Printable Sample Tax Return Transcript Template

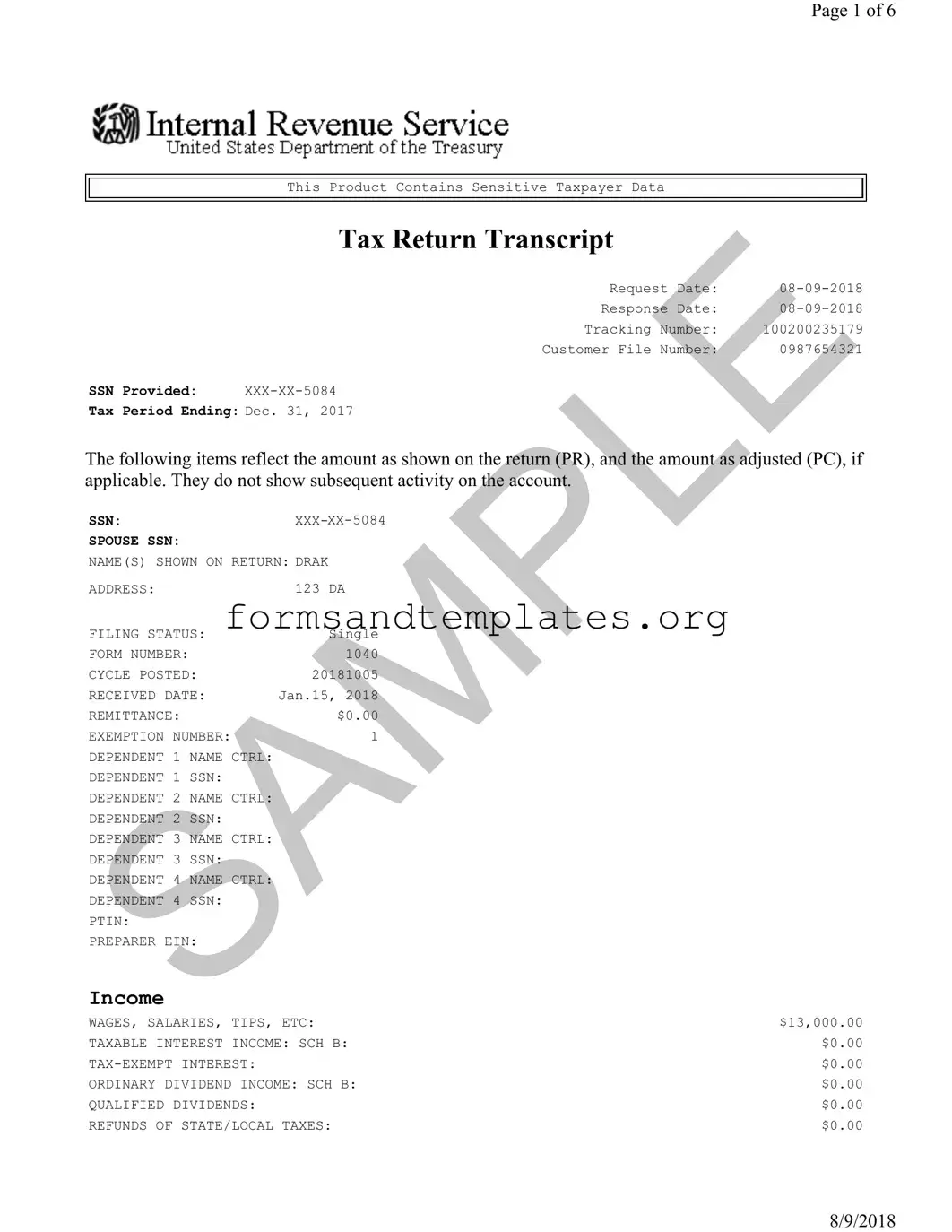

The Sample Tax Return Transcript form serves as a vital document for taxpayers seeking to understand their tax situation as reported to the Internal Revenue Service (IRS). This form provides a detailed summary of an individual's tax return, reflecting key information such as income, deductions, and tax liabilities. For instance, it includes the taxpayer's Social Security Number (SSN), filing status, and total income, which in this case amounts to $15,500. Additionally, it outlines various sources of income, including wages, business income, and adjustments to income, highlighting a self-employment tax deduction of $177. The form also summarizes tax credits and liabilities, revealing a tentative tax of $749 and total payments made of $1,000. Importantly, it indicates whether the taxpayer owes any amount or is due a refund, providing a clear financial picture. The Sample Tax Return Transcript is especially useful for individuals applying for loans or financial aid, as it serves as a verification tool for income and tax information. By examining this form, taxpayers can gain insights into their financial standing and ensure compliance with tax regulations.

