Gift Deed Template for the State of Texas

In the realm of property transfer, the Texas Gift Deed form stands out as a vital instrument for individuals wishing to convey real estate without the exchange of money. This legal document allows a property owner, known as the grantor, to voluntarily give their property to another person, referred to as the grantee, as a gift. The significance of this form lies not only in its ability to facilitate a seamless transfer of ownership but also in its potential tax implications and the preservation of family relationships. By clearly outlining the details of the property, including its legal description, and the intentions of the grantor, the Gift Deed ensures that both parties are protected throughout the process. Additionally, the form must be properly executed, including signatures and notarization, to be valid under Texas law. Understanding the nuances of this form is essential for anyone considering gifting property, as it encompasses various considerations that can impact both the giver and the recipient.

Common mistakes

-

Not Including a Legal Description of the Property: One common mistake is failing to provide a complete legal description of the property being gifted. This description must be precise and can often be found on the property’s deed or tax records.

-

Omitting the Grantor and Grantee Information: It’s crucial to clearly identify both the person giving the gift (the grantor) and the person receiving it (the grantee). Missing this information can lead to confusion and potential legal issues.

-

Not Having the Document Notarized: A Gift Deed must be notarized to be legally binding. Failing to do so can render the deed invalid, which means the gift may not be recognized in a legal context.

-

Incorrectly Stating the Nature of the Gift: Some people mistakenly indicate that the gift is subject to conditions or restrictions when it should be an outright gift. This can complicate the transfer and lead to misunderstandings.

-

Forgetting to Include the Date: The date of execution is an important element of the Gift Deed. Omitting this detail can create ambiguity regarding when the transfer took place.

-

Neglecting to Record the Deed: After completing the Gift Deed, it is essential to file it with the county clerk’s office. Failing to record the deed can lead to disputes about ownership in the future.

-

Not Seeking Professional Advice: Many individuals attempt to fill out the Gift Deed without consulting a legal expert. This can lead to mistakes that may have been easily avoided with professional guidance.

Other Common Gift Deed State Templates

Virginia Transfer Taxes - Be aware that not all states treat gifts in the same way regarding tax obligations.

The California Notice to Quit form is essential for landlords initiating the eviction process, and to assist in this matter, you can find templates at California Templates, which provide guidance on completing the required documentation accurately.

Key takeaways

Filling out and utilizing the Texas Gift Deed form can be a straightforward process, but there are important considerations to keep in mind. Here are four key takeaways that can guide individuals through this process:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It is essential to recognize that this deed signifies a voluntary transfer of property from one individual to another.

- Complete the Form Accurately: Ensure that all required fields are filled out correctly. This includes the names of the donor and recipient, a description of the property, and the date of the gift. Inaccuracies can lead to complications in the future.

- Consider Tax Implications: While the gift may not involve a sale, it could have tax consequences. It is advisable to consult with a tax professional to understand any potential gift tax liabilities that may arise from the transfer.

- Record the Deed: After completing the Gift Deed, it is crucial to file it with the county clerk's office where the property is located. This step formalizes the transfer and protects the rights of the new owner.

