Loan Agreement Template for the State of Texas

When entering into a loan agreement in Texas, it’s essential to understand the key components that make up this important document. A Texas Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. It specifies the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the form addresses default conditions and remedies available to the lender if the borrower fails to meet their obligations. Clarity is crucial; both parties should clearly understand their rights and responsibilities. This agreement not only serves as a legal safeguard but also fosters trust between the lender and borrower. With a well-structured loan agreement, both parties can avoid misunderstandings and ensure a smoother financial transaction.

Common mistakes

-

Incomplete Information: One common mistake is leaving sections of the form blank. Every part of the Texas Loan Agreement requires specific information. Failing to provide complete details can lead to delays or even rejection of the loan application.

-

Incorrect Personal Details: Borrowers sometimes enter incorrect names, addresses, or Social Security numbers. Accuracy is crucial, as discrepancies can complicate the loan process and affect credit checks.

-

Misunderstanding Loan Terms: Many individuals do not fully understand the terms of the loan, such as interest rates, repayment schedules, and fees. It’s important to read and comprehend these terms before signing the agreement.

-

Not Providing Required Documentation: Some people forget to include necessary documents, like proof of income or identification. This documentation is often essential for processing the loan, and missing items can slow down the approval process.

-

Failing to Review the Agreement: Before submitting the form, it is vital to review the entire agreement carefully. Overlooking any errors or misunderstandings can lead to complications later on.

Key takeaways

When filling out and using the Texas Loan Agreement form, consider the following key takeaways:

- Ensure all parties involved are clearly identified. This includes full names and addresses.

- Specify the loan amount in clear terms. This should include any interest rates and repayment terms.

- Include the purpose of the loan. This helps clarify the intent and can prevent misunderstandings.

- Outline the repayment schedule. Detail when payments are due and the method of payment.

- Make sure to include any collateral details if applicable. This secures the loan and protects the lender.

- Both parties should sign the agreement. This confirms that all terms are understood and accepted.

Following these guidelines will help ensure that the Loan Agreement is clear and enforceable.

