Attorney-Verified Owner Financing Contract Template

Owner financing is a popular alternative to traditional mortgage financing, allowing buyers to purchase real estate directly from sellers without involving banks or other financial institutions. This arrangement can be beneficial for both parties, as it often facilitates a quicker sale and provides more flexible terms. The Owner Financing Contract form serves as a critical document in this process, outlining the terms and conditions agreed upon by the buyer and seller. Key aspects of the form include the purchase price, down payment amount, interest rate, payment schedule, and the duration of the loan. Additionally, it details responsibilities for property maintenance and outlines the consequences of default. By clearly defining these elements, the contract helps protect both the buyer's and seller's interests, ensuring that each party understands their obligations and rights throughout the transaction. This form is essential for creating a legally binding agreement that can prevent disputes and misunderstandings in the future.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to confusion or disputes. Ensure that names, addresses, and financial details are fully filled out.

-

Incorrect Payment Terms: Misstating the interest rate or payment schedule can create financial strain. Double-check these terms to ensure accuracy and clarity.

-

Neglecting Legal Requirements: Overlooking state-specific regulations may result in an unenforceable contract. Research local laws to ensure compliance.

-

Forgetting Signatures: Omitting signatures from either party renders the contract invalid. Confirm that all necessary parties have signed the document.

-

Not Including Contingencies: Failing to address potential issues, such as property inspections or financing contingencies, can lead to complications later. Clearly outline any contingencies to protect all parties involved.

Create Popular Types of Owner Financing Contract Templates

Real Estate Agent Termination Letter - In case of disputes, having a termination form can support a party’s claims in a legal setting.

The Texas Real Estate Purchase Agreement form is a legally binding document that outlines the conditions and terms under which the sale of a property will take place. It ensures that both the buyer and seller are clear on the details of the transaction, from the sales price to the closing date. For anyone looking to buy or sell property in Texas, this document is essential. To access a useful template for this agreement, you can visit https://txtemplate.com/real-estate-purchase-agreement-pdf-template/ to get started on filling out your form.

Personal Guarantee Example - A Personal Guarantee secures financial obligations by linking an individual to the debtor’s responsibilities.

Purchase Agreement Addendum - This document can include additional provisions for personal property sales.

Key takeaways

Here are some important points to consider when filling out and using the Owner Financing Contract form:

- Understand the Terms: Familiarize yourself with all terms and conditions outlined in the contract. Clarity on these points can prevent misunderstandings later.

- Include Accurate Information: Ensure that all personal and property details are filled out correctly. This includes names, addresses, and property descriptions.

- Payment Structure: Clearly define the payment terms, including the down payment, interest rate, and payment schedule. This will help both parties know what to expect.

- Legal Review: Consider having a legal professional review the contract before signing. This step can help identify any potential issues.

- Keep Copies: After completing the contract, make sure to keep copies for both parties. This ensures that everyone has access to the same information.