Common mistakes

-

Failing to provide accurate Social Security Numbers (SSNs) for all parties involved can lead to processing delays. Ensure that the SSN for the taxpayer, spouse, and dependents are correctly entered.

-

Omitting essential income sources may result in incorrect tax calculations. All income, including wages, business income, and interest, should be reported accurately.

-

Not updating personal information, such as address or filing status, can cause issues with correspondence and tax processing. Ensure that all personal details are current.

-

Neglecting to include all applicable deductions can lead to a higher tax liability. Review all possible deductions and credits that may apply to your situation.

-

Incorrectly calculating the total income or tax liability may result in penalties. Double-check all figures before submission to ensure accuracy.

-

Forgetting to sign and date the form can delay processing. Always ensure that the form is signed by the taxpayer and, if applicable, the spouse.

-

Using outdated forms or instructions can lead to errors. Always verify that you are using the most recent version of the tax return transcript form.

-

Not keeping copies of submitted forms for personal records can create difficulties in future tax filings or audits. Always retain a copy of the completed form for your records.

Find Common Documents

Blank Ncoer Support Form - The evaluation fosters a culture of growth and improvement.

For those looking to ensure a seamless transaction, it's important to use the proper documentation; you can find the necessary form at PDF Documents Hub to assist you in completing your Boat Bill of Sale effectively.

Imm1294e - The IMM 1294 form is used to apply for a study permit outside of Canada.

Key takeaways

When filling out and using the Sample Tax Return Transcript form, consider the following key takeaways:

- Understand the Purpose: The form provides a summary of your tax return, including income, deductions, and tax liability.

- Check Your Information: Ensure that your name, Social Security Number (SSN), and tax period are correct. Any discrepancies can lead to issues.

- Know What It Shows: The transcript reflects amounts as reported on your return and any adjustments made by the IRS.

- Review Income Sources: The form details various income types, including wages, business income, and interest. This information is crucial for understanding your financial situation.

- Adjustments Matter: Look at any adjustments to your income, such as self-employment tax deductions. These can affect your taxable income.

- Credits and Payments: The transcript lists available credits and payments made. This information can help you determine your tax refund or amount owed.

- Use for Verification: The transcript can serve as proof of income when applying for loans or financial aid.

- Keep it Secure: Since the form contains sensitive taxpayer data, store it safely to protect your personal information.

Sample Tax Return Transcript Example

Page 1 of 6

This Product Contains Sensitive Taxpayer Data

Tax Return Transcript

|

Request Date: |

|

|

Response Date: |

|

|

Tracking Number: |

100200235179 |

|

Customer File Number: |

0987654321 |

SSN Provided: |

|

Tax Period Ending: Dec. 31, 2017

The following items reflect the amount as shown on the return (PR), and the amount as adjusted (PC), if applicable. They do not show subsequent activity on the account.

