Last Will and Testament Template for the State of Texas

In the state of Texas, the Last Will and Testament serves as a crucial legal document that outlines an individual's wishes regarding the distribution of their assets after death. This form not only identifies the testator—the person creating the will—but also designates beneficiaries who will receive specific properties or sums of money. Additionally, it often includes provisions for the appointment of an executor, the individual responsible for ensuring that the will is executed according to the testator's wishes. Moreover, the Texas Last Will and Testament form allows for the inclusion of guardianship provisions for minor children, ensuring their care is entrusted to a chosen individual. The document must be signed in the presence of at least two witnesses, who also sign to affirm the testator's capacity and intent, thereby adding a layer of legal validity. Understanding the nuances of this form is essential for anyone looking to secure their legacy and provide clear instructions for their loved ones, making it a vital component of estate planning in Texas.

Common mistakes

-

Not signing the document properly. In Texas, a will must be signed by the testator (the person making the will) in the presence of two witnesses. Failing to do this can render the will invalid.

-

Neglecting to date the will. A will should always include the date it was created. Without a date, it can be difficult to determine which version of the will is the most recent, leading to potential disputes.

-

Forgetting to name an executor. An executor is responsible for carrying out the wishes outlined in the will. Omitting this crucial detail can complicate the probate process.

-

Not being clear about asset distribution. Vague language can lead to confusion and disputes among heirs. Clearly specifying who receives what can help prevent misunderstandings.

-

Overlooking state-specific requirements. Each state has its own laws regarding wills. Failing to adhere to Texas laws can invalidate the will, so it's essential to be aware of these regulations.

-

Not updating the will after significant life changes. Events such as marriage, divorce, or the birth of a child can affect your wishes. Regularly reviewing and updating your will ensures it reflects your current intentions.

Other Common Last Will and Testament State Templates

Can I Write My Own Will in Tennessee - May include both monetary and sentimental items for distribution.

Make Will - A tool to ensure your estate is managed according to your preferences.

For those looking to understand the nuances of vehicle ownership transfer, the Georgia Motor Vehicle Bill of Sale is an indispensable document to streamline the process. You can explore the necessary details by checking out this informative guide on the Motor Vehicle Bill of Sale.

Free Will Forms Online - A way to support causes you care about through bequests and donations.

Key takeaways

When filling out and using the Texas Last Will and Testament form, it is crucial to understand the following key takeaways:

- Ensure Clarity: Clearly state your intentions regarding the distribution of your assets. Ambiguities can lead to disputes among beneficiaries.

- Witness Requirements: Texas law mandates that your will be signed by at least two witnesses who are not beneficiaries. Their signatures validate the document.

- Revocation of Previous Wills: If you create a new will, ensure it explicitly revokes any prior wills. This prevents confusion about which document holds authority.

- Storage and Accessibility: Keep your will in a safe but accessible place. Inform your executor and trusted family members about its location to ensure it can be located when needed.

