Printable Stock Transfer Ledger Template

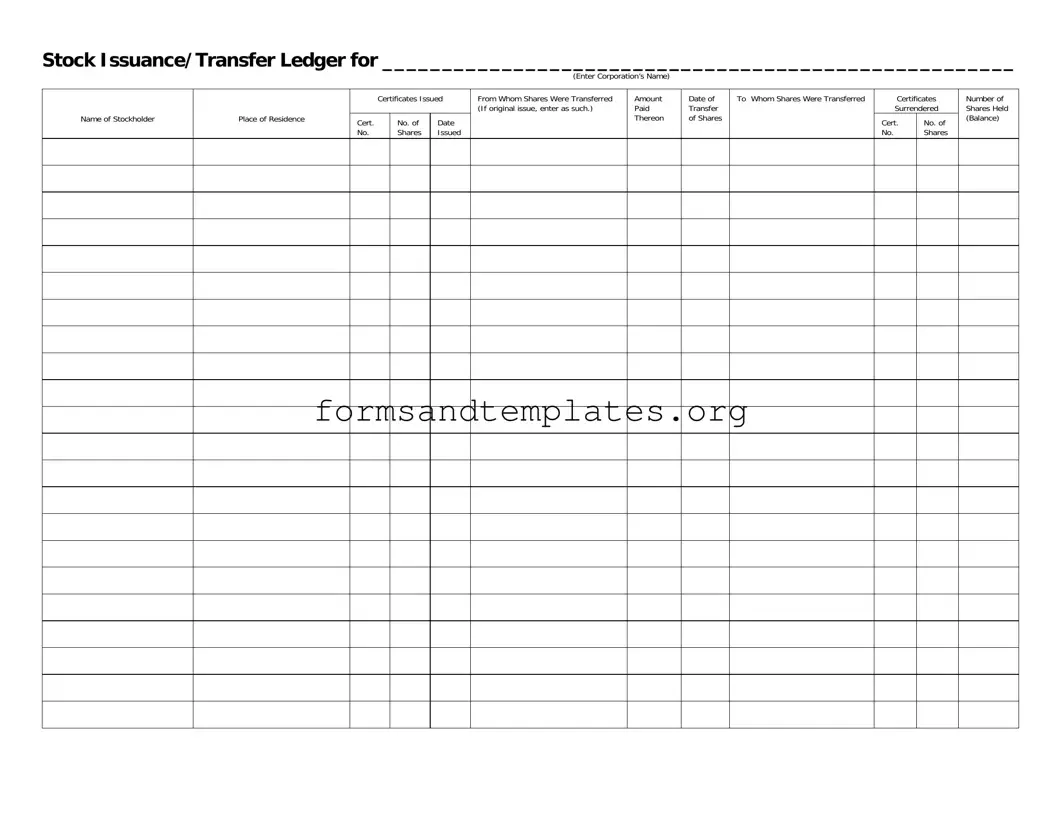

The Stock Transfer Ledger form is a crucial document for any corporation managing the issuance and transfer of its shares. This form captures essential information about the stockholder, including their name and place of residence, ensuring that all parties involved are accurately identified. It details the certificates issued, along with their corresponding certificate numbers and the date of issuance. The form also specifies the number of shares transferred, indicating whether the shares are part of an original issue or a subsequent transfer. Furthermore, it records the amount paid for the shares and the date of transfer, providing a clear timeline of ownership changes. The ledger also includes information about the party from whom the shares were transferred and to whom they were transferred, ensuring transparency in the transaction. Finally, it tracks the certificates surrendered and the number of shares held after the transfer, offering a complete picture of the stockholder's current position. This comprehensive approach helps maintain accurate records and supports compliance with corporate governance standards.

Common mistakes

-

Neglecting to enter the corporation’s name: Always fill in the name of the corporation at the top of the form. Failing to do so can lead to confusion and delays in processing.

-

Incorrectly listing the stockholder’s name: Ensure the name matches the records exactly. Any discrepancies can cause issues with ownership verification.

-

Forgetting to include the place of residence: This information is crucial for record-keeping. Missing it can complicate future communications.

-

Not providing certificate numbers: Each certificate issued must have its corresponding number listed. Omitting this detail can lead to lost shares.

-

Failing to indicate the amount paid: It’s important to document the amount paid for the shares. This information is necessary for financial records.

-

Omitting the date of transfer: Always include the date when shares are transferred. This helps maintain an accurate timeline of ownership.

-

Not specifying to whom shares were transferred: Clearly state the name of the recipient. This ensures proper documentation and prevents disputes.

-

Ignoring the balance of shares held: After the transfer, update the number of shares held. This reflects the current ownership accurately.

Find Common Documents

Panel Schedule - An organized panel schedule prevents overloading circuits.

