Attorney-Verified Prenuptial Agreement Template

A prenuptial agreement, often referred to as a prenup, serves as a crucial legal document that outlines the financial and property rights of each spouse in the event of a divorce or separation. This form addresses various important aspects, including the division of assets, debts, and potential spousal support. By establishing clear terms before marriage, couples can mitigate future conflicts and misunderstandings. The prenup typically includes provisions for property acquired before and during the marriage, ensuring that both parties understand their financial responsibilities and entitlements. Additionally, it may address how to handle any future income or inheritance, thereby providing a comprehensive framework for financial management within the marriage. Ultimately, a well-crafted prenuptial agreement fosters transparency and communication, laying a solid foundation for a partnership built on trust and mutual respect.

Common mistakes

-

Not Being Honest About Assets: One common mistake is failing to fully disclose all assets. It’s crucial for both parties to be transparent about what they own. Hiding information can lead to disputes later.

-

Using Ambiguous Language: Clarity is key. Vague terms can cause confusion and misunderstandings. Be specific about what each party is bringing into the marriage and what will happen in case of divorce.

-

Neglecting to Include Debts: Many people focus only on assets. However, debts should also be included. Understanding both parties’ financial responsibilities is important for a fair agreement.

-

Not Seeking Legal Advice: Some individuals fill out the form without consulting a lawyer. This can lead to mistakes that might have been avoided with professional guidance. Each party should have their own legal representation.

-

Failing to Update the Agreement: Life changes, and so do financial situations. Not revisiting the prenuptial agreement after significant life events can make it outdated. Regular reviews ensure it remains relevant.

-

Rushing the Process: Prenuptial agreements should not be filled out in haste. Taking the time to discuss and negotiate terms can prevent issues later. Patience is essential for a solid agreement.

Prenuptial Agreement - Tailored for State

Fill out Other Templates

Consolation Tournament - Consolidate all relevant match information in one comprehensive format.

Osha 301 Requirements - Establish a protocol for documenting near-misses as well.

By using the California Power of Attorney for a Child form, you can provide a trusted adult with the authority to act in your child's best interest when needed, whether it be for travel or medical situations. To streamline the process and safeguard your child's needs, explore the resources available at California Templates.

Miscellaneous Information - Payments to attorneys, even if part of a settlement, can be captured on this form.

Key takeaways

When filling out and using a Prenuptial Agreement form, consider the following key takeaways:

- Both parties should disclose their financial information fully. Transparency is crucial for a valid agreement.

- Each individual should have independent legal representation. This ensures that both parties understand their rights and obligations.

- The agreement must be in writing and signed by both parties. Oral agreements are not enforceable.

- Review and update the agreement periodically. Life changes, such as the birth of children or significant financial changes, may necessitate revisions.

- Ensure that the agreement complies with state laws. Each state has specific requirements regarding prenuptial agreements.

- Consider including provisions for property division, spousal support, and debt responsibility. Clear terms can help prevent disputes in the future.

