Printable Payroll Check Template

The Payroll Check form serves as a crucial document in the payroll process, ensuring that employees receive their rightful compensation in a timely manner. This form typically includes essential details such as the employee's name, identification number, and the pay period for which the payment is being issued. Additionally, it outlines the gross pay, deductions, and net pay, providing transparency regarding how the final amount was calculated. Employers must ensure that the form is completed accurately to avoid any discrepancies that could lead to confusion or delays in payment. Furthermore, the Payroll Check form often requires signatures from authorized personnel, confirming that the payment has been reviewed and approved. Understanding the components and significance of this form is vital for both employers and employees, as it facilitates a smooth payroll process and fosters trust in the employer-employee relationship.

Common mistakes

-

Missing Employee Information: Failing to include essential details such as the employee's name, address, and social security number can lead to delays in processing.

-

Incorrect Pay Period Dates: Entering wrong dates for the pay period can result in inaccurate payments. Always double-check the start and end dates.

-

Wrong Payment Amount: Miscalculating hours worked or not applying the correct hourly wage can cause significant errors in the paycheck.

-

Omitting Deductions: Forgetting to list deductions such as taxes, insurance, or retirement contributions can lead to incorrect net pay.

-

Using an Outdated Form: Using an old version of the Payroll Check form may lead to compliance issues. Always ensure you are using the most current version.

-

Not Signing the Form: A lack of signature from the authorized person can render the form invalid. Ensure that all necessary signatures are included.

-

Inconsistent Formatting: Using different formats for dates or numbers can cause confusion. Stick to a consistent format throughout the form.

-

Failing to Keep Copies: Not retaining a copy of the completed Payroll Check form can lead to problems if there are discrepancies later. Always keep records for your files.

Find Common Documents

Warranty on Roof - Documenting changes or repairs made to the roof is essential for tracking warranty claims.

When entering into a rental arrangement, it is essential to have a clear understanding of the terms involved, which can be effectively achieved through the use of a California Residential Lease Agreement. This document not only helps to delineate the responsibilities of both the landlord and tenant but also serves as a reference point in case of disputes. For those looking to streamline the process, the form is readily available at California Templates, making it easier to embark on your rental journey.

Real Id Veteran Status - The VSD 001 form is used in California for verifying veteran status and service-connected disabilities.

Puppy Health Record - This health record stands as a comprehensive source of your puppy's medical history.

Key takeaways

Filling out and using a Payroll Check form is essential for ensuring employees are paid correctly and on time. Here are some key takeaways to keep in mind:

- Accuracy is crucial. Double-check all entries to avoid mistakes that could delay payments.

- Include all necessary information, such as employee name, hours worked, and pay rate.

- Make sure to calculate taxes and deductions correctly to comply with federal and state laws.

- Keep a copy of each Payroll Check form for your records. This helps in case of disputes or audits.

- Use clear and legible handwriting or type the information to ensure clarity.

- Distribute checks promptly to maintain employee trust and satisfaction.

- Stay updated on any changes in tax rates or labor laws that may affect payroll calculations.

By following these guidelines, you can streamline the payroll process and ensure compliance with regulations.

