Printable Profit And Loss Template

The Profit and Loss form serves as a vital tool for businesses, providing a clear snapshot of financial performance over a specific period. It captures key elements such as revenues, costs, and expenses, ultimately revealing the net profit or loss incurred. By detailing income sources, whether from sales or services, the form helps stakeholders understand where money is coming from. Equally important are the expenses, which can be categorized into fixed and variable costs, allowing for a comprehensive analysis of spending patterns. This form not only aids in tracking profitability but also plays a crucial role in budgeting and forecasting future financial health. Investors and management alike rely on the insights offered by the Profit and Loss form to make informed decisions, ensuring the business remains on a path toward growth and sustainability.

Common mistakes

-

Omitting Income Sources: Many individuals forget to include all sources of income. This can lead to an inaccurate representation of financial health.

-

Incorrect Categorization: Misclassifying expenses can distort profit calculations. For example, personal expenses should not be mixed with business expenses.

-

Failure to Keep Receipts: Not retaining receipts for expenses can create challenges when verifying costs. This may result in missing deductions during tax preparation.

-

Neglecting to Update Regularly: Some people fill out the form once and forget about it. Regular updates are crucial for an accurate financial overview.

-

Inaccurate Calculations: Simple math errors can lead to significant discrepancies. Double-checking calculations helps ensure accuracy.

-

Ignoring Non-Monetary Contributions: Many overlook non-monetary income, such as barter transactions. These should be included to reflect true profitability.

-

Not Seeking Professional Help: Some individuals attempt to fill out the form without assistance. Consulting a financial advisor can provide valuable insights and prevent mistakes.

Find Common Documents

I-134 Affidavit of Support - The I-134 can foster trust between sponsors and immigration authorities.

Doctor Return to Work Note - The Work Release form can enhance opportunities for job skills development while serving time.

Understanding the ADP Pay Stub form is vital for employees, as it not only outlines their earnings and deductions but also provides essential insight into financial performance. For those looking to streamline their pay stub management, options like Fast PDF Templates can offer valuable resources and templates that make handling these documents more efficient.

Test Drive Agreement Form - Failure to comply with the agreement may incur charges.

Key takeaways

Understanding how to effectively fill out and utilize the Profit and Loss form is essential for managing your business finances. Here are seven key takeaways to keep in mind:

- Accurate data entry is crucial. Ensure that all income and expenses are recorded correctly to reflect the true financial status of your business.

- Regular updates are necessary. Update the form consistently, ideally on a monthly basis, to monitor performance and make informed decisions.

- Analyze trends over time. Look for patterns in your income and expenses to identify areas for improvement or potential growth.

- Use clear categories. Organize income and expenses into distinct categories for easier understanding and analysis.

- Include all sources of income. Don’t overlook any revenue streams, as every dollar contributes to your overall financial picture.

- Review with stakeholders. Share the Profit and Loss form with key team members or advisors to gain insights and feedback.

- Utilize the form for tax preparation. A well-maintained Profit and Loss form simplifies the process of filing taxes and can help maximize deductions.

By keeping these points in mind, you can leverage the Profit and Loss form to enhance your business's financial health.

