Articles of Incorporation Template for the State of Texas

The Texas Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form serves as the foundation for creating a legal entity that can operate independently of its owners. Key aspects of the form include the corporation's name, which must be unique and comply with state regulations, as well as the purpose of the corporation, which outlines its intended business activities. Additionally, the form requires information about the registered agent, who is responsible for receiving legal documents on behalf of the corporation. It also includes details about the initial directors and the number of shares the corporation is authorized to issue. By completing and filing this form with the Texas Secretary of State, individuals can officially register their corporation and gain the legal protections and benefits associated with this business structure.

Common mistakes

-

Incorrect Name of the Corporation: Many individuals fail to ensure that the proposed name of the corporation is unique and not already in use by another entity. It is crucial to check the Texas Secretary of State's database for name availability.

-

Failure to Include Required Information: Some people overlook essential details such as the corporation's purpose or the names and addresses of the initial directors. Omitting this information can lead to delays in processing.

-

Inaccurate Registered Agent Information: The registered agent's name and address must be accurate. If the information is incorrect, it can result in legal complications for the corporation.

-

Not Specifying the Duration: Corporations must indicate whether they are intended to exist perpetually or for a specified period. Failing to provide this information can lead to confusion about the corporation's longevity.

-

Improper Signatures: The Articles of Incorporation must be signed by the incorporators. Some individuals neglect to sign or have unauthorized individuals sign, which invalidates the document.

-

Ignoring Filing Fees: Each submission requires a specific filing fee. People sometimes forget to include payment or miscalculate the amount due, resulting in rejection of the application.

-

Not Keeping Copies: After submission, it is vital to keep copies of the filed Articles of Incorporation for personal records. Some individuals fail to do this, which can complicate future legal matters.

Other Common Articles of Incorporation State Templates

Document Retrieval Center - Speeds up the process of establishing corporate credit.

Incorporating in Tennessee - Creates a formal identity that may be beneficial in legal matters.

How Much Does It Cost to Open Up an Llc - The Articles may outline the process for adding or removing directors.

To streamline the rental process and minimize misunderstandings, utilizing the California Residential Lease Agreement is essential for both landlords and tenants. This form not only delineates the specific terms and conditions of the rental arrangement but also reinforces the legal standing of each party involved. For those ready to take the next step, you can access the necessary documentation through California Templates.

Virginia Llc Filing Fee - The Articles also require disclosure of the nature of initial corporate activities.

Key takeaways

When filling out and using the Texas Articles of Incorporation form, it is essential to keep several key points in mind. Understanding these elements can streamline the incorporation process and ensure compliance with state requirements.

- Choose the Right Name: The name of your corporation must be unique and distinguishable from other registered entities in Texas. Conduct a name search to avoid potential conflicts.

- Designate a Registered Agent: A registered agent is required to receive legal documents on behalf of the corporation. This agent must have a physical address in Texas and be available during business hours.

- Specify the Purpose: Clearly state the purpose of your corporation. This can be a general business purpose or a more specific description of the activities your corporation will engage in.

- Include Incorporator Information: The form must list the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation and establishing the corporation.

- File with the Secretary of State: After completing the form, submit it to the Texas Secretary of State along with the required filing fee. Ensure you keep a copy for your records.

By paying attention to these key aspects, you can facilitate a smoother incorporation process in Texas.

