Deed in Lieu of Foreclosure Template for the State of Texas

In the state of Texas, homeowners facing financial difficulties and potential foreclosure may find a viable alternative in the Deed in Lieu of Foreclosure form. This legal document allows property owners to voluntarily transfer the title of their home back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By executing this form, homeowners can mitigate the negative impact on their credit score and potentially relieve themselves of the burdensome mortgage debt. The Deed in Lieu of Foreclosure is not simply a one-size-fits-all solution; it requires careful consideration of various factors, including the homeowner's financial situation, the lender's willingness to accept the deed, and the potential tax implications that may arise from the transfer. Additionally, this form often comes with specific requirements and conditions that must be met, making it essential for homeowners to understand the implications fully before proceeding. As such, navigating this process requires a clear grasp of both the benefits and responsibilities associated with the Deed in Lieu of Foreclosure, ensuring that homeowners can make informed decisions during a challenging time.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejection of the deed. Ensure that every section is addressed, including names, property details, and signatures.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create legal issues. Use the exact legal description found on the original deed.

-

Not Notarizing the Document: A deed in lieu of foreclosure must be notarized to be valid. Skipping this step can result in the document being deemed unenforceable.

-

Overlooking Lender Requirements: Different lenders may have specific requirements for accepting a deed in lieu. Always check with the lender to ensure compliance with their guidelines.

-

Failing to Keep Copies: After submitting the deed, it’s crucial to retain copies for your records. This helps in case of future disputes or verification needs.

Other Common Deed in Lieu of Foreclosure State Templates

Foreclosure Vs Deed in Lieu - This process can allow homeowners to move on more quickly from their property burdens.

For those looking to acquire or sell a motorcycle in California, it is essential to utilize the appropriate documentation, such as the California Motorcycle Bill of Sale. This form not only verifies the sale but also ensures a clear transfer of ownership by detailing vital information including the parties involved and the motorcycle's specifics. To create a seamless transaction, you can refer to California Templates for a reliable bill of sale template.

Key takeaways

When dealing with a Texas Deed in Lieu of Foreclosure, it’s essential to understand the key aspects of the process. Here are some important takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Check with your lender about their specific criteria.

- Impact on Credit: This option may still affect your credit score, though it might be less severe than a foreclosure.

- Consult a Professional: It’s wise to talk to a real estate attorney or financial advisor before proceeding.

- Document Preparation: Ensure all necessary documents are completed accurately to avoid delays in the process.

- Negotiate Terms: You can discuss terms with your lender, including potential forgiveness of any remaining debt.

- Property Condition: The property should be in good condition, as lenders may refuse the deed if significant repairs are needed.

- Seek Legal Advice: After signing the deed, consult with a legal expert to understand your rights and responsibilities moving forward.

Being informed and prepared can make a significant difference in navigating this process smoothly.

