Durable Power of Attorney Template for the State of Texas

In the state of Texas, a Durable Power of Attorney (DPOA) is an essential legal tool that allows individuals to designate someone they trust to make financial and legal decisions on their behalf, especially in the event they become incapacitated. This document remains effective even if the principal, the person granting the authority, loses the ability to make decisions due to illness or injury. By establishing a DPOA, individuals can ensure that their financial affairs are managed according to their wishes, thereby avoiding potential conflicts or complications that might arise in the absence of clear directives. The form typically outlines the powers granted to the agent, who is the person appointed to act on behalf of the principal, and can include a wide range of responsibilities, such as managing bank accounts, paying bills, or making investment decisions. Importantly, a DPOA can be tailored to fit the specific needs and preferences of the principal, allowing for a flexible approach to personal and financial management. Understanding the nuances of this document is crucial for anyone looking to safeguard their interests and ensure that their affairs are handled in a manner they deem appropriate, even when they are no longer able to do so themselves.

Common mistakes

-

Not specifying the powers granted: Some individuals fail to clearly outline the specific powers they wish to grant their agent. This can lead to confusion and potential misuse of authority.

-

Using outdated forms: Laws and requirements can change. Using an outdated Durable Power of Attorney form can result in invalidation or complications.

-

Forgetting to sign and date: A common oversight is neglecting to sign and date the document. Without these, the form may not be considered legally binding.

-

Not having witnesses or notarization: In Texas, certain Durable Power of Attorney forms require either witnesses or notarization. Failing to include these can invalidate the document.

-

Choosing an inappropriate agent: Selecting someone who may not act in your best interest can lead to misuse of power. It is crucial to choose a trustworthy individual.

-

Ignoring state-specific requirements: Each state has its own laws regarding Durable Power of Attorney. Ignoring Texas-specific requirements can lead to complications.

-

Not discussing the document with the agent: Failing to communicate your wishes and the responsibilities involved can create misunderstandings later on.

-

Neglecting to review and update: Life circumstances change. Not reviewing and updating the document regularly can result in outdated information or undesired choices.

Other Common Durable Power of Attorney State Templates

Free Tennessee Power of Attorney Form - A clear and concise Durable Power of Attorney can alleviate stress in difficult life situations.

Financial Power of Attorney Arizona - Plan ahead by establishing a Durable Power of Attorney to avoid complications later.

In addition to providing essential information for the transaction, obtaining a California Templates can make the process of creating your RV Bill of Sale more efficient, ensuring that you capture all necessary details for a legal transfer of ownership.

Power of Attorney Washington State Requirements - It is advisable to periodically review and update the Durable Power of Attorney as life circumstances change.

Virginia Financial Power of Attorney - Your agent has a duty to act in your best interest, providing an extra layer of reassurance about your financial matters.

Key takeaways

When considering the Texas Durable Power of Attorney form, it's essential to understand its significance and the steps involved in filling it out. Here are some key takeaways:

- Understanding the Purpose: A Durable Power of Attorney allows you to designate someone to make decisions on your behalf if you become incapacitated.

- Choosing an Agent: Select a trustworthy individual as your agent. This person will have significant authority over your financial matters.

- Scope of Authority: Clearly define the powers you are granting. You can limit the authority to specific tasks or grant broad powers.

- Durability: The term "durable" means that the power of attorney remains effective even if you become incapacitated.

- State-Specific Requirements: Ensure that the form meets Texas state requirements, including proper signatures and notarization.

- Revocation: You have the right to revoke the Durable Power of Attorney at any time, as long as you are mentally competent.

- Communication: Discuss your wishes with your agent. Open communication helps ensure your intentions are understood.

- Review Regularly: Life circumstances change. Regularly review and update your Durable Power of Attorney to reflect your current wishes.

- Legal Advice: Consider consulting with an attorney to ensure that the document is correctly executed and meets your needs.