Payroll Check Example

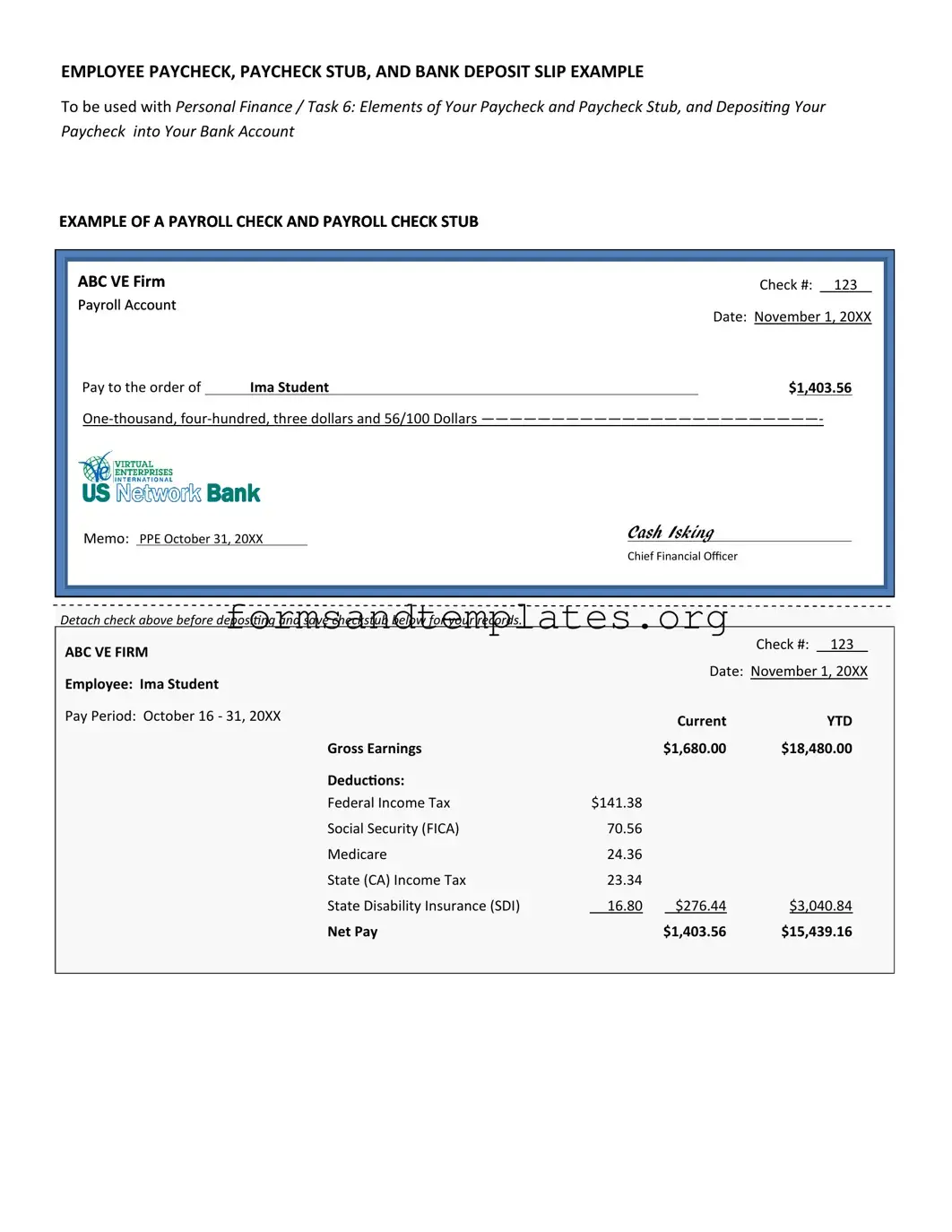

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

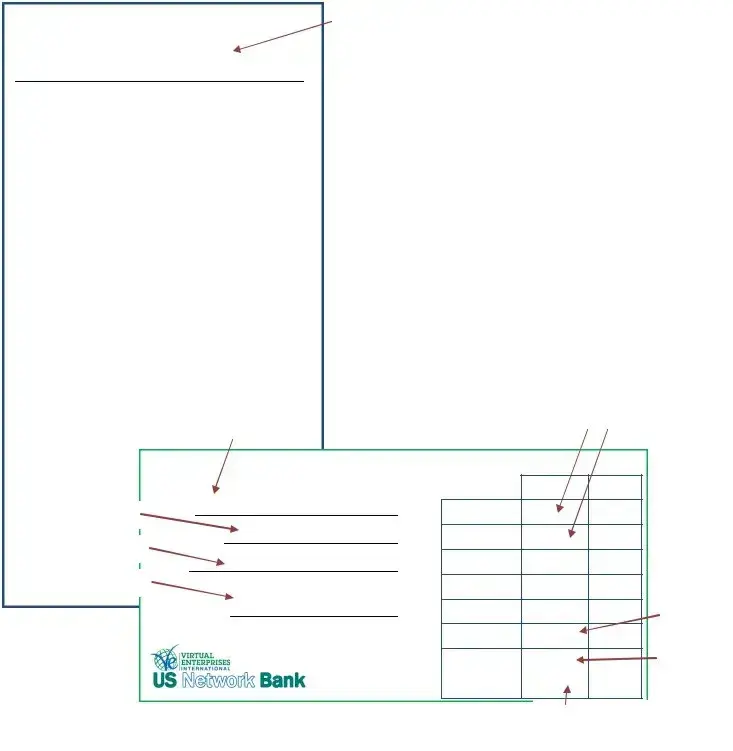

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Understanding Payroll Check

What is the Payroll Check form?

The Payroll Check form is a document used by employers to process employee payments. It includes important information such as the employee's name, pay period, hours worked, and the total amount to be paid. This form ensures that employees receive their wages accurately and on time.

Who needs to fill out the Payroll Check form?

Typically, the Payroll Check form needs to be filled out by the employer or the payroll department. However, employees may need to provide their personal information, such as their name and hours worked, to ensure that the form is completed correctly.

How often is the Payroll Check form submitted?

The frequency of submitting the Payroll Check form depends on the company’s payroll schedule. Most businesses process payroll on a weekly, bi-weekly, or monthly basis. It's essential to follow the specific timeline set by your employer to ensure timely payments.

What information is required on the Payroll Check form?

The Payroll Check form generally requires the following information:

- Employee’s full name

- Employee identification number or Social Security number

- Pay period dates

- Total hours worked

- Hourly wage or salary

- Any deductions or withholdings

- Total amount to be paid

What should I do if I notice an error on my Payroll Check form?

If you find an error on your Payroll Check form, it’s important to address it promptly. Contact your payroll department or supervisor as soon as possible. Provide them with the correct information and keep a record of your communication. This will help ensure that the issue is resolved quickly.

Can I request direct deposit instead of a physical check?