Prenuptial Agreement Example

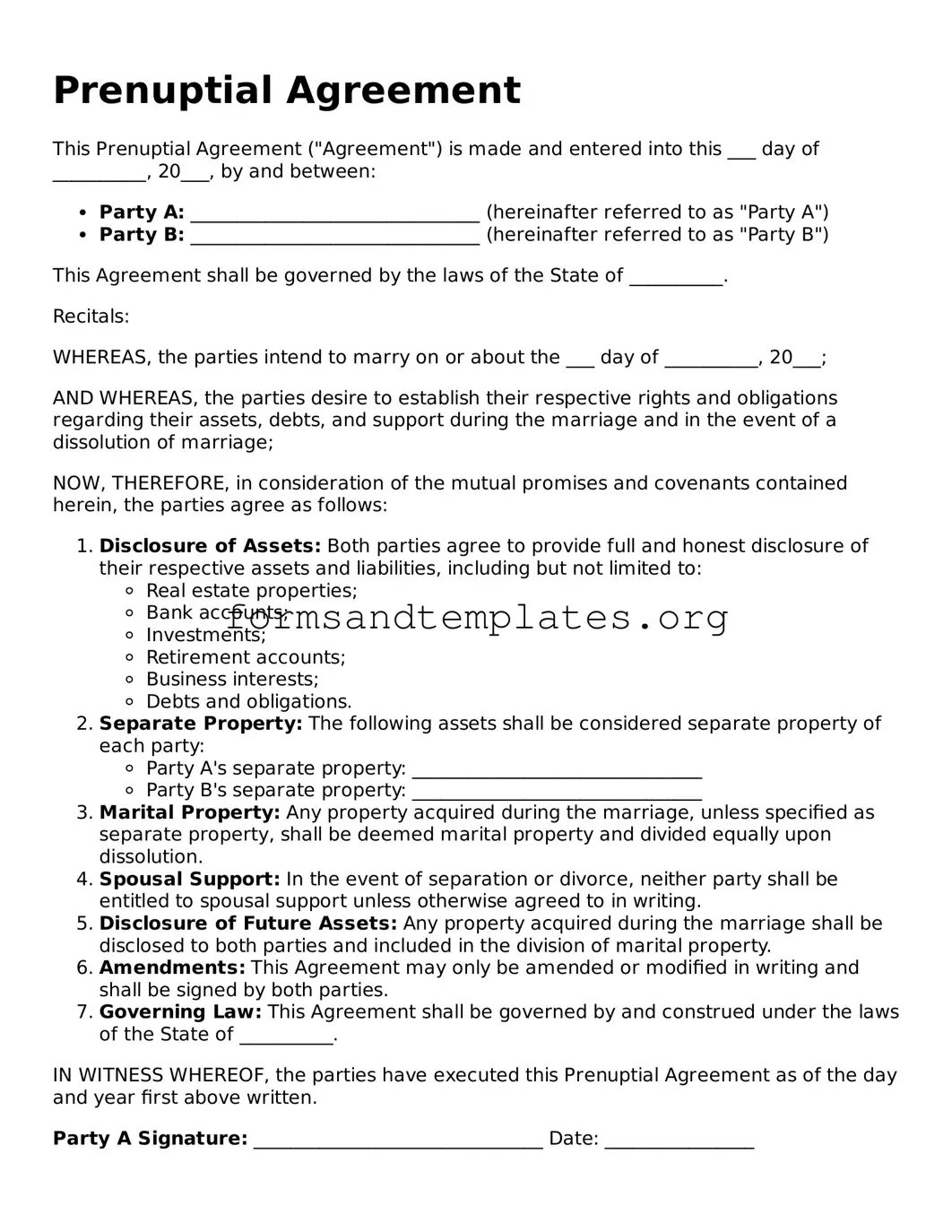

Prenuptial Agreement

This Prenuptial Agreement ("Agreement") is made and entered into this ___ day of __________, 20___, by and between:

- Party A: _______________________________ (hereinafter referred to as "Party A")

- Party B: _______________________________ (hereinafter referred to as "Party B")

This Agreement shall be governed by the laws of the State of __________.

Recitals:

WHEREAS, the parties intend to marry on or about the ___ day of __________, 20___;

AND WHEREAS, the parties desire to establish their respective rights and obligations regarding their assets, debts, and support during the marriage and in the event of a dissolution of marriage;

NOW, THEREFORE, in consideration of the mutual promises and covenants contained herein, the parties agree as follows:

- Disclosure of Assets: Both parties agree to provide full and honest disclosure of their respective assets and liabilities, including but not limited to:

- Real estate properties;

- Bank accounts;

- Investments;

- Retirement accounts;

- Business interests;

- Debts and obligations.

- Separate Property: The following assets shall be considered separate property of each party:

- Party A's separate property: _______________________________

- Party B's separate property: _______________________________

- Marital Property: Any property acquired during the marriage, unless specified as separate property, shall be deemed marital property and divided equally upon dissolution.

- Spousal Support: In the event of separation or divorce, neither party shall be entitled to spousal support unless otherwise agreed to in writing.

- Disclosure of Future Assets: Any property acquired during the marriage shall be disclosed to both parties and included in the division of marital property.

