Attorney-Verified Operating Agreement Template

An Operating Agreement is a crucial document for any limited liability company (LLC) as it outlines the management structure and operational procedures of the business. This form serves as a roadmap for how the LLC will function, detailing the roles and responsibilities of each member, the distribution of profits and losses, and the procedures for making important decisions. It also addresses how new members can be added and what happens if a member decides to leave the company. By establishing clear guidelines, the Operating Agreement helps prevent disputes among members and provides a framework for resolving conflicts should they arise. Additionally, having this agreement in place can enhance the credibility of the LLC in the eyes of banks and potential investors. Understanding the components of an Operating Agreement is essential for anyone looking to form an LLC, as it ensures that all members are on the same page and protects their interests over the long term.

Common mistakes

-

Omitting essential member information. It is crucial to include the names and addresses of all members involved in the business.

-

Failing to specify the management structure. Clearly defining whether the business will be member-managed or manager-managed is important for operational clarity.

-

Not addressing profit and loss distribution. Members should agree on how profits and losses will be allocated to avoid future disputes.

-

Ignoring the process for adding or removing members. A well-defined procedure for membership changes helps maintain stability within the organization.

-

Neglecting to outline decision-making processes. Establishing how decisions will be made, including voting rights and procedures, is vital for effective governance.

-

Overlooking dispute resolution methods. Including a plan for resolving disagreements can prevent conflicts from escalating.

-

Not addressing the duration of the agreement. It is advisable to specify whether the agreement is perpetual or has a defined term.

-

Failing to review and update the agreement regularly. As circumstances change, the operating agreement should be revisited to reflect current conditions.

-

Neglecting to consult legal counsel. Seeking professional advice can help ensure that the agreement complies with state laws and meets the specific needs of the business.

Operating Agreement - Tailored for State

Operating Agreement Form Types

Fill out Other Templates

Flu Vaccine Card - This record serves as a foundational document for your child's medical history.

To streamline your application process, you can access the Chick-fil-A Job Request form, which is essential for those wishing to pursue a career with this beloved fast-food chain.

How to Fill Out a Conditional Waiver and Release on Progress Payment - Encourages trust between property owners and contractors in financial dealings.

Salary Advance Agreement - Support your financial situation with an advance using this form.

Key takeaways

Filling out and utilizing an Operating Agreement form is a crucial step for any business entity, particularly limited liability companies (LLCs). Here are some key takeaways to consider:

- Clarifies Ownership Structure: The Operating Agreement outlines the ownership percentages of each member, providing clarity on who owns what in the company.

- Defines Roles and Responsibilities: It specifies the roles of each member, helping to avoid confusion about responsibilities and decision-making authority.

- Establishes Operating Procedures: The agreement details how the business will operate day-to-day, including voting rights and procedures for making major decisions.

- Protects Limited Liability Status: A well-drafted Operating Agreement can help maintain the limited liability status of the members, protecting personal assets from business liabilities.

- Facilitates Dispute Resolution: It includes provisions for resolving disputes among members, which can help prevent conflicts from escalating into legal battles.

- Guides Membership Changes: The agreement outlines the process for adding or removing members, ensuring a clear path for changes in ownership.

- Enhances Credibility: Having a formal Operating Agreement can enhance the credibility of the business in the eyes of banks, investors, and potential partners.

- Legal Compliance: While not always legally required, having an Operating Agreement can help meet state requirements and demonstrate the seriousness of the business structure.

Understanding these key points can significantly impact the effectiveness of the Operating Agreement and the overall success of the business.

