Attorney-Verified Release of Promissory Note Template

The Release of Promissory Note form is an important document in the world of finance and lending. This form signifies the completion of a loan agreement, marking the moment when the borrower has fulfilled their obligation to repay the loan. It serves as proof that the lender has received all payments and releases the borrower from any further liability related to the note. By using this form, both parties can ensure clarity and avoid any future disputes regarding the debt. The document typically includes essential details such as the names of the borrower and lender, the original loan amount, and the date of release. Additionally, it often requires signatures from both parties, confirming that the loan has been fully satisfied. Understanding the significance of this form can help individuals navigate their financial agreements with confidence.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and dates, can lead to delays or rejection of the form.

-

Incorrect Signatures: The form must be signed by the appropriate parties. Missing or mismatched signatures can invalidate the release.

-

Not Dating the Form: Omitting the date can create confusion regarding when the release was executed, which is crucial for legal purposes.

-

Ignoring Notary Requirements: Some jurisdictions require notarization. Failing to have the document notarized when necessary may render it unenforceable.

-

Using Incorrect Terminology: Mislabeling the document or using vague language can lead to misunderstandings about the release’s intent.

-

Not Keeping Copies: It is essential to retain copies of the completed form for personal records. Failure to do so can complicate future disputes.

-

Assuming Automatic Acceptance: Believing that submission guarantees acceptance can lead to disappointment. Always confirm the form’s acceptance with the relevant party.

Create Popular Types of Release of Promissory Note Templates

Promissary Note Template - Details default procedures if the borrower fails to pay.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. By utilizing resources from NY Templates, individuals can better understand its structure and requirements, helping them navigate their financial obligations effectively.

Key takeaways

When filling out and using the Release of Promissory Note form, consider the following key takeaways:

- Understand the Purpose: The form serves to formally release a borrower from their obligation to repay a promissory note.

- Accurate Information: Ensure all information provided is accurate and up-to-date to avoid any legal complications.

- Signatures Required: Both the lender and borrower must sign the document for it to be valid.

- Witness or Notary: Having a witness or notary public can add an extra layer of validation to the release.

- Keep Copies: Retain copies of the signed form for your records. This can be important for future reference.

- Timeliness: Complete and submit the form promptly after the debt is settled to ensure clarity in the transaction.

- Consultation: If unsure about any part of the process, consider consulting a financial advisor or attorney.

- Legal Implications: Understand that signing the release signifies that the lender relinquishes their rights to collect the debt.

- Clear Communication: Communicate clearly with all parties involved to ensure everyone understands the terms of the release.