SSN: |

|

|

SPOUSE SSN: |

|

|

NAME(S) SHOWN ON RETURN: DRAK |

||

ADDRESS: |

|

123 DA |

FILING STATUS: |

Single |

|

FORM NUMBER: |

|

1040 |

CYCLE POSTED: |

20181005 |

|

RECEIVED DATE: |

Jan.15, 2018 |

|

REMITTANCE: |

|

$0.00 |

EXEMPTION NUMBER: |

1 |

|

DEPENDENT 1 |

N ME CTRL: |

|

DEPENDENT 1 |

SSN: |

|

DEPENDENT 2 |

N ME CTRL: |

|

DEPENDENT 2 |

SSN: |

|

DEPENDENT 3 |

N ME CTRL: |

|

DEPENDENT 3 |

N: |

|

DEPENDENT 4 |

N ME CTRL: |

|

DEPENDENT 4 |

N: |

|

PTIN: |

|

|

PREPARER EIN: |

|

|

Income

WAGES, SALARIES, TIPS, ETC: |

$13,000.00 |

TAXABLE INTEREST INCOME: SCH B: |

$0.00 |

$0.00 |

|

ORDINARY DIVIDEND INCOME: SCH B: |

$0.00 |

QUALIFIED DIVIDENDS: |

$0.00 |

REFUNDS OF STATE/LOCAL TAXES: |

$0.00 |

8/9/2018

Page 2 of 6

ALIMONY RECEIVED: |

|

$0.00 |

BUSINESS INCOME OR LOSS (Schedule C): |

|

$2,500.00 |

BUSINESS INCOME OR LOSS: SCH C PER COMPUTER: |

|

$2,500.00 |

CAPITAL GAIN OR LOSS: (Schedule D): |

|

$0.00 |

CAPITAL GAINS OR LOSS: SCH D PER COMPUTER: |

|

$0.00 |

OTHER GAINS OR LOSSES (Form 4797): |

|

$0.00 |

TOTAL IRA DISTRIBUTIONS: |

|

$0.00 |

TAXABLE IRA DISTRIBUTIONS: |

|

$0.00 |

TOTAL PENSIONS AND ANNUITIES: |

|

$0.00 |

SAMPLE |

$0.00 |

|

TAXABLE PENSION/ANNUITY AMOUNT: |

|

|

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E): |

|

$0.00 |

RENT/ROYALTY/PARTNERSHIP/ESTATE (Schedule E) PER COMPUTER: |

|

$0.00 |

RENT/ROYALTY INCOME/LOSS PER COMPUTER: |

|

$0.00 |

ESTATE/TRUST INCOME/LOSS PER COMPUTER: |

|

$0.00 |

|

$0.00 |

|

FARM INCOME OR LOSS (Schedule F): |

|

$0.00 |

FARM INCOME OR LOSS (Schedule F) PER COMPUTER: |

|

$0.00 |

UNEMPLOYMENT COMPENSATION: |

|

$0.00 |

TOTAL SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS: |

|

$0.00 |

TAXABLE SOCIAL SECURITY BENEFITS PER COM UTER: |

|

$0.00 |

OTHER INCOME: |

|

$0.00 |

SCHEDULE EIC SE INCOME PER COMPUTER: |

|

$2,323.00 |

SCHEDULE EIC EARNED INCOME PER COMPUTER: |

$15,323.00 |

|

SCH EIC DISQUALIFIED INC COMPUTER: |

|

$0.00 |

TOTAL INCOME: |

$15,500.00 |

|

TOTAL INCOME PER COMPUTER: |

$15,500.00 |

|

Adjustments to Income

EDUCATOR EXPENSES: |

|

$0.00 |

||

EDUCATOR EXPENSES PER CO PUTER: |

$0.00 |

|||

RESERVIST AND OTHER |

BUSINESS EXPENSE: |

$0.00 |

||

HEALTH |

VINGS |

CCT |

DEDUCTION: |

$0.00 |

HEALTH S VINGS |

CCT |

DEDUCTION PER CO PTR: |

$0.00 |

|

MOVING EXPENSES: F3903: |

$0.00 |

|||

SELF EMPLOYMENT T X DEDUCTION: |

$177.00 |

|||

SELF EMPLOYMENT T X DEDUCTION PER COMPUTER: |

$177.00 |

|||

ELF EMPLOYMENT T X DEDUCTION VERIFIED: |

$0.00 |

|||

KEOGH/ EP CONTRIBUTION DEDUCTION: |

$0.00 |

|||

$0.00 |

||||

EARLY WITHDRAWAL OF |

AVINGS PENALTY: |

$0.00 |

||

ALIMONY PAID |

N: |

|

|

|

ALIMONY PAID: |

|

|

$0.00 |

|

IRA DEDUCTION: |

|

|

$0.00 |

|

IRA DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION PER COMPUTER: |

$0.00 |

|||

STUDENT LOAN INTEREST DEDUCTION VERIFIED: |

$0.00 |

|||

TUITION AND FEES DEDUCTION: |

$0.00 |

|||

TUITION AND FEES DEDUCTION PER COMPUTER: |

$0.00 |

|||

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION: |

$0.00 |

|||

8/9/2018

Page 3 of 6

DOMESTIC PRODUCTION ACTIVITIES DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

