Attorney-Verified Promissory Note for a Car Template

When it comes to financing a vehicle, a Promissory Note for a Car serves as a crucial document that outlines the agreement between the borrower and the lender. This form details the terms of the loan, including the principal amount, interest rate, and repayment schedule, ensuring that both parties have a clear understanding of their obligations. Additionally, it specifies the consequences of default, providing a safety net for the lender while also protecting the borrower's rights. The Promissory Note typically includes essential information such as the names and addresses of both parties, the vehicle's identification details, and any collateral involved in the transaction. By establishing a formal agreement, this document not only facilitates a smoother transaction but also fosters trust and accountability, making it an indispensable part of the car-buying process. Understanding the components and implications of this form can empower individuals to make informed decisions when financing their next vehicle.

Common mistakes

-

Not including all required information: Many individuals forget to provide essential details such as the borrower's name, address, and contact information. Omitting this information can lead to confusion and potential disputes later on.

-

Incorrectly stating the loan amount: It's crucial to double-check the loan amount. A simple typo can result in significant financial discrepancies that may affect repayment terms.

-

Failing to specify the interest rate: Some people neglect to include the interest rate, which is vital for understanding the total cost of the loan. Without this, the borrower may not grasp the full financial obligation.

-

Not outlining the repayment schedule: A clear repayment schedule is essential. Failing to specify when payments are due can lead to misunderstandings and missed payments.

-

Ignoring late payment penalties: Some individuals overlook the importance of including penalties for late payments. This can lead to confusion and unexpected charges if payments are missed.

-

Not signing the document: It may seem obvious, but forgetting to sign the promissory note is a common mistake. Without a signature, the document lacks legal validity.

-

Neglecting to date the document: Failing to include the date on which the promissory note is signed can create issues regarding the timeline of the agreement.

-

Not keeping a copy for personal records: After filling out the form, it's important to keep a copy for yourself. Many people forget this step, which can lead to difficulties if disputes arise.

-

Overlooking state-specific requirements: Different states may have unique regulations regarding promissory notes. Not being aware of these can result in an invalid agreement.

Create Popular Types of Promissory Note for a Car Templates

Promissory Note Release - This form eliminates any lingering concerns regarding unpaid debts.

The necessary New Jersey Promissory Note serves as a fundamental document for clearly defining loan terms between borrowers and lenders, ensuring both parties understand their rights and obligations.

Key takeaways

Filling out a Promissory Note for a car is an important step in formalizing a loan agreement between the buyer and the seller. Understanding the key elements of this document can help ensure that both parties are protected. Here are some essential takeaways to consider:

- Understand the Purpose: A Promissory Note serves as a written promise to pay a specific amount of money at a designated time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed for the purchase of the car.

- Outline the Interest Rate: If applicable, include the interest rate that will be charged on the loan amount.

- Detail the Repayment Terms: Specify how and when payments will be made, including the frequency and due dates.

- Include Late Fees: Consider stating any penalties for late payments to encourage timely repayment.

- State the Collateral: Identify the car being financed, including its make, model, and VIN, to clarify what is at stake.

- Consider Default Clauses: Outline what will happen if the borrower fails to make payments, including potential repossession of the vehicle.

- Signatures Required: Ensure that both parties sign and date the document, as this validates the agreement.

- Keep Copies: Both the borrower and lender should retain copies of the signed Promissory Note for their records.

By paying attention to these key aspects, both parties can navigate the loan process more smoothly and with a clearer understanding of their rights and responsibilities.

