Transfer-on-Death Deed Template for the State of New Jersey

In New Jersey, planning for the future often involves making decisions about how to transfer property after passing away. One useful tool for this purpose is the Transfer-on-Death Deed (TODD). This form allows property owners to designate beneficiaries who will receive their real estate directly upon their death, bypassing the often lengthy and costly probate process. By filling out this deed, individuals can maintain control over their property during their lifetime while ensuring a smooth transition to their chosen heirs. The TODD can be revoked or modified at any time, offering flexibility as circumstances change. It's important to understand the specific requirements for completing this deed, including the need for proper execution and recording, to ensure that it holds up in court. With the right knowledge, property owners can make informed decisions that align with their estate planning goals.

Common mistakes

-

Inaccurate Property Description: One common mistake involves failing to provide a clear and accurate description of the property. The deed must specify the property in a way that is easily identifiable. Omitting details or using vague language can lead to confusion or disputes later on.

-

Not Including All Required Signatures: The Transfer-on-Death Deed requires signatures from all owners of the property. Neglecting to obtain the necessary signatures can invalidate the deed, leaving the intended beneficiary without the property upon the owner's death.

-

Improper Witnessing and Notarization: New Jersey law mandates that the deed must be properly witnessed and notarized. Failing to follow these requirements can render the deed ineffective. It is essential to ensure that the signing process complies with legal standards.

-

Not Recording the Deed: After completing the Transfer-on-Death Deed, many people forget to record it with the county clerk's office. This step is crucial; if the deed is not recorded, it may not be recognized, and the property could be subject to probate.

Other Common Transfer-on-Death Deed State Templates

Transfer on Death Deed Virginia - Assists in immediate property access for beneficiaries following death.

When preparing for the future, understanding the significance of a meticulously drafted Last Will and Testament can be crucial. This document serves as a powerful declaration of your wishes, ensuring that your assets are allocated according to your desires. To explore more about the implications and benefits, check out this resource: detailed Last Will and Testament guide.

Property Title Transfer Attorney - By using a Transfer-on-Death Deed, you can maintain control of your property during your lifetime while deciding who will receive it afterward.

Key takeaways

When considering the New Jersey Transfer-on-Death Deed form, it is important to understand its implications and requirements. Here are key takeaways to keep in mind:

- Eligibility: The Transfer-on-Death Deed can only be used for residential real estate owned by individuals, not by corporations or partnerships.

- Beneficiary Designation: Clearly identify the beneficiary or beneficiaries who will inherit the property upon the owner’s death. This designation must be made explicitly in the deed.

- Execution Requirements: The deed must be signed by the property owner in the presence of a notary public. This ensures that the document is legally valid.

- Recording the Deed: After execution, the deed must be recorded with the county clerk’s office where the property is located. This step is crucial for the deed to take effect.

- Revocation: The property owner can revoke the Transfer-on-Death Deed at any time before death. This provides flexibility should circumstances change.

Understanding these aspects can help ensure a smooth transfer of property and avoid potential disputes among heirs.