Operating Agreement Example

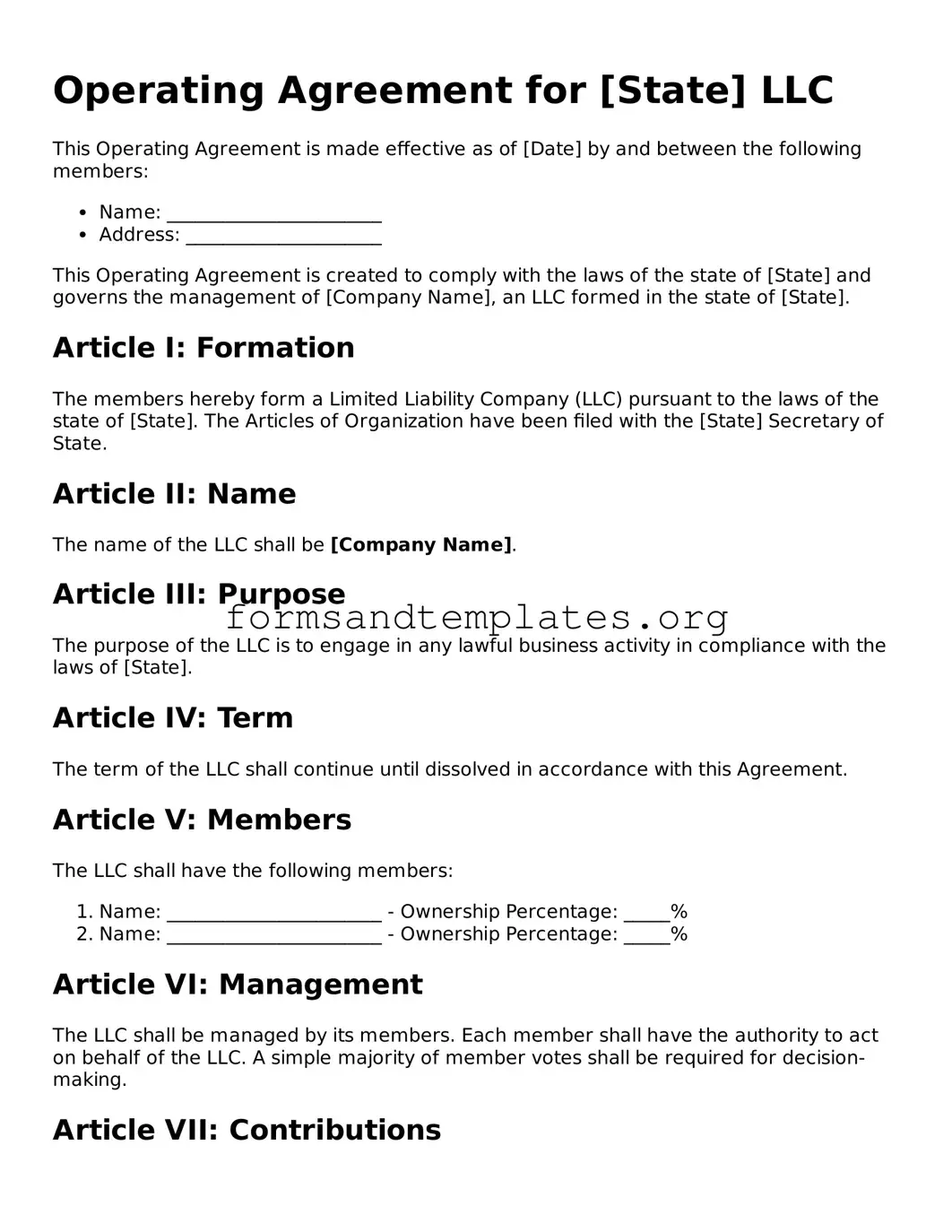

Operating Agreement for [State] LLC

This Operating Agreement is made effective as of [Date] by and between the following members:

- Name: _______________________

- Address: _____________________

This Operating Agreement is created to comply with the laws of the state of [State] and governs the management of [Company Name], an LLC formed in the state of [State].

Article I: Formation

The members hereby form a Limited Liability Company (LLC) pursuant to the laws of the state of [State]. The Articles of Organization have been filed with the [State] Secretary of State.

Article II: Name

The name of the LLC shall be [Company Name].

Article III: Purpose

The purpose of the LLC is to engage in any lawful business activity in compliance with the laws of [State].

Article IV: Term

The term of the LLC shall continue until dissolved in accordance with this Agreement.

Article V: Members

The LLC shall have the following members:

- Name: _______________________ - Ownership Percentage: _____%

- Name: _______________________ - Ownership Percentage: _____%

Article VI: Management

The LLC shall be managed by its members. Each member shall have the authority to act on behalf of the LLC. A simple majority of member votes shall be required for decision-making.

