Printable Release Of Lien Texas Template

The Release of Lien Texas form is an important document for anyone involved in real estate transactions in Texas. It serves to formally acknowledge that a lien, typically held by a lender, has been satisfied. This means that the borrower has paid off their debt in full, and the property is now free from any claims associated with that lien. The form includes essential details such as the date of the release, the names of the holder of the note and lien, and the borrower. It also specifies the original principal amount and the maturity date, if applicable. By signing this document, the holder of the lien agrees to relinquish all rights to enforce the lien in the future, providing peace of mind to the property owner. The form must be properly acknowledged before a notary public, ensuring its validity. Once executed, it is crucial to record the release with the appropriate county office to protect the interests of the property owner and to update public records accordingly.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejections. Ensure every section, from the holder's mailing address to the borrower's name, is complete.

-

Incorrect Dates: Entering the wrong date for the note or maturity can create confusion. Double-check these dates to ensure accuracy.

-

Missing Signatures: The form must be signed by the holder of the note and lien. Neglecting this crucial step can render the document invalid.

-

Notary Errors: Ensure that the notary public correctly acknowledges the document. An incorrectly completed notary section can lead to complications.

-

Failure to Record: After completion, the form must be recorded with the appropriate county office. Skipping this step means the lien may not be officially released.

-

Incorrect Property Description: Providing an inaccurate description of the property can cause issues. Be specific and thorough to avoid misunderstandings.

-

Ignoring Future Liens: The form releases the property from all current liens, but failing to understand the implications for future debts can lead to complications.

-

Not Keeping Copies: Always retain a copy of the completed form for your records. This can be vital for future reference or disputes.

Find Common Documents

I-134 Affidavit of Support - Sponsors may need to provide tax returns as evidence of income.

Understanding the importance of a Durable Power of Attorney in your estate planning is crucial; this legal document ensures that your financial and legal matters are managed by a trusted individual if you are unable to make decisions for yourself. To learn more about this critical aspect of your planning, you can explore our guide to the Durable Power of Attorney process and secure your future effectively.

Authorization Letter to Travel With a Minor - Ensure your child's safety by completing the parental consent form.

Key takeaways

Filling out and using the Release of Lien Texas form is an important process for property owners and lien holders. Here are key takeaways to consider:

- Understand the Purpose: The form serves to acknowledge that a lien has been satisfied and releases the property from any claims related to that lien.

- Accurate Information: Ensure that all details, such as the holder's name, mailing address, and property description, are filled out correctly to avoid any legal complications.

- Payment Confirmation: The holder of the note must confirm that payment has been made in full before the lien can be released.

- Notary Requirement: The form must be acknowledged by a notary public to be legally binding. This adds an extra layer of verification.

- Waiver of Future Claims: The holder waives any future rights to enforce the lien, which means they cannot claim the lien again for any future debts.

- Recording the Document: After completion, the form should be recorded with the appropriate county office to ensure it is officially recognized.

These points are essential for anyone involved in the lien release process in Texas. Properly completing and using this form can help prevent future disputes over property rights.

