Attorney-Verified Single-Member Operating Agreement Template

When establishing a single-member LLC, having a well-crafted operating agreement is essential for clarity and protection. This document serves as the foundational framework for how the business will operate, even if it is just one owner. It outlines key aspects such as the management structure, decision-making processes, and financial arrangements. Additionally, the agreement can specify the owner’s rights and responsibilities, ensuring that personal and business assets remain distinct. By detailing procedures for profit distribution, tax treatment, and potential future changes in ownership, this form provides both guidance and security. While it may seem straightforward, a single-member operating agreement can play a crucial role in safeguarding the owner's interests and enhancing the legitimacy of the business in the eyes of banks, investors, and courts.

Common mistakes

-

Failing to include the name of the LLC. This is a crucial element that identifies the business.

-

Not specifying the principal place of business. This address is important for legal and tax purposes.

-

Omitting the purpose of the LLC. Clearly stating the business purpose helps clarify the scope of operations.

-

Neglecting to outline management structure. Even as a single-member LLC, it’s essential to define how decisions will be made.

-

Using vague language in the operating provisions. Specificity is key to avoid misunderstandings in the future.

-

Not including a provision for amendments. This allows for flexibility as the business evolves.

-

Failing to sign and date the agreement. A signature is necessary to validate the document.

-

Overlooking the need for compliance with state laws. Each state has different requirements that must be followed.

-

Not keeping a copy of the signed agreement. Maintaining records is important for future reference and legal protection.

Create Popular Types of Single-Member Operating Agreement Templates

Sample Operating Agreement for Two Member Llc - Can streamline the onboarding of new members with predefined terms.

The Florida Operating Agreement form is a crucial document for limited liability companies (LLCs) in the state. This form outlines the management structure, responsibilities, and financial arrangements of the company, ensuring all members are on the same page. By clearly defining roles and expectations, it helps prevent misunderstandings and promotes smooth operations, and for those looking for a comprehensive resource, Florida Forms provides valuable assistance in drafting and understanding this important document.

Key takeaways

When filling out and using the Single-Member Operating Agreement form, there are several important points to keep in mind. This document serves as a foundational element for your business and can help protect your interests.

- Define Your Business Structure: Clearly outline the nature of your business and its operations. This helps establish your identity as a single-member LLC.

- Clarify Roles and Responsibilities: Even as a single member, defining your role can help clarify decision-making processes and responsibilities.

- Outline Financial Arrangements: Specify how profits and losses will be handled. This includes details on distributions and any capital contributions.

- Establish an Operating Framework: Include procedures for managing your business, such as how to handle disputes or changes in ownership.

- Consult Legal Guidance: While the form can be filled out independently, seeking professional advice ensures compliance with state laws and regulations.

Taking the time to carefully complete this agreement can provide clarity and security for your business operations.