Texas Deed in Lieu of Foreclosure Example

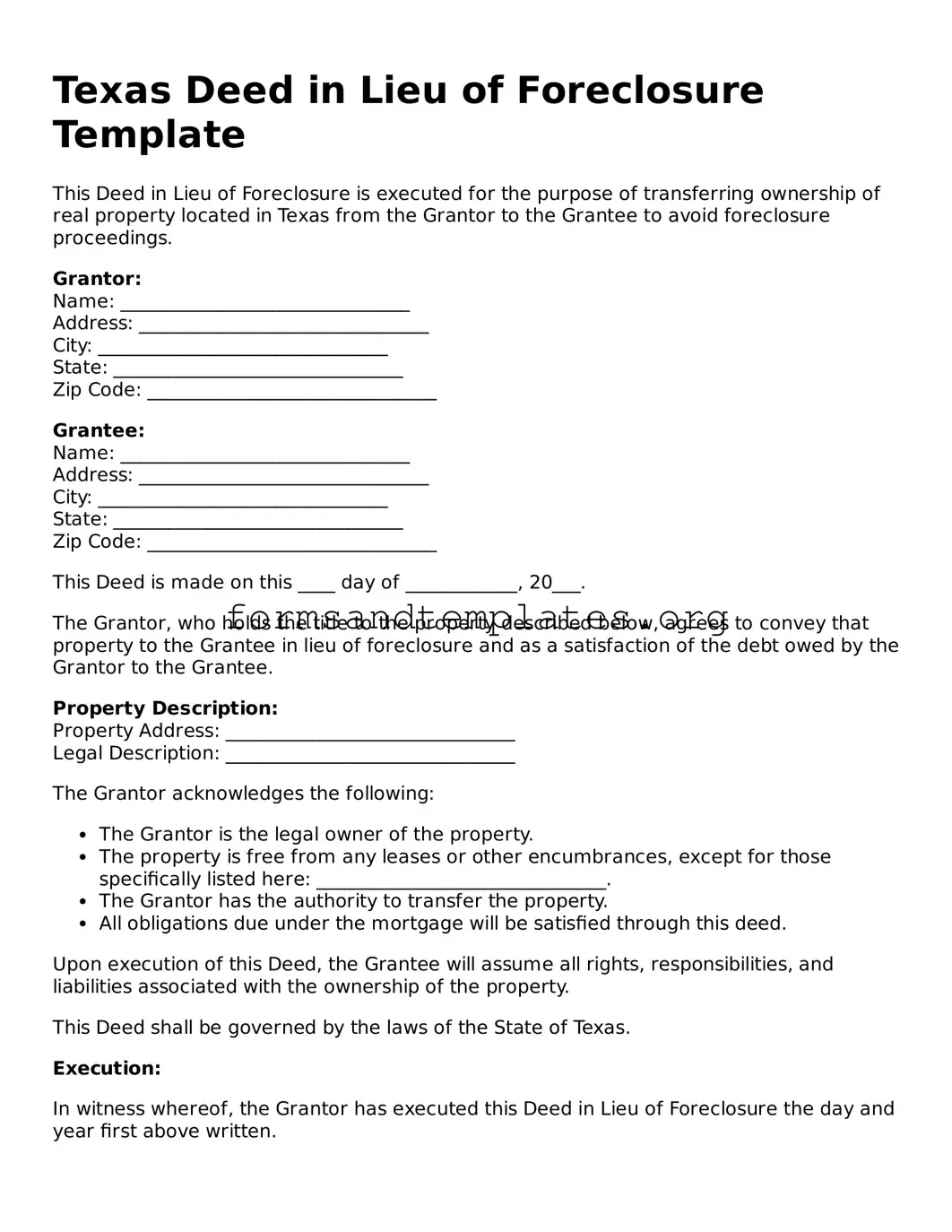

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed for the purpose of transferring ownership of real property located in Texas from the Grantor to the Grantee to avoid foreclosure proceedings.

Grantor:

Name: _______________________________

Address: _______________________________

City: _______________________________

State: _______________________________

Zip Code: _______________________________

Grantee:

Name: _______________________________

Address: _______________________________

City: _______________________________

State: _______________________________

Zip Code: _______________________________

This Deed is made on this ____ day of ____________, 20___.

The Grantor, who holds the title to the property described below, agrees to convey that property to the Grantee in lieu of foreclosure and as a satisfaction of the debt owed by the Grantor to the Grantee.

Property Description:

Property Address: _______________________________

Legal Description: _______________________________

The Grantor acknowledges the following:

- The Grantor is the legal owner of the property.

- The property is free from any leases or other encumbrances, except for those specifically listed here: _______________________________.

- The Grantor has the authority to transfer the property.

- All obligations due under the mortgage will be satisfied through this deed.

Upon execution of this Deed, the Grantee will assume all rights, responsibilities, and liabilities associated with the ownership of the property.

This Deed shall be governed by the laws of the State of Texas.

Execution:

In witness whereof, the Grantor has executed this Deed in Lieu of Foreclosure the day and year first above written.

Grantor Signature: _______________________________

Date: _______________________________

Grantee Signature: _______________________________

Date: _______________________________

Witness Signature: _______________________________

Date: _______________________________

Notary Public:

State of Texas

County: _______________________________

My commission expires: _______________________________

Understanding Texas Deed in Lieu of Foreclosure

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This process allows the borrower to walk away from the mortgage obligation without going through the lengthy and often stressful foreclosure process.

-

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are facing financial hardship and are unable to keep up with their mortgage payments may qualify. Lenders usually look for borrowers who have exhausted other options, such as loan modifications or repayment plans. Each lender may have specific criteria, so it’s essential to check with your lender directly.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- It can be less damaging to your credit score compared to a foreclosure.

- The process is typically faster and less costly than foreclosure.

- Homeowners can avoid the stress and uncertainty of a foreclosure process.

- It may provide a clean slate, allowing homeowners to move forward more quickly.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are some potential drawbacks:

- Homeowners may still be liable for any deficiency balance if the property sells for less than the mortgage amount.

- It may not be an option if there are multiple liens on the property.

- Some lenders may require the homeowner to provide a financial statement or proof of hardship.

-

How does the process work?

The process generally involves several steps:

- Contact your lender to discuss your situation and express your interest in a Deed in Lieu of Foreclosure.

- Submit any required documentation, such as financial statements.

- Once approved, you and the lender will sign the deed, transferring ownership of the property.

- After the deed is recorded, the lender will release you from the mortgage obligation.

-

Will I need an attorney to complete a Deed in Lieu of Foreclosure?

While it’s not strictly necessary to hire an attorney, it can be beneficial. An attorney can help ensure that all paperwork is completed correctly and that your rights are protected throughout the process. If you have concerns or questions, consulting with a legal professional is a wise choice.

-

Can I still live in my home during the process?

Generally, homeowners can continue to live in their home until the Deed in Lieu of Foreclosure is finalized. However, once the deed is signed and recorded, you will need to vacate the property. It’s important to discuss any specific arrangements with your lender.

-

What happens to my credit score?

While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it will still impact your credit score. The extent of the impact depends on various factors, including your overall credit history. Typically, the effect is less severe than a foreclosure, but it’s crucial to understand that it will still be recorded on your credit report.

-

Can I pursue a Deed in Lieu of Foreclosure if I’ve already been served with foreclosure papers?

Yes, it may still be possible to pursue a Deed in Lieu of Foreclosure even if you have received foreclosure papers. However, time is of the essence. It’s important to act quickly and communicate with your lender to explore this option before the foreclosure process moves forward.

-

What should I do if I have more questions?

If you have more questions or need personalized advice, consider reaching out to a housing counselor or a legal professional. They can provide guidance tailored to your specific situation and help you navigate the process smoothly.

How to Use Texas Deed in Lieu of Foreclosure

Once you have obtained the Texas Deed in Lieu of Foreclosure form, it is essential to fill it out accurately to ensure that the transfer of property is legally recognized. Following the completion of the form, the next steps typically involve submitting it to the appropriate parties, which may include the lender and local authorities. Ensure that all required signatures are gathered and that the document is recorded with the county clerk's office.

- Obtain the Texas Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the names of the grantor (the property owner) and the grantee (the lender).

- Provide the property address, including the county and any relevant legal descriptions.

- State the date of the transaction.

- Include a statement indicating that the grantor is conveying the property to the grantee.

- Sign the document in the presence of a notary public.

- Have the notary public complete their section of the form, including their signature and seal.

- Make copies of the signed document for your records.

- Submit the original signed document to the lender and file it with the county clerk’s office.