Deed Template for the State of Texas

The Texas Deed form is an essential document in real estate transactions, providing a clear and legal way to transfer property ownership. This form outlines key details, such as the names of the buyer and seller, a description of the property, and any conditions attached to the transfer. It serves to protect both parties by ensuring that the transaction is recorded properly and that the new owner has a legitimate claim to the property. Additionally, various types of deeds, including warranty deeds and quitclaim deeds, cater to different needs and situations, each offering unique levels of protection and assurance. Understanding the Texas Deed form is crucial for anyone involved in buying or selling real estate in the state, as it lays the groundwork for a smooth transaction and helps avoid potential disputes in the future. Whether you are a first-time homebuyer or a seasoned investor, knowing how to navigate this form can make a significant difference in your real estate dealings.

Common mistakes

-

Incorrect Grantee Information: One common mistake is providing inaccurate details about the grantee. This includes misspellings of names or incorrect addresses. It is crucial to ensure that the grantee's full legal name and current address are clearly stated.

-

Failure to Include a Legal Description: The legal description of the property must be precise. Omitting this information or using vague terms can lead to confusion and potential disputes. Always include the exact lot number, block number, and subdivision name.

-

Not Signing the Deed: A deed must be signed by the grantor. Failing to sign the document renders it invalid. Ensure that all necessary signatures are included and that they are executed in the presence of a notary public.

-

Improper Notarization: Notarization is a critical step in the process. If the notarization is not completed correctly, the deed may not be accepted. Verify that the notary's signature and seal are present and that the notary has followed all required procedures.

-

Incorrect Filing: After completing the deed, it must be filed with the appropriate county clerk's office. Some individuals mistakenly file in the wrong jurisdiction or fail to file altogether. Confirm that the deed is submitted to the correct office for it to be legally effective.

Other Common Deed State Templates

Washington State Deed Forms - Understanding when to use a deed versus another type of agreement is important in real estate dealings.

In addition to its importance, obtaining the Florida Motor Vehicle Bill of Sale form can be done easily through various online resources, including floridaforms.net/blank-motor-vehicle-bill-of-sale-form/, ensuring that you have all necessary information and documentation at hand to facilitate a smooth vehicle transaction.

Discharge of Mortgage Form Nj - It is advisable to consult with a legal professional when preparing a Deed.

Key takeaways

When filling out and using the Texas Deed form, several important considerations come into play. Understanding these key points can facilitate a smoother transaction and ensure compliance with state requirements.

- Identify the Parties: Clearly state the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: Provide a detailed description of the property being transferred. This includes the legal description, which can often be found in the previous deed.

- Consideration Amount: Specify the amount of money or value being exchanged for the property. This is known as "consideration" and must be included in the deed.

- Signatures: Ensure that the deed is signed by the grantor. If there are multiple grantors, all must sign. Notarization is also required for the deed to be valid.

- Witness Requirements: While Texas does not require witnesses for most deeds, having one can add an extra layer of verification.

- Recording the Deed: After completion, the deed should be filed with the county clerk in the county where the property is located. This protects the grantee's rights.

- Tax Considerations: Be aware of potential tax implications related to the transfer of property. Consulting a tax professional may be advisable.

- Title Insurance: Consider obtaining title insurance to protect against any unforeseen claims or issues with the property title.

- Legal Advice: If there are any uncertainties or complex situations, seeking legal advice can help ensure that all aspects of the deed are properly addressed.

By keeping these key takeaways in mind, individuals can navigate the process of filling out and using the Texas Deed form with greater confidence and clarity.