- Amendments: This Agreement may only be amended or modified in writing and shall be signed by both parties.

- Governing Law: This Agreement shall be governed by and construed under the laws of the State of __________.

IN WITNESS WHEREOF, the parties have executed this Prenuptial Agreement as of the day and year first above written.

Party A Signature: _______________________________ Date: ________________

Party B Signature: _______________________________ Date: ________________

Witness Signature: _______________________________ Date: ________________

Witness Signature: _______________________________ Date: ________________

Understanding Prenuptial Agreement

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal contract created by two individuals before they get married. This document outlines how assets and debts will be divided in the event of a divorce or separation. It can also address other matters such as spousal support and the management of finances during the marriage. By establishing clear terms ahead of time, couples can avoid potential disputes and misunderstandings in the future.

Why should I consider a prenuptial agreement?

Many couples choose to enter into a prenuptial agreement for several reasons:

- Asset Protection: If one or both partners have significant assets, a prenup can help protect those assets from being divided in a divorce.

- Debt Management: A prenup can specify how debts will be handled, ensuring that one partner is not held responsible for the other's debts.

- Clarity and Communication: Discussing and drafting a prenup encourages open communication about finances, which can strengthen the relationship.

- Customizable Terms: Couples can tailor the agreement to fit their unique circumstances, addressing specific concerns that matter to them.

How do I create a prenuptial agreement?

Creating a prenuptial agreement involves several steps:

- Consult a Lawyer: It's advisable for both parties to seek independent legal advice to ensure their interests are protected.

- Discuss Terms: Openly discuss what you want to include in the agreement. This might cover property division, spousal support, and other financial matters.

- Draft the Agreement: Once terms are agreed upon, a lawyer can help draft the document to ensure it meets legal requirements.

- Review and Revise: Both parties should carefully review the agreement and make any necessary revisions.

- Sign the Agreement: The prenup must be signed by both parties, ideally well in advance of the wedding date.

Are prenuptial agreements enforceable?

Yes, prenuptial agreements are generally enforceable in most states, provided they meet certain legal standards. To be valid, the agreement must be in writing, signed by both parties, and entered into voluntarily. Additionally, it should be fair and not unconscionable at the time of enforcement. Courts may scrutinize the agreement for any signs of coercion or lack of full disclosure of assets. Therefore, it's crucial to ensure that both parties fully understand the terms and implications of the agreement.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified or revoked after marriage, but both parties must agree to the changes. This is typically done through a written amendment or a new agreement. It's important to consult with legal counsel when making changes to ensure that the new terms are enforceable and comply with state laws. Couples may choose to revisit their prenup as their financial situations or life circumstances evolve, ensuring that it continues to reflect their current needs and intentions.

How to Use Prenuptial Agreement

Filling out a Prenuptial Agreement form can be an important step for couples planning their future together. This document helps clarify financial arrangements and responsibilities before marriage, ensuring both parties have a mutual understanding. Here’s a straightforward guide to help you navigate the process of completing the form.

- Gather Personal Information: Collect essential details such as full names, addresses, and contact information for both partners.

- List Assets and Debts: Create a comprehensive inventory of all assets and debts each partner brings into the marriage. This includes bank accounts, properties, investments, and any liabilities.

- Define Separate and Marital Property: Clearly distinguish what will be considered separate property (owned before marriage) and what will be marital property (acquired during the marriage).

- Discuss Financial Responsibilities: Outline how financial responsibilities will be managed during the marriage, including expenses, savings, and investments.

- Consider Future Earnings: Address how future earnings and increases in asset value will be handled. Will they remain separate or be considered marital property?

- Include Provisions for Changes: Determine how changes in circumstances, such as children or significant financial changes, will affect the agreement.

- Consult Legal Advice: It’s wise to seek guidance from a legal professional who specializes in family law to ensure the agreement is fair and enforceable.

- Review and Sign: Once both partners are satisfied with the terms, review the document thoroughly and sign it in the presence of a notary public.

By following these steps, couples can create a clear and mutually agreed-upon framework for their financial future. This proactive approach can foster open communication and trust as they embark on their journey together.