OTHER ADJUSTMENTS: |

|

|

$0.00 |

||

ARCHER MSA DEDUCTION: |

|

$0.00 |

|||

ARCHER MSA DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TOTAL ADJUSTMENTS: |

|

|

$177.00 |

||

TOTAL ADJUSTMENTS PER COMPUTER: |

|

$177.00 |

|||

ADJUSTED GROSS INCOME: |

$15,323.00 |

||||

ADJUSTED GROSS INCOME PER COMPUTER: |

$15,323.00 |

||||

SAMPLE |

|

||||

Tax and Credits |

|

|

|||

|

|

NO |

|||

BLIND: |

|

|

|

|

NO |

SPOUSE |

|

|

NO |

||

SPOUSE BLIND: |

|

|

NO |

||

STANDARD DEDUCTION PER COMPUTER: |

|

$4,850.00 |

|||

ADDITIONAL STANDARD DEDUCTION PER COMPUTER: |

|

$0.00 |

|||

TAX TABLE INCOME PER COMPUTER: |

$10,473.00 |

||||

EXEMPTION AMOUNT PER COMPUTER: |

|

$3,100.00 |

|||

TAXABLE INCOME: |

|

|

$7,373.00 |

||

TAXABLE INCOME PER COMPUTER: |

|

$7,373.00 |

|||

TOTAL POSITIVE INCOME PER COMPUTER: |

$15,500.00 |

||||

TENTATIVE TAX: |

|

|

$749.00 |

||

TENTATIVE TAX PER COMPUTER: |

|

$749.00 |

|||

FORM 8814 ADDITIONAL TAX AMOUNT: |

|

$0.00 |

|||

TAX ON INCOME LESS SOC SEC INCOME PER COM UTER: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE MINIMUM TAX: |

|

$0.00 |

|||

FORM 6251 ALTERNATIVE INI UM TAX PER CO UTER: |

|

$0.00 |

|||

FOREIGN TAX CREDIT: |

|

$0.00 |

|||

FOREIGN TAX CREDIT PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION PER CO PUTER: |

|

$0.00 |

|||

FOREIGN INCOME EXCLUSION TAX PER CO PUTER: |

|

$0.00 |

|||

EXCESS ADVANCE PREMIUM TAX CREDIT REPAY ENT OUNT: |

|

$0.00 |

|||

EXCESS |

DV NCE PREMIUM T X CREDIT REP Y ENT VERIFIED A OUNT: |

|

$0.00 |

||

CHILD & DEPENDENT C RE CREDIT: |

|

$0.00 |

|||

CHILD & DEPENDENT C RE CREDIT PER COMPUTER: |

|

$0.00 |

|||

CREDIT FOR ELDERLY |

ND DIS BLED: |

|

$0.00 |

||

CREDIT FOR ELDERLY |

ND DIS BLED PER COMPUTER: |

|

$0.00 |

||

EDUCATION CREDIT: |

|

|

$0.00 |

||

EDUCATION CREDIT PER COMPUTER: |

|

$0.00 |

|||

GRO EDUC TION CREDIT PER COMPUTER: |

|

$0.00 |

|||

RETIREMENT |

AVINGS CNTRB CREDIT: |

|

$0.00 |

||

RETIREMENT |

AVINGS CNTRB CREDIT PER COMPUTER: |

|

$0.00 |

||

PRIM RET |

|

AV CNTRB: F8880 LN6A: |

|

$0.00 |

|

EC RET |

AV CNTRB: F8880 LN6B: |

|

$0.00 |

||

TOTAL RETIREMENT |

AVINGS CONTRIBUTION: F8880 CMPTR: |

|

$0.00 |

||

RESIDENTIAL ENERGY CREDIT: |

|

$0.00 |

|||

RESIDENTIAL ENERGY CREDIT PER COMPUTER: |

|

$0.00 |

|||

CHILD TAX CREDIT: |

|

|

$0.00 |

||

CHILD TAX CREDIT PER COMPUTER: |

|

$0.00 |

|||

ADOPTION CREDIT: F8839: |

|

$0.00 |

|||

ADOPTION CREDIT PER COMPUTER: |

|

$0.00 |

|||

8/9/2018

Page 4 of 6

FORM 8396 MORTGAGE CERTIFICATE CREDIT: |

$0.00 |

|

FORM 8396 MORTGAGE CERTIFICATE CREDIT PER COMPUTER: |

$0.00 |

|

F3800, F8801 AND OTHER CREDIT AMOUNT: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS: |

