Lady Bird Deed Template for the State of Texas

The Texas Lady Bird Deed is a unique estate planning tool that offers individuals a way to transfer property while retaining certain rights during their lifetime. This form allows property owners to maintain control over their real estate, enabling them to live in the home, collect income from it, or even sell it without needing the consent of the beneficiaries. One of the most significant advantages of the Lady Bird Deed is its ability to avoid probate, which can simplify the transfer process upon the owner's passing. Furthermore, this deed provides a level of protection from creditors, ensuring that the property can be passed on to heirs without being subject to claims against the estate. As families navigate the complexities of property ownership and inheritance, understanding the benefits and implications of the Lady Bird Deed becomes essential for effective estate planning in Texas.

Common mistakes

-

Inaccurate Property Description: Many individuals fail to provide a precise legal description of the property. This can lead to confusion or disputes regarding the property in question.

-

Incorrect Names of Grantees: Mistakes often occur in listing the names of the grantees. It is essential to ensure that all names are spelled correctly and reflect the legal names of the individuals involved.

-

Failure to Include All Required Signatures: All parties involved in the deed must sign the document. Omitting a signature can render the deed invalid.

-

Not Notarizing the Document: A common error is neglecting to have the deed notarized. This step is crucial for the deed to be legally binding.

-

Omitting the Right of Survivorship: Some individuals overlook the importance of specifying rights of survivorship. This can affect how the property is transferred upon the death of a grantee.

-

Failing to Record the Deed: After completing the form, it is vital to record the deed with the appropriate county office. Failing to do so can lead to issues with ownership and title claims in the future.

Key takeaways

Understanding the Texas Lady Bird Deed can simplify the process of transferring property while retaining certain rights. Here are some key takeaways:

- Retain Control: With a Lady Bird Deed, you can keep control of your property during your lifetime. You can sell, mortgage, or change your mind about the deed at any time.

- Automatic Transfer: Upon your passing, the property automatically transfers to your designated beneficiaries without going through probate. This can save time and money.

- Medicaid Protection: The Lady Bird Deed can help protect your property from being counted as an asset for Medicaid eligibility, allowing you to qualify for assistance if needed.

- Simple Process: Filling out the form is straightforward. It requires basic information about the property and the beneficiaries, making it accessible for most homeowners.

- Consultation Recommended: While the form is user-friendly, it's wise to consult with a legal professional to ensure it meets your specific needs and complies with Texas law.

