Tractor Bill of Sale Template for the State of Tennessee

The Tennessee Tractor Bill of Sale form is an essential document for anyone involved in the buying or selling of tractors in the state. This form serves as a legal record of the transaction, providing details such as the buyer's and seller's names and addresses, the tractor's make, model, year, and vehicle identification number (VIN). It also outlines the purchase price and any terms of sale, ensuring both parties are clear about the agreement. By using this form, sellers can protect themselves from future claims regarding ownership, while buyers gain peace of mind knowing they have proof of their purchase. Additionally, the form can help facilitate the transfer of title, making it easier to register the tractor with the state. Understanding the importance of this document can streamline the sale process and safeguard the interests of both buyers and sellers.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. It’s crucial to include the full names and addresses of both the buyer and the seller. Missing this information can lead to disputes later.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurate. A simple typo can render the document invalid, complicating the registration process for the buyer.

-

Omitting Sale Price: Some people forget to list the sale price. This figure is essential for tax purposes and can affect the buyer's ability to register the tractor.

-

Not Signing the Document: Both parties must sign the form. A missing signature can invalidate the sale, leaving both parties in a precarious position.

-

Failing to Date the Form: The date of the transaction is critical. Without it, there could be confusion about when the sale took place, which may impact ownership rights.

-

Neglecting to Keep Copies: After completing the form, it’s vital to make copies for both the buyer and seller. This ensures that both parties have proof of the transaction should any issues arise later.

Other Common Tractor Bill of Sale State Templates

Farm Equipment Bill of Sale - Ideal for individual owners and businesses alike.

Bill of Sale Tractor - It can serve as a guide for what information is needed during the sale.

For those navigating the eviction process, it is essential to utilize the proper documentation. The California Notice to Quit form serves as a critical tool for landlords, helping to clearly communicate the need for tenants to vacate. To simplify this process, you can find useful resources at California Templates, ensuring that all necessary legal requirements are met efficiently.

Tractor Bill of Sale - The effect of a bill of sale primarily rests in its ability to clearly show ownership transfer.

Farm Equipment Bill of Sale - A Tractor Bill of Sale documents the transfer of ownership for a tractor between a seller and a buyer.

Key takeaways

When completing and utilizing the Tennessee Tractor Bill of Sale form, several important considerations come into play. Below are key takeaways to ensure proper use of the document.

- The form serves as a legal record of the transaction between the buyer and seller.

- Accurate details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), must be included.

- Both parties should provide their full names and addresses to establish clear identities.

- The sale price should be clearly stated to avoid future disputes regarding the transaction amount.

- Both the buyer and seller should sign and date the form to validate the agreement.

- It is advisable to keep a copy of the signed bill of sale for personal records.

- Consider having the document notarized to add an extra layer of verification.

- This bill of sale may be required for registration purposes with the Tennessee Department of Revenue.

