Durable Power of Attorney Template for the State of Tennessee

The Tennessee Durable Power of Attorney form serves as a crucial legal document that empowers individuals to designate a trusted person to make financial and legal decisions on their behalf in the event they become incapacitated. This form is particularly significant because it remains effective even if the principal loses the ability to make decisions due to illness or disability. By completing this form, individuals can ensure that their financial affairs are managed according to their wishes, providing peace of mind for both themselves and their loved ones. The document outlines specific powers granted to the agent, which may include handling banking transactions, managing real estate, and making investment decisions. Furthermore, it is essential for the principal to select an agent who is trustworthy and capable of fulfilling these responsibilities. The form can be tailored to meet individual needs, allowing for broad or limited powers, depending on the preferences of the principal. Understanding the implications and requirements of this form is vital for anyone considering establishing a durable power of attorney in Tennessee.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the powers granted to the agent. It's crucial to specify whether the agent can handle financial matters, healthcare decisions, or both. Ambiguity can lead to confusion and potential disputes.

-

Choosing the Wrong Agent: Selecting an agent who lacks the necessary knowledge or trustworthiness can lead to issues. It’s important to choose someone who understands your wishes and can act in your best interest.

-

Not Signing or Dating the Document: A Durable Power of Attorney must be signed and dated to be valid. Forgetting this step can render the document ineffective, leaving your wishes unfulfilled.

-

Failing to Inform the Agent: After appointing an agent, it’s essential to inform them of their responsibilities. Without proper communication, the agent may be unaware of their role and your specific wishes.

-

Neglecting to Review Regularly: Life circumstances change, and so do your needs. Regularly reviewing and updating your Durable Power of Attorney ensures it reflects your current wishes and circumstances.

Other Common Durable Power of Attorney State Templates

Virginia Financial Power of Attorney - It’s wise to review your Durable Power of Attorney periodically to ensure it still aligns with your current situation and desires.

For individuals seeking to navigate legal obligations, understanding the significance of a crucial Hold Harmless Agreement can provide invaluable protection against unforeseen liabilities during events or activities. This form serves to clarify the responsibility between parties, ensuring mutual agreement on risk tolerances.

Power of Attorney Washington State Requirements - You can appoint multiple agents or alternate agents to ensure there is always someone available to act.

Key takeaways

Filling out and using a Durable Power of Attorney (DPOA) form in Tennessee is an important step in planning for the future. Here are some key takeaways to keep in mind:

- The DPOA allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so.

- It’s crucial to choose an agent who is responsible and understands your wishes. This person will have significant authority over your financial and legal matters.

- In Tennessee, the DPOA must be signed by you (the principal) and notarized. This adds a layer of legitimacy to the document.

- Make sure to clearly outline the powers you are granting to your agent. You can specify what they can and cannot do.

- The DPOA remains effective even if you become incapacitated, which is why it’s termed “durable.”

- Review the document periodically. Life changes, such as a new relationship or changes in health, may necessitate updates to your DPOA.

- Provide copies of the DPOA to your agent, financial institutions, and healthcare providers to ensure they are aware of your wishes.

- Keep the original document in a safe place but ensure that your agent knows where to find it when needed.