Owner Financing Contract Example

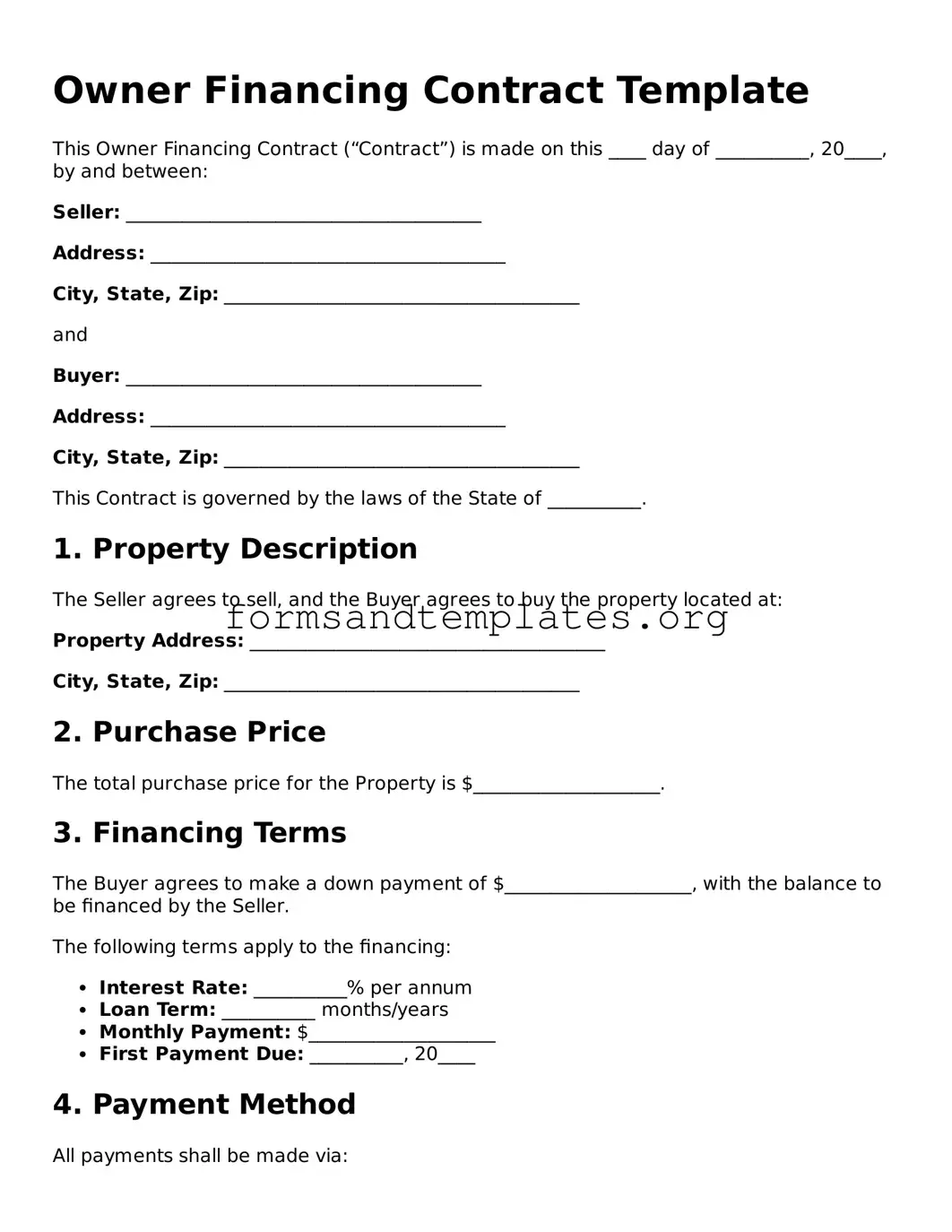

Owner Financing Contract Template

This Owner Financing Contract (“Contract”) is made on this ____ day of __________, 20____, by and between:

Seller: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

and

Buyer: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

This Contract is governed by the laws of the State of __________.

1. Property Description

The Seller agrees to sell, and the Buyer agrees to buy the property located at:

Property Address: ______________________________________

City, State, Zip: ______________________________________

2. Purchase Price

The total purchase price for the Property is $____________________.

3. Financing Terms

The Buyer agrees to make a down payment of $____________________, with the balance to be financed by the Seller.

The following terms apply to the financing:

- Interest Rate: __________% per annum

- Loan Term: __________ months/years

- Monthly Payment: $____________________

- First Payment Due: __________, 20____

4. Payment Method

All payments shall be made via:

- Check

- Electronic transfer

- Other: ______________________

5. Closing Costs

Both parties agree to share the closing costs as follows:

- Seller: __________% of costs

- Buyer: __________% of costs

6. Default

In the event of a default by the Buyer, the Seller retains the right to:

- Terminate this Contract

- Retain any payments made as liquidated damages

7. Governing Law

This Contract shall be governed by the laws of the State of __________.

8. Signatures

By signing below, both parties agree to the terms of this Contract.