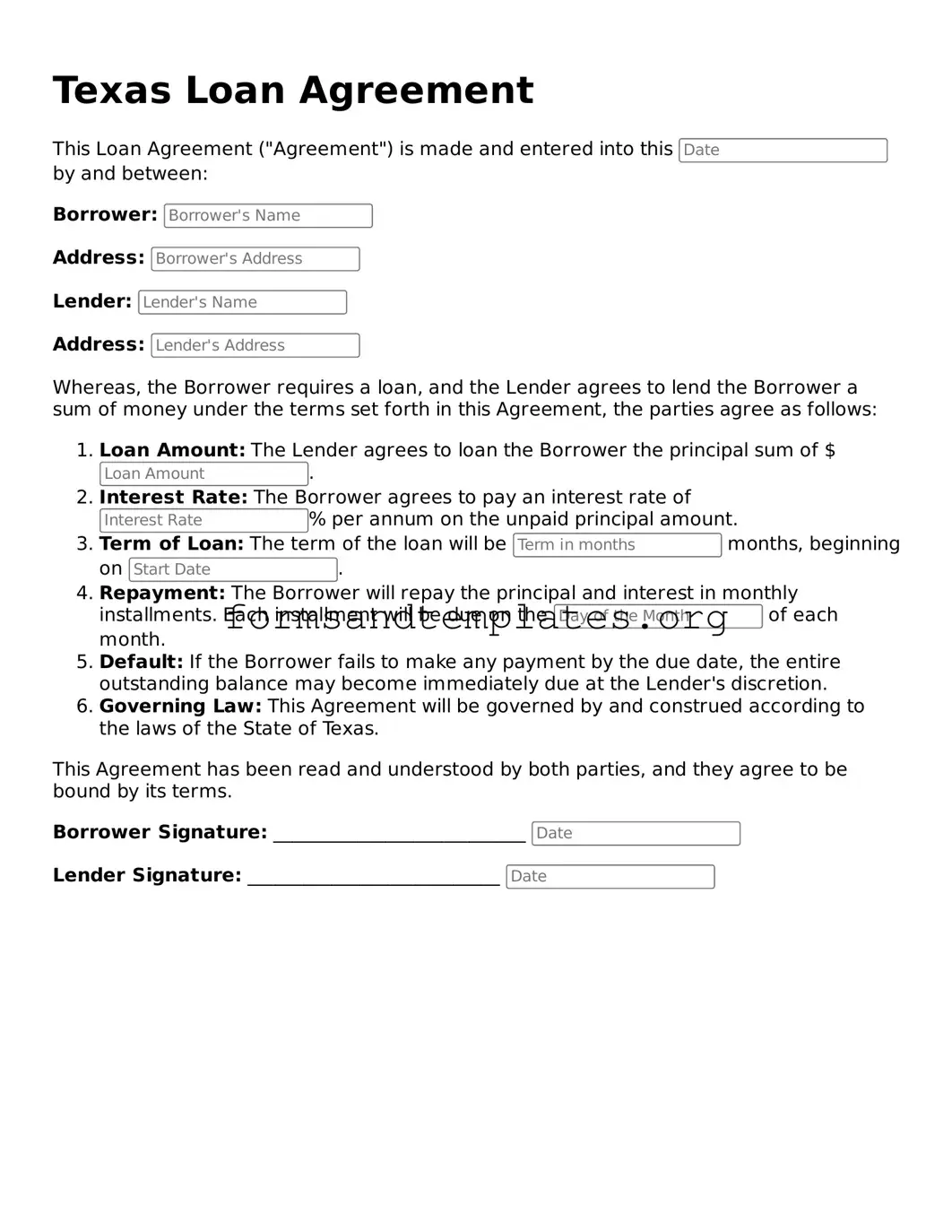

Texas Loan Agreement Example

Texas Loan Agreement

This Loan Agreement ("Agreement") is made and entered into this by and between:

Borrower:

Address:

Lender:

Address:

Whereas, the Borrower requires a loan, and the Lender agrees to lend the Borrower a sum of money under the terms set forth in this Agreement, the parties agree as follows:

- Loan Amount: The Lender agrees to loan the Borrower the principal sum of $.

- Interest Rate: The Borrower agrees to pay an interest rate of % per annum on the unpaid principal amount.

- Term of Loan: The term of the loan will be months, beginning on .

- Repayment: The Borrower will repay the principal and interest in monthly installments. Each installment will be due on the of each month.

- Default: If the Borrower fails to make any payment by the due date, the entire outstanding balance may become immediately due at the Lender's discretion.

- Governing Law: This Agreement will be governed by and construed according to the laws of the State of Texas.

This Agreement has been read and understood by both parties, and they agree to be bound by its terms.

Borrower Signature: ___________________________

Lender Signature: ___________________________

Understanding Texas Loan Agreement

What is a Texas Loan Agreement form?

The Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form specifies the amount borrowed, interest rates, repayment terms, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations. Having a written agreement helps to avoid misunderstandings and provides a reference point in case of disputes.

What are the key components of a Texas Loan Agreement?

A Texas Loan Agreement typically includes several important components:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: Details on how and when the borrower will repay the loan, including due dates and payment methods.

- Collateral: Any assets pledged by the borrower to secure the loan, which can be seized if the borrower defaults.

- Default Conditions: Circumstances under which the borrower would be considered in default and the lender's rights in that situation.

Is a Texas Loan Agreement legally binding?

Yes, a Texas Loan Agreement is legally binding as long as it meets certain criteria. Both parties must agree to the terms and sign the document voluntarily. It is crucial that the agreement is clear, specific, and compliant with Texas law. If any party fails to adhere to the terms, the other party may have legal grounds to enforce the agreement or seek damages.

Can a Texas Loan Agreement be modified?

Yes, a Texas Loan Agreement can be modified if both parties agree to the changes. Modifications should be documented in writing and signed by both the lender and the borrower. This ensures that all parties have a clear understanding of the new terms. It is advisable to consult legal counsel when making significant changes to ensure compliance with applicable laws and regulations.

How to Use Texas Loan Agreement

Completing the Texas Loan Agreement form is an important step in securing a loan. This process requires careful attention to detail to ensure all necessary information is accurately provided. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form. This is the date you are completing the agreement.

- Fill in the names and addresses of both the borrower and the lender. Make sure to include full names and current addresses.

- Specify the loan amount. Clearly write the total amount being borrowed in both numerical and written form.

- Indicate the interest rate. This should be the annual percentage rate (APR) agreed upon by both parties.

- Detail the repayment terms. Include how long the borrower has to repay the loan and the frequency of payments (e.g., monthly, bi-weekly).

- Provide any collateral information if applicable. Describe the assets being used to secure the loan.

- Include any additional terms or conditions that are specific to this loan. Be clear and concise in your descriptions.

- Both parties must sign and date the agreement. Ensure that signatures are legible and dated appropriately.

- Make copies of the completed form for both the borrower and the lender. This ensures that each party has a record of the agreement.