Texas Gift Deed Example

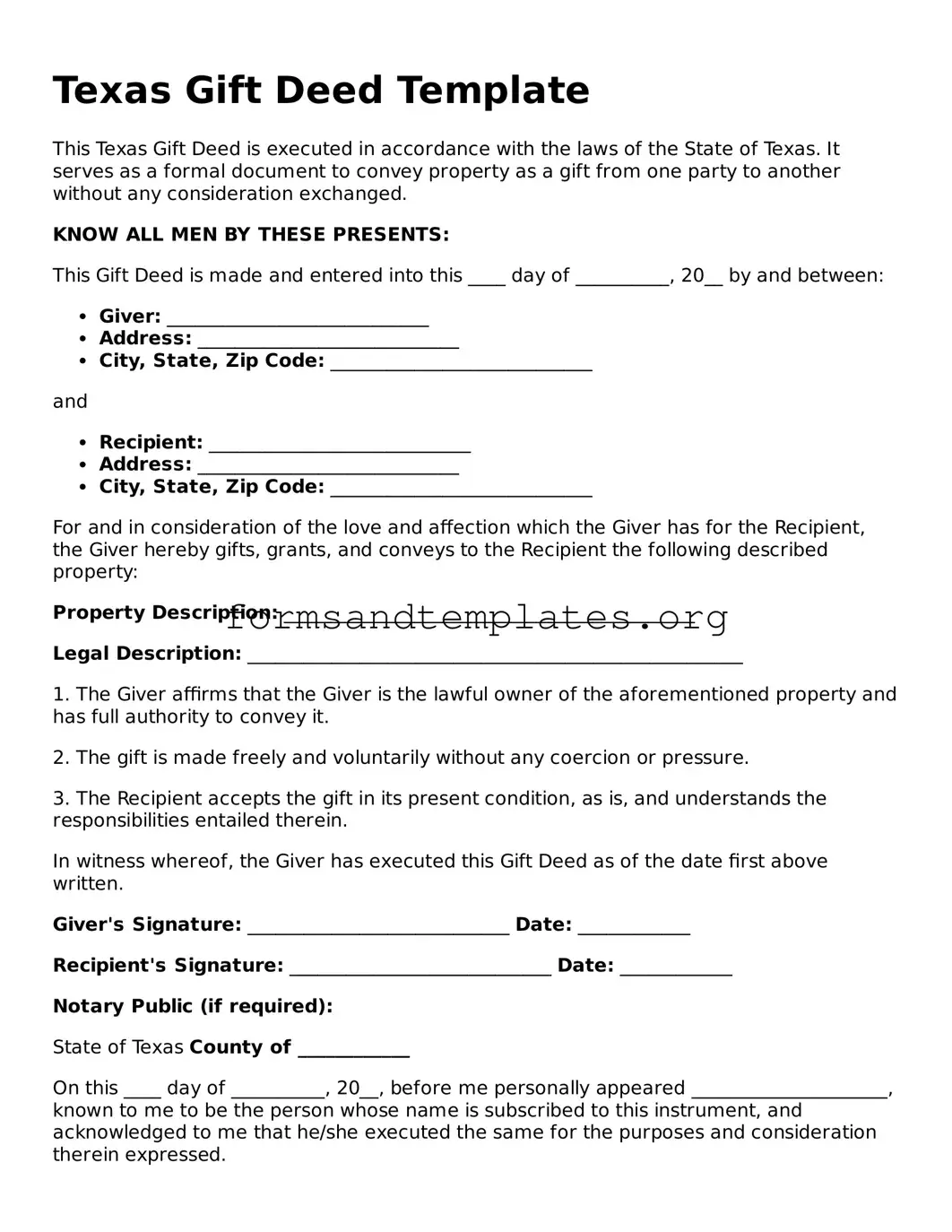

Texas Gift Deed Template

This Texas Gift Deed is executed in accordance with the laws of the State of Texas. It serves as a formal document to convey property as a gift from one party to another without any consideration exchanged.

KNOW ALL MEN BY THESE PRESENTS:

This Gift Deed is made and entered into this ____ day of __________, 20__ by and between:

- Giver: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

and

- Recipient: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

For and in consideration of the love and affection which the Giver has for the Recipient, the Giver hereby gifts, grants, and conveys to the Recipient the following described property:

Property Description: ____________________________________________

Legal Description: _____________________________________________________

1. The Giver affirms that the Giver is the lawful owner of the aforementioned property and has full authority to convey it.

2. The gift is made freely and voluntarily without any coercion or pressure.

3. The Recipient accepts the gift in its present condition, as is, and understands the responsibilities entailed therein.

In witness whereof, the Giver has executed this Gift Deed as of the date first above written.

Giver's Signature: ____________________________ Date: ____________

Recipient's Signature: ____________________________ Date: ____________

Notary Public (if required):

State of Texas County of ____________

On this ____ day of __________, 20__, before me personally appeared _____________________, known to me to be the person whose name is subscribed to this instrument, and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed.

Given under my hand and seal this ____ day of __________, 20__.

Notary Public Signature: ____________________________

Printed Name: ____________________________

My commission expires: ____________________________

Understanding Texas Gift Deed

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of property from one individual to another without any exchange of money. This form is often utilized when a property owner wishes to give a gift of real estate to a family member or friend. The deed must be signed by the donor (the person giving the gift) and typically requires notarization to be legally binding.

What information is required to complete a Gift Deed?

To complete a Texas Gift Deed, the following information is typically required:

- The full names and addresses of both the donor and the recipient.

- A legal description of the property being gifted, which can usually be found on the property’s existing deed or tax records.

- The date of the transfer.

- Any specific conditions or terms related to the gift, if applicable.

It is essential to ensure that all information is accurate to avoid potential disputes or legal issues in the future.

Are there any tax implications associated with a Gift Deed in Texas?

Yes, there can be tax implications when transferring property through a Gift Deed. The donor may be subject to federal gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. As of 2023, this limit is $17,000 per recipient. Additionally, the recipient may face property tax reassessment depending on local regulations. It is advisable to consult with a tax professional to understand the full implications of gifting property.

How do I record a Gift Deed in Texas?

To record a Gift Deed in Texas, follow these steps:

- Complete the Gift Deed form with all required information.

- Have the deed signed by the donor in the presence of a notary public.

- Submit the signed and notarized deed to the county clerk's office in the county where the property is located.

Recording the deed provides public notice of the transfer and protects the recipient’s ownership rights. There may be a small fee for recording the document, which varies by county.

How to Use Texas Gift Deed

Filling out the Texas Gift Deed form is an important step in transferring property ownership without a financial exchange. After completing the form, it must be properly signed and filed to ensure the transfer is legally recognized. Follow these steps to accurately fill out the form.

- Obtain the Form: Download the Texas Gift Deed form from a reliable source or visit your local county clerk's office to get a physical copy.

- Identify the Grantor: Fill in the full name and address of the person giving the gift (the grantor).

- Identify the Grantee: Enter the full name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a clear description of the property being gifted. Include details such as the address and legal description, if available.

- State the Gift Intent: Clearly state that the transfer is a gift and that no payment is involved.

- Include Additional Terms: If there are any specific conditions or terms related to the gift, include them in this section.

- Sign the Form: The grantor must sign the form in the presence of a notary public to make it legally binding.

- Notarization: Have the signature notarized. The notary will add their seal and signature to verify the authenticity.

- File the Deed: Submit the completed and notarized Gift Deed form to the appropriate county clerk's office for recording.

Once the Gift Deed is filed, it becomes part of the public record, officially documenting the transfer of ownership. It is advisable to keep a copy of the filed deed for personal records.