Article VII: Contributions

Each member shall make an initial capital contribution as follows:

- Name: _______________________ - Contribution: $__________

- Name: _______________________ - Contribution: $__________

Article VIII: Distributions

Profits and losses shall be allocated to members in accordance with their ownership percentages. Distributions shall be made annually, or as decided by the members.

Article IX: Indemnification

The LLC shall indemnify its members to the fullest extent permitted by law against any losses incurred in the course of performing their duties.

Article X: Amendments

This Agreement may be amended only by a written agreement signed by all members.

Article XI: Governing Law

This Agreement shall be governed by the laws of the state of [State].

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the day and year first above written.

_______________________________

Member Signature

_______________________________

Member Signature

Understanding Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC). It serves as a blueprint for how the LLC will be run and details the rights and responsibilities of its members. This agreement is crucial for ensuring that all members are on the same page regarding the operation of the business.

Why do I need an Operating Agreement?

Having an Operating Agreement is important for several reasons:

- It helps clarify the roles and responsibilities of each member.

- It provides a framework for resolving disputes among members.

- It can protect your personal assets by reinforcing the limited liability status of the LLC.

- Some banks and investors may require an Operating Agreement to open a business account or provide funding.

Who should create the Operating Agreement?

All members of the LLC should participate in creating the Operating Agreement. This ensures that everyone’s input is considered and that all members agree on the terms. It’s advisable to consult with a legal professional to ensure that the agreement meets all legal requirements and adequately protects the interests of all members.

What should be included in an Operating Agreement?

An Operating Agreement typically includes the following key elements:

- The name and purpose of the LLC.

- The names and addresses of the members.

- The management structure (member-managed or manager-managed).

- Voting rights and procedures.

- Distribution of profits and losses.

- Procedures for adding or removing members.

- How disputes will be resolved.

- Amendment procedures for the agreement.

Is an Operating Agreement required by law?

While not all states require LLCs to have an Operating Agreement, it is highly recommended. Some states may mandate it if there are multiple members. Even in states where it is not required, having one can help prevent misunderstandings and protect your business interests.

Can I change the Operating Agreement after it’s created?

Yes, the Operating Agreement can be amended. Most agreements will include a section that outlines the process for making changes. Typically, a majority vote of the members is needed to approve any amendments. It’s important to document any changes in writing to maintain clarity and legal standing.

What happens if I don’t have an Operating Agreement?

If you do not have an Operating Agreement, your LLC will be governed by the default rules of your state’s LLC laws. This can lead to unexpected outcomes, such as profit distribution that does not align with your intentions or difficulties in resolving disputes. Without a clear agreement, members may face challenges in managing the business effectively.

How can I create an Operating Agreement?

You can create an Operating Agreement by drafting it yourself or using templates available online. However, for the best results, consider consulting with a legal professional. They can help tailor the agreement to your specific business needs and ensure compliance with state laws.

Where should I store my Operating Agreement?

It’s important to keep your Operating Agreement in a safe place where all members can access it. This could be a physical file in a secure location or a digital copy stored in a cloud service. Ensure that all members have a copy and know where to find it for reference.

How to Use Operating Agreement

Filling out the Operating Agreement form is an important step in establishing the rules and guidelines for your business. This document will help clarify the roles and responsibilities of all members involved. Follow the steps below to complete the form accurately.

- Begin by entering the name of your business. Make sure it matches the name registered with your state.

- Provide the principal address of your business. This is where official documents will be sent.

- List all members of the business. Include their full names and addresses.

- Specify the ownership percentage for each member. This shows how much of the business each person owns.

- Detail the management structure. Indicate whether the business will be member-managed or manager-managed.

- Outline the voting rights of each member. Clarify how decisions will be made within the business.

- Include provisions for adding new members. Describe the process for admitting new individuals into the business.

- Address the process for handling disputes. Specify how disagreements among members will be resolved.

- Sign and date the document. All members must sign to indicate their agreement to the terms outlined.