$0.00 |

|

FORM 3800 GENERAL BUSINESS CREDITS PER COMPUTER: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801: |

$0.00 |

|

PRIOR YR MIN TAX CREDIT: F8801 PER COMPUTER: |

$0.00 |

|

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT AMOUNT: |

$0.00 |

F8936 |

ELECTRIC MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

SAMPLE |

$0.00 |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT AMOUNT: |

|

F8910 |

ALTERNATIVE MOTOR VEHICLE CREDIT PER COMPUTER: |

$0.00 |

OTHER CREDITS: |

$0.00 |

|

TOTAL CREDITS: |

$0.00 |

|

TOTAL CREDITS PER COMPUTER: |

$0.00 |

|

INCOME TAX AFTER CREDITS PER COMPUTER: |

$749.00 |

|

Other Taxes

SE TAX: |

|

$354.00 |

SE TAX PER COMPUTER: |

|

$354.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNREPORTED TIPS: |

|

$0.00 |

SOCIAL SECURITY AND MEDICARE TAX ON UNRE ORTED TI |

ER COM UTER: |

$0.00 |

TAX ON QUALIFIED PLANS F5329 (PR): |

|

$0.00 |

TAX ON QUALIFIED PLANS F5329 PER COM UTER: |

|

$0.00 |

IRAF TAX PER COMPUTER: |

|

$0.00 |

TP TAX FIGURES (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

IMF TOTAL TAX (REDUCED BY IRAF) PER COM UTER: |

|

$1,103.00 |

OTHER TAXES PER COMPUTER: |

|

$0.00 |

UNPAID FICA ON REPORTED TIPS: |

|

$0.00 |

OTHER TAXES: |

|

$0.00 |

RECAPTURE TAX: F8611: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES: |

|

$0.00 |

HOUSEHOLD EMPLOYMENT TAXES PER CO PUTER: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY: |

|

$0.00 |

HEALTH C RE RESPONSIBILITY PEN LTY VERIFIED: |

|

$0.00 |

HEALTH COVER GE REC PTURE: F8885: |

|

$0.00 |

RECAPTURE T XES: |

|

$0.00 |

TOTAL SSESSMENT PER COMPUTER: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES: |

|

$1,103.00 |

TOTAL T X LI BILITY TP FIGURES PER COMPUTER: |

|

$1,103.00 |

Payments

FEDERAL INCOME TAX WITHHELD: |

$1,000.00 |

|

HEALTH CARE: INDIVIDUAL RESPONSIBILITY: |

$0.00 |

|

HEALTH CARE |

0 |

|

E TIMATED TAX |

PAYMENT : |

$0.00 |

OTHER PAYMENT CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT PER COMPUTER: |

$0.00 |

|

REFUNDABLE EDUCATION CREDIT VERIFIED: |

$0.00 |

|

EARNED INCOME CREDIT: |

$0.00 |

|

EARNED INCOME CREDIT PER COMPUTER: |

$0.00 |

|

EARNED INCOME CREDIT NONTAXABLE COMBAT PAY: |

$0.00 |

|

8/9/2018

Page 5 of 6

SCHEDULE 8812 |

NONTAXABLE COMBAT PAY: |

$0.00 |

EXCESS SOCIAL |

SECURITY & RRTA TAX WITHHELD: |

$0.00 |

SCHEDULE 8812 |

TOT SS/MEDICARE WITHHELD: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT PER COMPUTER: |