Promissory Note for a Car Example

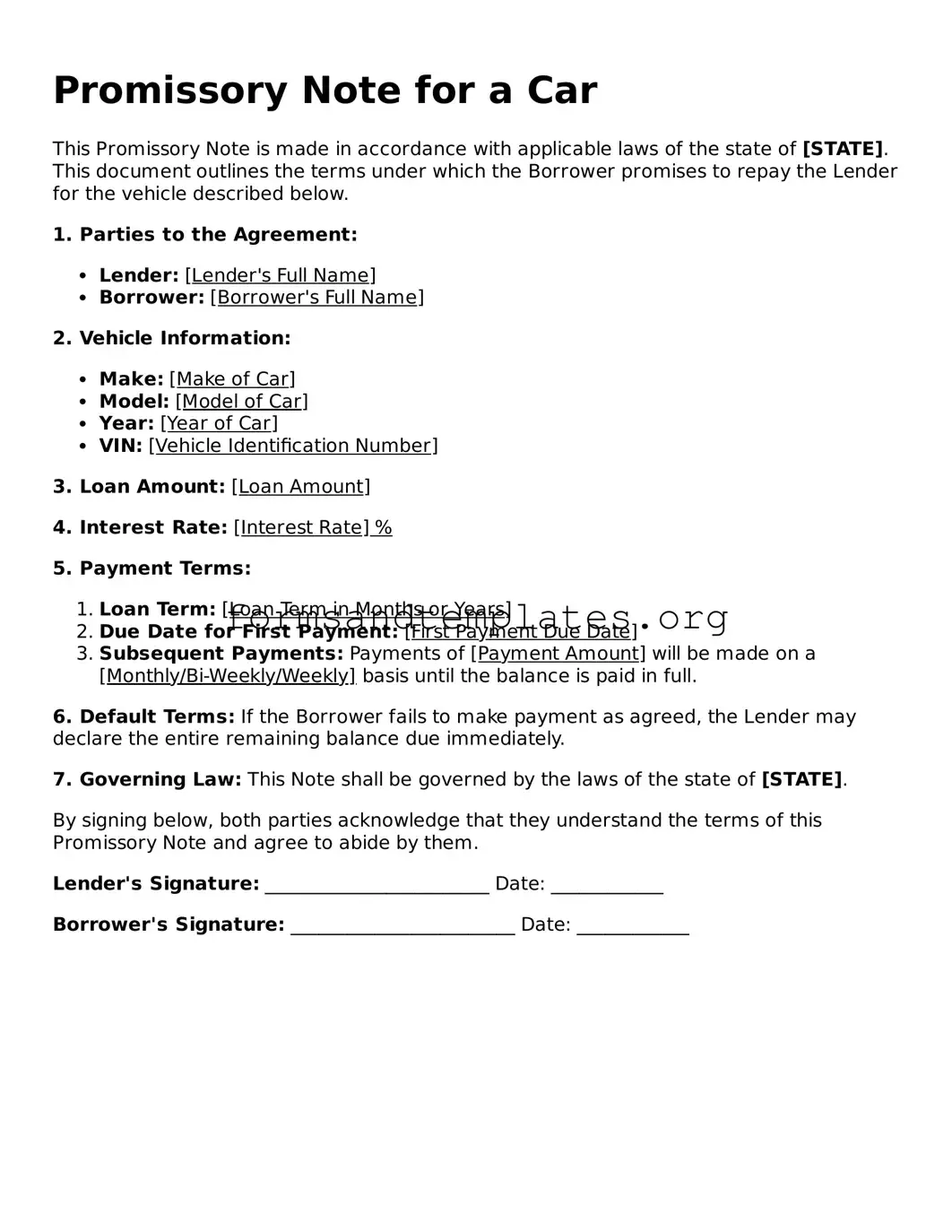

Promissory Note for a Car

This Promissory Note is made in accordance with applicable laws of the state of [STATE]. This document outlines the terms under which the Borrower promises to repay the Lender for the vehicle described below.

1. Parties to the Agreement:

- Lender: [Lender's Full Name]

- Borrower: [Borrower's Full Name]

2. Vehicle Information:

- Make: [Make of Car]

- Model: [Model of Car]

- Year: [Year of Car]

- VIN: [Vehicle Identification Number]

3. Loan Amount: [Loan Amount]

4. Interest Rate: [Interest Rate] %

5. Payment Terms:

- Loan Term: [Loan Term in Months or Years]

- Due Date for First Payment: [First Payment Due Date]

- Subsequent Payments: Payments of [Payment Amount] will be made on a [Monthly/Bi-Weekly/Weekly] basis until the balance is paid in full.

6. Default Terms: If the Borrower fails to make payment as agreed, the Lender may declare the entire remaining balance due immediately.

7. Governing Law: This Note shall be governed by the laws of the state of [STATE].

By signing below, both parties acknowledge that they understand the terms of this Promissory Note and agree to abide by them.

Lender's Signature: ________________________ Date: ____________

Borrower's Signature: ________________________ Date: ____________

Understanding Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document in which one party promises to pay another party a specific amount of money for the purchase of a vehicle. It outlines the terms of the loan, including payment amounts, due dates, and interest rates, if applicable.

Who uses a Promissory Note for a Car?

This document is typically used by individuals purchasing a car from another individual or a dealership when financing is involved. It serves as a formal agreement between the buyer and the seller regarding the loan terms.

What information is included in a Promissory Note for a Car?

The Promissory Note generally includes the following information:

- The names and addresses of the buyer and seller

- The vehicle's make, model, year, and Vehicle Identification Number (VIN)

- The total loan amount

- The interest rate (if applicable)

- The payment schedule, including due dates

- Consequences of defaulting on the loan

Is a Promissory Note legally binding?

Yes, once both parties sign the Promissory Note, it becomes a legally binding contract. Both the buyer and seller are obligated to adhere to the terms outlined in the document.

What happens if the buyer fails to make payments?

If the buyer fails to make payments as agreed, the seller may have the right to take legal action to recover the owed amount. This may include repossession of the vehicle, depending on the terms specified in the note.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and legality.

Do I need a lawyer to create a Promissory Note for a Car?

While it is not legally required to have a lawyer draft a Promissory Note, it is often beneficial to seek legal advice to ensure that the document is complete and enforceable. This can help prevent potential disputes in the future.

How is a Promissory Note different from a Bill of Sale?

A Bill of Sale is a document that transfers ownership of the vehicle from the seller to the buyer. In contrast, a Promissory Note outlines the repayment terms for any loan related to the purchase of the vehicle. Both documents serve different purposes in the transaction process.

Can I use a Promissory Note for a used car?

Yes, a Promissory Note can be used for both new and used cars. The terms of the loan will depend on the agreement between the buyer and seller, regardless of the vehicle's age.

Where can I find a template for a Promissory Note for a Car?

Templates for Promissory Notes can be found online through various legal websites. It is important to choose a template that complies with your state's laws and to customize it to fit the specific details of your transaction.

How to Use Promissory Note for a Car

Once you have the Promissory Note for a Car form, you will need to fill it out carefully. This document is important for both the borrower and the lender. It outlines the terms of the loan and ensures that both parties understand their responsibilities. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form.

- Write the full name of the borrower. Include the address and contact information.

- Next, enter the name of the lender, along with their address and contact details.

- Specify the amount being borrowed. This should be a clear and accurate figure.

- State the interest rate. If there is no interest, indicate that clearly.

- Include the repayment schedule. Specify how often payments will be made (weekly, bi-weekly, monthly) and the due date for each payment.

- Detail the total number of payments that will be made over the life of the loan.

- Describe the collateral, which in this case is the car. Include the make, model, year, and Vehicle Identification Number (VIN).

- Both the borrower and lender should sign and date the form at the bottom. Make sure signatures are clear and legible.

After completing the form, review it for accuracy. It’s important that all information is correct before finalizing the agreement. Both parties should keep a copy of the signed document for their records.