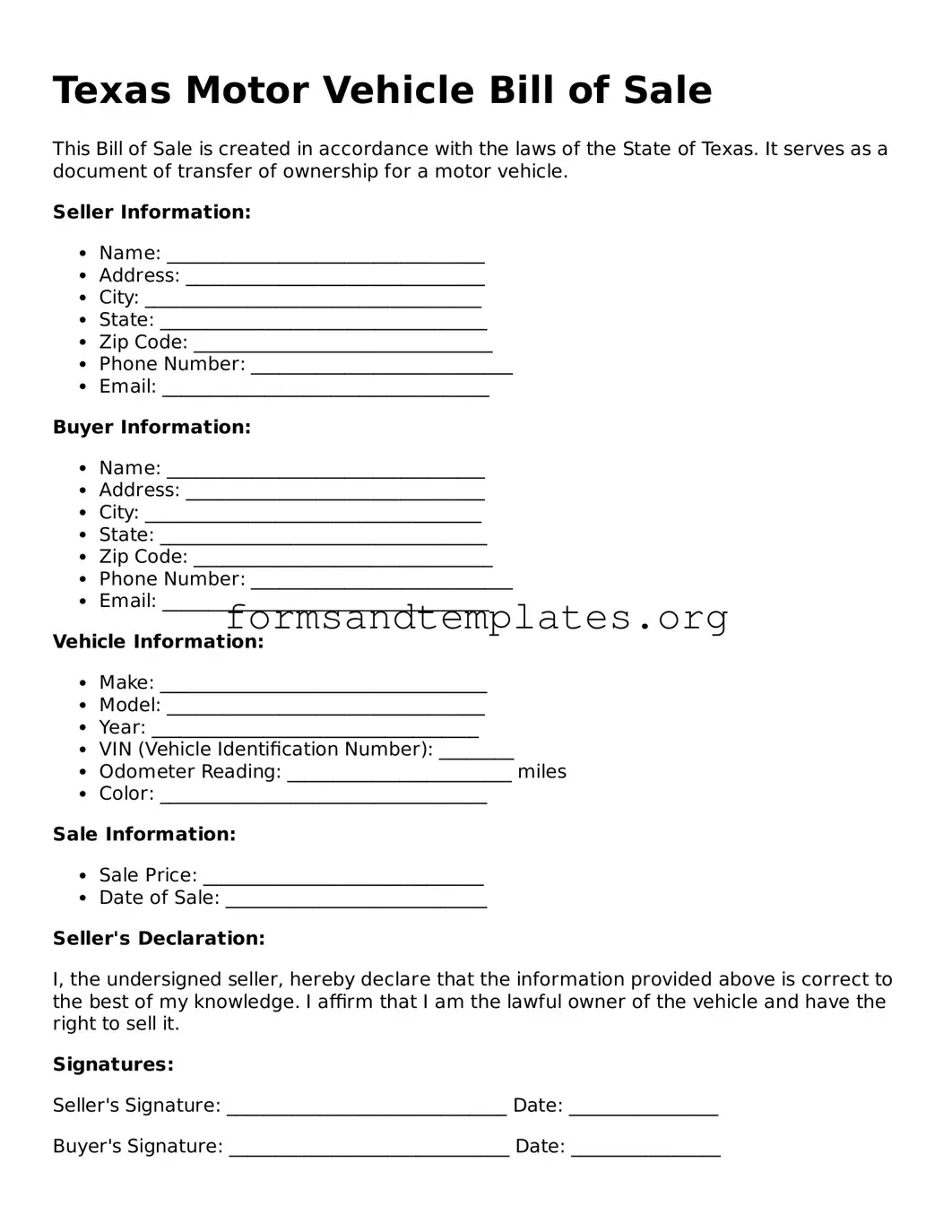

Texas Motor Vehicle Bill of Sale

This Bill of Sale is created in accordance with the laws of the State of Texas. It serves as a document of transfer of ownership for a motor vehicle.

Seller Information:

- Name: __________________________________

- Address: ________________________________

- City: ____________________________________

- State: ___________________________________

- Zip Code: ________________________________

- Phone Number: ____________________________

- Email: ___________________________________

Buyer Information:

- Name: __________________________________

- Address: ________________________________

- City: ____________________________________

- State: ___________________________________

- Zip Code: ________________________________

- Phone Number: ____________________________

- Email: ___________________________________

Vehicle Information:

- Make: ___________________________________

- Model: __________________________________

- Year: ___________________________________

- VIN (Vehicle Identification Number): ________

- Odometer Reading: ________________________ miles

- Color: ___________________________________

Sale Information:

- Sale Price: ______________________________

- Date of Sale: ____________________________

Seller's Declaration:

I, the undersigned seller, hereby declare that the information provided above is correct to the best of my knowledge. I affirm that I am the lawful owner of the vehicle and have the right to sell it.

Signatures:

Seller's Signature: ______________________________ Date: ________________

Buyer's Signature: ______________________________ Date: ________________

This Bill of Sale serves as a record of the transaction between the seller and the buyer.

Understanding Texas Motor Vehicle Bill of Sale

What is a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a vehicle from one party to another. It serves as proof of the transaction and includes important details such as the vehicle's identification number (VIN), make, model, year, and the names and addresses of both the buyer and seller. This document is essential for registering the vehicle in the new owner's name.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every vehicle transaction in Texas, it is highly recommended. Having a Bill of Sale can help protect both the buyer and seller in case of disputes. It provides a clear record of the sale and can be useful for tax purposes or if the buyer needs to register the vehicle. Additionally, if the vehicle is financed, the lender may require a Bill of Sale for their records.

What information should be included in the Bill of Sale?

When creating a Bill of Sale in Texas, ensure it contains the following information:

- The full names and addresses of both the buyer and seller.

- The vehicle's make, model, year, and VIN.

- The sale price of the vehicle.

- The date of the transaction.

- Any warranties or representations made by the seller.

Including this information helps to create a comprehensive record of the sale and can assist in future transactions or registrations.

Do I need to have the Bill of Sale notarized?

No, a Bill of Sale does not need to be notarized in Texas. However, having it notarized can add an extra layer of authenticity and protection for both parties involved. It can also be beneficial if there are any disputes in the future, as a notarized document may hold more weight in legal matters.

Where can I obtain a Texas Motor Vehicle Bill of Sale form?

You can obtain a Texas Motor Vehicle Bill of Sale form from several sources:

- The Texas Department of Motor Vehicles (TxDMV) website offers downloadable forms.

- Local county tax offices often provide printed forms.

- Various online legal services also offer customizable templates.

Make sure to choose a reliable source to ensure that the form meets all necessary requirements for your transaction.

How to Use Texas Motor Vehicle Bill of Sale

After gathering the necessary information, you are ready to fill out the Texas Motor Vehicle Bill of Sale form. This document is important for transferring ownership of a vehicle. Make sure all details are accurate to avoid any issues down the line.

- Start by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Include any relevant contact information.

- Next, fill in the buyer's full name and address, along with their contact information.

- Clearly describe the vehicle being sold. Include the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the vehicle. Make sure this is the agreed amount between the buyer and seller.

- Both the seller and buyer should sign and date the form at the bottom. This confirms the transaction.

- Make copies of the completed form for both parties to keep for their records.