$0.00 |

SCHEDULE 8812 |

ADDITIONAL CHILD TAX CREDIT VERIFIED: |

$0.00 |

AMOUNT PAID WITH FORM 4868: |

$0.00 |

|

FORM 2439 REGULATED INVESTMENT COMPANY CREDIT: |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS: |

$0.00 |

|

SAMPLE |

$0.00 |

|

FORM 4136 CREDIT FOR FEDERAL TAX ON FUELS PER COMPUTER: |

||

HEALTH COVERAGE TX CR: F8885: |

$0.00 |

|

PREMIUM TAX CREDIT AMOUNT: |

$0.00 |

|

PREMIUM TAX CREDIT VERIFIED AMOUNT: |

$0.00 |

|

PRIMARY NAP FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

|

SECONDARY NAP |

FIRST TIME HOME BUYER INSTALLMENT AMT: |

$0.00 |

FIRST TIME HOMEBUYER CREDIT REPAYMENT AMOUNT: |

$0.00 |

|

FORM 5405 TOTAL HOMEBUYERS CREDIT REPAYMENT PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER: |

$0.00 |

|

SMALL EMPLOYER HEALTH INSURANCE PER COMPUTER (2): |

$0.00 |

|

FORM 2439 AND |

OTHER CREDITS: |

$0.00 |

TOTAL PAYMENTS: |

$1,000.00 |

|

TOTAL PAYMENTS PER COMPUTER: |

$1,000.00 |

|

Refund or Amount Owed

AMOUNT YOU OWE: |

$103.00 |

APPLIED TO NEXT YEAR'S ESTIMATED TAX: |

$0.00 |

ESTIMATED TAX PENALTY: |

$0.00 |

TAX ON INCOME LESS STATE REFUND PER CO UTER: |

$0.00 |

BAL DUE/OVER PYMT USING TP FIG PER CO PUTER: |

$103.00 |

BAL DUE/OVER PYMT USING CO PUTER FIGURES: |

$103.00 |

FORM 8888 TOTAL REFUND PER CO PUTER: |

$0.00 |

Third Party Designee

THIRD P RTY DESIGNEE ID NU BER: |

|

AUTHORIZ TION INDIC TOR: |

0 |

THIRD RTY DESIGNEE N ME: |

|

Schedule

OCIAL |

ECURITY NUMBER: |

|

EMPLOYER |

ID NUMBER: |

|

BU INE |

NAME: |

|

DE CRIPTION OF BU INE /PROFESSION: |

DRAK |

|

NAICS CODE: |

000000 |

|

ACCT MTHD: |

|

|

FIR T TIME CHEDULE C FILED: |

N |

|

TATUTORY EMPLOYEE IND: |

N |

|

INCOME

GROSS RECEIPTS OR SALES: |

$2,700.00 |

RETURNS AND ALLOWANCES: |

$0.00 |

NET GROSS RECEIPTS: |

$0.00 |

COST OF GOODS SOLD: |

$0.00 |

SCHEDULE C FORM 1099 REQUIRED: |

NONE |

8/9/2018

Page 6 of 6

SCHEDULE C FORM 1099 FILED: |

NONE |

OTHER INCOME: |

$0.00 |

EXPENSES

CAR AND TRUCK EXPENSES: |

$0.00 |

DEPRECIATION: |

$0.00 |

INSURANCE (OTHER THAN HEALTH): |

$0.00 |

MORTGAGE INTEREST: |

$0.00 |

LEGAL AND PROFESSIONAL SERVICES: |

$0.00 |

SAMPLE |

$0.00 |

REPAIRS AND MAINTENANCE: |

|

TRAVEL: |

$0.00 |

MEALS AND ENTERTAINMENT: |

$0.00 |

WAGES: |

$0.00 |

OTHER EXPENSES: |

$0.00 |

TOTAL EXPENSES: |

$200.00 |

EXP FOR BUSINESS USE OF HOME: |

$0.00 |

SCH C NET PROFIT OR LOSS PER COMPUTER: |

$2,500.00 |

AT RISK CD: |

|

OFFICE EXPENSE AMOUNT: |

$0.00 |

UTILITIES EXPENSE AMOUNT: |

$0.00 |

COST OF GOODS SOLD

INVENTORY |

AT |

BEGINNING OF |

YEAR: |

$0.00 |

INVENTORY |

AT |

END OF YEAR: |

|

$0.00 |

Schedule

SSN OF |

|

NET FARM PROFIT/LOSS: SCH F: |

$0.00 |

CONSERVATION RESERVE PROGRAM PAY ENTS: |

$0.00 |

NET NONFARM PROFIT/LOSS: |

$2,500.00 |

TOTAL SE INCOME: |

$2,500.00 |

SE QUARTERS COVERED: |

4 |

TOTAL SE TAX PER COMPUTER: |

$353.12 |

SE INCOME COMPUTER VERIFIED: |

$0.00 |

SE INCOME PER COMPUTER: |

$2,308.00 |

TOTAL NET E RNINGS PER CO PUTER: |

$2,308.00 |

LONG FORM ONLY

TENTATIVE |

CHURCH RNINGS: |

$0.00 |

|

TOTAL SOC |

SEC & RR W GES: |

$0.00 |

|

E |

T X |

COMPUTER: |

$286.19 |

E MEDIC RE INCOME PER COMPUTER: |

$2,308.00 |

||

E MEDICARE TAX PER COMPUTER: |

$66.93 |

||

E FARM OPTION METHOD U ED: |

0 |

||

E OPTIONAL METHOD INCOME: |

$0.00 |

||

Form 8863 - Education Credits (Hope and Lifetime Learning Credits)

PART III - ALLOWABLE EDUCATION CREDITS

GROSS EDUCATION CR PER COMPUTER: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT: |

$0.00 |

||

TOTAL EDUCATION CREDIT AMOUNT PER COMPUTER: |

$0.00 |

|

|

|

This Product Contains Sensitive Taxpayer Data |

|

|

|

|

|

|

8/9/2018

Understanding Sample Tax Return Transcript

What is a Sample Tax Return Transcript?