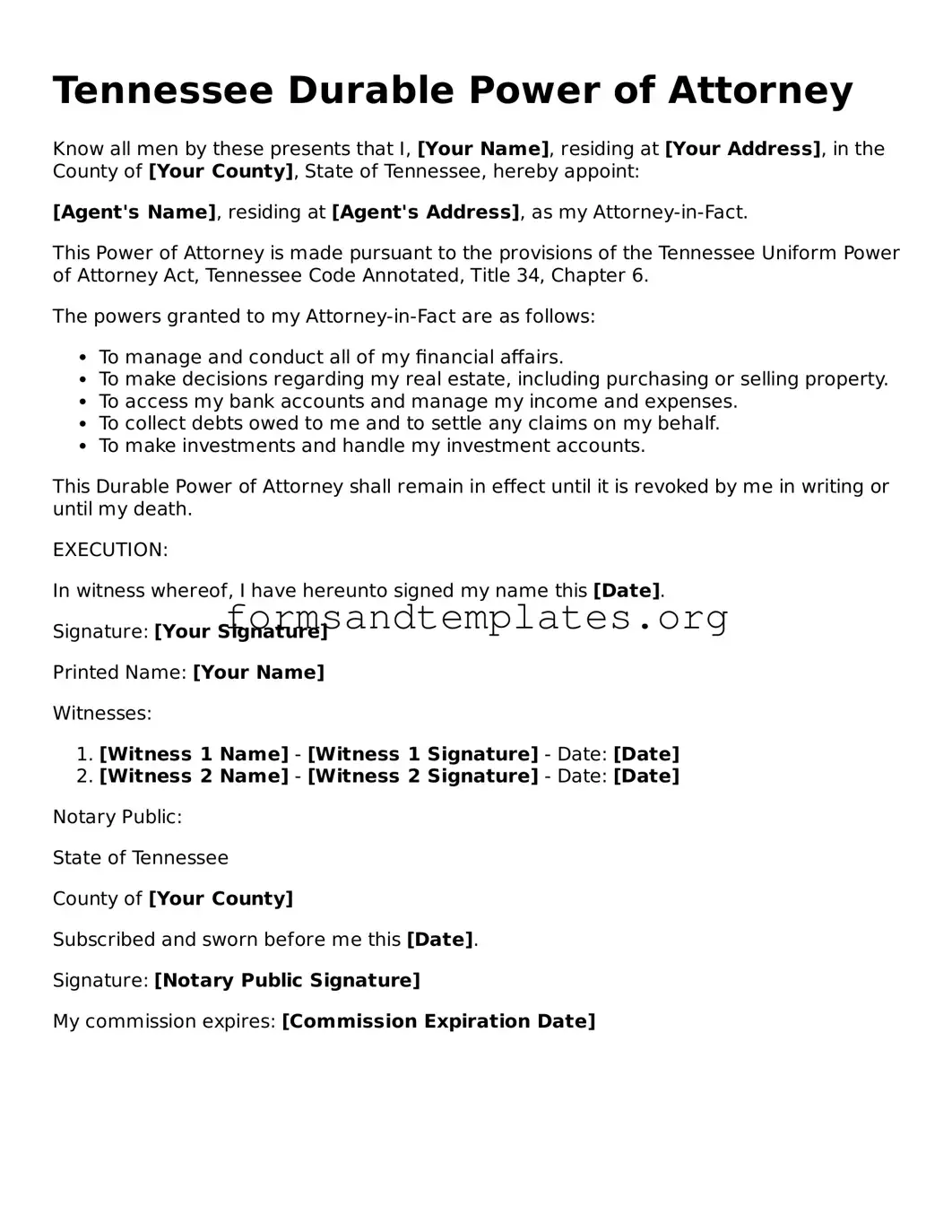

Tennessee Durable Power of Attorney Example

Tennessee Durable Power of Attorney

Know all men by these presents that I, [Your Name], residing at [Your Address], in the County of [Your County], State of Tennessee, hereby appoint:

[Agent's Name], residing at [Agent's Address], as my Attorney-in-Fact.

This Power of Attorney is made pursuant to the provisions of the Tennessee Uniform Power of Attorney Act, Tennessee Code Annotated, Title 34, Chapter 6.

The powers granted to my Attorney-in-Fact are as follows:

- To manage and conduct all of my financial affairs.

- To make decisions regarding my real estate, including purchasing or selling property.

- To access my bank accounts and manage my income and expenses.

- To collect debts owed to me and to settle any claims on my behalf.

- To make investments and handle my investment accounts.

This Durable Power of Attorney shall remain in effect until it is revoked by me in writing or until my death.

EXECUTION:

In witness whereof, I have hereunto signed my name this [Date].

Signature: [Your Signature]

Printed Name: [Your Name]

Witnesses:

- [Witness 1 Name] - [Witness 1 Signature] - Date: [Date]

- [Witness 2 Name] - [Witness 2 Signature] - Date: [Date]

Notary Public:

State of Tennessee

County of [Your County]

Subscribed and sworn before me this [Date].

Signature: [Notary Public Signature]

My commission expires: [Commission Expiration Date]

Understanding Tennessee Durable Power of Attorney

What is a Durable Power of Attorney in Tennessee?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become incapacitated. Unlike a regular Power of Attorney, a DPOA remains effective even if you are unable to make decisions for yourself.

Who can be appointed as an agent under a DPOA?

You can choose any competent adult to serve as your agent. This can be a family member, friend, or even a professional, such as an attorney. It’s important to select someone you trust, as they will have significant control over your affairs.

What powers can I grant to my agent?

You can grant a wide range of powers to your agent, including:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Handling investments

- Making tax decisions

However, you can limit the powers if you wish. Just be clear about what your agent can and cannot do.

How do I create a Durable Power of Attorney in Tennessee?

To create a DPOA in Tennessee, follow these steps:

- Choose your agent carefully.

- Complete the DPOA form, ensuring it meets state requirements.

- Sign the document in front of a notary public.

Make sure to keep copies for yourself and provide one to your agent.

Do I need a lawyer to create a Durable Power of Attorney?

No, you do not need a lawyer to create a DPOA in Tennessee. However, consulting with a legal professional can help ensure that the document meets your needs and complies with state laws.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your DPOA at any time, as long as you are mentally competent. To do this, you should create a revocation document and notify your agent and any institutions that may have a copy of the original DPOA.

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, the court may appoint a guardian or conservator to make decisions on your behalf. This process can be time-consuming and costly, so having a DPOA in place is often a better option.

Is a Durable Power of Attorney valid in other states?

A DPOA created in Tennessee is generally valid in other states, but it’s wise to check the specific laws of the state where it will be used. Some states may have different requirements or forms.

What should I do with my Durable Power of Attorney once it’s completed?

After completing your DPOA, store it in a safe place. Share copies with your agent, family members, and any financial institutions that may need it. Keeping everyone informed helps ensure your wishes are respected.

How to Use Tennessee Durable Power of Attorney

Filling out the Tennessee Durable Power of Attorney form is an important step in planning for the future. This document allows you to designate someone to make decisions on your behalf if you are unable to do so. Follow these steps to complete the form accurately.

- Begin by downloading the Tennessee Durable Power of Attorney form from a reliable source or obtaining a physical copy.

- Read the entire form carefully to understand the sections that need to be filled out.

- In the first section, provide your full legal name and address. This identifies you as the principal.

- Next, enter the name and address of the person you are appointing as your agent. This person will act on your behalf.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific areas, such as financial decisions or healthcare matters.

- If applicable, include any additional instructions or limitations regarding your agent’s authority.

- Sign and date the form in the designated area. Your signature confirms your intent to create this document.

- Have the form notarized. This step adds an extra layer of validity to your document.

- Make copies of the completed and notarized form. Keep one for your records and provide copies to your agent and any relevant institutions.

Once you have filled out and notarized the form, it's crucial to keep it in a safe place and inform your agent where to find it. This ensures that your wishes are honored when needed.