Promissory Note Template for the State of New Jersey

The New Jersey Promissory Note form is an essential document that outlines the terms of a loan agreement between a lender and a borrower. This form serves as a written promise from the borrower to repay a specified amount of money, along with any agreed-upon interest, within a certain timeframe. Key components of the form include the principal amount, interest rate, payment schedule, and any penalties for late payments. Additionally, it often details the rights and responsibilities of both parties involved, ensuring clarity and protection in the lending process. Whether you are lending money to a friend or entering into a formal business agreement, understanding the New Jersey Promissory Note form is crucial. This document not only formalizes the transaction but also provides a clear framework for what to expect, making it a valuable tool for managing financial relationships.

Common mistakes

-

Incorrect Names: People often make the mistake of misspelling names or using nicknames instead of legal names. This can create confusion and lead to enforceability issues later on.

-

Missing Signatures: Failing to sign the document is a common error. Both the borrower and lender must sign the note for it to be valid.

-

Ambiguous Terms: Sometimes, individuals do not clearly define the loan amount, interest rate, or repayment schedule. This lack of clarity can result in disputes down the line.

-

Omitting Dates: Not including the date of the agreement can lead to confusion regarding when the loan terms begin. It’s essential to have a clear starting point.

-

Ignoring State Requirements: Each state may have specific requirements for promissory notes. Failing to adhere to New Jersey’s regulations can render the document unenforceable.

Other Common Promissory Note State Templates

How to Do a Promissory Note - The lender might require a background check before issuing the note.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. For more information on how to create this essential tool for managing vehicle affairs, especially when you are unable to do so yourself, you can visit https://floridaforms.net/blank-motor-vehicle-power-of-attorney-form/.

Washington Promissory Note - Classifying the loan accurately in the note can help clarify IRS tax implications.

Key takeaways

When dealing with the New Jersey Promissory Note form, it is essential to understand its components and implications. Here are seven key takeaways that can guide you through the process:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan under specified terms. It serves as a record of the debt and can be enforced in court if necessary.

- Include Essential Details: The note should contain critical information such as the names of the borrower and lender, the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Specify the Interest Rate: Clearly state the interest rate, whether it is fixed or variable. This detail is crucial as it affects the total amount to be repaid.

- Repayment Terms Matter: Outline the repayment schedule, including due dates and the method of payment. This clarity helps both parties understand their obligations.

- Consider Legal Requirements: Ensure compliance with New Jersey laws regarding promissory notes. Certain formalities may need to be observed for the note to be legally binding.

- Signatures Are Vital: Both the borrower and lender must sign the document. Without signatures, the note may not be enforceable.

- Keep Copies for Records: After completing the note, both parties should retain a copy. This serves as proof of the agreement and can be vital in case of disputes.

Being thorough in filling out the New Jersey Promissory Note form can prevent misunderstandings and protect the rights of both the lender and borrower. Take the time to review each section carefully.