Yes, many employers offer direct deposit as an option for payroll payments. If you prefer direct deposit, you will typically need to fill out a separate form with your bank account details. Check with your HR or payroll department to see if this option is available and to obtain the necessary forms.

What happens if I forget to submit my Payroll Check form?

If you forget to submit your Payroll Check form, it could delay your payment. It’s best to submit it as soon as you remember. Communicate with your payroll department about the oversight. They may be able to expedite the process to ensure you receive your payment on time.

How to Use Payroll Check

Filling out the Payroll Check form is a straightforward process that ensures employees are compensated accurately for their work. By following these steps, you will create a complete and correct payroll check that meets all necessary requirements.

- Start with the date: Write the current date at the top of the form. This indicates when the check is issued.

- Enter the employee's name: Fill in the full name of the employee receiving the payment. Ensure the spelling is correct.

- Provide the employee's address: Include the complete address of the employee, including street, city, state, and zip code.

- List the pay period: Specify the dates for the pay period that the check covers. This helps clarify the time frame for the payment.

- Detail the amount: Write the total amount being paid to the employee in both numerical and written form. Double-check for accuracy.

- Include deductions: If applicable, list any deductions that may apply to the paycheck, such as taxes or benefits.

- Sign the check: The authorized person must sign the check at the bottom to validate it. This step is crucial for the check to be processed.

- Provide a memo: Optionally, include a brief note or memo that explains the purpose of the payment, such as "salary for October."

Once you have completed these steps, you will have a properly filled out Payroll Check form ready for processing. Ensure that all information is accurate and legible to avoid any issues with payment delivery.