Texas Last Will and Testament Example

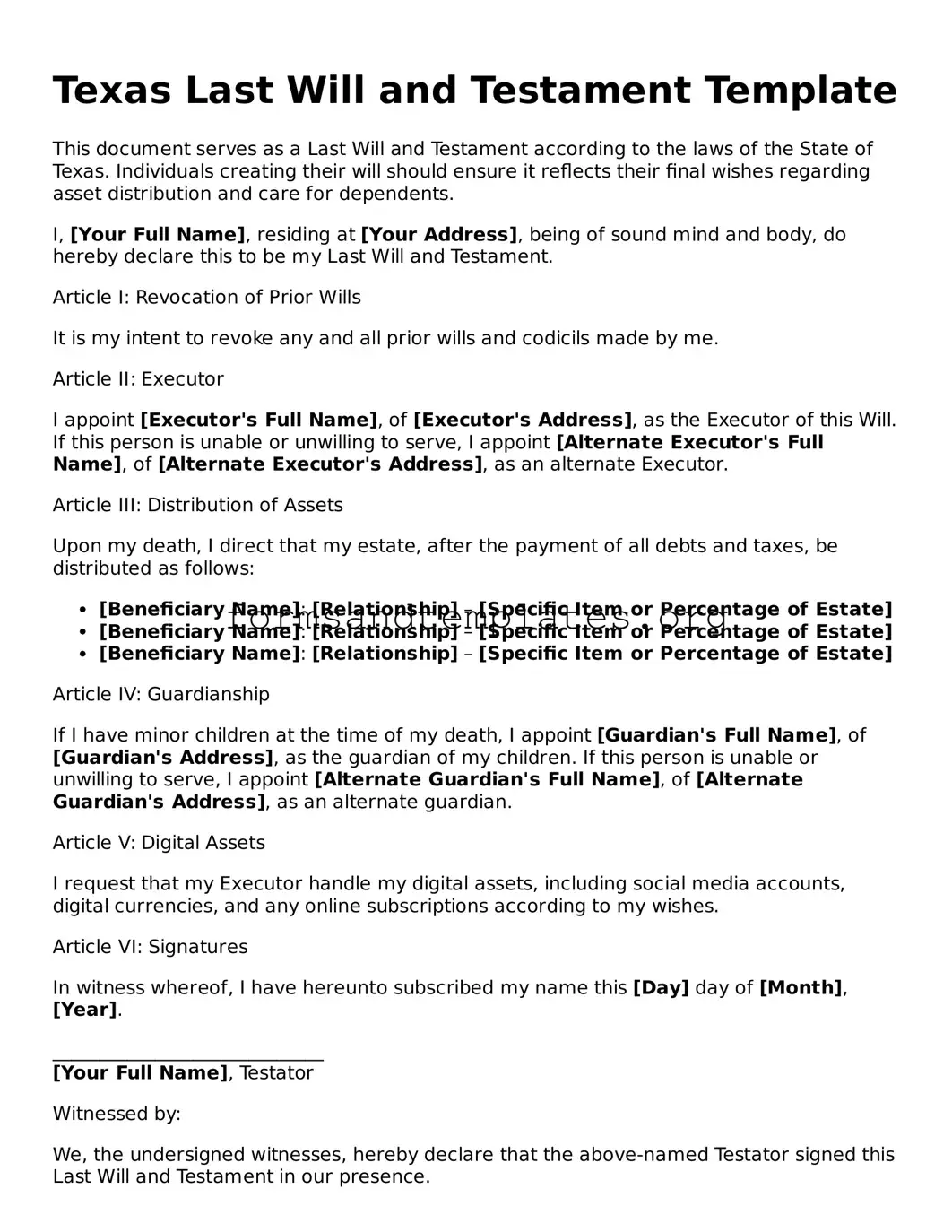

Texas Last Will and Testament Template

This document serves as a Last Will and Testament according to the laws of the State of Texas. Individuals creating their will should ensure it reflects their final wishes regarding asset distribution and care for dependents.

I, [Your Full Name], residing at [Your Address], being of sound mind and body, do hereby declare this to be my Last Will and Testament.

Article I: Revocation of Prior Wills

It is my intent to revoke any and all prior wills and codicils made by me.

Article II: Executor

I appoint [Executor's Full Name], of [Executor's Address], as the Executor of this Will. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Full Name], of [Alternate Executor's Address], as an alternate Executor.

Article III: Distribution of Assets

Upon my death, I direct that my estate, after the payment of all debts and taxes, be distributed as follows:

- [Beneficiary Name]: [Relationship] – [Specific Item or Percentage of Estate]

- [Beneficiary Name]: [Relationship] – [Specific Item or Percentage of Estate]

- [Beneficiary Name]: [Relationship] – [Specific Item or Percentage of Estate]

Article IV: Guardianship

If I have minor children at the time of my death, I appoint [Guardian's Full Name], of [Guardian's Address], as the guardian of my children. If this person is unable or unwilling to serve, I appoint [Alternate Guardian's Full Name], of [Alternate Guardian's Address], as an alternate guardian.