Form for Direct Deposit - Electronic transactions enabled by this form can improve financial management for individuals.

Before initiating the eviction process, it is essential for landlords to familiarize themselves with the legal requirements and proper procedures involved, which can be guided by resources such as California Templates that offer fillable forms and additional information on the Notice to Quit.

Facial Consent Forms - The form establishes your acceptance of potential risks.

Key takeaways

When dealing with the Stock Transfer Ledger form, there are several important aspects to keep in mind. Here are key takeaways to ensure a smooth process:

- Accurate Information is Crucial: Always ensure that the corporation's name and stockholder details are correctly entered. Mistakes can lead to confusion and potential legal issues.

- Document Every Transfer: For each transaction, record the date of transfer, the number of shares involved, and the parties involved. This creates a clear history of ownership and helps maintain transparency.

- Certificates Must be Surrendered: When shares are transferred, the original certificates must be surrendered. This step is essential to prevent unauthorized claims on shares.

- Maintain a Balance Record: Keep track of the number of shares held after each transaction. This balance is important for both the corporation and the stockholders to understand their current ownership status.

Stock Transfer Ledger Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Understanding Stock Transfer Ledger

What is the Stock Transfer Ledger form?

The Stock Transfer Ledger form is a document used by corporations to track the issuance and transfer of stock shares. It provides a detailed record of stockholders, including their names, addresses, and the number of shares they hold. This form is crucial for maintaining accurate records of ownership and ensuring compliance with legal requirements.

Why is it important to maintain a Stock Transfer Ledger?

Maintaining a Stock Transfer Ledger is essential for several reasons:

- It ensures accurate tracking of stock ownership.

- It helps the corporation comply with state laws regarding stock issuance and transfers.

- It provides clarity in case of disputes regarding ownership.

- It assists in the calculation of dividends and voting rights based on the number of shares held.

Who should fill out the Stock Transfer Ledger form?

The form should be filled out by the corporation's designated officer, typically the secretary or treasurer. This individual is responsible for maintaining accurate records of stock transactions and ensuring that all necessary information is captured correctly.

What information is required on the Stock Transfer Ledger form?

The form requires several key pieces of information, including:

- The corporation's name.

- The name of the stockholder.

- The stockholder's place of residence.

- The certificates issued and their corresponding certificate numbers.

- The number of shares issued.

- Details about the transfer, including the date of transfer and to whom the shares were transferred.

- The amount paid for the shares.

- The number of shares held after the transfer.

What happens if a stockholder loses their stock certificate?

If a stockholder loses their stock certificate, they should notify the corporation immediately. The corporation may require the stockholder to complete an affidavit of loss and may issue a replacement certificate. It's important to act quickly to prevent unauthorized transfers of the lost certificate.

Can the Stock Transfer Ledger be updated after it has been filled out?

Yes, the Stock Transfer Ledger can and should be updated to reflect any changes in stock ownership. Whenever shares are transferred or new shares are issued, the ledger must be updated to maintain accurate records. This ensures that all stockholder information is current and reliable.

How long should the Stock Transfer Ledger be maintained?

The Stock Transfer Ledger should be maintained for as long as the corporation exists. In addition, it is advisable to keep records of all stock transactions for a minimum of several years, as they may be needed for legal or tax purposes. Retaining these records helps protect the corporation and its stockholders.

How to Use Stock Transfer Ledger

Completing the Stock Transfer Ledger form is an essential step in documenting the transfer of stock ownership. This form requires specific information to ensure accurate record-keeping. After filling out the form, it should be reviewed for completeness before submission to the appropriate parties.

- Begin by entering the name of the corporation in the designated space at the top of the form.

- In the section for "Name of Stockholder," write the full name of the individual or entity transferring the shares.

- Next, fill in the "Place of Residence" of the stockholder, ensuring accuracy in the address.

- Proceed to the "Certificates Issued" section and indicate the number of certificates being transferred.

- In the "Cert. No." field, provide the certificate number associated with the shares being transferred.

- Record the "Date" on which the shares were issued.

- In the "No. Shares Issued" section, enter the total number of shares being transferred.

- For "From Whom Shares Were Transferred," specify the name of the person or entity from whom the shares are being received. If this is an original issue, note that accordingly.

- Document the "Amount Paid Thereon" to reflect any payment made for the shares.

- Fill in the "Date of Transfer of Shares" to indicate when the transfer is taking place.

- In the "To Whom Shares Were Transferred" section, write the name of the individual or entity receiving the shares.

- For "Certificates Surrendered," note the certificate number of any certificates that are being surrendered as part of this transfer.

- Indicate the "No. Shares" associated with the surrendered certificates.

- Finally, complete the "Number of Shares Held (Balance)" to reflect the remaining shares held by the stockholder after the transfer.