Attorney-Verified Promissory Note Template

The Promissory Note form serves as a vital instrument in the realm of finance and personal lending, encapsulating the essential agreement between a borrower and a lender. This document outlines the specific terms of a loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It establishes the borrower's commitment to repay the borrowed funds, while also detailing the lender's rights should the borrower default. Importantly, the form often includes provisions for late payments and the potential for acceleration of the loan, meaning the lender can demand full repayment if certain conditions are not met. Additionally, the Promissory Note may specify whether it is secured or unsecured, affecting the lender's recourse in the event of non-payment. By clearly delineating the obligations and expectations of both parties, this form not only facilitates trust and transparency but also provides a legal framework that can be enforced in court if disputes arise. Understanding the nuances of this document is crucial for anyone involved in lending or borrowing, as it lays the foundation for a successful financial transaction.

Common mistakes

-

Not including all necessary details: It's important to provide complete information. Missing details like the loan amount, interest rate, or repayment schedule can lead to confusion later.

-

Incorrectly stating the interest rate: Ensure the interest rate is accurate. An error here can change the total amount owed significantly.

-

Failing to specify payment terms: Clearly outline when payments are due. Vague terms can result in misunderstandings between parties.

-

Not including a default clause: A default clause protects both parties. It outlines what happens if payments are missed, so it's crucial to include it.

-

Neglecting to sign the document: A Promissory Note is not valid without signatures. Both the borrower and lender must sign to make it enforceable.

-

Using unclear language: Avoid complicated terms. Use simple language to ensure that all parties understand the agreement.

-

Not keeping copies: Always keep a copy of the signed note for your records. This can help resolve disputes if they arise in the future.

-

Ignoring state laws: Each state may have specific requirements for Promissory Notes. Familiarize yourself with local laws to ensure compliance.

Promissory Note - Tailored for State

Promissory Note Form Types

Fill out Other Templates

Collision Repair Auto Body Repair Estimate Template - Receiving detailed estimates is a step towards better vehicle care.

By utilizing the California Power of Attorney for a Child form, you can grant necessary authority to another trusted adult, ensuring your child's needs are met even in your absence. This document becomes particularly valuable during travel or unforeseen circumstances. For your convenience, access the template through California Templates to fill out the form and safeguard your child's welfare.

Fake Restraining Order Form - The Fake Restraining Order form is designed to provide temporary protection for employees from workplace violence.

Authorization Letter to Travel With a Minor - This is a vital step for youth engagement in various programs and outings.

Key takeaways

Filling out and using a Promissory Note can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understand the Basics: A Promissory Note is a written promise to pay a specific amount of money at a certain time. Knowing this helps clarify its purpose.

- Include Essential Information: Make sure to include the names of both the borrower and the lender, the loan amount, interest rate, and repayment schedule. This information is crucial for clarity.

- Be Clear About Terms: Specify whether the loan is secured or unsecured. This distinction affects the lender's rights if the borrower defaults.

- Consider Legal Requirements: While many states do not require a Promissory Note to be notarized, having it notarized can add an extra layer of protection.

- Keep Copies: Always keep a signed copy for your records. This ensures that both parties have access to the agreed-upon terms.

By following these guidelines, you can create a Promissory Note that protects both the lender and the borrower, making the lending process smoother and more secure.