New Jersey Promissory Note Example

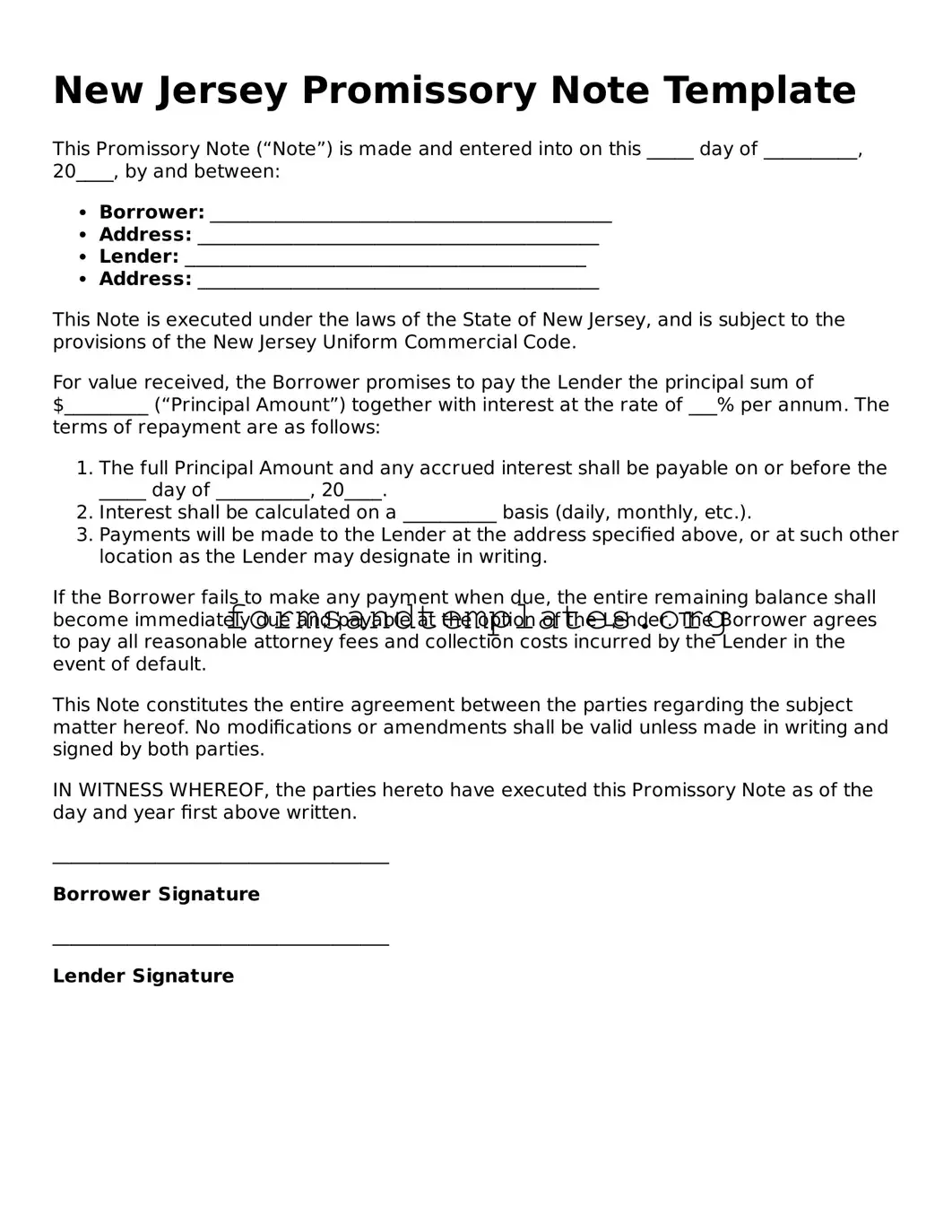

New Jersey Promissory Note Template

This Promissory Note (“Note”) is made and entered into on this _____ day of __________, 20____, by and between:

- Borrower: ___________________________________________

- Address: ___________________________________________

- Lender: ___________________________________________

- Address: ___________________________________________

This Note is executed under the laws of the State of New Jersey, and is subject to the provisions of the New Jersey Uniform Commercial Code.

For value received, the Borrower promises to pay the Lender the principal sum of $_________ (“Principal Amount”) together with interest at the rate of ___% per annum. The terms of repayment are as follows:

- The full Principal Amount and any accrued interest shall be payable on or before the _____ day of __________, 20____.

- Interest shall be calculated on a __________ basis (daily, monthly, etc.).

- Payments will be made to the Lender at the address specified above, or at such other location as the Lender may designate in writing.

If the Borrower fails to make any payment when due, the entire remaining balance shall become immediately due and payable at the option of the Lender. The Borrower agrees to pay all reasonable attorney fees and collection costs incurred by the Lender in the event of default.

This Note constitutes the entire agreement between the parties regarding the subject matter hereof. No modifications or amendments shall be valid unless made in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the day and year first above written.

____________________________________

Borrower Signature

____________________________________

Lender Signature

Understanding New Jersey Promissory Note

What is a promissory note in New Jersey?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a predetermined time. In New Jersey, this document serves as a legal agreement between a borrower and a lender, outlining the terms of the loan, including interest rates and repayment schedules.

Why would I need a promissory note?

Having a promissory note is crucial for both parties involved in a loan. It provides clear documentation of the loan terms, which helps prevent misunderstandings. In case of disputes, this note can serve as evidence in court, making it an essential tool for protecting your interests.

What information should be included in a New Jersey promissory note?

A well-drafted promissory note should include the following key elements:

- The names and addresses of both the borrower and the lender.

- The principal amount being borrowed.

- The interest rate and how it will be calculated.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties, along with the date of signing.

Is a promissory note legally binding?

Yes, a promissory note is legally binding as long as it meets certain requirements. It must be signed by both parties and contain clear terms. If the borrower fails to repay, the lender has the right to take legal action to recover the funds.

Do I need a lawyer to create a promissory note?

While it is not legally required to have a lawyer draft a promissory note, consulting with one can be beneficial. A lawyer can ensure that the note complies with New Jersey laws and meets your specific needs. This can help avoid potential issues down the line.

Can I modify a promissory note after it has been signed?

Yes, modifications can be made to a promissory note, but both parties must agree to the changes. It’s important to document any modifications in writing and have both parties sign the revised agreement to maintain its enforceability.

What happens if the borrower defaults on the loan?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They can attempt to negotiate a new payment plan, or they may choose to pursue legal action to recover the owed amount. The promissory note will serve as key evidence in such cases.

Are there different types of promissory notes?

Yes, there are various types of promissory notes, including:

- Secured promissory notes, which are backed by collateral.

- Unsecured promissory notes, which do not have collateral backing.

- Demand promissory notes, which require payment upon request.

- Installment promissory notes, which are repaid in scheduled payments.

Where can I find a promissory note template for New Jersey?

Promissory note templates can be found online through legal document websites or state resources. However, it’s important to ensure that any template you use complies with New Jersey laws. Customizing the template to fit your specific situation can help ensure it meets all legal requirements.

Is there a statute of limitations on enforcing a promissory note in New Jersey?

Yes, in New Jersey, the statute of limitations for enforcing a promissory note is typically six years from the date of default. This means that if the borrower does not make payments for six years, the lender may lose the right to take legal action to collect the debt. Keeping track of payment schedules is essential for both parties.

How to Use New Jersey Promissory Note

After you have obtained the New Jersey Promissory Note form, you will need to complete it accurately to ensure that it is legally binding. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, write the name and address of the borrower. This should include the full name and the complete mailing address.

- In the following section, provide the name and address of the lender. Again, include the full name and complete mailing address.

- Specify the principal amount being borrowed. This is the total sum that the borrower agrees to repay.

- Indicate the interest rate, if applicable. Make sure to state whether it is fixed or variable.

- Detail the repayment schedule. Include the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Include any late fees or penalties for missed payments, if applicable. Clearly outline the terms for these fees.

- Sign and date the form at the bottom. The borrower must sign, and if there is a co-signer, they should also sign.

- Finally, provide a witness signature if required. Some forms may require a witness to validate the agreement.