______________________________________

Seller's Signature Date: __________

______________________________________

Buyer's Signature Date: __________

This Contract is binding upon both parties and their respective heirs, assigns, and successors.

Understanding Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a property seller and a buyer, allowing the buyer to purchase the property directly from the seller without involving traditional lenders. In this arrangement, the seller acts as the bank, providing financing to the buyer to complete the purchase. This type of contract can be beneficial for buyers who may not qualify for conventional loans and for sellers looking to attract more potential buyers.

Who can use an Owner Financing Contract?

Both individual sellers and buyers can utilize an Owner Financing Contract. Sellers who own their property outright and wish to sell it can offer financing as an option. Buyers who may have difficulty securing a mortgage due to credit issues or other financial constraints can benefit from this arrangement. It is essential for both parties to understand the terms and conditions laid out in the contract.

What are the key components of an Owner Financing Contract?

Several critical components should be included in an Owner Financing Contract:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial amount the buyer pays upfront, which reduces the financed amount.

- Interest Rate: The rate at which interest will accrue on the financed amount.

- Loan Term: The duration over which the buyer will repay the loan.

- Payment Schedule: Details on how often payments will be made (monthly, quarterly, etc.).

- Default Terms: Conditions that outline what happens if the buyer fails to make payments.

What are the benefits of using an Owner Financing Contract?

Owner financing offers several advantages:

- Flexibility: Sellers can set their terms, including interest rates and payment schedules.

- Faster Transactions: Bypassing banks can speed up the buying process.

- Wider Audience: Sellers can attract buyers who might not qualify for traditional financing.

- Potential for Higher Sale Price: Sellers may command a higher price due to the financing option.

Are there any risks associated with Owner Financing Contracts?

Yes, there are risks involved for both parties. For sellers, the risk includes the possibility of the buyer defaulting on payments, which could lead to foreclosure proceedings. For buyers, the primary risk is that they may not have the same protections as traditional mortgage borrowers, such as those provided by federal laws. It is crucial for both parties to conduct thorough due diligence and consider seeking legal advice before entering into this type of agreement.

How can I ensure that my Owner Financing Contract is legally binding?

To make an Owner Financing Contract legally binding, it should be written clearly and include all necessary components. Both parties must sign the contract, and it is advisable to have it notarized. Additionally, recording the contract with the local county recorder's office can provide further protection and public notice of the agreement. Consulting with a real estate attorney can help ensure that all legal requirements are met.

Can I modify an existing Owner Financing Contract?

Yes, modifications to an existing Owner Financing Contract can be made, but they must be documented in writing and signed by both parties. Common reasons for modifications include changes to the payment schedule or interest rate. It is essential to ensure that any amendments comply with the original terms of the contract and applicable laws to maintain its validity.

How to Use Owner Financing Contract

Completing the Owner Financing Contract form is a straightforward process. This document outlines the terms and conditions under which the seller agrees to finance the buyer's purchase of property. It is essential to provide accurate information to ensure clarity and legal compliance.

- Obtain the form: Ensure you have the correct Owner Financing Contract form. You can typically find this document online or through a legal forms provider.

- Fill in the date: At the top of the form, write the date when the contract is being filled out.

- Identify the parties: Enter the full names and addresses of both the seller and the buyer. This information should be accurate and current.

- Describe the property: Provide a detailed description of the property being sold. Include the address, parcel number, and any other identifying information.

- Outline the purchase price: Clearly state the total purchase price of the property. This figure should reflect the agreed-upon amount between the buyer and seller.

- Detail financing terms: Specify the amount of the down payment, interest rate, payment schedule, and loan term. This section is crucial for both parties to understand their financial obligations.

- Include any contingencies: If there are any conditions that must be met for the sale to proceed, list them in this section. This may include inspections or financing approvals.

- Sign and date: Both parties must sign and date the contract at the bottom of the form. Ensure that signatures are legible and that the dates are correct.

- Make copies: After completing the form, make copies for both the seller and buyer. Each party should retain a signed copy for their records.