Transfer-on-Death Deed Template for the State of Tennessee

The Tennessee Transfer-on-Death Deed form is a valuable tool for property owners who wish to pass on their real estate without going through the lengthy probate process. This legal document allows individuals to designate one or more beneficiaries who will automatically receive the property upon the owner's death. By using this deed, property owners can maintain control of their assets during their lifetime while ensuring a smooth transition to their chosen heirs. It’s important to note that the deed must be properly executed and recorded with the county register of deeds to be valid. Additionally, the transfer occurs outside of probate, which can save time and money for the beneficiaries. Understanding the nuances of this form can help property owners make informed decisions about their estate planning and ensure their wishes are honored after their passing.

Common mistakes

-

Incorrect Property Description: Failing to provide a clear and accurate description of the property can lead to complications. Ensure the legal description matches what is on the deed.

-

Not Naming Beneficiaries: Omitting or incorrectly naming beneficiaries is a common error. Make sure to include full names and any necessary identifying information.

-

Signature Issues: The deed must be signed by the property owner. Neglecting to sign or having the wrong person sign can invalidate the document.

-

Failure to Notarize: A Transfer-on-Death Deed needs to be notarized to be valid. Skipping this step can cause legal problems later.

-

Not Recording the Deed: After completing the form, it must be recorded with the local county register. Failing to do so means the deed may not be enforceable.

-

Ignoring State Laws: Each state has specific rules regarding Transfer-on-Death Deeds. Not being aware of Tennessee's requirements can lead to mistakes.

Other Common Transfer-on-Death Deed State Templates

Transfer on Death Deed Virginia - Offers practicality in estate planning through direct property transfers.

In addition to the essential details outlined in the California Lease Agreement, it is advisable for both landlords and tenants to review resources such as California Templates to ensure they fully understand their rights and responsibilities within the rental arrangement.

Transfer on Death Deed Texas Form Free - Through this deed, owners can ensure their properties align with their final wishes without complicated legal structures.

Free Printable Beneficiary Deed Form Arizona - Property owners can designate alternate beneficiaries in case the primary beneficiary predeceases them, adding a layer of security.

New Jersey Transfer on Death Deed - Real estate is the only type of property that can be transferred using this deed, simplifying the process.

Key takeaways

The Tennessee Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death.

This deed must be completed and filed with the county register of deeds to be effective. Simply creating the deed is not sufficient.

Both the property owner and the beneficiaries must be clearly identified on the form to avoid any confusion or disputes later.

It is important to ensure that the deed complies with all state requirements, including the correct legal description of the property.

Beneficiaries do not have any rights to the property until the death of the owner, which means the owner can still sell or mortgage the property during their lifetime.

Filing the deed does not incur any tax implications for the owner during their lifetime.

To revoke the deed, the owner must file a revocation form with the county register of deeds.

Consulting with a legal professional can help clarify any questions regarding the deed's implications and requirements.

It is advisable to keep a copy of the filed deed in a safe place and inform beneficiaries of its existence.

