Attorney-Verified Quitclaim Deed Template

The Quitclaim Deed form serves as a crucial tool in real estate transactions, allowing property owners to transfer their interest in a property to another party without making any guarantees about the title. This form is particularly useful in situations where the parties involved have a level of trust, such as between family members or in divorce settlements. Unlike warranty deeds, which provide assurances regarding the title's validity, quitclaim deeds do not protect the grantee against any potential claims or liens on the property. The simplicity of the quitclaim deed process can expedite transfers, making it an appealing option for those looking to quickly convey property rights. Additionally, it is important to note that while the quitclaim deed can be a straightforward method for transferring ownership, it does not remove any existing encumbrances on the property. Understanding the implications of using a quitclaim deed is essential for anyone involved in real estate transactions, as it highlights the need for thorough title searches and awareness of the potential risks associated with this form of property transfer.

Common mistakes

-

Failing to include the correct names of all parties involved. It's essential to ensure that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are accurate and match their legal documents.

-

Not providing a complete legal description of the property. A vague or incomplete description can lead to confusion and potential disputes over property boundaries.

-

Omitting the date of the transfer. The date is crucial for establishing the timeline of the property transfer and can affect legal rights.

-

Neglecting to have the document notarized. Most states require a notarized signature to validate the Quitclaim Deed, ensuring that the identities of the parties are confirmed.

-

Not recording the Quitclaim Deed with the appropriate county office. Failing to file the deed can leave the property transfer unprotected against future claims.

-

Using outdated or incorrect forms. Laws and requirements can change, so it’s important to use the most current version of the Quitclaim Deed form.

-

Overlooking any potential liens or encumbrances on the property. Buyers should be aware of any existing debts or claims against the property before completing the transfer.

-

Assuming that a Quitclaim Deed offers warranties or guarantees. Unlike a warranty deed, a Quitclaim Deed does not provide any assurances regarding the title's validity.

-

Not seeking legal advice when necessary. Consulting with a legal professional can help clarify any uncertainties and ensure that all requirements are met.

Quitclaim Deed - Tailored for State

Create Popular Types of Quitclaim Deed Templates

Lady Bird Deed Form Michigan - This type of deed is advantageous for those who want to keep ownership of their home until they pass away.

The California Power of Attorney for a Child form is a legal document that allows a parent or guardian to grant temporary authority to another adult to make decisions on behalf of their child. This arrangement can be essential in situations such as travel, medical emergencies, or short-term caregiving. To ensure the well-being of your child, consider filling out the form by clicking the button below, or visit California Templates for more information.

Key takeaways

When dealing with a Quitclaim Deed, it is essential to understand its purpose and implications. Here are some key takeaways to consider:

- Definition: A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees.

- Usage: This form is commonly used among family members or in situations where the parties know each other well, such as divorces or estate transfers.

- Title Issues: Unlike a warranty deed, a Quitclaim Deed does not assure the buyer that the title is clear. It merely transfers whatever interest the seller has.

- Filling Out the Form: Ensure that all names, addresses, and property descriptions are accurate and complete to avoid future disputes.

- Notarization: Most states require the Quitclaim Deed to be notarized to be legally binding. Check local requirements.

- Recording: After signing, the deed should be recorded with the local county clerk or recorder’s office to provide public notice of the transfer.

- Tax Implications: Be aware of potential tax consequences when transferring property, including possible gift taxes or reassessment of property taxes.

- Legal Advice: Consulting with a legal expert before using a Quitclaim Deed can help clarify any concerns and ensure compliance with state laws.

- Revocation: Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked without the consent of all parties involved.

Understanding these key points will help you navigate the Quitclaim Deed process more effectively.

