Bill of Sale Template for the State of Texas

The Texas Bill of Sale form serves as a crucial document in various transactions, particularly in the sale and transfer of personal property, including vehicles, boats, and other tangible assets. This form provides a written record that captures essential details about the transaction, such as the names and addresses of the buyer and seller, a description of the item being sold, and the sale price. Additionally, it may include information about the condition of the item and any warranties or guarantees associated with the sale. By documenting these key elements, the Bill of Sale not only helps protect the interests of both parties but also serves as proof of ownership transfer, which can be vital for future legal or financial matters. In Texas, while the Bill of Sale is not always legally required, it is highly recommended to ensure clarity and transparency in personal property transactions. Understanding the nuances of this form can facilitate smoother exchanges and provide peace of mind for both buyers and sellers.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to issues. Ensure that names, addresses, and contact information for both the buyer and seller are fully completed.

-

Incorrect Vehicle Identification Number (VIN): Entering the wrong VIN can create confusion. Double-check the VIN against the vehicle’s title and registration documents.

-

Omitting Sale Price: Not including the sale price can lead to disputes later. Clearly state the agreed amount to avoid misunderstandings.

-

Not Notarizing the Document: In some cases, notarization is required for the Bill of Sale to be valid. Ensure you understand the requirements specific to your transaction.

-

Incorrect Date: Failing to include the correct date of sale can complicate matters. Always verify that the date reflects when the transaction occurred.

-

Neglecting to Sign: Both parties must sign the document for it to be legally binding. Missing signatures can invalidate the Bill of Sale.

-

Using an Outdated Form: Utilizing an old version of the Bill of Sale can lead to legal issues. Always use the most current form available.

-

Failure to Keep Copies: Not retaining copies for both parties can create problems in the future. Each party should have a signed copy for their records.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for a Bill of Sale. Familiarize yourself with Texas regulations to ensure compliance.

Other Common Bill of Sale State Templates

Does a Bill of Sale Have to Be Notarized in Arizona - A Bill of Sale can be used in auctions or liquidation sales.

Tn Bill of Sale - A Bill of Sale can also specify any payment plans agreed upon between parties.

The Aaa International Driving Permit Application form is a document that allows U.S. citizens to drive legally in many countries around the world. This permit is recognized internationally and serves as a translation of a driver's existing license. For those interested in obtaining their permit, resources like Fast PDF Templates can be invaluable, enhancing your travel experience and providing peace of mind when on the road abroad.

Washington Bill of Sale - This document serves as a receipt for the seller and buyer during a transaction.

Key takeaways

When filling out and using the Texas Bill of Sale form, it is important to understand its purpose and the necessary details to include. Below are key takeaways to guide you through the process.

- Purpose of the Bill of Sale: This document serves as a legal record of the transfer of ownership for personal property, such as vehicles, boats, or equipment.

- Accurate Information: Ensure that all information provided is accurate. This includes the names and addresses of both the seller and the buyer, as well as a detailed description of the item being sold.

- Item Description: Clearly describe the item, including its make, model, year, and any identifying numbers, such as a Vehicle Identification Number (VIN) for cars.

- Purchase Price: The Bill of Sale should clearly state the purchase price of the item. This is important for both parties and may also be required for tax purposes.

- Signatures: Both the seller and the buyer must sign the document. Their signatures validate the transfer of ownership and indicate agreement to the terms outlined in the Bill of Sale.

- Notarization: While notarization is not required for all transactions, it is recommended for added legal protection. A notary public can verify the identities of the parties involved.

- Keep Copies: After the Bill of Sale is completed and signed, both parties should keep a copy for their records. This serves as proof of the transaction in case of future disputes.