Tennessee Tractor Bill of Sale Example

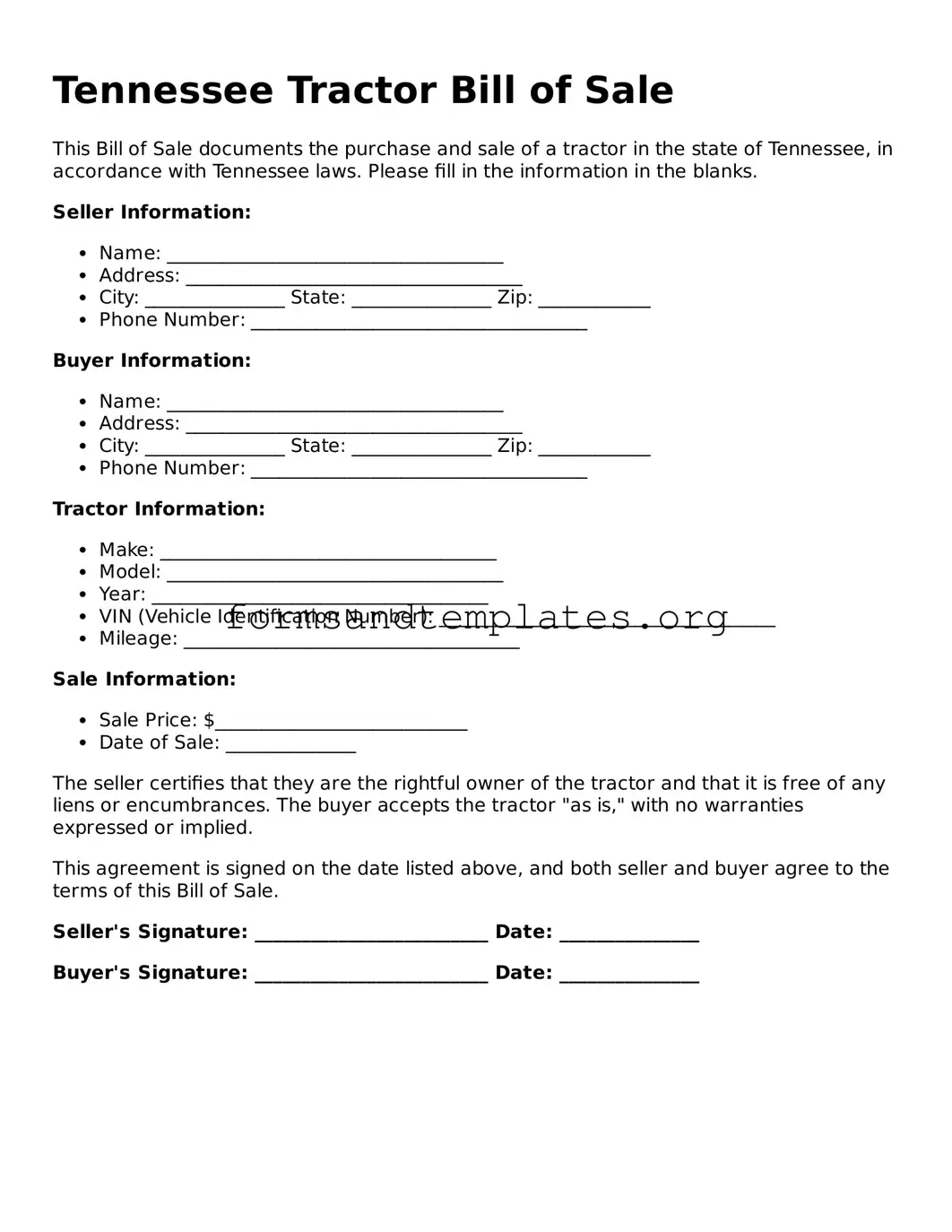

Tennessee Tractor Bill of Sale

This Bill of Sale documents the purchase and sale of a tractor in the state of Tennessee, in accordance with Tennessee laws. Please fill in the information in the blanks.

Seller Information:

- Name: ____________________________________

- Address: ____________________________________

- City: _______________ State: _______________ Zip: ____________

- Phone Number: ____________________________________

Buyer Information:

- Name: ____________________________________

- Address: ____________________________________

- City: _______________ State: _______________ Zip: ____________

- Phone Number: ____________________________________

Tractor Information:

- Make: ____________________________________

- Model: ____________________________________

- Year: ____________________________________

- VIN (Vehicle Identification Number): ____________________________________

- Mileage: ____________________________________

Sale Information:

- Sale Price: $___________________________

- Date of Sale: ______________

The seller certifies that they are the rightful owner of the tractor and that it is free of any liens or encumbrances. The buyer accepts the tractor "as is," with no warranties expressed or implied.

This agreement is signed on the date listed above, and both seller and buyer agree to the terms of this Bill of Sale.

Seller's Signature: _________________________ Date: _______________

Buyer's Signature: _________________________ Date: _______________

Understanding Tennessee Tractor Bill of Sale

What is a Tractor Bill of Sale in Tennessee?

A Tractor Bill of Sale is a legal document that records the transfer of ownership of a tractor from one party to another in Tennessee. This document serves as proof of the transaction and includes essential details about the buyer, seller, and the tractor itself.

Why is a Bill of Sale necessary?

The Bill of Sale is crucial for several reasons:

- It provides legal protection for both the buyer and seller.

- It serves as evidence of the sale in case of disputes.

- It helps in the registration process with the state.

- It can be required for insurance purposes.

What information is required on the Bill of Sale?

The following information should be included in a Tennessee Tractor Bill of Sale:

- Names and addresses of the buyer and seller.

- Description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- Sale price of the tractor.

- Date of the sale.

- Signatures of both parties.

Is the Bill of Sale required to be notarized?

While notarization is not a strict requirement in Tennessee, it is highly recommended. Having the document notarized adds an extra layer of legitimacy and can help prevent disputes in the future.

Can I use a generic Bill of Sale form?

Yes, you can use a generic Bill of Sale form, but it is advisable to use a form specifically designed for tractors in Tennessee. This ensures that all necessary information is captured and complies with state laws.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer should also take the document to their local Department of Motor Vehicles (DMV) to register the tractor in their name.

Are there any fees associated with the Bill of Sale?

There are no fees specifically associated with the Bill of Sale itself. However, the buyer may incur fees when registering the tractor at the DMV, including title transfer fees and sales tax based on the purchase price.

What if the tractor has a lien on it?

If the tractor has an outstanding lien, the seller must disclose this information to the buyer. The lien must be settled before the sale can be completed, as the buyer will not want to assume any financial obligations tied to the tractor.

Can I sell a tractor that I bought with a Bill of Sale?

Yes, you can sell a tractor that you purchased with a Bill of Sale. Ensure that you have the original Bill of Sale and any other relevant documents to provide to the new buyer. This helps establish a clear chain of ownership.

Where can I obtain a Tennessee Tractor Bill of Sale form?

You can obtain a Tennessee Tractor Bill of Sale form from various sources, including:

- Online legal document providers.

- Local DMV offices.

- Legal stationery stores.

Ensure that the form you choose meets all state requirements to avoid any complications during the sale process.

How to Use Tennessee Tractor Bill of Sale

After gathering the necessary information, you will need to fill out the Tennessee Tractor Bill of Sale form. This document serves as a record of the transaction between the buyer and seller. Make sure to have all details ready to ensure a smooth process.

- Obtain the form: Download the Tennessee Tractor Bill of Sale form from a reliable source or visit your local DMV office to get a physical copy.

- Fill in the seller's information: Enter the seller's full name, address, and contact information in the designated fields.

- Fill in the buyer's information: Provide the buyer's full name, address, and contact information as required.

- Describe the tractor: Include details such as the make, model, year, Vehicle Identification Number (VIN), and any other relevant specifications.

- State the sale price: Clearly write the amount for which the tractor is being sold. Be sure to specify the currency.

- Indicate the date of sale: Write the exact date when the transaction takes place.

- Sign the form: Both the buyer and seller must sign the document to validate the sale.

- Keep copies: Make copies of the completed Bill of Sale for both the buyer and seller for their records.