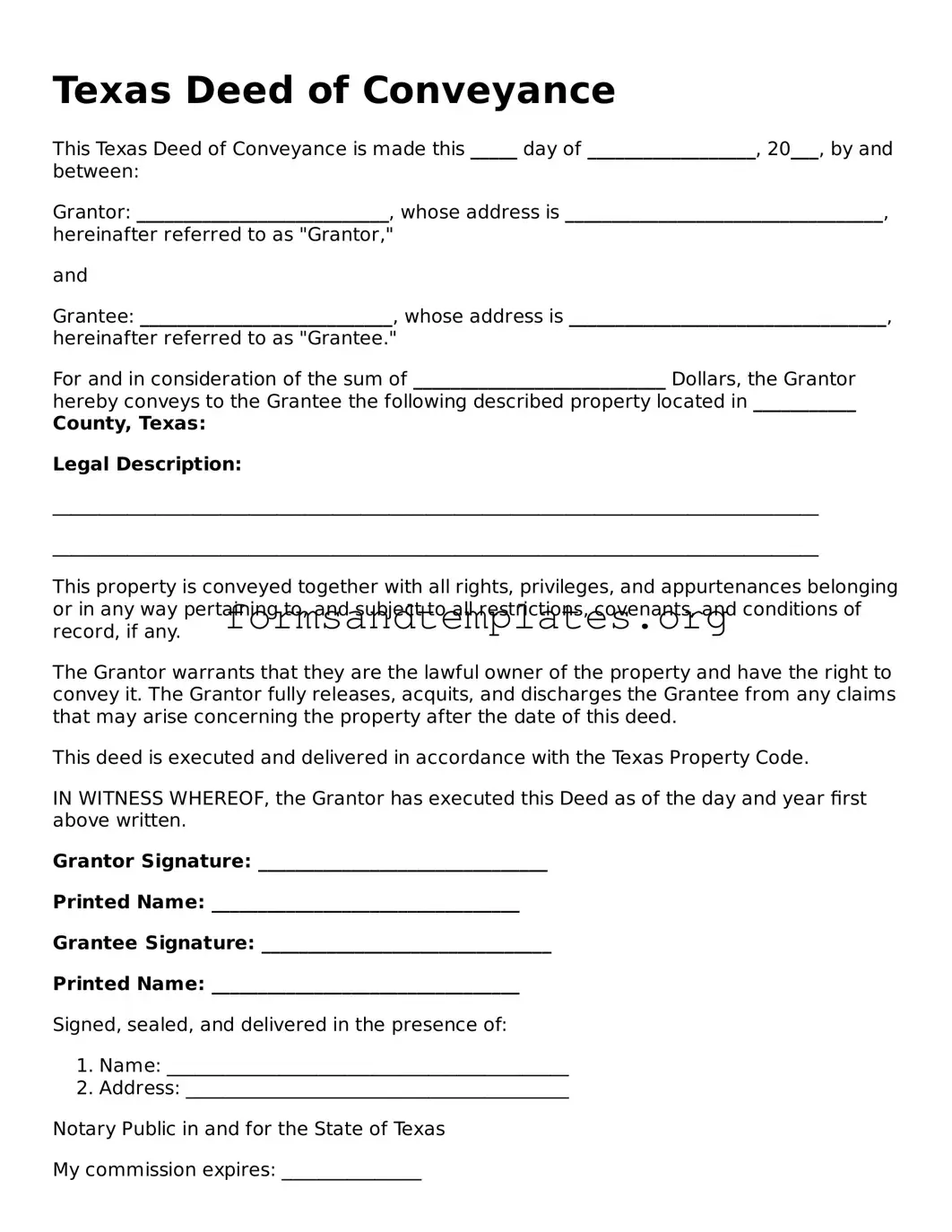

Texas Deed Example

Texas Deed of Conveyance

This Texas Deed of Conveyance is made this _____ day of __________________, 20___, by and between:

Grantor: ___________________________, whose address is __________________________________, hereinafter referred to as "Grantor,"

and

Grantee: ___________________________, whose address is __________________________________, hereinafter referred to as "Grantee."

For and in consideration of the sum of ___________________________ Dollars, the Grantor hereby conveys to the Grantee the following described property located in ___________ County, Texas:

Legal Description:

__________________________________________________________________________________

__________________________________________________________________________________

This property is conveyed together with all rights, privileges, and appurtenances belonging or in any way pertaining to, and subject to all restrictions, covenants, and conditions of record, if any.

The Grantor warrants that they are the lawful owner of the property and have the right to convey it. The Grantor fully releases, acquits, and discharges the Grantee from any claims that may arise concerning the property after the date of this deed.

This deed is executed and delivered in accordance with the Texas Property Code.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the day and year first above written.

