Promissory Note Template for the State of Tennessee

The Tennessee Promissory Note is an essential financial document that serves as a written promise to repay a specified amount of money under agreed-upon terms. This form typically outlines key details such as the principal amount borrowed, the interest rate, and the repayment schedule, which can vary from monthly to annually. Borrowers and lenders alike benefit from its clear structure, which helps to prevent misunderstandings and disputes. The document may also include provisions for late fees, default consequences, and any collateral that secures the loan. By establishing the rights and responsibilities of both parties, the Tennessee Promissory Note fosters transparency and trust in financial transactions. Understanding this form is crucial for anyone involved in lending or borrowing money in Tennessee, as it lays the groundwork for a legally binding agreement that can protect both parties' interests.

Common mistakes

-

Failing to include the correct names of the parties involved. Each party's full legal name should be clearly stated to avoid confusion.

-

Omitting the date of the agreement. The date is crucial as it marks the beginning of the obligation.

-

Not specifying the loan amount. The exact dollar amount must be clearly indicated to prevent disputes later.

-

Neglecting to outline the interest rate. If applicable, the interest rate should be detailed to ensure transparency.

-

Leaving out the payment schedule. Clearly defining when payments are due helps both parties understand their obligations.

-

Failing to include a late payment penalty. This can serve as a deterrent against late payments and encourages timely repayment.

-

Not providing a clause for default. This is essential to outline the consequences if the borrower fails to meet their obligations.

-

Using vague language. Clarity is key; ambiguous terms can lead to misunderstandings.

-

Neglecting to sign the document. Both parties must sign to make the agreement legally binding.

-

Not keeping a copy of the signed note. Each party should retain a copy for their records to reference if necessary.

Other Common Promissory Note State Templates

Promissory Note Template Arizona - This form can serve as a foundation for mutual trust in lending agreements.

The proper management of rental agreements is crucial for a successful landlord-tenant relationship, and having a comprehensive Florida Lease Agreement is part of that process. This essential document can be easily accessed online, and for those looking to streamline their leasing process, you can visit https://floridaforms.net/blank-lease-agreement-form for a blank lease agreement form that covers all necessary terms and conditions, helping to protect the interests of both parties involved.

Free Promissory Note Template Texas - A direct way to turn a personal loan into a structured financial agreement.

Washington Promissory Note - It serves as a reminder of the debt owed and the terms that govern its repayment.

Create Promissory Note - Promissory notes often outline payment schedules, such as monthly or quarterly installments.

Key takeaways

When dealing with the Tennessee Promissory Note form, it is crucial to understand its components and implications. Here are key takeaways to keep in mind:

- Clarity is essential: Ensure that all terms are clearly defined to avoid misunderstandings.

- Identify the parties: Clearly state the names and addresses of both the borrower and lender.

- Specify the loan amount: Indicate the exact amount being borrowed to avoid disputes later.

- Include interest rates: If applicable, specify the interest rate and how it will be calculated.

- Outline repayment terms: Detail when payments are due and the method of payment.

- Consider default terms: Clearly outline what constitutes a default and the consequences that follow.

- Signatures are mandatory: Both parties must sign the document for it to be legally binding.

- Keep records: Maintain a copy of the signed note for your records and future reference.

Understanding these elements can significantly impact the enforceability of the note and the relationship between the parties involved.