Promissory Note Example

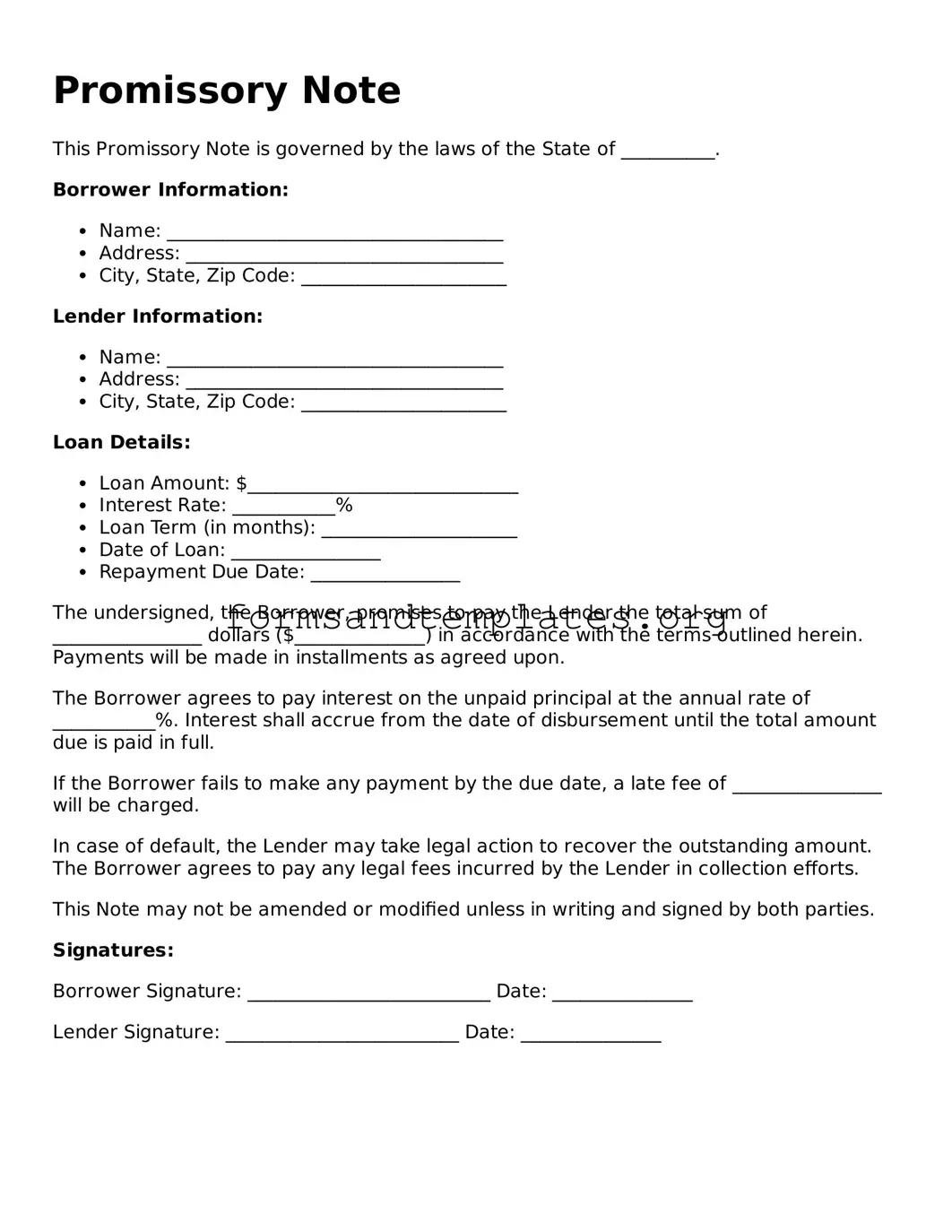

Promissory Note

This Promissory Note is governed by the laws of the State of __________.

Borrower Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip Code: ______________________

Lender Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip Code: ______________________

Loan Details:

- Loan Amount: $_____________________________

- Interest Rate: ___________%

- Loan Term (in months): _____________________

- Date of Loan: ________________

- Repayment Due Date: ________________

The undersigned, the Borrower, promises to pay the Lender the total sum of ________________ dollars ($______________) in accordance with the terms outlined herein. Payments will be made in installments as agreed upon.

The Borrower agrees to pay interest on the unpaid principal at the annual rate of ___________%. Interest shall accrue from the date of disbursement until the total amount due is paid in full.

If the Borrower fails to make any payment by the due date, a late fee of ________________ will be charged.

In case of default, the Lender may take legal action to recover the outstanding amount. The Borrower agrees to pay any legal fees incurred by the Lender in collection efforts.

This Note may not be amended or modified unless in writing and signed by both parties.

Signatures:

Borrower Signature: __________________________ Date: _______________

Lender Signature: _________________________ Date: _______________

Understanding Promissory Note

-

What is a Promissory Note?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a particular time or on demand. It serves as a legal document that outlines the terms of the loan or debt, including the principal amount, interest rate, and repayment schedule.

-

Who typically uses a Promissory Note?

Promissory notes are commonly used by individuals, businesses, and financial institutions. They can be utilized in various situations, such as personal loans between friends or family, business loans, or when financing a purchase, like a car or home.

-

What are the key components of a Promissory Note?

A promissory note generally includes the following key components:

- The names and addresses of the borrower and lender

- The principal amount borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any collateral securing the loan, if applicable

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a promissory note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and the document should be signed by both the borrower and the lender. It is advisable to keep a copy for personal records.

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the amended note to ensure clarity and legal enforceability.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender may take various actions to recover the owed amount. This could include negotiating a new payment plan, initiating legal proceedings, or pursuing any collateral specified in the note. The specific course of action will depend on the terms outlined in the promissory note and applicable laws.

-

Are there different types of Promissory Notes?

Yes, there are several types of promissory notes, including:

- Demand promissory notes, which are payable on demand

- Installment promissory notes, which require regular payments

- Secured promissory notes, which are backed by collateral

- Unsecured promissory notes, which are not backed by collateral

-

Do I need a lawyer to create a Promissory Note?

While it is not strictly necessary to involve a lawyer in creating a promissory note, it can be beneficial. A legal professional can help ensure that the document complies with state laws and adequately protects the interests of both parties.

-

Where can I find a template for a Promissory Note?

Templates for promissory notes can be found online through various legal websites and resources. Many templates are customizable and can be tailored to meet specific needs. It is important to choose a template that complies with local laws and reflects the terms agreed upon by both parties.

-

Can a Promissory Note be transferred to another party?

Yes, a promissory note can typically be transferred to another party, a process known as assignment. The original lender must inform the borrower of the transfer, and the new lender assumes the rights and obligations outlined in the note.

How to Use Promissory Note

Once you have the Promissory Note form in hand, it’s time to fill it out accurately. Completing this form is an essential step in documenting the agreement between the lender and the borrower. Ensure you have all necessary information ready before you begin.

- Start with the date at the top of the form. Write the date when the note is being created.

- Identify the parties involved. Fill in the full name and address of the borrower and the lender.

- Specify the principal amount. This is the total amount of money being borrowed.

- Outline the interest rate. Indicate whether the interest is fixed or variable, and provide the percentage rate.

- Detail the repayment terms. Include how often payments will be made (monthly, quarterly, etc.) and the duration of the loan.

- Include any late fees or penalties. If applicable, specify the amount that will be charged if a payment is late.

- Provide a section for signatures. Both the borrower and lender should sign and date the document to confirm their agreement.

After completing the form, make sure to keep a copy for your records. It’s also advisable to give a copy to the other party involved in the agreement. This ensures that everyone has a clear understanding of the terms outlined in the Promissory Note.