Attorney-Verified Personal Guarantee Template

The Personal Guarantee form serves as a crucial document in various financial and business transactions, often acting as a safety net for lenders and service providers. This form is typically signed by an individual who agrees to be personally responsible for the debts or obligations of a business entity, ensuring that if the business fails to meet its financial commitments, the individual will cover those debts. Key aspects of the form include the identification of the parties involved, the specific obligations being guaranteed, and the terms under which the guarantee will be enforced. Additionally, it often outlines the duration of the guarantee and any limitations on liability. Understanding the implications of signing a Personal Guarantee is essential, as it can significantly impact one's personal finances and creditworthiness. It is important to approach this document with care, as the responsibilities it entails can extend well beyond the life of the business itself.

Common mistakes

-

Inaccurate Information: Providing incorrect personal details, such as name, address, or Social Security number, can lead to significant issues. Always double-check for accuracy.

-

Not Reading the Fine Print: Many overlook the terms and conditions included in the form. Understanding your obligations is crucial before signing.

-

Failure to Understand Liability: Some signers do not fully grasp the extent of their financial responsibility. It's important to recognize that a personal guarantee can mean personal assets are at risk.

-

Neglecting to Consult a Professional: Skipping legal advice can lead to misunderstandings. Consulting with a lawyer can clarify your rights and responsibilities.

-

Not Keeping a Copy: After submission, many forget to retain a copy of the signed form. Keeping records is essential for future reference and protection.

Create Popular Types of Personal Guarantee Templates

Private Mortgage Contract - Offers a straightforward method for sellers to reach potential buyers.

Purchase Agreement Addendum - This addendum can be critical for commercial property transactions.

In the realm of real estate, clarity and mutual understanding are vital, making the Texas Real Estate Purchase Agreement an essential tool for both buyers and sellers. This document not only defines the obligations of each party but also provides a clear structure to the transaction. For those seeking a reliable template, Texas Forms Online offers a useful resource to help ensure that nothing is overlooked in this critical agreement.

Real Estate Agent Termination Letter - Completing this form is an important step to officially cease all contractual obligations.

Key takeaways

When filling out and using the Personal Guarantee form, keep the following key takeaways in mind:

- Understand the purpose of the form. A Personal Guarantee provides assurance to lenders or creditors that an individual will be responsible for a debt if the primary borrower defaults.

- Provide accurate personal information. Include your full name, address, and contact details to ensure the form is valid and can be processed efficiently.

- Review the terms carefully. Read through the obligations and responsibilities outlined in the guarantee to ensure you fully understand what you are committing to.

- Consult with a financial advisor or attorney if needed. It’s wise to seek professional advice before signing, especially if you have concerns about the implications of the guarantee.

- Be mindful of the financial implications. Consider your ability to cover the debt should the primary borrower fail to do so.

- Sign and date the form where indicated. Your signature confirms your agreement to the terms laid out in the Personal Guarantee.

- Keep a copy for your records. After submitting the form, retain a copy for your personal files to reference in the future.

- Notify the lender of any changes. If your personal information changes, inform the lender to maintain accurate records.

- Understand the duration of the guarantee. Be aware of how long your guarantee is in effect and any conditions that may lead to its termination.