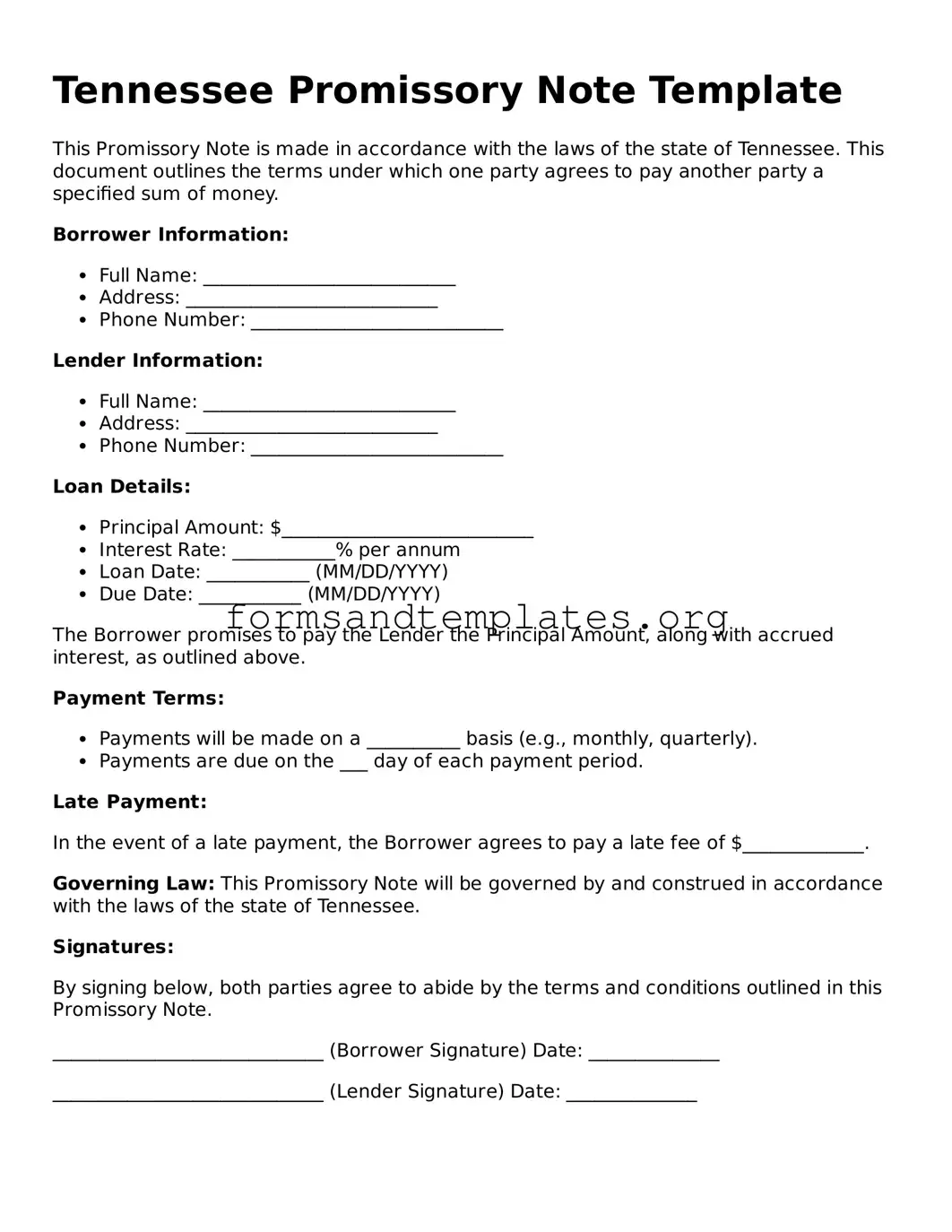

Tennessee Promissory Note Example

Tennessee Promissory Note Template

This Promissory Note is made in accordance with the laws of the state of Tennessee. This document outlines the terms under which one party agrees to pay another party a specified sum of money.

Borrower Information:

- Full Name: ___________________________

- Address: ___________________________

- Phone Number: ___________________________

Lender Information:

- Full Name: ___________________________

- Address: ___________________________

- Phone Number: ___________________________

Loan Details:

- Principal Amount: $___________________________

- Interest Rate: ___________% per annum

- Loan Date: ___________ (MM/DD/YYYY)

- Due Date: ___________ (MM/DD/YYYY)

The Borrower promises to pay the Lender the Principal Amount, along with accrued interest, as outlined above.

Payment Terms:

- Payments will be made on a __________ basis (e.g., monthly, quarterly).

- Payments are due on the ___ day of each payment period.

Late Payment:

In the event of a late payment, the Borrower agrees to pay a late fee of $_____________.

Governing Law: This Promissory Note will be governed by and construed in accordance with the laws of the state of Tennessee.

Signatures:

By signing below, both parties agree to abide by the terms and conditions outlined in this Promissory Note.

_____________________________ (Borrower Signature) Date: ______________

_____________________________ (Lender Signature) Date: ______________

Understanding Tennessee Promissory Note

What is a Tennessee Promissory Note?

A Tennessee Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This document serves as a record of the loan agreement and includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. It is essential for both parties to have a clear understanding of their obligations.

What are the key components of a Tennessee Promissory Note?

A well-drafted Tennessee Promissory Note should include the following key components:

- Borrower and Lender Information: Names and contact information of both parties.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage of interest that will be charged on the loan.

- Repayment Terms: A detailed schedule outlining when payments are due and how much will be paid at each interval.

- Late Fees: Any fees that may apply if payments are not made on time.

- Signatures: Both parties must sign the document to make it legally binding.

Is a Tennessee Promissory Note legally binding?

Yes, a properly executed Tennessee Promissory Note is legally binding. This means that both the borrower and the lender are obligated to adhere to the terms outlined in the document. If either party fails to meet their obligations, the other party has the right to take legal action to enforce the agreement. It's important to ensure that all terms are clear and agreed upon to avoid disputes in the future.

Can I modify a Tennessee Promissory Note after it has been signed?

Yes, modifications can be made to a Tennessee Promissory Note after it has been signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and the lender to maintain clarity and enforceability. This could involve changing the repayment schedule, interest rate, or any other terms. Always keep a copy of the modified document for your records.

How to Use Tennessee Promissory Note

Filling out the Tennessee Promissory Note form is a straightforward process. It’s important to ensure that all information is accurate and complete to avoid any potential issues later. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the month, day, and year format.

- Next, write the name of the borrower. This is the person or entity receiving the loan.

- Then, enter the address of the borrower. Include the street address, city, state, and zip code.

- Now, fill in the name of the lender. This is the person or entity providing the loan.

- Provide the lender's address in the same format as the borrower's address.

- Specify the principal amount of the loan. This is the total amount borrowed.

- Indicate the interest rate. This should be the annual percentage rate (APR).

- Next, state the repayment terms. This includes how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Finally, both the borrower and lender should sign and date the form at the bottom.

Once the form is filled out, make sure to keep copies for both parties. It’s a good idea to review the completed document together to ensure all details are correct before signing.