Single-Member Operating Agreement Example

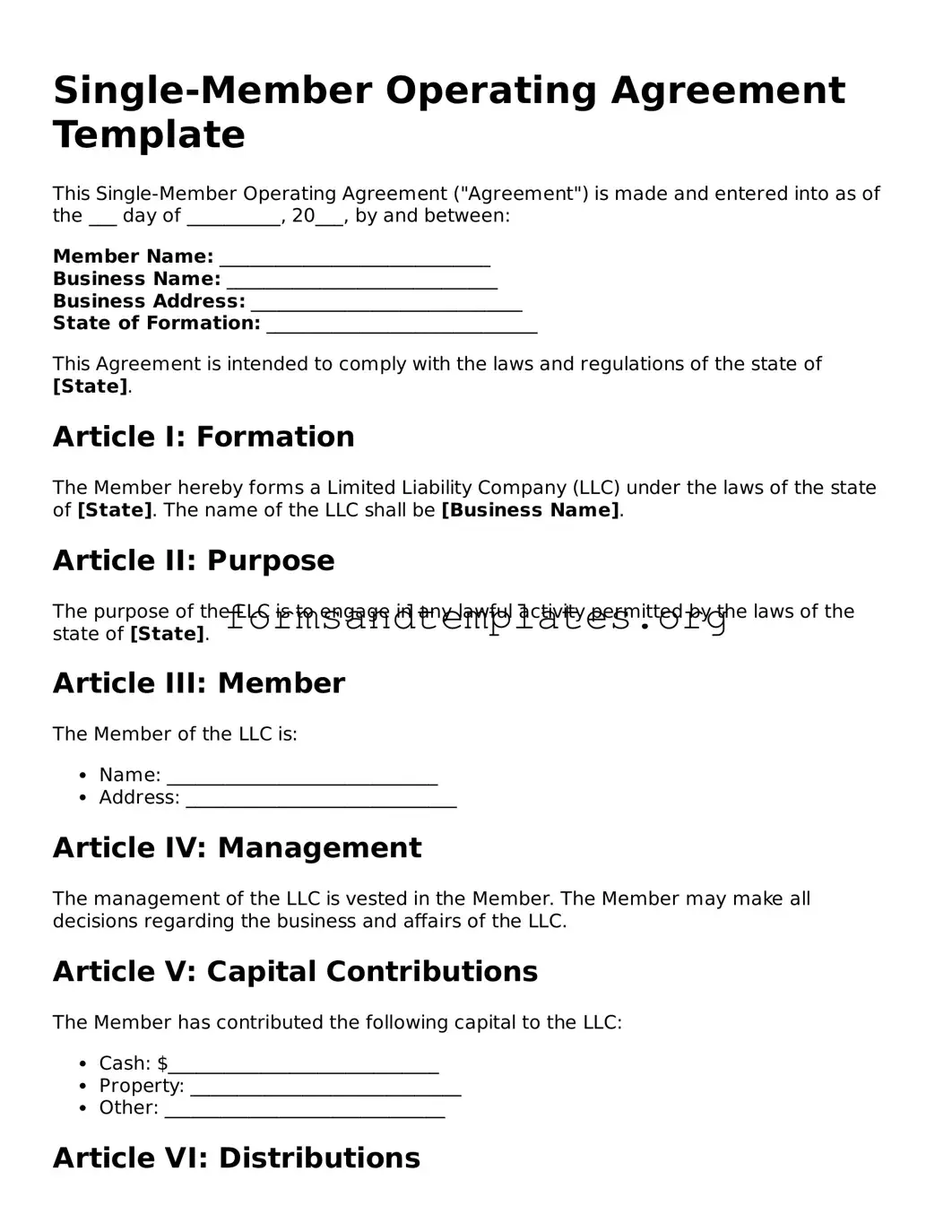

Single-Member Operating Agreement Template

This Single-Member Operating Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20___, by and between:

Member Name: _____________________________

Business Name: _____________________________

Business Address: _____________________________

State of Formation: _____________________________

This Agreement is intended to comply with the laws and regulations of the state of [State].

Article I: Formation

The Member hereby forms a Limited Liability Company (LLC) under the laws of the state of [State]. The name of the LLC shall be [Business Name].

Article II: Purpose

The purpose of the LLC is to engage in any lawful activity permitted by the laws of the state of [State].

Article III: Member

The Member of the LLC is:

- Name: _____________________________

- Address: _____________________________

Article IV: Management

The management of the LLC is vested in the Member. The Member may make all decisions regarding the business and affairs of the LLC.

Article V: Capital Contributions

The Member has contributed the following capital to the LLC:

- Cash: $_____________________________

- Property: _____________________________

- Other: ______________________________

Article VI: Distributions

Distributions of profits and losses shall be made to the Member at the times and in the amounts determined by the Member.

Article VII: Indemnification

The LLC shall indemnify the Member against any losses or liabilities incurred as a result of the Member's activities on behalf of the LLC, to the fullest extent permitted by law.

Article VIII: Amendments

This Agreement may be amended or modified only by a written agreement signed by the Member.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of [State].

Article X: Miscellaneous

This Agreement constitutes the entire understanding between the Member and the LLC. No other agreements or understandings, whether written or oral, shall be binding unless signed by the Member.

IN WITNESS WHEREOF, the undersigned has executed this Single-Member Operating Agreement as of the date first above written.

Member Signature: _____________________________

Date: _____________________________

Understanding Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the operational procedures and guidelines for a limited liability company (LLC) with one owner. This agreement serves as an internal document, detailing how the business will be run, how profits and losses will be handled, and how decisions will be made. Although it is not always required by law, having an operating agreement is highly recommended as it helps establish the legitimacy of the LLC and protects the owner's personal assets from business liabilities.

Why should I create a Single-Member Operating Agreement?

Creating a Single-Member Operating Agreement offers several important benefits:

- Clarification of Structure: It clearly defines the structure and rules of your business, which can prevent misunderstandings in the future.

- Liability Protection: By formalizing your business operations, you reinforce the limited liability status of your LLC, safeguarding your personal assets.

- Banking and Financing: Many banks and lenders require an operating agreement when you apply for business accounts or loans.

- Dispute Resolution: It provides a framework for resolving disputes, should they arise, even in a single-member context.

What should be included in a Single-Member Operating Agreement?

A comprehensive Single-Member Operating Agreement typically includes the following elements:

- Business Information: The name of the LLC, its principal address, and the purpose of the business.

- Ownership Structure: A statement confirming that the LLC is owned by a single member.

- Management Structure: Details on how the LLC will be managed and who will make decisions.

- Financial Provisions: Guidelines on how profits and losses will be allocated, as well as how distributions will be made.

- Amendment Procedures: Instructions on how the agreement can be modified in the future.

Is a Single-Member Operating Agreement legally required?

While not all states require a Single-Member Operating Agreement, having one is advisable. Some jurisdictions may not mandate it, but without this document, the LLC could be treated as a sole proprietorship, exposing the owner to personal liability. Therefore, even if it is not legally required in your state, creating an operating agreement is a prudent step to protect your interests and clarify your business operations.

How do I create a Single-Member Operating Agreement?

Creating a Single-Member Operating Agreement can be done through several methods:

- Templates: Many online resources offer free or paid templates that you can customize to fit your needs.

- Legal Software: Various software programs provide guided assistance in drafting an operating agreement.

- Consulting an Attorney: For those who prefer a tailored approach, working with a legal professional ensures that all specific requirements and nuances are addressed.

Regardless of the method chosen, ensure that the document is thorough and reflects your business intentions accurately.

How to Use Single-Member Operating Agreement

After gathering all necessary information, the next step involves filling out the Single-Member Operating Agreement form accurately. This document will serve as a formal record of the business structure and the sole member's rights and responsibilities.

- Begin by entering the name of the business at the top of the form.

- Provide the principal office address for the business.

- Indicate the name of the sole member.

- Include the date the agreement is being executed.

- State the purpose of the business in a clear and concise manner.

- Outline the capital contributions made by the sole member.

- Specify how profits and losses will be allocated.

- Detail the management structure, indicating that the sole member is responsible for all management decisions.

- Include any provisions regarding amendments to the agreement.

- Sign and date the document at the bottom.

Once the form is completed, it is advisable to keep a copy for personal records and provide a copy to any relevant parties, if necessary.