Texas Durable Power of Attorney Example

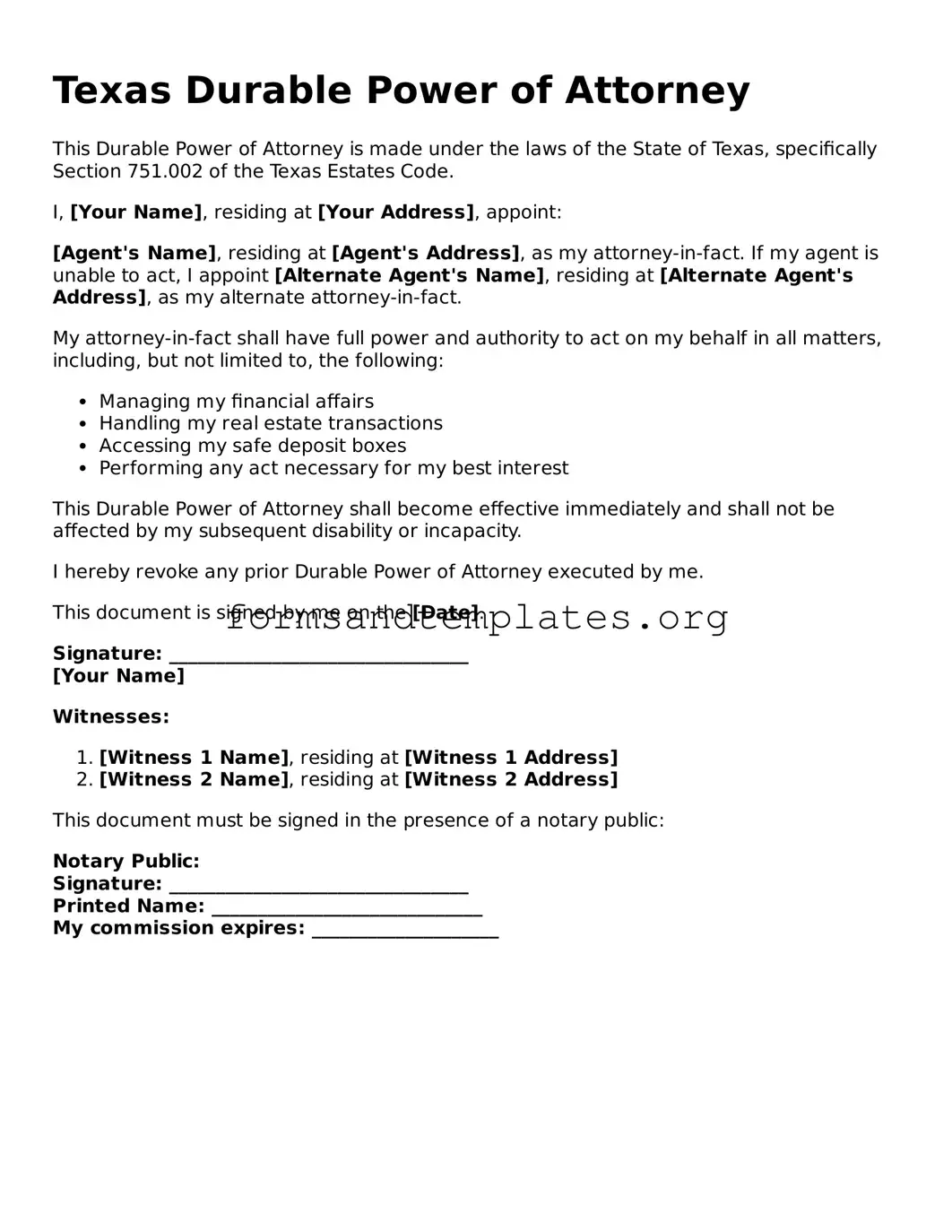

Texas Durable Power of Attorney

This Durable Power of Attorney is made under the laws of the State of Texas, specifically Section 751.002 of the Texas Estates Code.

I, [Your Name], residing at [Your Address], appoint:

[Agent's Name], residing at [Agent's Address], as my attorney-in-fact. If my agent is unable to act, I appoint [Alternate Agent's Name], residing at [Alternate Agent's Address], as my alternate attorney-in-fact.

My attorney-in-fact shall have full power and authority to act on my behalf in all matters, including, but not limited to, the following:

- Managing my financial affairs

- Handling my real estate transactions

- Accessing my safe deposit boxes

- Performing any act necessary for my best interest

This Durable Power of Attorney shall become effective immediately and shall not be affected by my subsequent disability or incapacity.