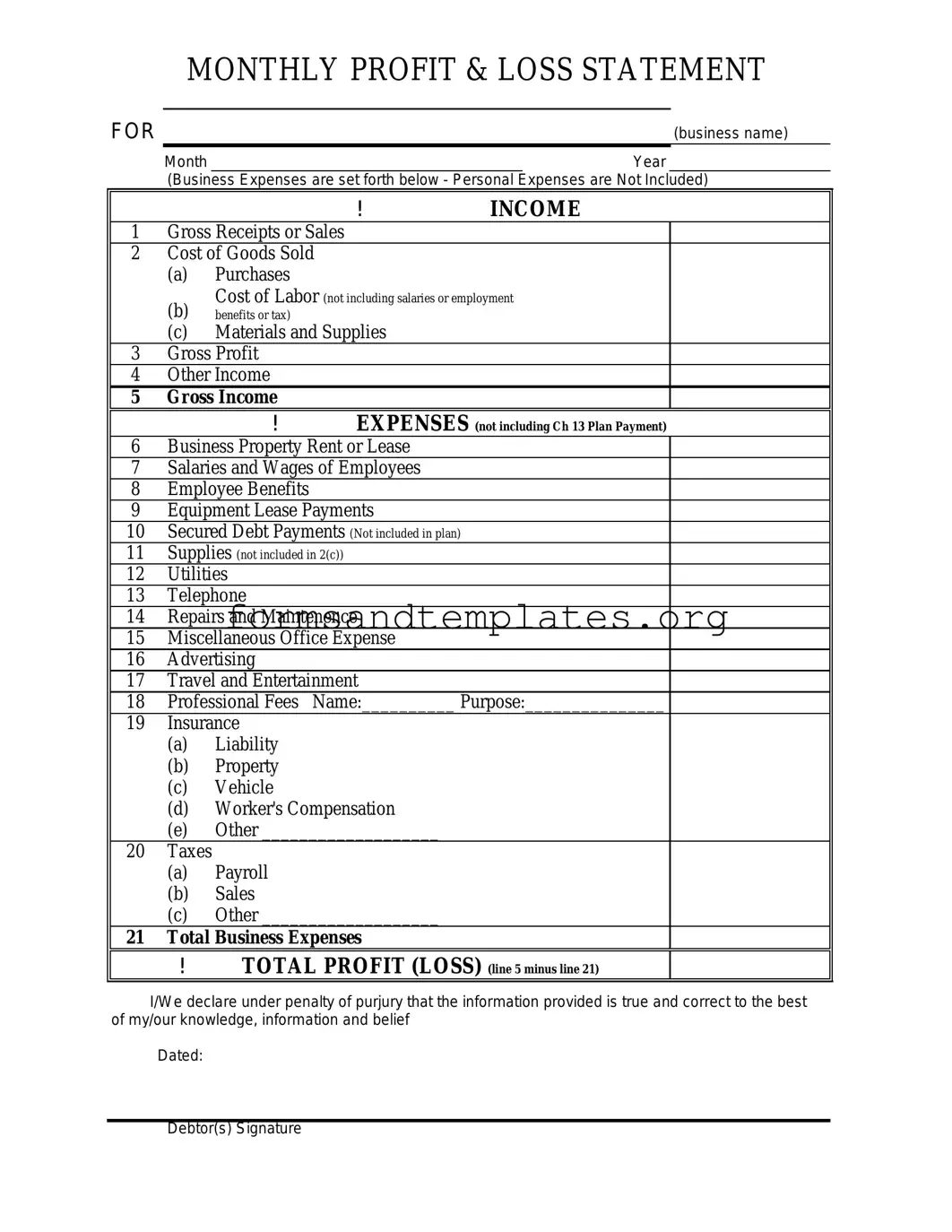

Profit And Loss Example

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Understanding Profit And Loss

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This form helps business owners understand their financial performance and is essential for assessing profitability. By analyzing this statement, stakeholders can make informed decisions about the future of the business.

Why is a Profit and Loss form important?

The Profit and Loss form is crucial for several reasons:

- It provides a clear picture of a company's financial health.

- It helps identify trends in revenue and expenses over time.

- It is often required for tax purposes and when applying for loans or investments.

- It aids in budgeting and forecasting future financial performance.

How often should a Profit and Loss form be prepared?

Typically, businesses prepare a Profit and Loss form on a monthly, quarterly, or annual basis. Monthly reports can help track performance closely, while quarterly and annual reports provide a broader view. The frequency often depends on the size of the business and the needs of its stakeholders.

What are the main components of a Profit and Loss form?

A standard Profit and Loss form includes several key components:

- Revenue: Total income generated from sales of goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred in the normal course of business, such as rent, utilities, and salaries.

- Net Profit: The final profit after all expenses have been deducted from total revenue.

How do I calculate my net profit?

To calculate net profit, follow these steps:

- Start with total revenue.

- Subtract the cost of goods sold to find gross profit.

- Subtract all operating expenses from gross profit.

- The result is your net profit.

It’s essential to ensure that all income and expenses are accurately recorded to get a true picture of profitability.

Can I use a Profit and Loss form for tax purposes?

Yes, the Profit and Loss form is often used for tax purposes. It provides a summary of income and expenses, which is necessary for filing taxes. However, it is advisable to consult with a tax professional to ensure compliance with all tax regulations and to maximize deductions.

What if my business has a net loss?

If your Profit and Loss form shows a net loss, it means that your expenses exceeded your revenue during the reporting period. While this can be concerning, it’s important to analyze the underlying reasons. Consider the following steps:

- Review your expenses to identify areas for cost reduction.

- Evaluate your pricing strategy to ensure competitiveness.

- Look for opportunities to increase sales or diversify revenue streams.

Addressing these factors can help turn a loss into a profit in future periods.

Where can I find a template for a Profit and Loss form?

Many resources offer free or paid templates for Profit and Loss forms. You can find them through accounting software, financial websites, or by searching online. Additionally, consulting with an accountant can provide tailored templates that suit your specific business needs.

How to Use Profit And Loss

Completing the Profit and Loss form is essential for understanding your financial performance. Follow these steps carefully to ensure accurate reporting of your income and expenses.

- Gather all necessary financial documents, including bank statements, invoices, and receipts.

- Open the Profit and Loss form on your computer or print a physical copy.

- Start with the Revenue section. Enter total income from sales and any other revenue sources.

- Move to the Cost of Goods Sold section. List all direct costs associated with producing your goods or services.

- Calculate your Gross Profit by subtracting the Cost of Goods Sold from Revenue.

- Proceed to the Operating Expenses section. Include all indirect costs such as rent, utilities, and salaries.

- Calculate Net Operating Income by subtracting Operating Expenses from Gross Profit.

- If applicable, include any Other Income or Expenses that may affect your total.

- Finally, calculate your Net Profit or Loss by adding or subtracting Other Income or Expenses from Net Operating Income.

- Review all entries for accuracy and completeness before submitting the form.