Quitclaim Deed Example

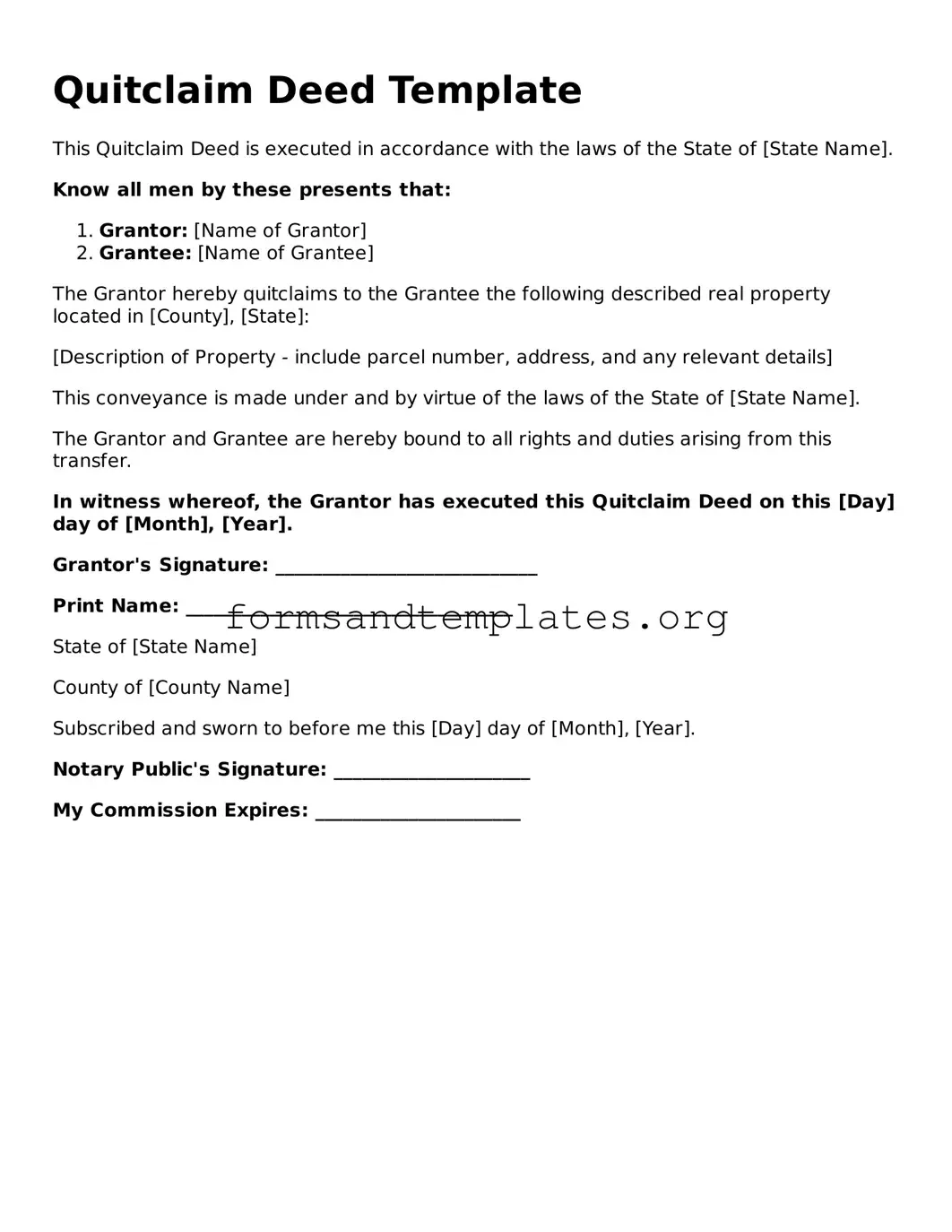

Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of [State Name].

Know all men by these presents that:

- Grantor: [Name of Grantor]

- Grantee: [Name of Grantee]

The Grantor hereby quitclaims to the Grantee the following described real property located in [County], [State]:

[Description of Property - include parcel number, address, and any relevant details]

This conveyance is made under and by virtue of the laws of the State of [State Name].

The Grantor and Grantee are hereby bound to all rights and duties arising from this transfer.

In witness whereof, the Grantor has executed this Quitclaim Deed on this [Day] day of [Month], [Year].

Grantor's Signature: ____________________________

Print Name: ___________________________________

State of [State Name]

County of [County Name]

Subscribed and sworn to before me this [Day] day of [Month], [Year].

Notary Public's Signature: _____________________

My Commission Expires: ______________________

Understanding Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. It provides a way for the current owner, known as the grantor, to relinquish any claim they may have to the property without making any guarantees about the title. This means the new owner, or grantee, receives whatever interest the grantor had, if any, but without any assurances regarding its validity.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in situations such as:

- Transferring property between family members, such as parents to children.

- Divorces, where one spouse may relinquish their interest in a property to the other.

- Clearing up title issues, such as removing a deceased person's name from a property title.

What are the advantages of using a Quitclaim Deed?

Using a Quitclaim Deed offers several benefits:

- It is typically a straightforward and quick process.

- It can be less costly than other types of deeds.

- It allows for easy transfer of property between parties who trust each other.

Are there any disadvantages to a Quitclaim Deed?

While Quitclaim Deeds are useful, they come with certain risks:

- The grantee receives no warranty of title, meaning they may inherit problems such as liens or claims against the property.

- It may not be suitable for transactions involving buyers who require assurance of clear title.

Do I need a lawyer to create a Quitclaim Deed?

While it is not legally required to have a lawyer draft a Quitclaim Deed, it is often advisable. A legal professional can ensure that the deed is properly executed and meets state requirements, minimizing the risk of future disputes.

How do I fill out a Quitclaim Deed?

To complete a Quitclaim Deed, follow these steps:

- Identify the parties involved, including the grantor and grantee.

- Provide a legal description of the property being transferred.

- Include the date of the transfer.

- Sign the deed in front of a notary public.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed guarantees that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed does not provide any guarantees about the title, making it a riskier option for the grantee.

How do I record a Quitclaim Deed?

To record a Quitclaim Deed, you must submit the signed and notarized document to the local county recorder's office where the property is located. There may be a recording fee, and it is essential to keep a copy for your records once it is filed.

Can a Quitclaim Deed be revoked?

A Quitclaim Deed cannot be revoked once it has been executed and recorded. However, if the parties involved wish to change the ownership arrangement, they can create a new deed to retransfer the property.

How to Use Quitclaim Deed

Once you have your Quitclaim Deed form ready, it's essential to complete it accurately to ensure a smooth transfer of property rights. After filling out the form, you will need to sign it in front of a notary public and then file it with the appropriate county office. This process helps to formalize the transfer and make it part of the public record.

- Obtain the Quitclaim Deed form: You can find this form online or at your local county clerk’s office.

- Fill in the Grantor's information: Enter the name and address of the person transferring the property.

- Fill in the Grantee's information: Provide the name and address of the person receiving the property.

- Describe the property: Include a complete legal description of the property being transferred. This may be found on the property deed or tax records.

- Include the consideration: State the amount of money or value exchanged for the property, if applicable. If it’s a gift, you can note that as well.

- Sign the document: The grantor must sign the deed in the presence of a notary public.

- Notarization: The notary will complete their section, confirming the identity of the grantor and witnessing the signature.

- File the deed: Submit the completed and notarized Quitclaim Deed to the county recorder’s office where the property is located.