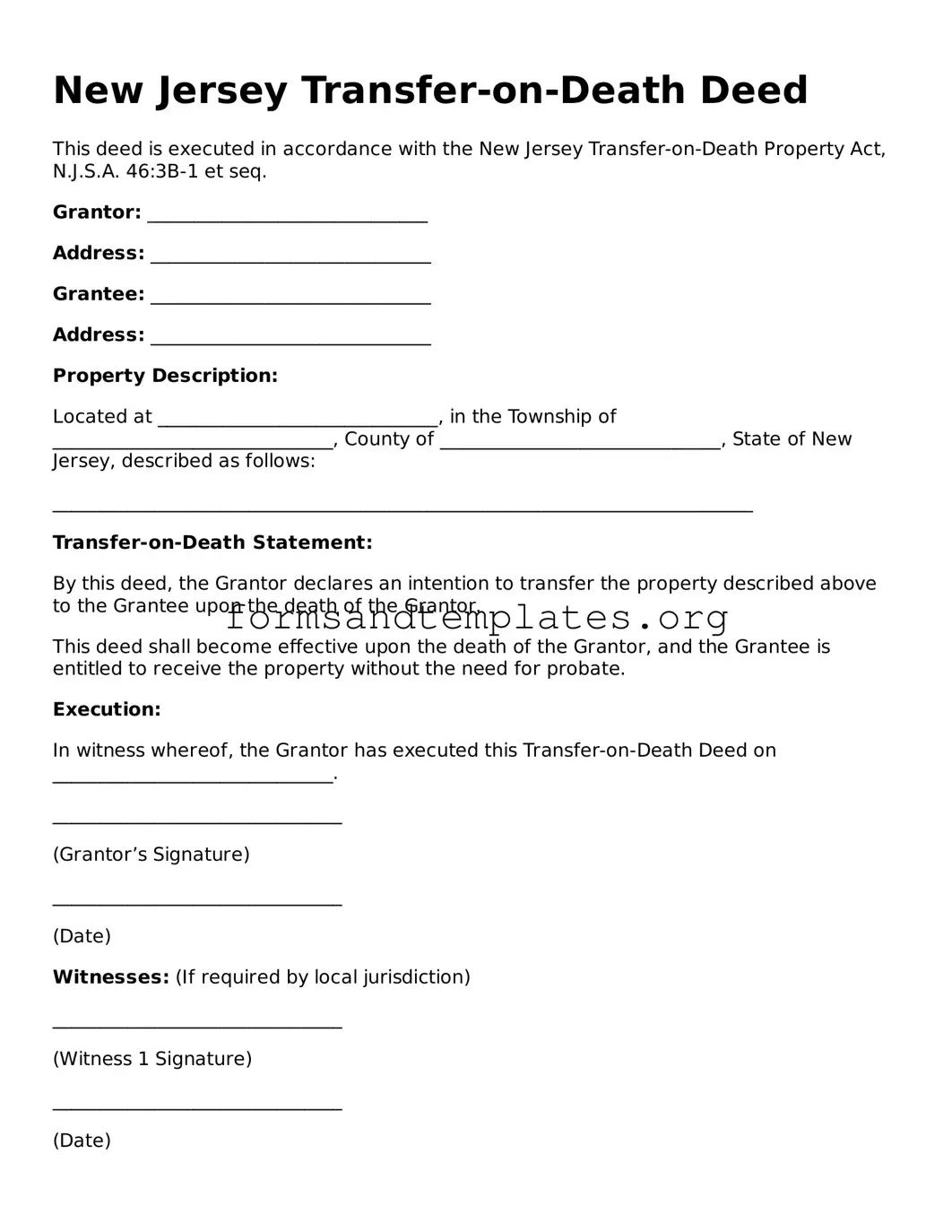

New Jersey Transfer-on-Death Deed Example

New Jersey Transfer-on-Death Deed

This deed is executed in accordance with the New Jersey Transfer-on-Death Property Act, N.J.S.A. 46:3B-1 et seq.

Grantor: ______________________________

Address: ______________________________

Grantee: ______________________________

Address: ______________________________

Property Description:

Located at ______________________________, in the Township of ______________________________, County of ______________________________, State of New Jersey, described as follows:

___________________________________________________________________________

Transfer-on-Death Statement:

By this deed, the Grantor declares an intention to transfer the property described above to the Grantee upon the death of the Grantor.

This deed shall become effective upon the death of the Grantor, and the Grantee is entitled to receive the property without the need for probate.

Execution:

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on ______________________________.

_______________________________

(Grantor’s Signature)

_______________________________

(Date)

Witnesses: (If required by local jurisdiction)

_______________________________

(Witness 1 Signature)

_______________________________

(Date)

_______________________________

(Witness 2 Signature)

_______________________________

(Date)

Notary Public:

State of New Jersey, County of _________________

Subscribed and sworn to before me on ________________, 20____.

_______________________________

Notary Public Signature

My Commission Expires: ________________

Understanding New Jersey Transfer-on-Death Deed

What is a Transfer-on-Death Deed in New Jersey?

A Transfer-on-Death Deed (TODD) allows property owners in New Jersey to transfer real estate to beneficiaries upon their death without going through probate. This deed enables you to retain full control of your property while you're alive, and it automatically transfers ownership to the designated beneficiaries when you pass away.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in New Jersey can use a Transfer-on-Death Deed. This includes homeowners and property owners. However, it's important to ensure that you are of sound mind and legal age to execute the deed. Additionally, you must not be subject to any legal restrictions regarding property ownership.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, follow these steps:

- Obtain the official Transfer-on-Death Deed form from the New Jersey Division of Taxation or your local county clerk's office.

- Fill out the form with the required information, including your name, the property description, and the names of the beneficiaries.

- Sign the deed in the presence of a notary public.

- Record the deed with the county clerk's office where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must complete a new deed or a formal revocation form and record it with the county clerk's office. Ensure that the new deed clearly states your intention to revoke the previous deed to avoid any confusion.

What happens if I sell the property before I die?

If you sell the property before your death, the Transfer-on-Death Deed becomes void. The new owner will not be affected by the deed, and the beneficiaries listed will not have any claim to the property. It's essential to understand that the deed only takes effect upon your death and is tied to the property as long as you retain ownership.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences. The property is not considered part of your estate for tax purposes until your death. However, beneficiaries may be responsible for property taxes once they inherit the property. It's advisable to consult with a tax professional for personalized guidance based on your specific situation.

How to Use New Jersey Transfer-on-Death Deed

Filling out the New Jersey Transfer-on-Death Deed form is a straightforward process. After completing the form, you will need to ensure it is signed, witnessed, and recorded with the county clerk's office. This will help ensure that your wishes regarding property transfer are honored after your passing.

- Obtain the Transfer-on-Death Deed form from the New Jersey Division of Taxation website or your local county clerk's office.

- Fill in your name as the owner of the property in the designated section.

- Provide the address and legal description of the property you wish to transfer.

- Identify the beneficiary or beneficiaries by entering their names and addresses in the appropriate fields.

- Include any specific instructions regarding the transfer, if applicable.

- Sign the form in the presence of a notary public to ensure it is legally binding.

- Have two witnesses sign the document as required by New Jersey law.

- Make a copy of the completed form for your records.

- Submit the original signed and witnessed form to the county clerk's office where the property is located for recording.