I hereby revoke any prior Durable Power of Attorney executed by me.

This document is signed by me on the [Date].

Signature: ________________________________

[Your Name]

Witnesses:

- [Witness 1 Name], residing at [Witness 1 Address]

- [Witness 2 Name], residing at [Witness 2 Address]

This document must be signed in the presence of a notary public:

Notary Public:

Signature: ________________________________

Printed Name: _____________________________

My commission expires: ____________________

Understanding Texas Durable Power of Attorney

What is a Durable Power of Attorney in Texas?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. In Texas, this form is particularly useful for managing financial matters, healthcare decisions, and other important affairs when the principal cannot act on their own.

Who can be appointed as an agent in a Durable Power of Attorney?

In Texas, any competent adult can be appointed as an agent. This includes family members, friends, or professionals like attorneys or financial advisors. It is essential to choose someone trustworthy, as the agent will have significant control over the principal's financial and legal matters. The principal should discuss their wishes and expectations with the chosen agent to ensure clarity and understanding.

What powers can be granted to an agent under a Durable Power of Attorney?

The powers granted to an agent can vary based on the principal's preferences. Common powers include:

- Managing bank accounts

- Buying or selling property

- Paying bills and taxes

- Making investment decisions

- Handling legal matters

It is important for the principal to specify which powers are granted in the document, as they can be tailored to meet individual needs.

How does one create a Durable Power of Attorney in Texas?

Creating a Durable Power of Attorney in Texas involves a few straightforward steps:

- Choose a trusted agent.

- Decide on the powers to be granted.

- Obtain a Durable Power of Attorney form, which can be found online or through legal resources.

- Complete the form by filling in the required information.

- Sign the document in the presence of a notary public.

Once completed, the DPOA should be kept in a safe place, and copies should be provided to the agent and any relevant financial institutions or healthcare providers.

Can a Durable Power of Attorney be revoked?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are competent to do so. To revoke the document, the principal should create a written revocation notice, sign it, and notify the agent and any institutions that have a copy of the original DPOA. This ensures that all parties are aware that the agent no longer has authority to act on the principal's behalf.

What happens if the principal becomes incapacitated?

Once the principal becomes incapacitated, the Durable Power of Attorney remains effective, allowing the agent to step in and manage the principal's affairs as outlined in the document. This is one of the key benefits of a DPOA, as it provides continuity in decision-making during a critical time. The agent must act in the best interest of the principal and follow any specific instructions provided in the DPOA.

Is a Durable Power of Attorney the same as a Medical Power of Attorney?

No, a Durable Power of Attorney and a Medical Power of Attorney are not the same. While a DPOA primarily deals with financial and legal matters, a Medical Power of Attorney specifically grants an agent the authority to make healthcare decisions on behalf of the principal if they are unable to do so. It is advisable for individuals to consider creating both documents to ensure comprehensive coverage for their needs.

How to Use Texas Durable Power of Attorney

Filling out a Texas Durable Power of Attorney form is an important process that allows you to designate someone to make decisions on your behalf. The following steps will guide you through the completion of the form, ensuring that your wishes are clearly communicated and legally recognized.

- Obtain the Form: Download the Texas Durable Power of Attorney form from a reliable source or visit a local legal office to acquire a physical copy.

- Read Instructions: Carefully review any accompanying instructions to understand the requirements and implications of the document.

- Fill in Your Information: Enter your full name, address, and contact information in the designated sections of the form.

- Select an Agent: Choose a trusted individual to act as your agent. Provide their full name, address, and contact information.

- Specify Powers: Clearly outline the powers you wish to grant your agent. This may include financial decisions, healthcare choices, or other specific authorizations.

- Sign the Document: Sign and date the form in the presence of a notary public to ensure its validity.

- Distribute Copies: Provide copies of the signed form to your agent and any relevant institutions, such as banks or healthcare providers.

Once you have completed these steps, the form will be ready for use. Ensure that you keep a copy for your records, and communicate with your agent about your preferences and expectations.