Texas Articles of Incorporation Example

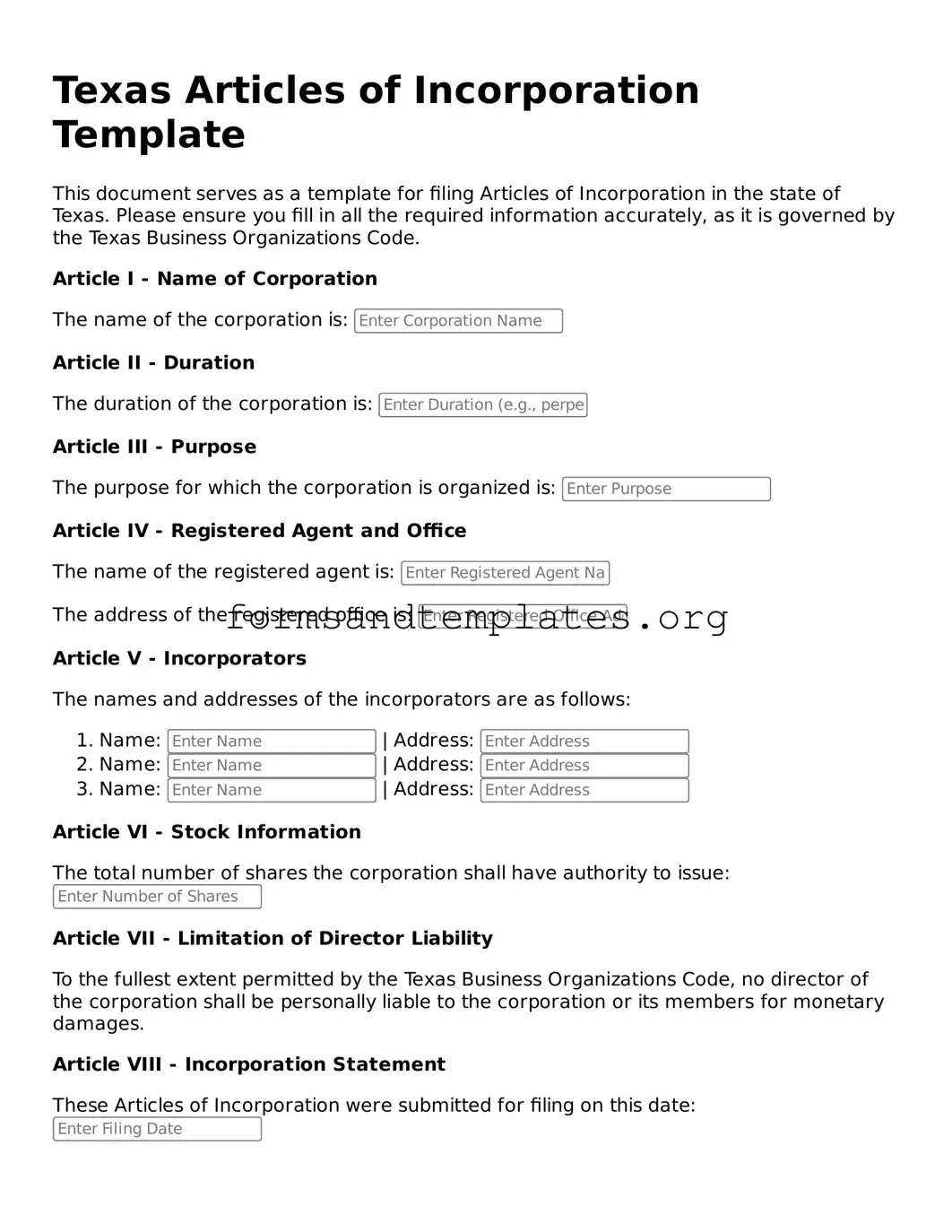

Texas Articles of Incorporation Template

This document serves as a template for filing Articles of Incorporation in the state of Texas. Please ensure you fill in all the required information accurately, as it is governed by the Texas Business Organizations Code.

Article I - Name of Corporation

The name of the corporation is:

Article II - Duration

The duration of the corporation is:

Article III - Purpose

The purpose for which the corporation is organized is:

Article IV - Registered Agent and Office

The name of the registered agent is:

The address of the registered office is:

Article V - Incorporators

The names and addresses of the incorporators are as follows:

- Name: | Address:

- Name: | Address:

- Name: | Address:

Article VI - Stock Information

The total number of shares the corporation shall have authority to issue:

Article VII - Limitation of Director Liability

To the fullest extent permitted by the Texas Business Organizations Code, no director of the corporation shall be personally liable to the corporation or its members for monetary damages.

Article VIII - Incorporation Statement

These Articles of Incorporation were submitted for filing on this date:

In witness whereof, the undersigned incorporators have executed these Articles of Incorporation on the date indicated above.

Signature:

Name:

Title:

Understanding Texas Articles of Incorporation

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document that establishes a corporation in the state of Texas. By filing this form with the Secretary of State, individuals can create a separate legal entity that can conduct business, enter contracts, and own property. The form requires specific information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue.

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in Texas must file the Articles of Incorporation. This includes individuals and groups who want to create a business entity that provides limited liability protection to its owners. Nonprofit organizations also need to file this form to establish their legal status. It is important to ensure that the corporation complies with state laws and regulations from the very beginning.

What information is required on the form?

When completing the Texas Articles of Incorporation form, several key pieces of information are necessary:

- Name of the Corporation: The name must be unique and not similar to any existing business in Texas.

- Purpose: A brief description of the corporation's intended business activities.

- Registered Agent: The individual or business designated to receive legal documents on behalf of the corporation.

- Incorporators: Names and addresses of the individuals who are forming the corporation.

- Shares: The total number of shares the corporation is authorized to issue.

Providing accurate information is crucial, as any errors may delay the approval process.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. Here are the steps to follow:

- Complete the Articles of Incorporation form with the required information.

- If filing online, visit the Texas Secretary of State's website and use their online filing system.

- If filing by mail, print the completed form and send it to the Secretary of State along with the required filing fee.

- Keep a copy of the filed document for your records.

After submission, the Secretary of State will review the form. If everything is in order, they will issue a Certificate of Formation, officially recognizing the corporation.

How to Use Texas Articles of Incorporation

Once you have the Texas Articles of Incorporation form ready, you will need to complete it accurately to ensure your business is legally recognized. Following these steps will help you fill out the form correctly.

- Obtain the Texas Articles of Incorporation form from the Texas Secretary of State's website or your local office.

- Begin by entering the name of your corporation. Ensure the name complies with Texas naming requirements.

- Provide the duration of the corporation. If it is to exist perpetually, indicate "perpetual." Otherwise, specify the duration.

- Fill in the purpose of the corporation. Be clear and concise about what your business will do.

- List the address of the corporation's initial registered office. This must be a physical address in Texas.

- Enter the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Include the number of shares the corporation is authorized to issue. Specify the classes of shares, if applicable.

- Provide the names and addresses of the initial directors. Include at least one director, but you may list more.

- Sign and date the form. The incorporator must sign, indicating their agreement to the information provided.

- Prepare the filing fee, which can vary. Check the Texas Secretary of State's website for the current fee amount.

- Submit the completed form along with the filing fee to the Texas Secretary of State, either by mail or in person.