Article V: Digital Assets

I request that my Executor handle my digital assets, including social media accounts, digital currencies, and any online subscriptions according to my wishes.

Article VI: Signatures

In witness whereof, I have hereunto subscribed my name this [Day] day of [Month], [Year].

_____________________________

[Your Full Name], Testator

Witnessed by:

We, the undersigned witnesses, hereby declare that the above-named Testator signed this Last Will and Testament in our presence.

_____________________________

[Witness 1 Full Name], Witness

_____________________________

[Witness 2 Full Name], Witness

Witnesses must be at least 14 years of age and cannot be named as beneficiaries in this Will.

Understanding Texas Last Will and Testament

What is a Last Will and Testament in Texas?

A Last Will and Testament is a legal document that outlines how an individual's assets and property will be distributed upon their death. In Texas, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and designate an executor to manage the estate. It ensures that the individual's wishes are honored and can help avoid disputes among heirs.

Who can create a Last Will and Testament in Texas?

In Texas, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means the individual must understand the nature of the document and the consequences of their decisions. Additionally, individuals who are married or who have minor children often find it particularly beneficial to have a will in place.

What are the requirements for a valid will in Texas?

For a Last Will and Testament to be considered valid in Texas, it must meet several criteria:

- The will must be in writing.

- The testator (the person creating the will) must sign the document.

- At least two witnesses must sign the will, confirming that they witnessed the testator's signature.

Alternatively, Texas recognizes holographic wills, which do not require witnesses if the testator writes the will in their own handwriting and signs it.

Can I change or revoke my Last Will and Testament?

Yes, individuals in Texas can change or revoke their Last Will and Testament at any time, as long as they are of sound mind. Changes can be made by creating a new will or by adding a codicil, which is an amendment to the existing will. To revoke a will, the individual can either destroy it or create a new will that explicitly states the previous will is revoked.

What happens if I die without a will in Texas?

If an individual dies without a will, they are considered to have died intestate. In this situation, Texas law dictates how the deceased's assets will be distributed. Generally, the estate will be divided among surviving relatives, which may include a spouse, children, parents, or siblings. This process can be lengthy and may lead to disputes among family members, making the creation of a will a prudent choice.

How do I ensure my will is executed properly?

To ensure that a Last Will and Testament is executed properly in Texas, it is advisable to:

- Consult with an attorney who specializes in estate planning.

- Choose a trustworthy executor who will carry out the wishes outlined in the will.

- Store the will in a safe yet accessible location, and inform relevant parties of its whereabouts.

- Review and update the will regularly to reflect any changes in circumstances, such as marriage, divorce, or the birth of children.

Can I use a template for my Last Will and Testament in Texas?

While templates for Last Will and Testament forms are available, it is crucial to ensure that any template used complies with Texas law. Using a generic template may lead to issues regarding validity or the intended distribution of assets. For this reason, it is often recommended to seek legal advice or assistance when drafting a will to ensure that it accurately reflects the individual's wishes and meets legal requirements.

How to Use Texas Last Will and Testament

Once you have the Texas Last Will and Testament form ready, it is essential to fill it out accurately to ensure that your wishes are clearly communicated. Following these steps will help you complete the form correctly, paving the way for the next steps in the estate planning process.

- Begin by entering your full name at the top of the form. Make sure to include any middle names or initials.

- Next, provide your current address, including the city, state, and zip code.

- Indicate your date of birth. This helps establish your identity and age.

- Identify any beneficiaries by listing their names and relationships to you. This may include family members, friends, or organizations.

- Clearly specify the assets you wish to distribute, such as real estate, bank accounts, and personal property. Be as detailed as possible.

- Designate an executor. This is the person responsible for ensuring that your wishes are carried out. Include their full name and contact information.

- If applicable, name a guardian for any minor children. Provide the guardian's full name and relationship to the children.

- Review the entire document for accuracy. Ensure that all information is correct and complete.

- Sign the form in the presence of at least two witnesses. Make sure they also sign the document, affirming they witnessed your signature.

- Finally, store the completed will in a safe place, and inform your executor and loved ones about its location.