A Sample Tax Return Transcript is a document provided by the IRS that summarizes the information from your tax return. It includes details such as your income, deductions, and tax liability for a specific tax year. This transcript is often used for various purposes, including loan applications, financial aid, and verifying income for government assistance programs. It does not include any subsequent account activity or changes made after the return was filed.

How can I obtain a Sample Tax Return Transcript?

You can request a Sample Tax Return Transcript from the IRS in several ways:

- Online: Use the IRS website to access the "Get Transcript" tool. You will need to provide personal information, including your Social Security number and filing status.

- By Mail: You can also request a transcript by completing Form 4506-T and sending it to the IRS. This method may take longer than the online option.

- By Phone: Call the IRS at 1-800-908-9946 and follow the prompts to request your transcript.

Keep in mind that it may take a few days to receive your transcript, especially if you request it by mail.

What information is included in a Sample Tax Return Transcript?

A Sample Tax Return Transcript typically includes the following information:

- Your name and Social Security number (or taxpayer identification number)

- Your filing status (e.g., single, married filing jointly)

- Your total income, including wages, business income, and other sources

- Deductions and credits claimed on your return

- Your tax liability and any payments made

This information provides a comprehensive overview of your tax situation for the specified year, making it useful for various financial assessments.

Why might I need a Sample Tax Return Transcript?

There are several reasons why you might need a Sample Tax Return Transcript:

- Loan Applications: Lenders often require proof of income when you apply for a mortgage or personal loan.

- Financial Aid: If you are applying for college financial aid, schools may request your tax information to determine eligibility.

- Income Verification: Government agencies may need to verify your income for assistance programs or benefits.

Having your transcript readily available can help streamline these processes and provide the necessary documentation when needed.

How to Use Sample Tax Return Transcript

Completing the Sample Tax Return Transcript form requires careful attention to detail. Each section must be filled out accurately to ensure that the information is processed correctly. Follow these steps to complete the form efficiently.

- Begin by entering the request date at the top of the form. Use the format MM-DD-YYYY.

- Input the response date in the same format as the request date.

- Fill in the tracking number provided to you.

- Enter the customer file number associated with your tax return.

- Provide the Social Security Number (SSN) of the primary taxpayer.

- Indicate the tax period ending date using the format MM-DD-YYYY.

- List the name(s) shown on the return clearly.

- Complete the address section with the full address of the taxpayer.

- Specify the filing status as either Single, Married Filing Jointly, etc.

- Enter the form number used for the tax return.

- Fill in the cycle posted date.

- Document the received date of the tax return.

- Record the remittance amount if applicable.

- Indicate the exemption number for the taxpayer.

- List any dependents by providing their names and SSNs, if applicable.

- Complete the income section by entering amounts for wages, interest, dividends, etc.

- Fill in the adjustments to income section, detailing any deductions.

- Calculate and enter the total income and adjusted gross income.

- Proceed to the tax and credits section, entering amounts for deductions and credits.

- Complete the other taxes section, if applicable.

- Document any payments made, including withheld taxes and estimated payments.

- Finally, indicate the refund or amount owed at the bottom of the form.