Release Of Lien Texas Example

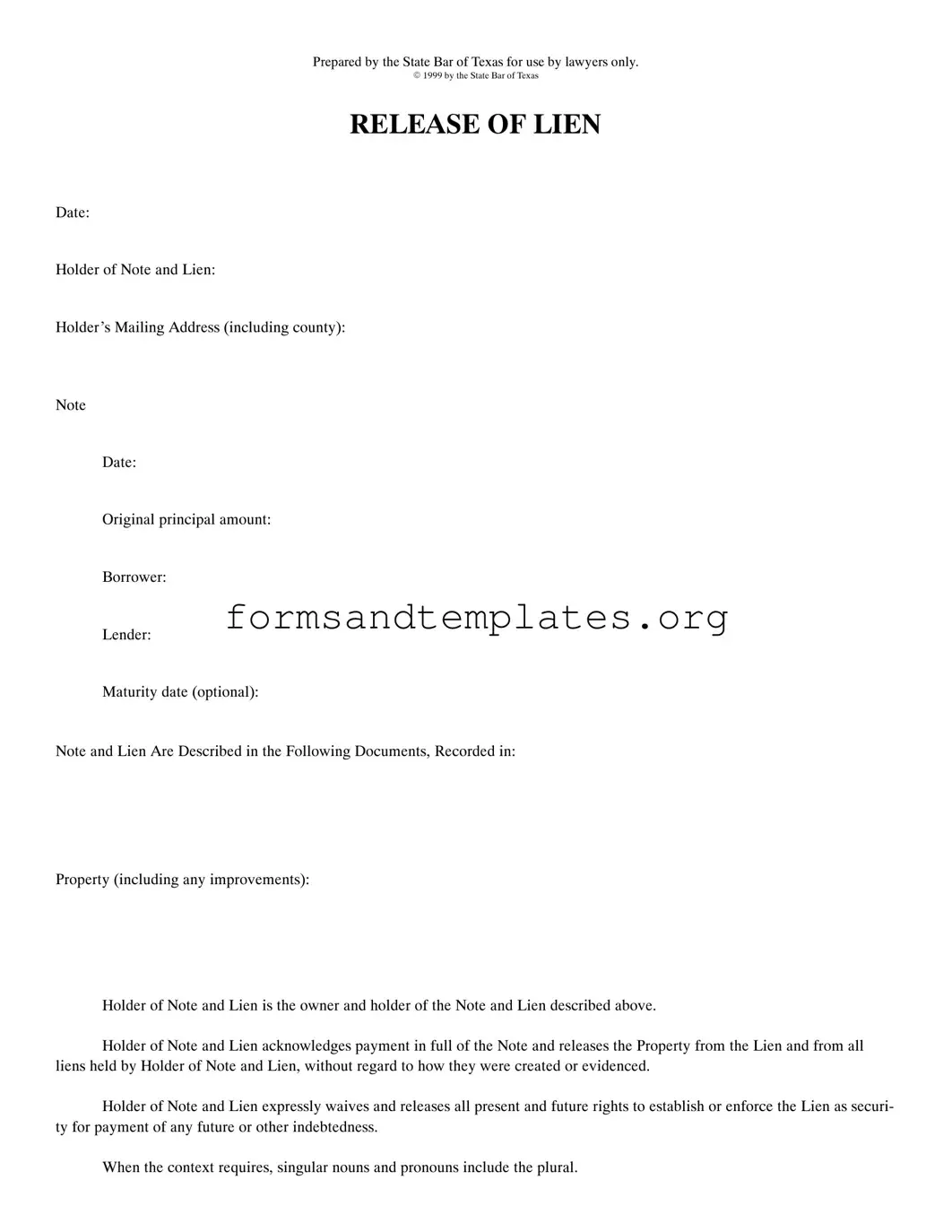

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Understanding Release Of Lien Texas

-

What is a Release of Lien in Texas?

A Release of Lien in Texas is a legal document that removes a lien from a property. When a lien is released, it means that the debt secured by the lien has been paid in full, and the property is free from any claims by the lienholder.

-

Who prepares the Release of Lien form?

The form is typically prepared by a lawyer. It is designed for use by legal professionals to ensure that all necessary details are included and that the document complies with Texas law.

-

What information is needed to complete the form?

To complete the form, you will need the following information:

- Date of the release

- Holder of the note and lien

- Holder’s mailing address

- Note date

- Original principal amount

- Borrower’s name

- Lender’s name

- Maturity date (if applicable)

- Description of the property

-

Why is it important to file a Release of Lien?

Filing a Release of Lien is important because it officially documents that the lien has been satisfied. This protects the property owner by ensuring that there are no lingering claims against the property, which could affect future sales or refinancing.

-

How does the lienholder acknowledge payment?

The lienholder acknowledges payment by signing the Release of Lien form. This signature confirms that they have received full payment and agree to release their claim on the property.

-

What happens if the Release of Lien is not filed?

If the Release of Lien is not filed, the lien may remain on the property. This could lead to complications for the property owner, such as difficulties in selling the property or securing additional financing.

-

Can I file a Release of Lien myself?

While it is possible to file a Release of Lien without a lawyer, it is generally recommended to seek legal assistance. A lawyer can ensure that the form is completed correctly and filed properly with the appropriate county office.

-

Where do I file the Release of Lien?

The Release of Lien must be filed with the county clerk’s office in the county where the property is located. This makes the release a matter of public record.

-

What is the cost to file a Release of Lien?

The cost to file a Release of Lien varies by county. It typically includes a filing fee, which can range from $10 to $50. Check with your local county clerk for specific fees.

-

How long does it take for the Release of Lien to be processed?

The processing time for a Release of Lien can vary. In most cases, it is processed within a few days to a couple of weeks, depending on the county's workload and policies.

How to Use Release Of Lien Texas

After completing the Release of Lien form, it is essential to ensure that all information is accurate and legible. Once filled out, the form should be signed and notarized before being submitted for recording with the appropriate county clerk's office.

- Begin by entering the Date at the top of the form.

- Fill in the Holder of Note and Lien section with the name of the lien holder.

- Provide the Holder’s Mailing Address, including the county.

- Enter the Note Date that corresponds to the original loan agreement.

- Specify the Original principal amount of the loan.

- List the name of the Borrower who took out the loan.

- Identify the Lender who provided the loan.

- If applicable, include the Maturity date of the loan.

- Describe the Note and Lien in the section provided, referencing the recorded documents.

- Detail the Property that is subject to the lien, including any improvements made.

- Confirm that the Holder of Note and Lien acknowledges payment in full and releases the property from the lien.

- Leave space for the Acknowledgment section, where a notary will sign and date the document.

- If applicable, complete the Corporate Acknowledgment section for corporate signers.

- At the bottom of the form, include the address where the document should be returned after recording.