Texas Bill of Sale Example

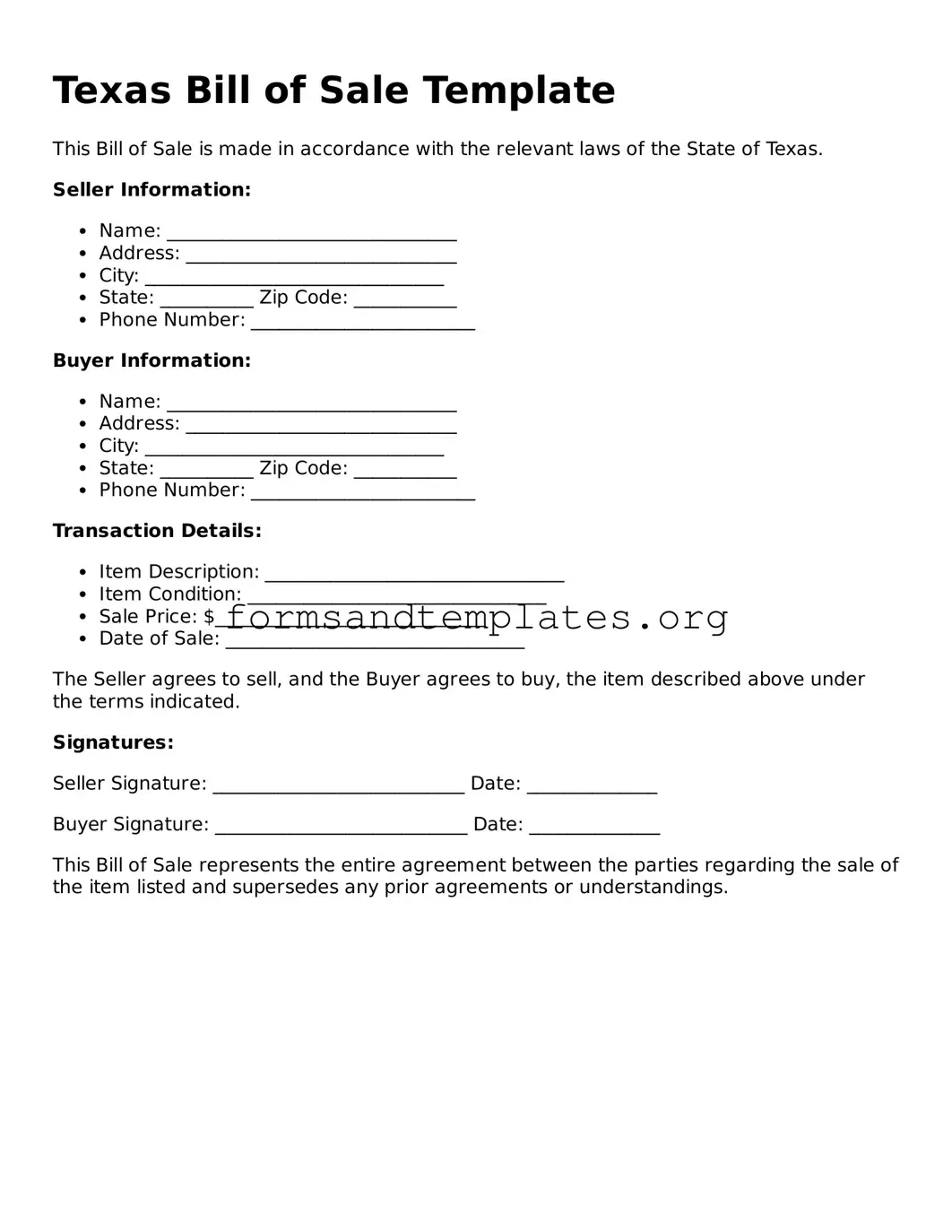

Texas Bill of Sale Template

This Bill of Sale is made in accordance with the relevant laws of the State of Texas.

Seller Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: __________ Zip Code: ___________

- Phone Number: ________________________

Buyer Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: __________ Zip Code: ___________

- Phone Number: ________________________

Transaction Details:

- Item Description: ________________________________

- Item Condition: ________________________________

- Sale Price: $_____________________________

- Date of Sale: ________________________________

The Seller agrees to sell, and the Buyer agrees to buy, the item described above under the terms indicated.

Signatures:

Seller Signature: ___________________________ Date: ______________

Buyer Signature: ___________________________ Date: ______________

This Bill of Sale represents the entire agreement between the parties regarding the sale of the item listed and supersedes any prior agreements or understandings.

Understanding Texas Bill of Sale

What is a Texas Bill of Sale form?

A Texas Bill of Sale form is a legal document that records the sale of personal property between a buyer and a seller in Texas. This form provides proof of the transaction and outlines the details of the sale, including the items sold, the sale price, and the date of the transaction. It can be used for various items, such as vehicles, boats, or personal goods.

Why do I need a Bill of Sale in Texas?

A Bill of Sale serves several important purposes:

- It provides legal proof that a sale took place.

- It helps protect both the buyer and seller by documenting the terms of the sale.

- It can be used to transfer ownership and register items, such as vehicles, with the state.

- It can assist in resolving disputes by serving as evidence of the agreement.

What information should be included in a Texas Bill of Sale?

A comprehensive Texas Bill of Sale should include the following information:

- The names and addresses of both the buyer and seller.

- A description of the item being sold, including any identifying details like VIN for vehicles.

- The sale price.

- The date of the transaction.

- Any warranties or guarantees, if applicable.

Is a Bill of Sale required for all transactions in Texas?

No, a Bill of Sale is not required for every transaction in Texas. However, it is highly recommended for significant sales, such as vehicles or high-value items. For smaller transactions, while it may not be legally required, having a Bill of Sale can still provide protection for both parties involved.

Do I need to have the Bill of Sale notarized?

In Texas, notarization is not required for a Bill of Sale to be valid. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise later. It can also be required by certain agencies when registering vehicles or other items.

Where can I obtain a Texas Bill of Sale form?

You can obtain a Texas Bill of Sale form from various sources, including:

- Online legal form websites that offer customizable templates.

- Local office supply stores that sell legal forms.

- Legal professionals who can create a tailored document for your needs.

How to Use Texas Bill of Sale

Once you have the Texas Bill of Sale form in hand, you will need to complete it accurately to ensure the transaction is legally recognized. Follow these steps to fill out the form correctly.

- Begin by entering the date of the transaction at the top of the form.

- Provide the full name and address of the seller. This should include street address, city, state, and zip code.

- Next, enter the full name and address of the buyer, using the same format as the seller's information.

- Clearly describe the item being sold. Include details such as make, model, year, and any identifying numbers (like a VIN for vehicles).

- Indicate the sale price of the item in the designated area.

- If applicable, specify any warranties or guarantees related to the item being sold.

- Both the seller and buyer should sign the form. Ensure that the signatures are dated.

- Make copies of the completed Bill of Sale for both parties' records.

After completing the form, it is advisable to keep a copy for your records. This document serves as proof of the transaction and may be needed for future reference, such as registering the item or for tax purposes.