Personal Guarantee Example

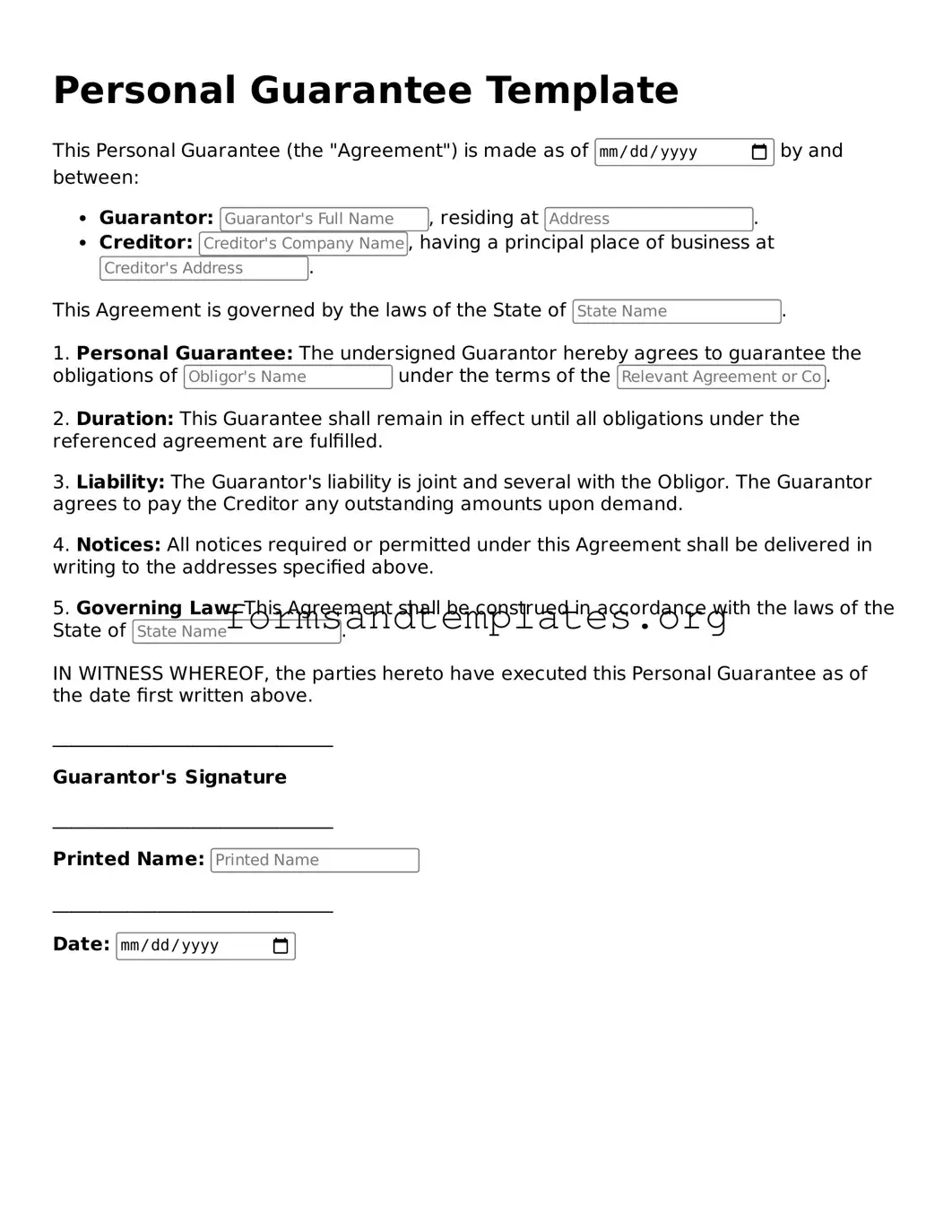

Personal Guarantee Template

This Personal Guarantee (the "Agreement") is made as of by and between:

- Guarantor: , residing at .

- Creditor: , having a principal place of business at .

This Agreement is governed by the laws of the State of .

1. Personal Guarantee: The undersigned Guarantor hereby agrees to guarantee the obligations of under the terms of the .

2. Duration: This Guarantee shall remain in effect until all obligations under the referenced agreement are fulfilled.

3. Liability: The Guarantor's liability is joint and several with the Obligor. The Guarantor agrees to pay the Creditor any outstanding amounts upon demand.

4. Notices: All notices required or permitted under this Agreement shall be delivered in writing to the addresses specified above.

5. Governing Law: This Agreement shall be construed in accordance with the laws of the State of .

IN WITNESS WHEREOF, the parties hereto have executed this Personal Guarantee as of the date first written above.

______________________________

Guarantor's Signature

______________________________

Printed Name:

______________________________

Date:

Understanding Personal Guarantee

What is a Personal Guarantee form?

A Personal Guarantee form is a document that an individual signs to agree to be personally responsible for the debts or obligations of a business or another individual. This form is often required by lenders or suppliers when extending credit to a business. By signing this form, the guarantor provides assurance that they will fulfill the financial obligations if the primary party fails to do so.

Who typically needs to sign a Personal Guarantee?

Typically, owners or key stakeholders of a business may be asked to sign a Personal Guarantee. This includes:

- Business owners who are applying for loans.

- Partners in a partnership agreement.

- Individuals seeking credit for a startup or small business.

In some cases, even individuals who are not owners but have a significant role in the business may be required to provide a guarantee.

What are the risks associated with signing a Personal Guarantee?

Signing a Personal Guarantee carries certain risks. The most significant risk is that the guarantor may be held personally liable for the business's debts. If the business defaults on its obligations, the lender or creditor can pursue the guarantor's personal assets, including bank accounts, property, and other valuables. Therefore, individuals should carefully consider their financial situation and the viability of the business before signing.

Can a Personal Guarantee be revoked or canceled?

A Personal Guarantee is generally a binding commitment. However, there are circumstances under which it may be revoked or canceled. This typically requires:

- Mutual agreement between the parties involved.

- Completion of the obligations outlined in the guarantee.

- A formal release document to be signed by the lender or creditor.

It is advisable to consult with a legal professional to understand the specific terms and conditions related to revoking a Personal Guarantee.

How to Use Personal Guarantee

After you have gathered all necessary information, you are ready to complete the Personal Guarantee form. This form requires your personal details and a commitment to guarantee a loan or obligation. Follow these steps carefully to ensure accurate completion.

- Begin by entering your full legal name in the designated field.

- Provide your current address, including city, state, and zip code.

- Input your phone number and email address for contact purposes.

- List your Social Security Number (SSN) in the appropriate section.

- Indicate your date of birth.

- Fill in your employment information, including your employer’s name and your job title.

- Specify your annual income and any other relevant financial information requested.

- Read through the terms of the guarantee carefully.

- Sign and date the form at the bottom.

Once you have completed the form, review it for any errors or missing information. Make sure to keep a copy for your records before submitting it to the relevant party.