Release of Promissory Note Example

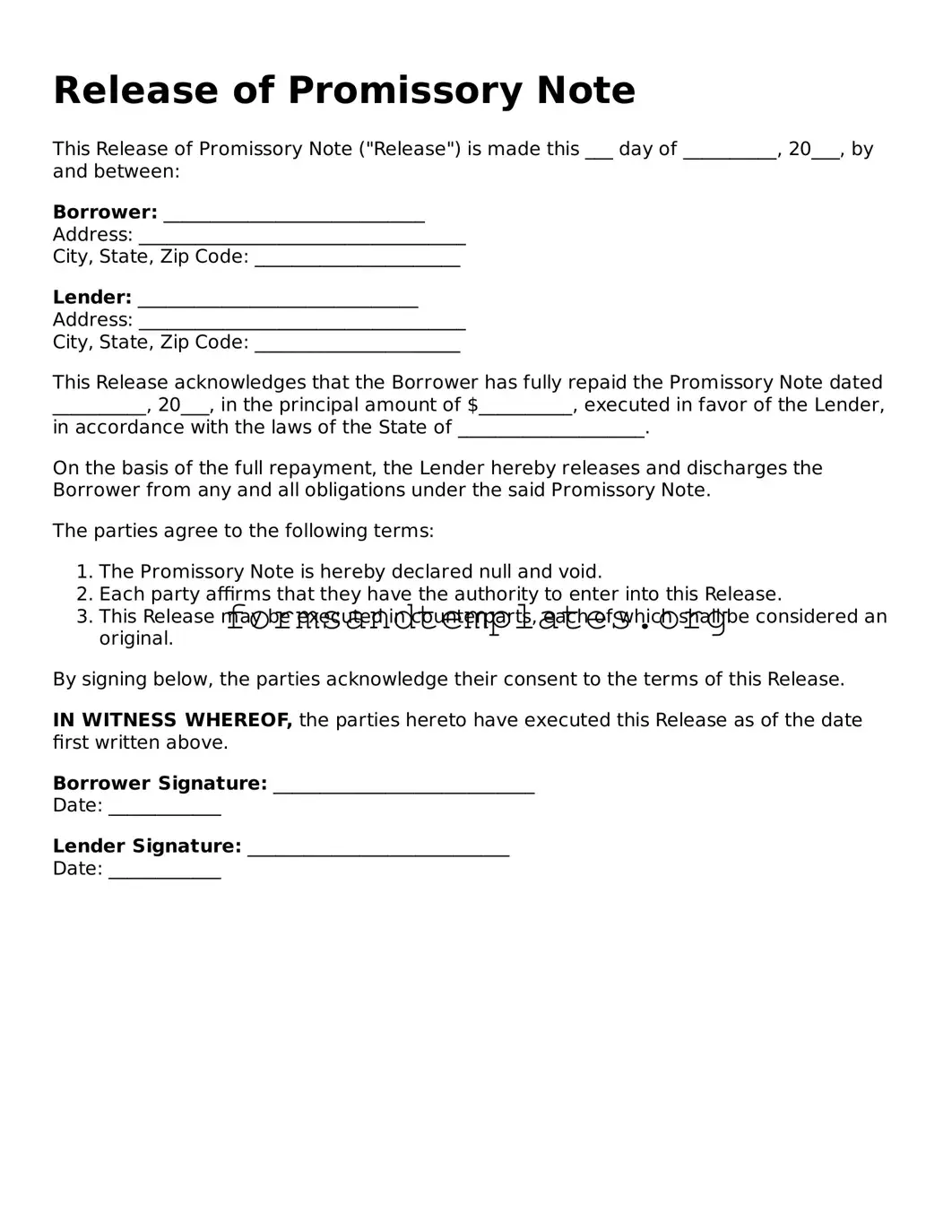

Release of Promissory Note

This Release of Promissory Note ("Release") is made this ___ day of __________, 20___, by and between:

Borrower: ____________________________

Address: ___________________________________

City, State, Zip Code: ______________________

Lender: ______________________________

Address: ___________________________________

City, State, Zip Code: ______________________

This Release acknowledges that the Borrower has fully repaid the Promissory Note dated __________, 20___, in the principal amount of $__________, executed in favor of the Lender, in accordance with the laws of the State of ____________________.

On the basis of the full repayment, the Lender hereby releases and discharges the Borrower from any and all obligations under the said Promissory Note.

The parties agree to the following terms:

- The Promissory Note is hereby declared null and void.

- Each party affirms that they have the authority to enter into this Release.

- This Release may be executed in counterparts, each of which shall be considered an original.

By signing below, the parties acknowledge their consent to the terms of this Release.

IN WITNESS WHEREOF, the parties hereto have executed this Release as of the date first written above.

Borrower Signature: ____________________________

Date: ____________

Lender Signature: ____________________________

Date: ____________

Understanding Release of Promissory Note

What is a Release of Promissory Note?

A Release of Promissory Note is a legal document that signifies the cancellation of a promissory note. This document is typically executed when the borrower has fulfilled their obligation to repay the loan, and the lender formally acknowledges that the debt has been satisfied. It serves to protect both parties by providing proof that the borrower no longer owes money under the terms of the original note.

Why is a Release of Promissory Note important?

This document is crucial for several reasons:

- It provides clarity and peace of mind for the borrower, confirming that their debt has been cleared.

- It protects the lender by ensuring that there is a formal record of the debt's cancellation.

- It may be required for future financial transactions, such as applying for new loans or mortgages.

Who should sign the Release of Promissory Note?

Typically, both the borrower and the lender must sign the Release of Promissory Note. The borrower confirms that they have repaid the loan, while the lender acknowledges the completion of the transaction. In some cases, witnesses or notaries may also need to sign to validate the document.

How do I create a Release of Promissory Note?

Creating a Release of Promissory Note can be straightforward. Follow these steps:

- Gather the original promissory note and any relevant documentation showing the loan has been repaid.

- Draft the release document, including details such as the names of both parties, the date of the original loan, and a statement confirming the debt has been satisfied.

- Have both parties sign the document, and consider having it notarized for added legal protection.

When should I use a Release of Promissory Note?

A Release of Promissory Note should be used once the borrower has fully repaid the loan as outlined in the promissory note. It’s essential to complete this process promptly to avoid any potential misunderstandings or disputes in the future.

What happens if I don’t get a Release of Promissory Note?

If a Release of Promissory Note is not obtained after repayment, the borrower may still be considered liable for the debt. This could lead to complications, especially if the lender attempts to collect on the loan in the future. It is advisable to secure this document to ensure that all parties are clear about the status of the loan.

Can I revoke a Release of Promissory Note?

Once a Release of Promissory Note has been signed and executed, it typically cannot be revoked. This document serves as a final acknowledgment that the debt has been satisfied. If there are extenuating circumstances or disputes, it may be necessary to consult a legal professional for guidance on how to proceed.

How to Use Release of Promissory Note

After completing the Release of Promissory Note form, you will need to ensure that all parties involved receive a copy of the signed document. This ensures that everyone is aware of the release and can refer to it if necessary.

- Start by downloading the Release of Promissory Note form from the appropriate source.

- Fill in the date at the top of the form.

- Provide the names and addresses of both the borrower and the lender in the designated sections.

- Clearly state the amount of the promissory note being released.

- Include any relevant details about the original promissory note, such as the date it was signed and any associated account numbers.

- Sign the form in the designated area. Ensure your signature is clear and legible.

- Have the lender sign the form as well, if required.

- Make copies of the completed form for your records and for the other party.

- Send the original signed form to the appropriate party.