Grantor Signature: _______________________________

Printed Name: _________________________________

Grantee Signature: _______________________________

Printed Name: _________________________________

Signed, sealed, and delivered in the presence of:

- Name: ___________________________________________

- Address: _________________________________________

Notary Public in and for the State of Texas

My commission expires: _______________

Understanding Texas Deed

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real property in the state of Texas. This form outlines the details of the property being transferred, the parties involved, and any conditions or warranties associated with the transfer. It serves as a public record of the transaction and is essential for establishing legal ownership.

What types of deeds are available in Texas?

In Texas, there are several types of deeds, each serving different purposes. The most common include:

- General Warranty Deed: Offers the highest level of protection to the buyer, guaranteeing that the seller has clear title to the property.

- Special Warranty Deed: Similar to a general warranty deed but only guarantees the title against defects that occurred during the seller's ownership.

- Quitclaim Deed: Transfers any interest the seller may have in the property without making any guarantees about the title.

- Deed of Trust: Used in financing arrangements, allowing a lender to hold a security interest in the property.

How do I fill out a Texas Deed form?

Filling out a Texas Deed form requires careful attention to detail. Here are the key steps to follow:

- Identify the parties involved: Include the full names and addresses of both the grantor (seller) and grantee (buyer).

- Describe the property: Provide a legal description of the property, which can usually be found on the current deed or in the property records.

- State the consideration: Mention the amount paid for the property, which can be a specific dollar amount or "for love and affection."

- Include any warranties: If applicable, specify any warranties or covenants that are part of the transfer.

Do I need a notary to sign the Texas Deed form?

Yes, a Texas Deed form must be signed in the presence of a notary public. The notary will verify the identities of the signers and witness the signing of the document. This step is crucial as it helps prevent fraud and ensures that the deed is legally binding.

Where do I file the Texas Deed form?

The completed Texas Deed form should be filed with the county clerk's office in the county where the property is located. This filing makes the deed a public record, allowing others to see the transfer of ownership. There may be a filing fee, so it’s wise to check with the local office for specific requirements.

How long does it take for a Texas Deed to be recorded?

Once you submit the Texas Deed form to the county clerk’s office, it is typically recorded within a few days. However, processing times can vary based on the office's workload. It’s a good idea to follow up if you do not receive confirmation of the recording within a reasonable time frame.

What happens if I don’t record the Texas Deed?

Failing to record the Texas Deed can lead to several issues. Without recording, the deed is not considered public notice of the transfer, which may affect the buyer’s ability to assert ownership against third parties. Additionally, it could create complications in future transactions involving the property. Recording is an important step in protecting your ownership rights.

Can I change or revoke a Texas Deed form after it is signed?

Once a Texas Deed form is signed and recorded, it cannot be simply changed or revoked. If you need to alter the terms or transfer ownership again, a new deed must be prepared and executed. In some cases, a quitclaim deed may be used to relinquish interest in the property, but it does not negate the original deed.

What should I do if I lose my Texas Deed?

If you lose your Texas Deed, don't panic. You can obtain a copy from the county clerk's office where the deed was recorded. There may be a small fee for the copy, but it is essential to keep a record of your property ownership. If you believe the loss may lead to fraudulent activity, consider consulting with a legal professional for further guidance.

How to Use Texas Deed

After gathering all necessary information, you can begin filling out the Texas Deed form. It's important to ensure that all details are accurate to avoid any issues later. Follow these steps carefully to complete the form correctly.

- Start by entering the date at the top of the form. This is the date when the deed will be executed.

- Provide the name of the grantor (the person transferring the property). Include their full legal name.

- Next, enter the name of the grantee (the person receiving the property). Again, use their full legal name.

- Fill in the property description. This should include the address and any legal description necessary to identify the property clearly.

- Indicate the type of ownership being transferred. This may include details like joint tenancy or tenancy in common.

- Include any consideration or payment details, if applicable. This is the amount being exchanged for the property.

- Have the grantor sign the form. Their signature must be dated and notarized to make it valid.

- Finally, check all information for accuracy before submitting the form. Ensure that all required fields are filled out completely.

Once the form is filled out and signed, you can proceed with the next steps, which may include filing the deed with the appropriate county office. Be sure to keep a copy for your records.