Real Estate Purchase Agreement Template for the State of Tennessee

The Tennessee Real Estate Purchase Agreement form serves as a vital tool in the home buying process, providing a structured framework for both buyers and sellers to outline the terms of their transaction. This document typically includes essential details such as the purchase price, property description, and closing date, ensuring that both parties have a clear understanding of their commitments. Additionally, the agreement addresses contingencies, such as financing and inspections, which protect the interests of the buyer while also setting expectations for the seller. By incorporating provisions for earnest money deposits and potential remedies for breach of contract, the form helps facilitate a smoother transaction process. Understanding each component of the Tennessee Real Estate Purchase Agreement is crucial for anyone involved in a real estate deal, as it not only establishes the legal foundation for the sale but also promotes transparency and trust between the parties involved.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers should ensure that names, addresses, and property descriptions are fully and accurately filled out. Missing information can lead to confusion and delays in the transaction.

-

Neglecting Contingencies: Another frequent error involves overlooking important contingencies. Buyers often forget to include conditions such as financing or inspections. Without these contingencies, buyers may find themselves in a difficult position if issues arise.

-

Incorrect Dates: Entering wrong dates can create significant problems. Parties should double-check that all deadlines, including the closing date and any contingency periods, are correctly noted. Incorrect dates may result in missed opportunities or legal complications.

-

Not Seeking Professional Guidance: Many individuals attempt to fill out the form without consulting a real estate agent or attorney. This can lead to misunderstandings or legal issues down the line. Seeking professional advice can help ensure that the agreement is completed correctly and protects the interests of all parties involved.

Other Common Real Estate Purchase Agreement State Templates

Agreement for Sale Arizona - Addresses any environmental assessments required for the property.

Real Estate Contract Template - Can specify any existing liens or encumbrances on the property.

Creating a Last Will and Testament is a vital step in planning for the future, and for those in California, utilizing resources like California Templates can simplify the process and ensure that all legal requirements are met, providing peace of mind that your wishes will be honored.

Nj Real Estate Contract - A legally binding agreement between the buyer and seller to transfer ownership of real estate.

Realestate Purchase Agreement - Incorporates local jurisdiction requirements as necessary.

Key takeaways

When filling out and using the Tennessee Real Estate Purchase Agreement form, consider the following key points:

- Ensure all parties involved are clearly identified, including full legal names and contact information.

- Specify the property address and legal description accurately to avoid any ambiguity.

- Include the purchase price and any earnest money deposit details to outline the financial aspects clearly.

- Set a timeline for closing and any contingencies that may apply, such as financing or inspections.

- Review all terms and conditions thoroughly, including any disclosures required by Tennessee law.

- Make sure all signatures are obtained from all parties to validate the agreement.

- Keep a copy of the signed agreement for your records, as it serves as a legal document in the transaction.