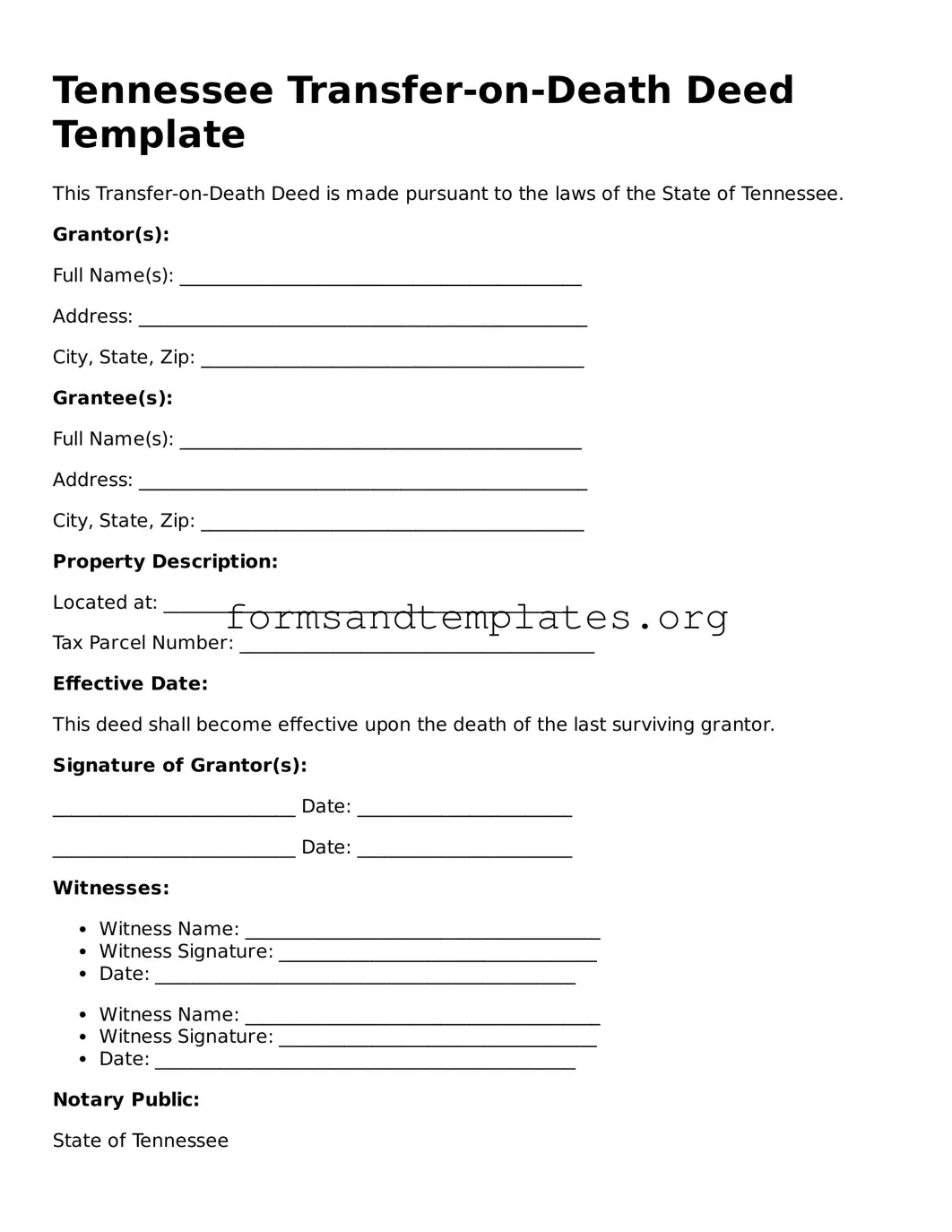

Tennessee Transfer-on-Death Deed Example

Tennessee Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to the laws of the State of Tennessee.

Grantor(s):

Full Name(s): ___________________________________________

Address: ________________________________________________

City, State, Zip: _________________________________________

Grantee(s):

Full Name(s): ___________________________________________

Address: ________________________________________________

City, State, Zip: _________________________________________

Property Description:

Located at: ____________________________________________

Tax Parcel Number: ______________________________________

Effective Date:

This deed shall become effective upon the death of the last surviving grantor.

Signature of Grantor(s):

__________________________ Date: _______________________

__________________________ Date: _______________________

Witnesses:

- Witness Name: ______________________________________

- Witness Signature: __________________________________

- Date: _____________________________________________

- Witness Name: ______________________________________

- Witness Signature: __________________________________

- Date: _____________________________________________

Notary Public:

State of Tennessee

County of ___________________________________

This instrument was acknowledged before me on the ____ day of ____________, 20__.

______________________________

Notary Public Signature

My Commission Expires: ________________________

Note: This document should be filed with the appropriate county register of deeds.

Understanding Tennessee Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Tennessee?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Tennessee to transfer real estate to designated beneficiaries upon the owner's death. This deed avoids the probate process, making the transfer smoother and often quicker for the heirs. It is a straightforward way to ensure that your property goes directly to your chosen beneficiaries without the complications that can arise from probate proceedings.

How do I create a Transfer-on-Death Deed?

Creating a TOD Deed involves several key steps:

- Identify the property you wish to transfer.

- Choose your beneficiaries carefully. You can name one or multiple individuals.

- Complete the Transfer-on-Death Deed form. Ensure that all required information is accurately filled out.

- Sign the deed in the presence of a notary public.

- Record the deed with the local county register of deeds. This step is crucial, as the transfer only takes effect upon your death if the deed is properly recorded.

Can I revoke a Transfer-on-Death Deed?

Yes, you can revoke a TOD Deed at any time while you are still alive. To do this, you must create a new document explicitly stating the revocation of the previous deed. Additionally, it is advisable to record the revocation with the same county register of deeds where the original TOD Deed was filed. This ensures clarity and prevents any confusion for your beneficiaries in the future.

Are there any limitations to using a Transfer-on-Death Deed?

While a TOD Deed offers many benefits, there are some limitations to be aware of:

- The deed can only be used for real property, such as land or buildings, and not for personal property or financial accounts.

- Beneficiaries cannot access the property until the owner passes away.

- If the property is subject to a mortgage, the mortgage obligations will still need to be addressed by the beneficiaries after the owner's death.

What happens if I do not have a Transfer-on-Death Deed?

If you do not have a TOD Deed in place, your property will likely go through the probate process after your death. This can be time-consuming and costly for your heirs. The court will determine how the property is distributed according to your will, if you have one, or by state intestacy laws if you do not. To avoid these complications, consider establishing a TOD Deed to facilitate a direct transfer of your property to your beneficiaries.

How to Use Tennessee Transfer-on-Death Deed

After obtaining the Tennessee Transfer-on-Death Deed form, you will need to fill it out carefully. Make sure to have all necessary information at hand. This deed allows you to designate a beneficiary for your property, which will transfer to them upon your death.

- Begin by entering the name of the current property owner at the top of the form.

- Provide the address of the property you wish to transfer.

- Include the legal description of the property. This information can typically be found on your property tax statement or deed.

- List the name of the beneficiary who will receive the property after your passing.

- Include the beneficiary's address to ensure proper identification.

- Sign the form in the designated area. Your signature must be notarized to make the deed valid.

- Have the form notarized by a licensed notary public.

- File the completed and notarized form with the county register of deeds where the property is located.