Texas Lady Bird Deed Example

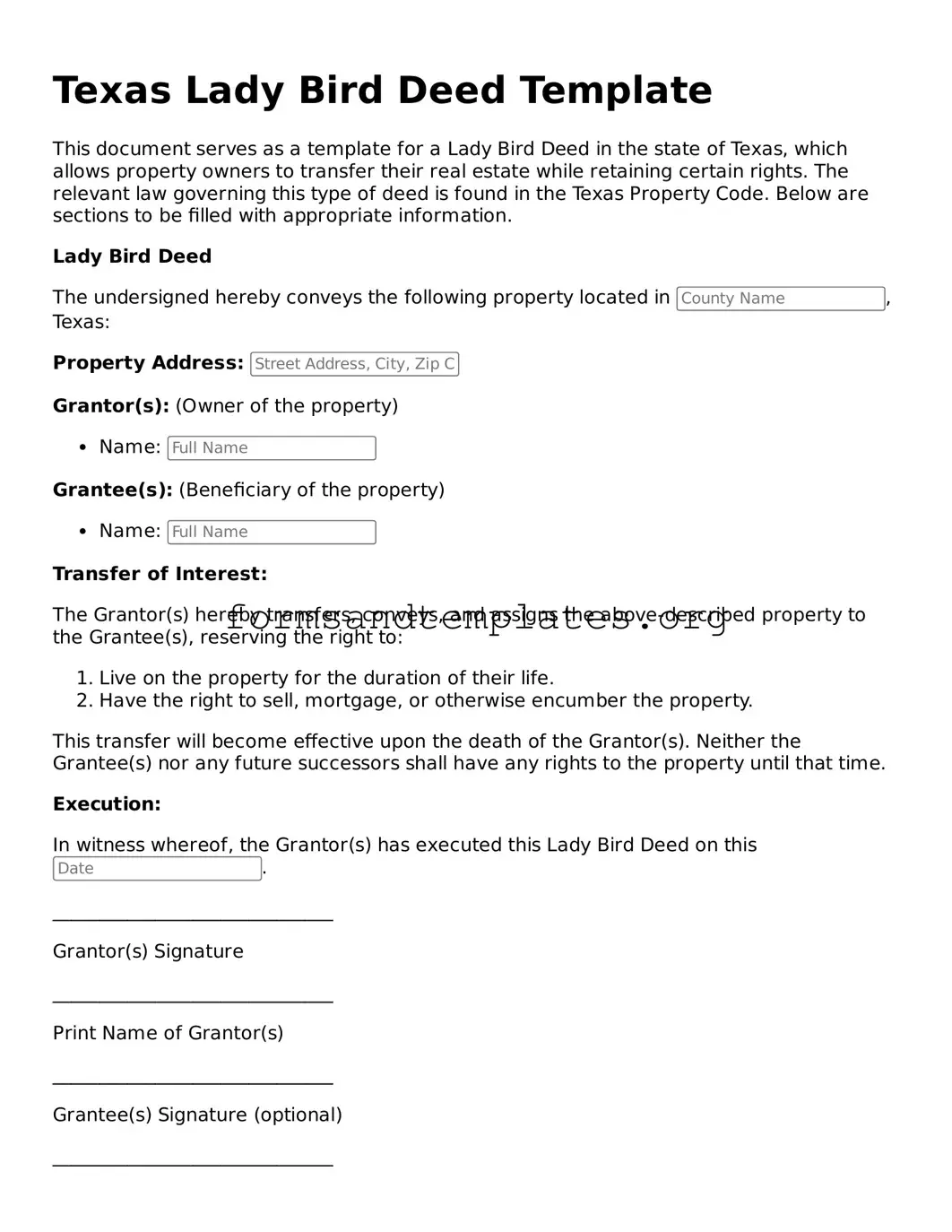

Texas Lady Bird Deed Template

This document serves as a template for a Lady Bird Deed in the state of Texas, which allows property owners to transfer their real estate while retaining certain rights. The relevant law governing this type of deed is found in the Texas Property Code. Below are sections to be filled with appropriate information.

Lady Bird Deed

The undersigned hereby conveys the following property located in , Texas:

Property Address:

Grantor(s): (Owner of the property)

- Name:

Grantee(s): (Beneficiary of the property)

- Name:

Transfer of Interest:

The Grantor(s) hereby transfers, conveys, and assigns the above-described property to the Grantee(s), reserving the right to:

- Live on the property for the duration of their life.

- Have the right to sell, mortgage, or otherwise encumber the property.

This transfer will become effective upon the death of the Grantor(s). Neither the Grantee(s) nor any future successors shall have any rights to the property until that time.

Execution:

In witness whereof, the Grantor(s) has executed this Lady Bird Deed on this .

______________________________

Grantor(s) Signature

______________________________

Print Name of Grantor(s)

______________________________

Grantee(s) Signature (optional)

______________________________

Print Name of Grantee(s) (optional)

State of Texas,

County of :

Before me, the undersigned authority, on this day personally appeared , known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes therein expressed.

Given under my hand and seal of office this .

______________________________

Notary Public, State of Texas

Understanding Texas Lady Bird Deed

-

What is a Texas Lady Bird Deed?

-

A Texas Lady Bird Deed is a specific type of property deed that allows an individual to transfer real estate to their beneficiaries while retaining certain rights during their lifetime. This deed is particularly useful for estate planning, as it can help avoid probate and ensure a smoother transition of property ownership upon death.

-

What are the benefits of using a Lady Bird Deed?

-

There are several advantages to using a Lady Bird Deed:

- Avoids Probate: The property automatically transfers to beneficiaries upon the owner's death, bypassing the often lengthy and costly probate process.

- Retained Control: The original owner retains the right to live in and manage the property during their lifetime, including the ability to sell or mortgage it.

- Tax Benefits: The property may receive a step-up in basis for tax purposes, which can be beneficial for heirs.

-

Who can create a Lady Bird Deed?

-

Any property owner in Texas can create a Lady Bird Deed. This includes individuals who own their home, land, or any real estate. However, it is advisable to consult with a legal professional to ensure that the deed is executed correctly and meets all legal requirements.

-

Are there any restrictions on who can be a beneficiary?

-

Generally, beneficiaries can be anyone the property owner chooses. This can include family members, friends, or even organizations. However, it’s essential to consider the potential implications of your choices, especially regarding family dynamics and tax consequences.

-

How does a Lady Bird Deed differ from a traditional deed?

-

The primary difference lies in the rights retained by the property owner. With a traditional deed, ownership is fully transferred to the new owner, and the original owner loses all rights to the property. In contrast, a Lady Bird Deed allows the owner to maintain control over the property while still designating beneficiaries for automatic transfer upon death.

-

Can a Lady Bird Deed be revoked or changed?

-

Yes, a Lady Bird Deed can be revoked or modified at any time during the property owner's lifetime. This flexibility allows the owner to adjust their estate plan as circumstances change, such as the addition of new beneficiaries or changes in personal relationships.

-

What should I consider before creating a Lady Bird Deed?

-

Before creating a Lady Bird Deed, consider the following:

- Your current financial situation and future needs.

- Potential tax implications for your beneficiaries.

- Family dynamics and how your choices may affect relationships.

- Consulting with a legal or financial advisor to understand the full impact of your decision.

How to Use Texas Lady Bird Deed

Filling out the Texas Lady Bird Deed form is a straightforward process. Once you have the form ready, you’ll need to gather some information about the property and the individuals involved. Make sure you have everything at hand before you start, as this will help streamline the process.

- Obtain the Form: Get a copy of the Texas Lady Bird Deed form. You can find it online or through legal supply stores.

- Property Description: Clearly describe the property you are transferring. Include the address and any legal description that might be necessary.

- Grantor Information: Fill in your name as the grantor (the person transferring the property). Include your address and any other required personal information.

- Grantee Information: Enter the names of the grantees (the individuals receiving the property). Make sure to include their addresses as well.

- Effective Date: Specify the date when the deed will take effect. This is often the date you sign the document.

- Signatures: Sign the form in the designated area. You may need a witness or notary, depending on your situation.

- File the Deed: Once completed, file the deed with the county clerk's office where the property is located. There may be a filing fee.

After completing these steps, you should have a properly filled out Texas Lady Bird Deed. Make sure to keep a copy for your records. It’s also wise to consult with a legal professional if you have any questions or concerns during the process.