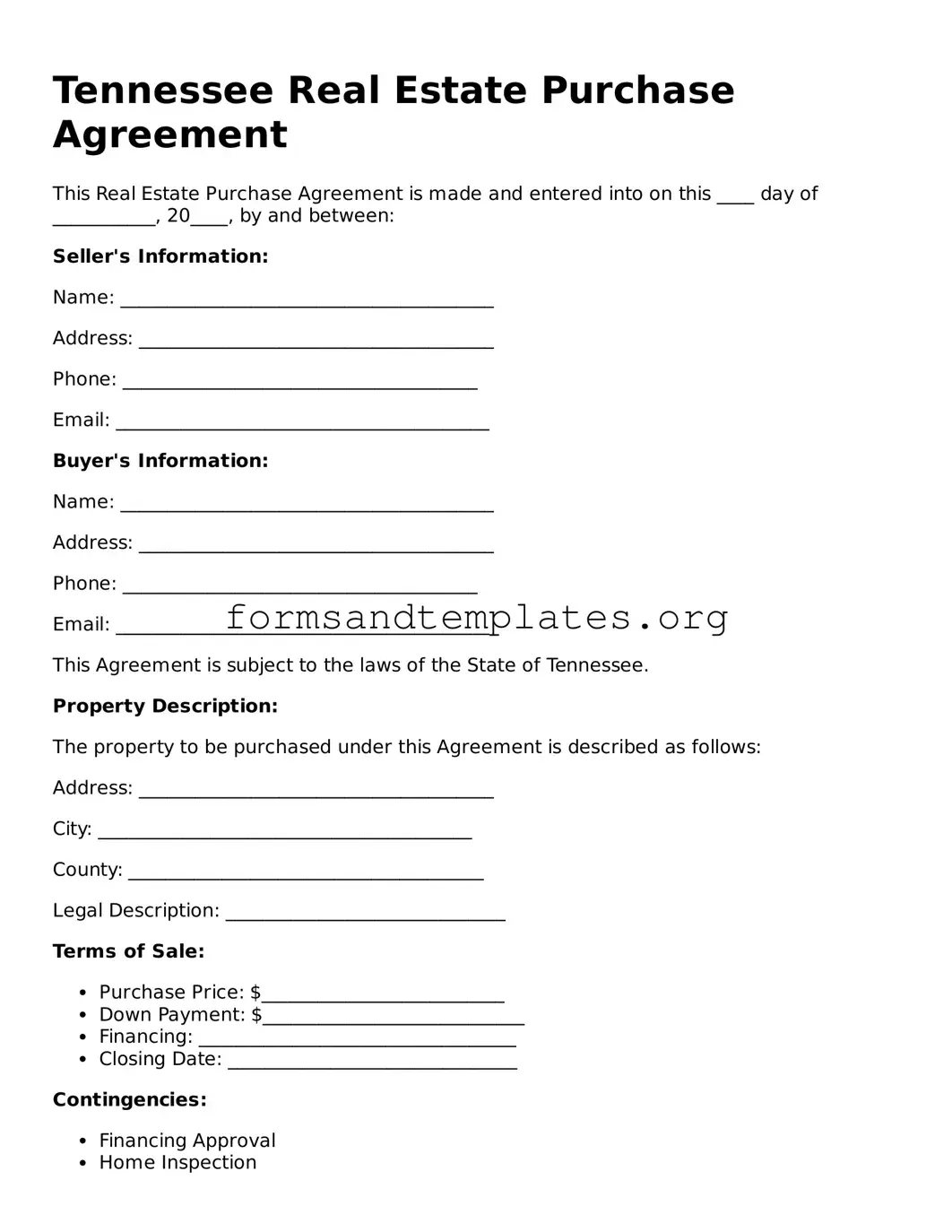

Tennessee Real Estate Purchase Agreement Example

Tennessee Real Estate Purchase Agreement

This Real Estate Purchase Agreement is made and entered into on this ____ day of ___________, 20____, by and between:

Seller's Information:

Name: ________________________________________

Address: ______________________________________

Phone: ______________________________________

Email: ________________________________________

Buyer's Information:

Name: ________________________________________

Address: ______________________________________

Phone: ______________________________________

Email: ________________________________________

This Agreement is subject to the laws of the State of Tennessee.

Property Description:

The property to be purchased under this Agreement is described as follows:

Address: ______________________________________

City: ________________________________________

County: ______________________________________

Legal Description: ______________________________

Terms of Sale:

- Purchase Price: $__________________________

- Down Payment: $____________________________

- Financing: __________________________________

- Closing Date: _______________________________

Contingencies:

- Financing Approval

- Home Inspection

- Appraisal

Additional Provisions:

_____________________________________________________________

_____________________________________________________________

Disclosures:

The Seller agrees to provide all necessary disclosures as required by Tennessee law.

Signatures:

By signing below, the parties agree to the terms and conditions of this Real Estate Purchase Agreement.

Seller's Signature: ____________________________ Date: ____________

Buyer's Signature: ____________________________ Date: ____________

Witness:

Name: ________________________________________

Signature: ____________________________________ Date: ____________

Understanding Tennessee Real Estate Purchase Agreement

What is the Tennessee Real Estate Purchase Agreement form?

The Tennessee Real Estate Purchase Agreement is a legal document used in real estate transactions within the state of Tennessee. This form outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. It typically includes details such as the purchase price, financing arrangements, contingencies, and the closing date. The agreement serves to protect the interests of both parties and provides a clear framework for the transaction.

What key elements should be included in the agreement?

Several important elements should be included in the Tennessee Real Estate Purchase Agreement:

- Property Description: A detailed description of the property being sold, including its address and legal description.

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing approval or home inspections.

- Closing Date: The date on which the transaction will be finalized, and ownership will be transferred.

- Earnest Money: A deposit made by the buyer to demonstrate serious intent to purchase the property.

How is the agreement executed?

The execution of the Tennessee Real Estate Purchase Agreement involves several steps. First, both the buyer and the seller review the terms of the agreement. Once both parties agree to the terms, they sign the document. It is advisable for each party to retain a copy of the signed agreement for their records. Additionally, if any changes are made after the initial signing, both parties must agree to and sign those changes as well.

What happens if one party does not fulfill their obligations?

If either the buyer or the seller fails to fulfill their obligations as outlined in the agreement, it may result in a breach of contract. The non-breaching party may have several options, including:

- Negotiation: Attempting to resolve the issue through discussion and compromise.

- Legal Action: Pursuing a lawsuit for damages or specific performance, which is a legal request to compel the other party to fulfill their contractual obligations.

- Termination: Cancelling the agreement if the breach is significant and cannot be resolved.

Can the agreement be modified after it is signed?

Yes, the Tennessee Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller. This ensures that all parties are aware of the changes and that the agreement remains legally binding. It is advisable to consult with a real estate professional or attorney when making modifications to ensure compliance with state laws.

How to Use Tennessee Real Estate Purchase Agreement

Once you have the Tennessee Real Estate Purchase Agreement form in hand, it’s time to fill it out. This form is essential for formalizing the agreement between the buyer and seller in a real estate transaction. Follow these steps carefully to ensure all necessary information is included.

- Start with the date: Write the date at the top of the form.

- Identify the parties: Fill in the names of the buyer(s) and seller(s). Include their addresses and contact information.

- Property description: Provide a detailed description of the property being sold. Include the address and any relevant legal descriptions.

- Purchase price: Clearly state the total purchase price for the property.

- Earnest money: Specify the amount of earnest money the buyer will provide, along with the method of payment.

- Financing details: Indicate how the buyer plans to finance the purchase, whether through a loan or cash.

- Closing date: Set a proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approval.

- Signatures: Ensure that both the buyer and seller sign and date the agreement at the bottom of the form.

After completing the form, review it carefully for accuracy. Both parties should keep a signed copy for their records. This agreement will guide the next steps in the transaction process.